August 2024

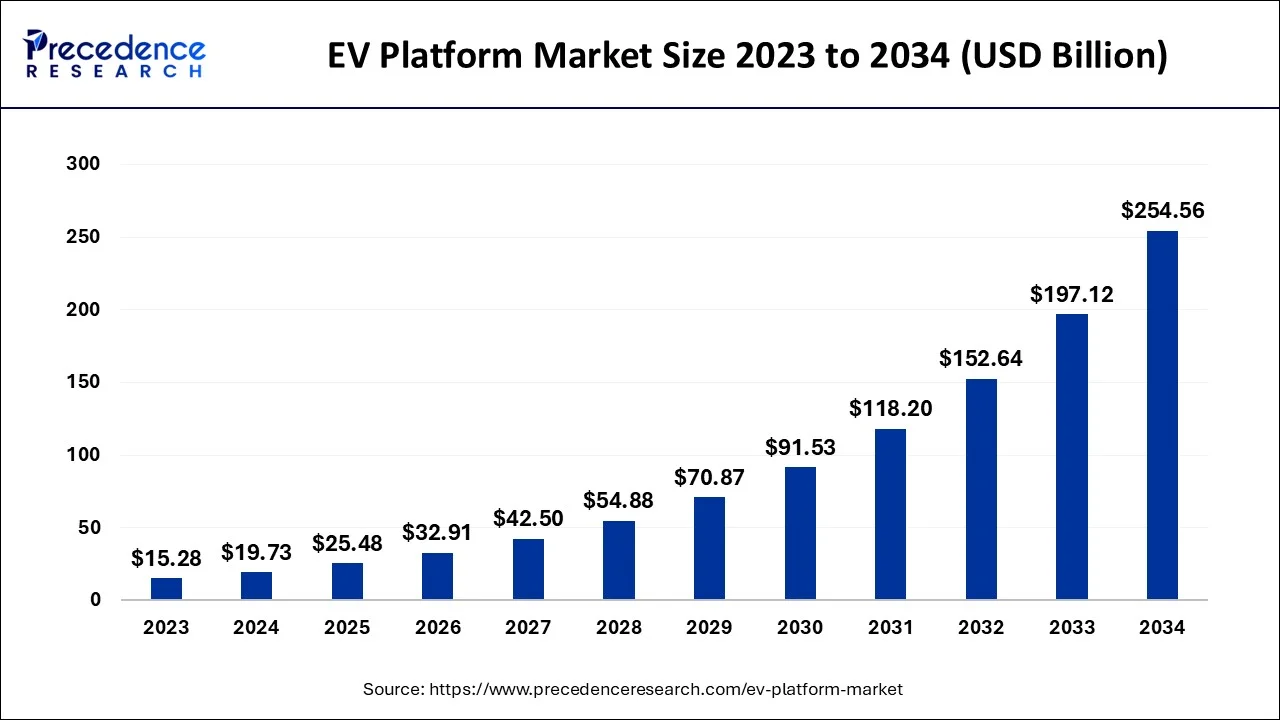

The global EV platform market size accounted for USD 19.73 billion in 2024, grew to USD 25.48 billion in 2025 and is projected to surpass around USD 254.56 billion by 2034, representing a healthy CAGR of 29.14% between 2024 and 2034.

The global EV platform market size is estimated at USD 19.73 billion in 2024 and is anticipated to reach around USD 254.56 billion by 2034, expanding at a CAGR of 29.14% between 2024 and 2034. The growth in infrastructure and environmental awareness are the key factors driving growth of global EV platform market.

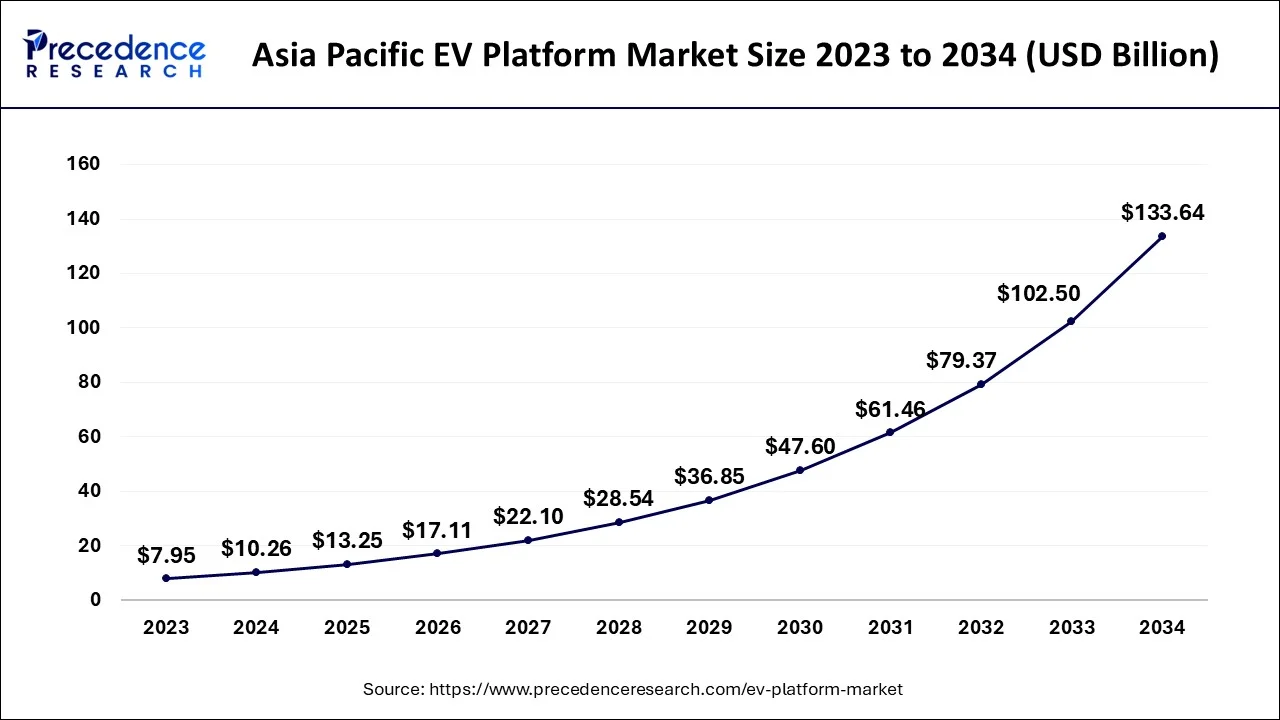

The Asia Pacific EV platform market size accounted for USD 10.26 billion in 2024 and is predicted to surpass around USD 133.64 billion by 2034, growing at a CAGR of 29.26% from 2024 to 2034.

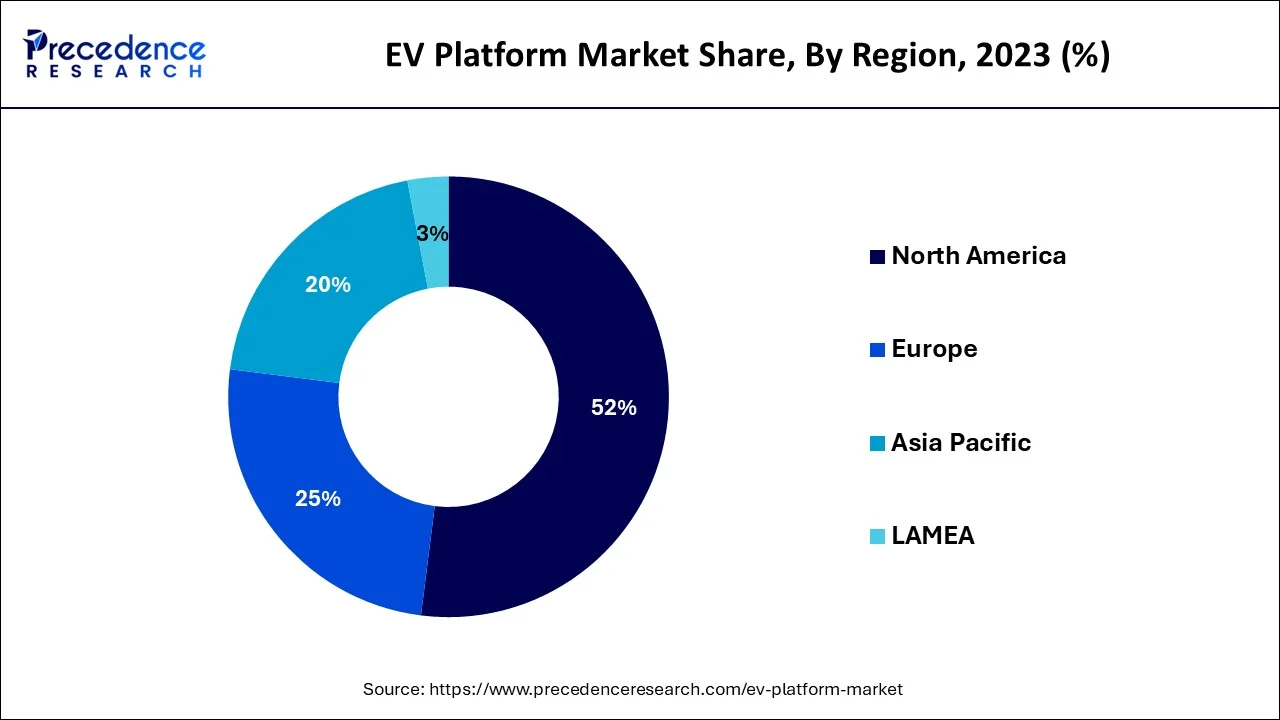

Asia Pacific dominates the global EV platform market; the region is expected to sustain its position in the market throughout the predicted timeframe. Several governments of the Asian countries including Japan, China and India have assisted the proliferation of EV demand through subsidies and favorable policies for EVs by distressing the use of gasoline-diesel vehicles. China dominates the global electric vehicle market, the rising production and advancements of electric vehicles in the country highlight the growth of the EV platform market for upcoming years.

Indian government plays crucial role in the development of EVs market in country due to its increased population and rapid growing urbanization. Indian government has initiated with policy to engage more sources like Reliance New Energy, Ola, ACC Energy Storage to start EV battery manufacturing in the country. Additionally, government policy scheme for Advanced Chemistry Cells (ACC) and the recent policy change and reduction in import duties on EVs above 15% are highly contributing in countries EV market growth.

Growing awareness of sustainability and zero emission goal are driving market growth in Europe. Several European companies has been participating to encourage EV adoption among region. For instant, France introduced its bonus-malus scheme for awarding companies who supports countries new CO2 emission requirements. European government activities like tax credit and subsidies are encouraging consumer for adoption of electric vehicles. Overall, Europe’s strict emission standards and sustainable vehicle promotions are fueling for regions market expansion.

The electric vehicle landscape rapidly varies as technology and interest evolve; the forthcoming years will have many more electric vehicles that will take to the roads. When the design is finalized, the production process moves to manufacture the individual components. These components may include the battery pack, electric motor, power electronics, charging system, and other parts that play a key part in the operation of EVs. Being one of the most integral and crucial parts of the electric vehicle, the EV platform acts as a base layer for the electric vehicle.

The global EV platform revolves around the production and distribution of the structure of electric vehicles. The structural part of the electric vehicle which is known as the EV platform is later fitted with a drive unit, suspension, and body.

The demand for EVs has grown significantly because of environmental concerns, the availability of models, increased cost competitiveness with conventional gas vehicles, and improved vehicle ranges. Rising fuel prices, alongside deteriorating air quality index in important cities globally, has significantly driven demand in the market. EVs are becoming increasingly cost-competitive with traditional gas-powered vehicles, particularly when it comes to the total cost of ownership over the vehicle's lifetime. This is making EV platforms more attractive to both consumers and fleet operators.

Moreover, multiple manufacturers are focused on the production of EV platforms to offer additional features that are observed to offer smooth and better driving experiences. For instance, The CMF-EV platform, the newest electric vehicle architecture from Nissan, offers designers several creative chances to completely reimagine the driver and passenger experiences.

| Report Coverage | Details |

| Market Size in 2024 | USD 19.73 Billion |

| Market Size by 2034 | USD 254.56 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 29.14% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Electric Vehicle Type, By Vehicle Type, By Sale Channel, and By Application |

| Regions Covered | Covered North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing awareness of environmental Sustainability among urban areas

Rapid growth in population and pollution driving shift toward sustainability by several urban areas. The main reason for adoption of EVs in urban areas is that electric vehicles are eco-friendly as they do not release CO2 in environment. Rapid growth in population and pollution driving shift toward sustainability. To improve air quality and reduce the emission, urban areas has been focusing on increasing the awareness of EV vehicles.

Additionally, raising noise pollution is driving focus of government on limiting traditional transportations. Electric vehicles are able to reduce their noise and run smoothly. Moreover, the affordability of EVs compared to conventional vehicles are boosting their success rates. For the all-human concerns and sustainability maintenance some urban areas as made strict rules regarding EV transportations. For instant, Delhi has regulated to “only sell electric vehicles” as of 2030.

Fluctuation in component prices

Raw materials and components are part of complete vehicles in a vehicle assembly plant. The fluctuating prices of components used for the production of EV platform act as a restraint for the market. It accounts for all the incoming materials, parts, supplies, workforce, and utilities and compares them against the vehicles. The battery pack is the essential component of an electric vehicle platform, and lithium is mainly used as a raw material. As the lithium supply is limited, the overall price of EV platform becomes expensive. The shortage of such raw materials causes fluctuation in the prices which may hamper the growth of the market by limiting manufacturers.

Rising utilization of electric vehicles in commercial applications

Some companies involved in last-mile delivery, such as online food delivery companies, e-commerce platforms, and courier services, are incorporating electric vehicles into their fleets. EVs are well-suited for urban delivery due to zero emissions. They help reduce pollution, such as air and noise while providing savings on fuel and maintenance. For instance, in India, companies like Ola and Uber are encouraging their drivers to switch into electric vehicles. Electric vehicles are well-suited for short-distance urban trips, and their lower operating costs can increase the drivers' earnings. Few cities offer incentives, such as access to reducing licensing fees and charging infrastructure to promote the use of EVs in the industry.

Companies are transitioning their internal fleets to electric vehicles, including companies with delivery services and field service operations. Electric vehicles in corporate fleets help reduce pollution from carbon footprints, maintenance costs, and lower fuel and align with sustainability goals. This element is expected to open lucrative opportunities for the EV platform market by increasing the pace of electric vehicle production.

The steering system segment is expected to increase rapidly during the forecast period. Electric steering systems are efficient since they do not need a pump to develop hydraulic pressure, which can help extend an EV's range. The need for EV platforms and increased safety regulations by creating precise and responsive steering systems, reducing the risk of accidents, and enhancing the safety of EVs will increase the demand for steering systems during the upcoming period.

Based on component, battery segment accelerated as the fastest growing market segment in 2023. Advanced battery technologies are able to reduce charging time and driving range, that drives major preference of consumer toward electric vehicles. Moreover, government of worldwide has been encouraging competitive landscapes for further innovations, boosting advantages and applications in batteries. For instant, lithium batteries have made electric vehicles cost-effective and practice. Companies are investing for enhance energy storage in lithium batteries for more safety, effectiveness and sustainability. Industry has witness significant rang in electric vehicles for energy renewable with advancement and adoption of AI-powered technology. Along with this technology advancement, 2024 is likely to archive mature developments of lithium batteries, which will help to maintain cleanness world and efficient energy landscape.

The battery electric vehicle segment is expected to lead the market with the highest revenue during the forecast period. The evolution of lithium-ion technology has raised the requirement for the growth of batteries, which has been a prominent solution for automobile developers that can give power to electric vehicle batteries. The main factors driving the market's growth are increased technological advancement, zero-emission assets, and the ability to not emit toxic gases.

For instance, In June 2022, General Motors announced that it was partnering with Honda to develop and produce Ultium batteries for both companies' electric vehicles.

The utility vehicle is the maximum contributor towards the EV platform market.

With the rising demand for electric vehicles to carry heavy loads, the significance of utility vehicles will continue to grow. Utility vehicles require fast charging; the EV platform provides a well-established, compatible charging network. Several automotive manufacturers are focused on customizing EV platforms according to durability and reliability requirements, especially for utility vehicles. This element highlights the segment's growth for the upcoming years. Companies extensively adopt this due to greater public demand and sales. For instance, in 2022, India's Mahindra and Mahindra showcased its forthcoming electric SUV - XUV-300 - re-badged as XUV-400.

The hatchback segment shows attractive growth during the forecast period.

Hatchback vehicles are often small with compact designs; EV platforms offer efficient use of space and proper weight distribution. Hatchback vehicles require an EV platform to maintain the battery capacity. The rising demand for personal vehicles as a transportation mode and the emphasis on the development of electric cars will boost the segment's growth.

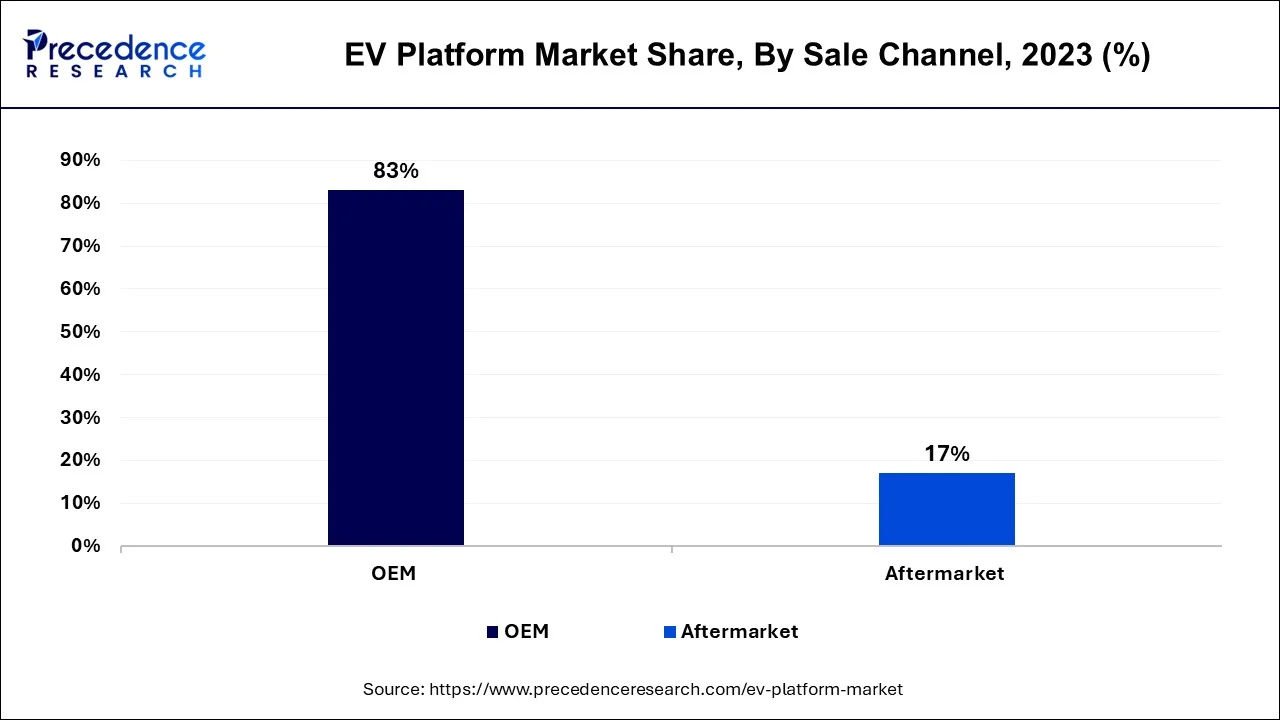

OEM captured the largest market share during the forecast period.

The vehicle returns to its original state since they make OEM parts easier to install with less room for error. If the car is in its original condition, it fits with the vehicle. The quality and safety of the product is maintained.

Aftermarket is anticipated to register the highest CAGR during the projected period.

The rising demand for vehicle conversion and customization will fuel the segment’s growth. The automotive market is experiencing a massive demand for do-it-yourself automotive parts; the aftermarket sales channel offers an opportunity for consumers to choose their platforms. Cheaper and affordable as compared to OEM. Rising retrofitting activities will grow the segment.

The passenger vehicles segment holds a significant position in the EV platform market. The enormous demand for personal vehicles and changing consumer preference towards electric vehicles promote the growth of the segment. The rise in middle-income population, especially in multiple developing countries highlights the demand for electric vehicles, which subsequently promotes the production of EV platforms.

The commercial vehicles segment plays a significant role in the EV platform market. Electric commercial vehicles produce zero emissions, reducing air pollution and greenhouse gas emissions compared to gasoline or diesel-powered vehicles, which makes them more environmentally friendly and helps in combating climate change.

The segment is expected to grow primarily owing to the increasing demand for minibusses and vans. The substantial demand for commercial vehicles from companies and industries will also promote the growth of the segment in the upcoming years. Light commercial vehicles are expected to witness an enormous demand in the future.

Electric commercial vehicles are highly efficient in converting energy into motion. They have higher energy efficiency than internal combustion engine vehicles, which results in better mileage per unit of energy consumed.

Segment Covered in the Report

By Component

By Electric Vehicle Type

By Vehicle Type

By Sale Channel

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024