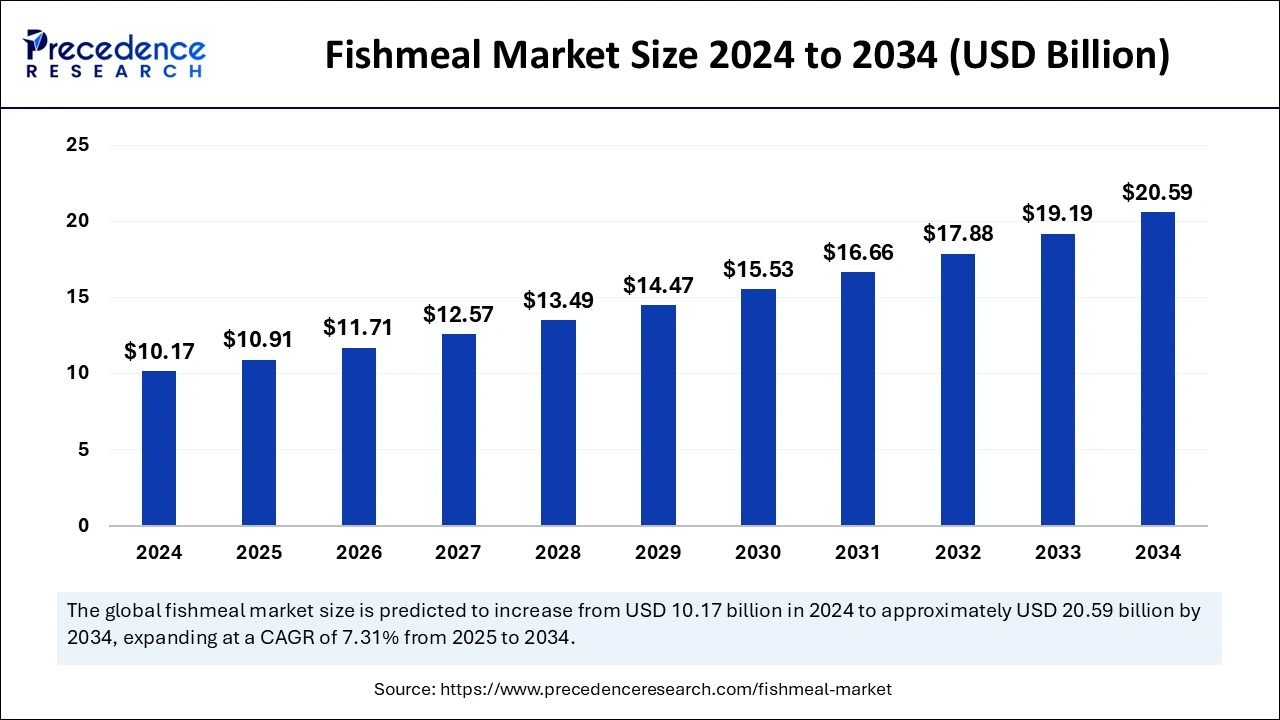

The global fishmeal market size is calculated at USD 10.91 billion in 2025 and is forecasted to reach around USD 20.59 billion by 2034, accelerating at a CAGR of 7.31% from 2025 to 2034. Asia Pacific market size surpassed USD 4.27 billion in 2024 and is expanding at a CAGR of 7.43% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global fishmeal market size was estimated at USD 10.17 billion in 2024 and is predicted to increase from USD 10.91 billion in 2025 to approximately USD 20.59 billion by 2034, expanding at a CAGR of 7.31% from 2025 to 2034. Increasing demand for fishmeal in the aquaculture and livestock feed industries is the key factor driving market growth. Also, ongoing scientific innovation in the sector, coupled with the growing emphasis on sustainable fishing practices, can fuel market growth further.

By using Artificial Intelligence algorithms, fish farmers can gain key insights into feeding behavior, fish growth patterns, and environmental factors impacting fish health. In the fishmeal market, AI systems can identify and predict diseases, anomalies, and stress indicators, facilitating timely interventions to decrease losses and tackle health issues. Furthermore, these systems leverage different cameras, sensors, and data analytics tools to collect real-time data on temperature, water quality, fish behavior, and oxygen levels.

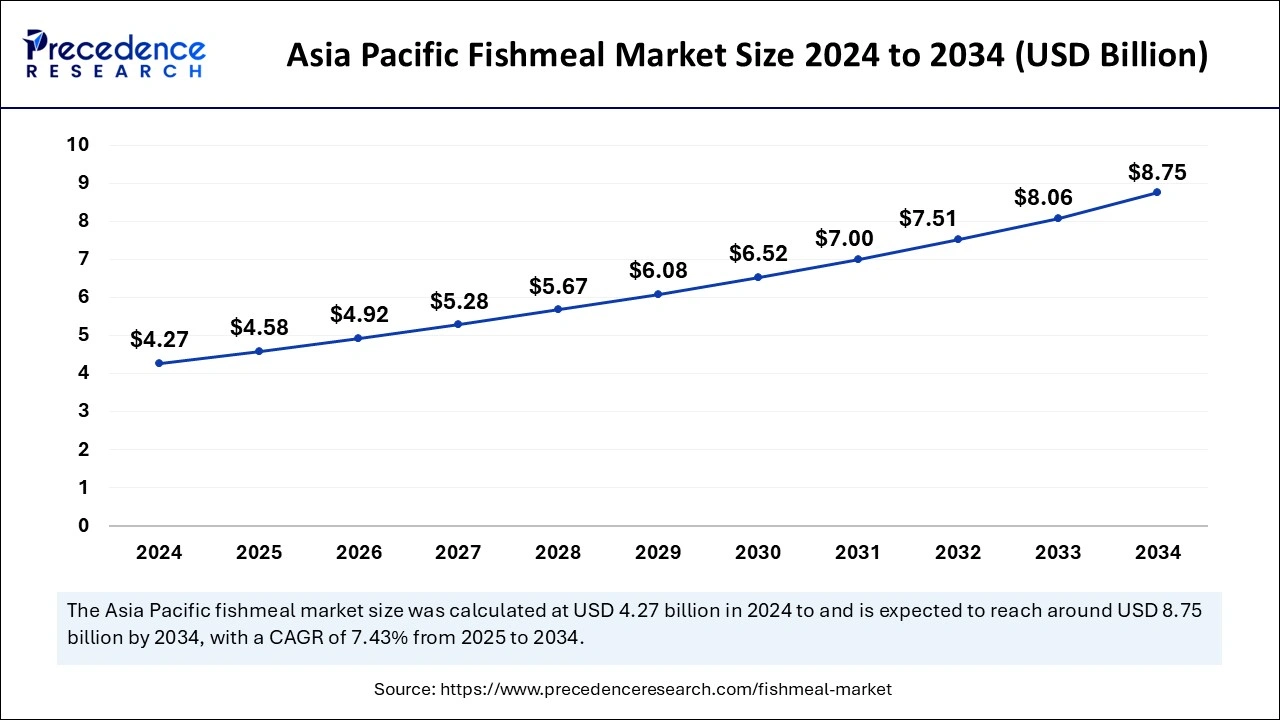

Asia Pacific fishmeal market size was exhibited at USD 4.27 billion in 2024 and is projected to be worth around USD 8.75 billion by 2034, growing at a CAGR of 7.43% from 2025 to 2034.

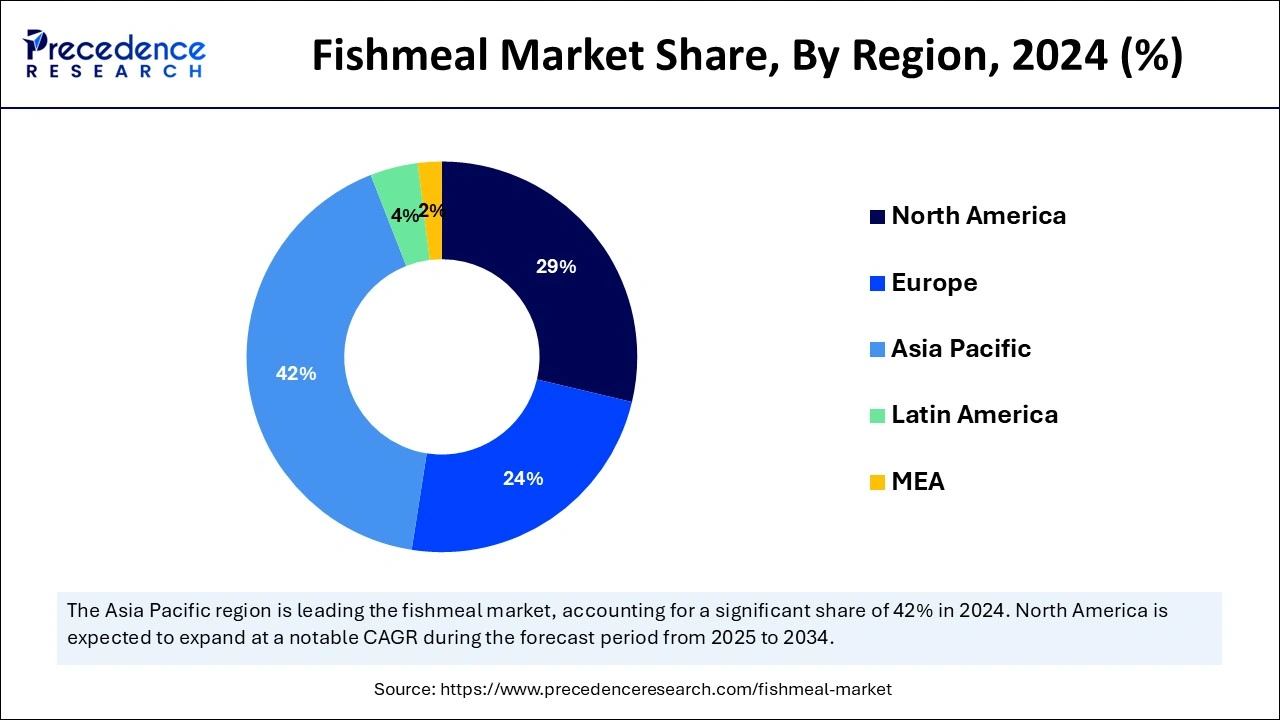

Asia Pacific dominated the fishmeal market in 2024. The dominance of the region can be attributed to the ongoing growth of the aquaculture sector in countries like Indonesia, Vietnam, China, and Thailand. Where there is an increasing need for standard fishmeal from marine and shrimp fishes. In Asia Pacific, China led the market owing to the increasing demand for pork and seafood.

North America is expected to show the fastest growth in the fishmeal market over the studied period. The growth of the region can be credited to the expanding fish meal market and monitoring the sustainability of sea fisheries grows the regional market. In North America, the U.S. dominated the market due to increasing consumption of pork, poultry farming, pig farms, escalating fish production, and the rising pet food consumption rate across the country.

Fish meal is a product that is made from small, pelagic, and oceanic fish. It is also high in protein and is a crucial source of necessary minerals, fatty acids, vitamins, and digestible energy. Fish meal is important in many industries like fertilizer, agriculture, and animal feed because of its high nutrient content, such as Omega-3, protein, minerals, and fatty acids. Major players in the fishmeal market have a wide understanding of "oxidation chemistry" and provide both natural and synthetic antioxidant solutions. This helps improve fish meal and feed safety.

| Report Coverage | Details |

| Market Size by 2034 | USD 20.59 Billion |

| Market Size in 2025 | USD 10.91 Billion |

| Market Size in 2024 | USD 10.17 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.31% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Livestock, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Developments in alternative protein sources

The rising concerns among the majority of the population regarding the sustainability of conventional fish meal production are optimizing the need for other protein sources. In addition, the growing need to reduce the reliance on wild fish stocks is playing a significant role in driving the market growth. Major players in the fishmeal market are seeking the usage of plant-based materials and insect protein, which is stimulating the widespread adoption of fish meals.

Lack of storage facilities

The limited sophisticated storage facilities necessary for the fish meals are the major factor hampering the fishmeal market. Convenient storage and drying facilities are important for storing fish meals. Moreover, proper transportation infrastructure is generally required for cheaper movement and equal distribution of fish meals. Some emerging economies have cold storage, which might be responsible for fish meal contamination.

Increasing aquaculture production worldwide

The fishmeal market is witnessing substantial growth because of the growing demand for standard-quality aquaculture feed. This feeds a major sector in the agricultural industry, which is experiencing a surge in production to fulfill the increasing consumption of many aquatic species like tilapias, salmons, carp, marine shrimps, and freshwater crustaceans. Furthermore, the cultivation of this species is escalating in North America because of the increasing preference for eco-friendly intensification in aquaculture.

The marine fish segment dominated the fishmeal market in 2024. The dominance of the segment can be attributed to the increasing product requirement from the aquaculture sector. The commonly used marine fishes in the manufacturing of fish meal are pilchard, herring, mackerel, and anchoveta. Additionally, these fishes contain high amounts of protein, some essential amino acids, and omega-3 fatty acids, which makes them an important source of fishmeal.

The crustaceans segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the rising popularity of crustaceans like krill, crab, and shrimp due to their protein, omega-3 fatty acids, and astaxanthin-rich content. However, it also enhances palatability and flavor in animal feed, which results in enhanced nutrient digestibility, greater feed efficiency, and improved overall growth rates and health in fish farms, hence propelling segment growth.

The aquatic animals segment led the global fishmeal market in 2024. The dominance of the segment can be linked to the increasing popularity of fish meals as a main protein source, recognized for its high bioavailability and nutritional value. Furthermore, Fish meal is the most preferred in aquaculture feeds because of its exceptional balance of amino acids and good protein content, therefore creating lucrative opportunities for the key players in the market soon.

The swine segment is estimated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by the increasing use of fishmeal as a protein source in pig farms. It is generally used as an alternative to conventional feed ingredients such as soybean meal and corn gluten meal. Also, It has high digestibility and low antigenicity, which decreases the stress in young pigs and keeps their gut healthy. It is the most commonly utilized feed ingredient, and it is high in omega-3 PUFA.

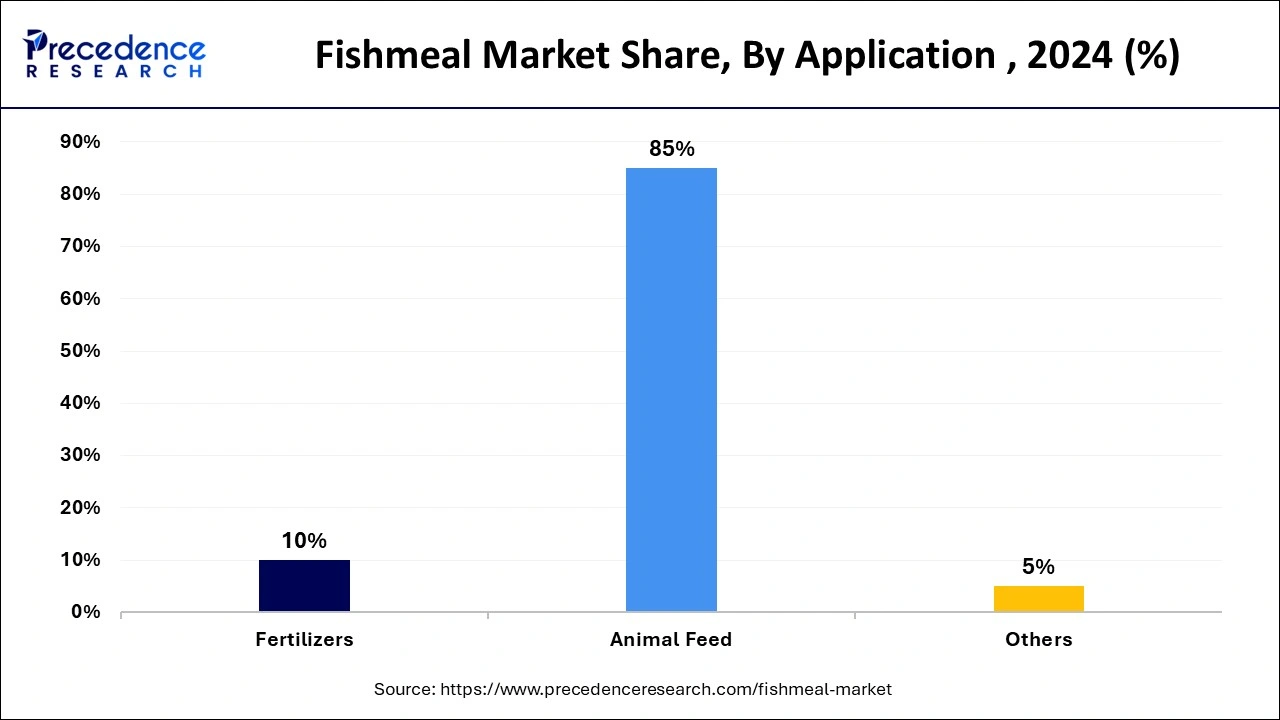

In 2024, the animal feed segment dominated the fishmeal market by holding the largest share. The dominance of the segment is due to the growing utilization of fish meals in animal diets across different sectors, as it is a nutrient-rich and highly valuable feed. Fish meal is considered a vital protein source in fish feed because of its excellent amino acid profile, high protein content, and better nutrient digestibility. Fishmeals have been praised for their good influence on the performance and health of livestock.

The fertilizer segment is projected to grow at the fastest rate during the forecast period. The growth of the segment is because fish meal in fertilizer is a good source of phosphorus and nitrogen, and it is suggested for flower beds, vegetable gardens, and outdoor plants, offering vital nutrients for plant growth. Additionally, roses especially benefit from fish fertilizer, which generates larger and longer flowers.

By Source

By Livestock

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client