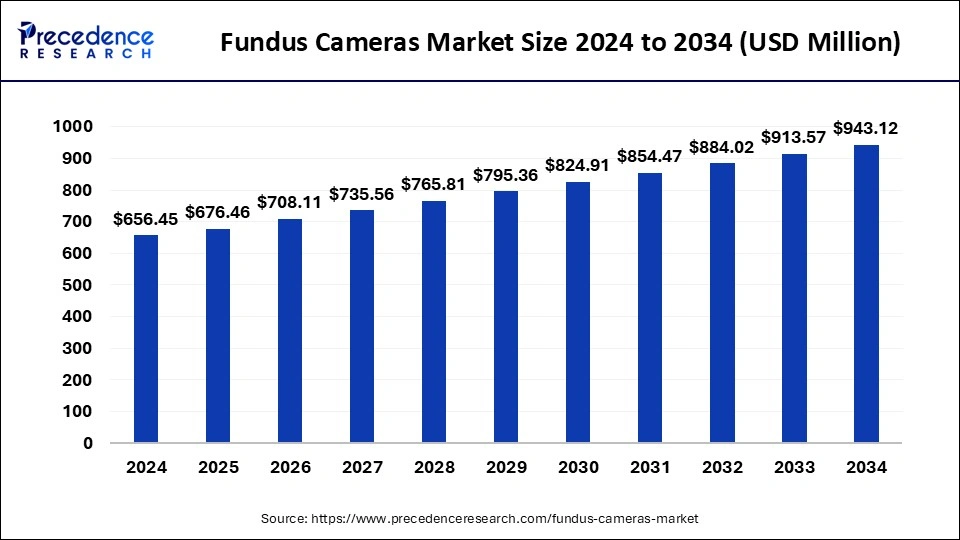

The global fundus cameras market size accounted for USD 676.46 million in 2025 and is forecasted to hit around USD 943.12 million by 2034, representing a CAGR of 3.80% from 2025 to 2034. The North America market size was estimated at USD 272.49 million in 2024 and is expanding at a CAGR of 3.40% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global fundus cameras market size accounted for USD 656.45 million in 2024 and is predicted to increase from USD 676.46 million in 2025 to approximately USD 943.12 million by 2034, expanding at a CAGR of 3.80%.

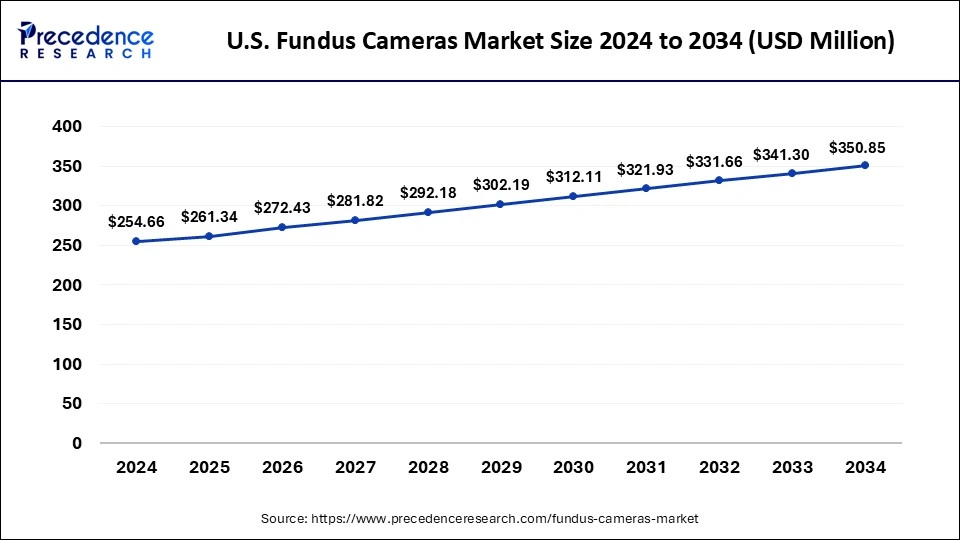

The U.S. fundus cameras market size was exhibited at USD 254.66 million in 2024 and is projected to be worth around USD 350.85 million by 2034, growing at a CAGR of 3.30%.

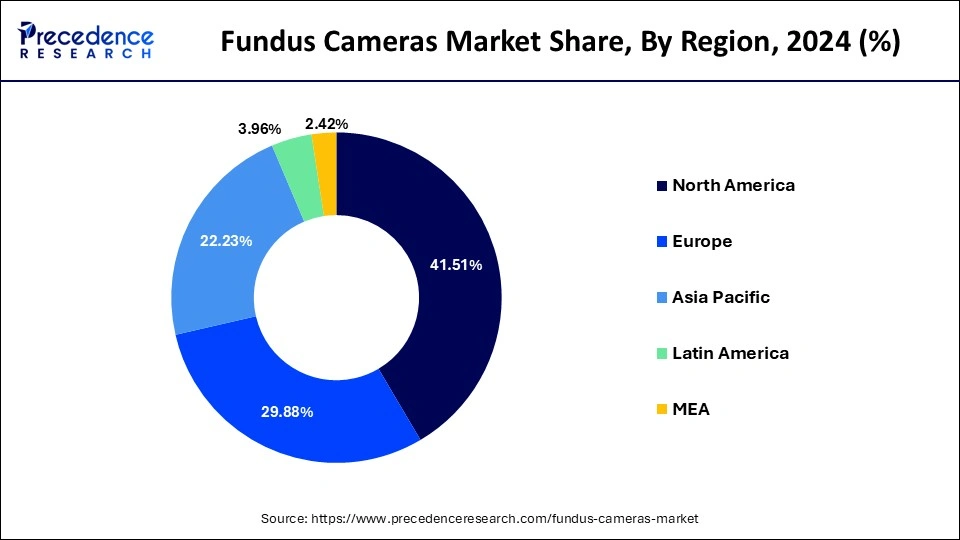

North America led the market with the biggest market share of 41.51% in 2024, driven by organizations like AmeriHealth Caritas, which play a crucial role in coverage determinations and healthcare policy. AmeriHealth Caritas has developed clinical policies based on guidelines from established industry sources such as the Centers for Medicare & Medicaid Services (CMS), state regulatory agencies, the American Medical Association (AMA), and peer-reviewed professional literature.

These clinical policies, alongside other sources, including plan benefits and state and federal laws, are considered by AmeriHealth Caritas when making coverage determinations. These policies are vital for ensuring proper reimbursement and access to fundus camera technology, thereby shaping the market landscape in North America. It reflects the region's commitment to evidence-based practices and adherence to established guidelines, ultimately driving advancements and innovation within the fundus cameras market.

Fundus cameras are sophisticated instruments utilized in ophthalmology for capturing detailed images of the retina. They employ a specialized optical design akin to an indirect ophthalmoscope, with the angle of view being a key parameter defining their functionality. While a standard angle of 30° is typical, wide-angle versions extending from 45° to 140° are also available, offering varying degrees of retinal magnification. Conversely, narrow-angle fundus cameras provide a view of 20° or less. These cameras produce invaluable fundus photographs, serving as visual records to aid in diagnosing and treating various ocular diseases. Fundus photography enables physicians to meticulously examine retinal changes over time, facilitating collaboration among colleagues and enhancing patient care.

In clinical practice, fundus cameras are indispensable for capturing fundus photographs, reflectance photographs, and fluorescein angiography images. These instruments utilize a single flash to capture images across large retinal areas, albeit with challenges such as autofluorescent signal interference and scattered light. Nevertheless, ongoing advancements driven by scientific research, innovative filters, and increased expertise hold promise for enhancing fundus autofluorescence (FAF) imaging capabilities in the near future. It's crucial to note that the efficacy of imaging in a fundus camera hinges more on system design than on the initial formation of the fundus image by the ophthalmoscopic lens.

| Report Coverage | Details |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.80% |

| Market Size in 2025 | USD 676.46 Million |

| Market Size by 2034 | USD 943.12 Million |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Multidisciplinary engagement and enhanced patient safety

The fundus cameras market is propelled by the active involvement of various healthcare professionals, including ophthalmologists, optometrists, ophthalmic photographers, and paramedical workers, in utilizing these devices for diagnosing and managing ophthalmic diseases. Nurses' awareness of potential side effects during invasive procedures like fundus fluorescein angiography or indocyanine green angiography significantly contributes to patient safety, fostering confidence in camera usage.

Streamlined coordination among all team members and caregivers, coupled with continuous education and training on fundus photography and related procedures, accelerates the expansion of the fundus cameras market by enhancing efficiency and encouraging adoption. By prioritizing comprehensive care and recognizing fundus cameras as essential tools for accurate diagnosis and effective disease management, the market experiences increased penetration and adoption rates, thus driving growth in the sector.

Advancements in imaging technologies for age-related macular degeneration (AMD)

The fundus cameras market experiences growth driven by the evolving landscape of imaging technologies, particularly in diagnosing age-related macular degeneration (AMD). Traditionally, fundus photography with film-based cameras, preferably through pharmacologically dilated pupils, has been pivotal in documenting AMD severity. The emergence of high-resolution digital cameras presents new opportunities in the market.

Comparisons among different imaging systems, including nonstereoscopic color retinal images taken with digital cameras through dark-adapted and dilated pupils, as well as stereoscopic images captured with standard film cameras, highlight the expanding applications of fundus cameras. Such comparisons underscore the need for versatile imaging solutions to accommodate diverse clinical scenarios, thus fueling the growth in the fundus cameras market.

Addressing challenges in fundus imaging

While fundus cameras offer a non-invasive means of examination, several challenges hinder their widespread adoption and growth within the market. Cross-infection risks from patients with active eye infections like conjunctivitis pose a concern, potentially limiting the utilization of shared imaging equipment. Moreover, the intense flashlight used during imaging may prove intolerable to patients with photophobia, leading to discomfort and reluctance to undergo the procedure.

Technical factors such as the presence of orange crescents due to poorly dilated pupils, hazy veils caused by eyelashes, and suboptimal distances between the eye and camera leading to loss of detail further constrain market growth. Addressing these challenges, including implementing infection control measures, patient comfort strategies, and optimizing technical parameters, is essential to mitigate these limitations and foster the expansion of the fundus cameras market.

Challenges in nonmydriatic fundus photography

Nonmydriatic fundus photography faces significant limitations that hinder its widespread adoption and growth within the fundus cameras market. Technical failures during procedures are more common due to factors such as media opacities, small pupils, and difficulties in obtaining stereoscopic views. While the performance of fundus cameras may be similar to ophthalmoscopy in most cases, challenges arise when ophthalmoscopy fails or succeeds only partially, making fundus photography more challenging.

The primary causes of failure include miotic pupils, oculomotor disorders, ptosis, and light sensitivity, with small pupil size being the most prevalent factor. These limitations in nonmydriatic fundus photography restrict its potential for market growth, emphasizing the need for innovative solutions to overcome technical obstacles and enhance the usability of fundus cameras in clinical practice.

Integration of artificial intelligence (AI)

The integration of artificial intelligence (AI) into fundus cameras presents a significant opportunity for market growth. AI algorithms demonstrate high accuracy in detecting diseases like diabetic retinopathy (DR), offering improved diagnostic capabilities. Furthermore, machine learning algorithms utilizing preoperative fundus photography alongside other data parameters have shown promise in identifying at-risk eyes for postoperative complications after refractive surgery. Deep learning algorithms applied to fundus photographs have been successful in predicting cerebral white matter hyperintensity in magnetic resonance imaging (MRI) scans and detecting DR with remarkable precision.

Studies exploring AI's role in correlating fundus photos, optical coherence tomography (OCT), and external eye photography with systemic diseases exhibit promising results. Particularly, AI-driven screening for DR holds significant potential. These advancements highlight the prospective role of AI-integrated fundus imaging in screening, diagnosing, and managing various retinal diseases, thus creating substantial opportunities for growth in the fundus cameras market.

Advancements in portable non-mydriatic fundus cameras

The introduction of a new type of non-mydriatic portable fundus camera presents a significant opportunity for market growth. This revolutionary screening camera offers professional-quality fundus images in a portable format, potentially enhancing the accessibility of retinal screening programs. The novel handheld portable non-mydriatic fundus camera provides low-cost screening solutions, particularly beneficial in scenarios with personnel shortages and limited photographic equipment.

Comparisons with traditional tabletop fundus cameras highlight the effectiveness of the new portable device. Additionally, the incorporation of a telemedicine system further enhances its utility, enabling high-quality fundus imaging remotely. With the potential to improve the accessibility and efficiency of retinal screening programs, this innovative camera creates substantial opportunities for growth in the fundus cameras market.

The non-mydriatic segment held the largest share of the fundus cameras market in 2024, offering significant advancements in ocular examination. Positioned as an advantageous option to direct ophthalmoscopy, non-mydriatic ocular fundus photography addresses technical barriers and enhances the adequacy of ocular fundus examination. This technology, especially with integrated telemedicine, has revolutionized medical research and patient care by facilitating clinical and epidemiologic research and providing access to ophthalmic consultative services in underserved areas.

By removing the need for pupil dilation and streamlining the examination process, non-mydriatic fundus photography incorporated into telemedicine holds substantial promise in revitalizing the importance of ocular fundus examination in patient care. Its ability to overcome technical barriers and provide efficient access to diagnostic services underscores its significance in reshaping ophthalmic examination practices.

Global Fundus Cameras Market Revenue, By Product, 2022-2024 (USD Million)

| Product | 2022 | 2023 | 2024 |

| Mydriatic Fundus Cameras | 66.7 | 68.5 | 69.8 |

| Non-mydriatic Fundus Cameras | 365.4 | 376.2 | 384.5 |

| Hybrid Fundus Cameras | 192.6 | 198.0 | 202.2 |

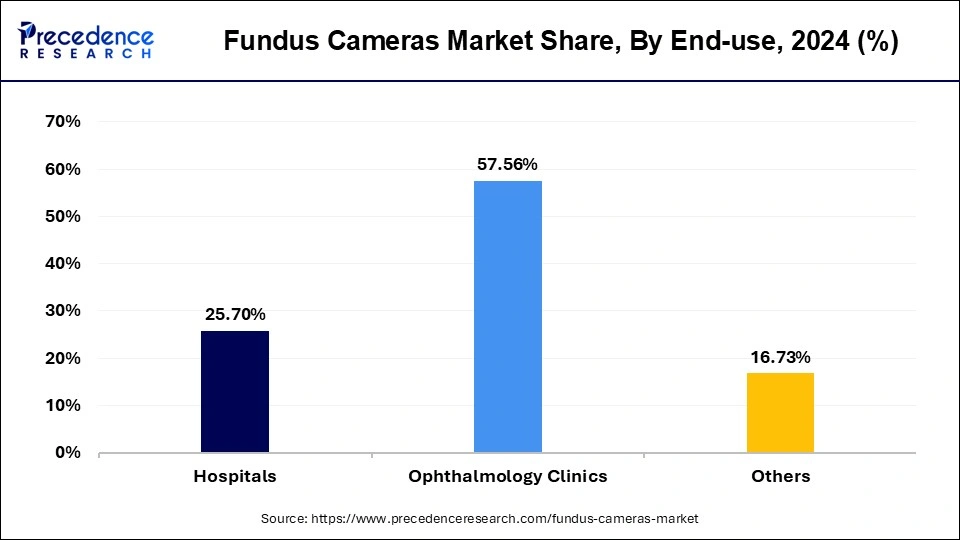

The hospital segment captured the biggest share in 2024, recognizing the pivotal role of these devices in ophthalmic care. Fundus cameras are indispensable for diagnosing, educating patients, monitoring, and forecasting various ophthalmic conditions, including diabetic retinopathy (DR), age-related macular degeneration (ARMD), retinal vascular disorders, retinopathy of prematurity (ROP), and glaucoma. As a critical tool in addressing preventable blindness, fundus cameras are garnering attention in developing countries where healthcare infrastructure is limited.

The advancements in optical sources and detectors have led to the development of miniature table-top fundus camera system designs at a lower cost. These compact systems provide retinal images that are comparable to traditional fundus cameras. They cater to the diverse needs of hospitals looking for cost-effective solutions without having to compromise diagnostic quality. Tele-ophthalmology is also gaining popularity, connecting remote villages to ophthalmologists and providing access to specialized care.

Nonmydriatic fundus cameras facilitate ocular fundoscopic examination in young children, simplifying diagnoses of conditions like retinopathy of prematurity and retinoblastoma. By leveraging innovative technologies and addressing specific healthcare challenges, hospitals are driving innovation in the fundus cameras market, ultimately enhancing patient care and outcomes.

Global Fundus Cameras Market Revenue, By End-use, 2022-2024 (USD Million)

| End-use | 2022 | 2023 | 2024 |

| Hospitals | 160.6 | 165.2 | 168.7 |

| Ophthalmology Clinics |

359.0 | 369.6 | 377.9 |

| Others | 105.1 | 107.8 | 109.8 |

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client