March 2025

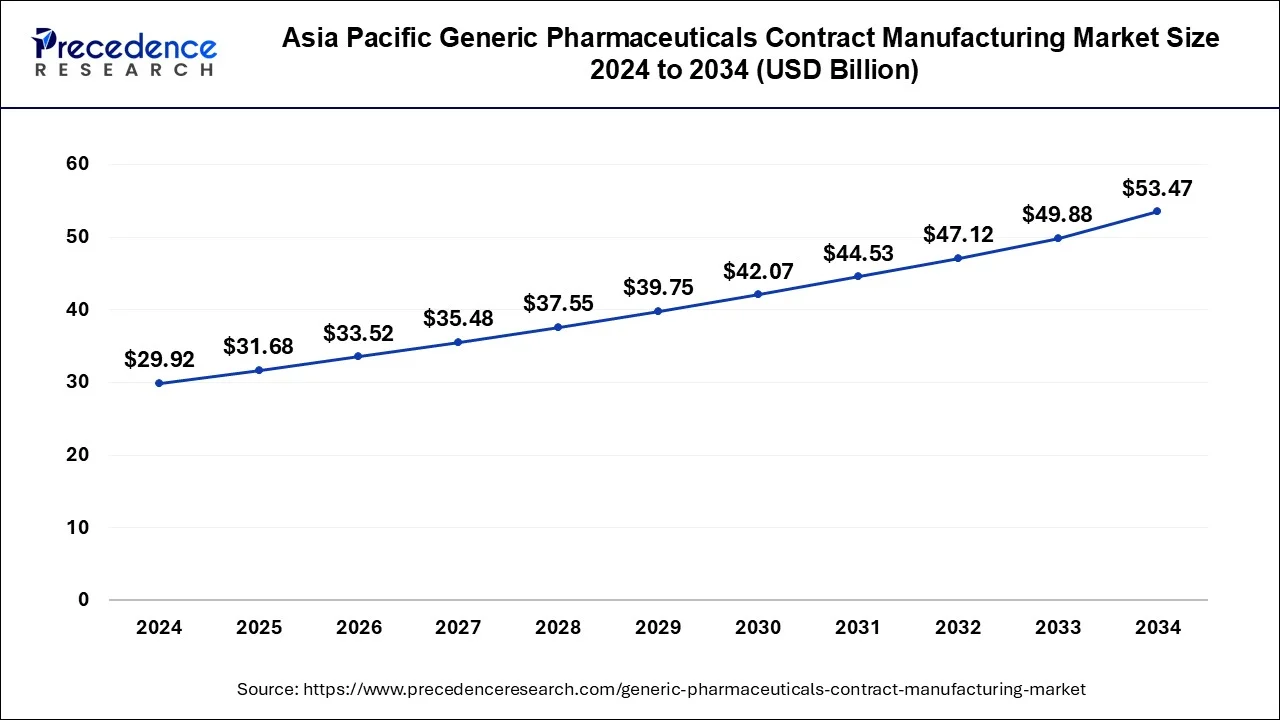

The global generic pharmaceuticals contract manufacturing market size is calculated at USD 81.22 billion in 2025 and is forecasted to reach around USD 135.36 billion by 2034, accelerating at a CAGR of 5.84% from 2025 to 2034. The Asia Pacific generic pharmaceuticals contract manufacturing market size accounted for USD 31.68 billion in 2024 and is expanding at a CAGR of 5.98% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global generic pharmaceuticals contract manufacturing market size was estimated at USD 76.73 billion in 2024 and is predicted to increase from USD 81.22 billion in 2025 to approximately USD 135.36 billion by 2034, expanding at a CAGR of 5.84% from 2025 to 2034. The benefits of generic pharmaceuticals contract manufacturing include reduced costs on running the facility, hiring in-house personnel, and manufacturing equipment, reduced time, produces a high number of products, collaboration and knowledge exchange, advanced technologies, etc. help to the growth of the market.

The Asia Pacific generic pharmaceuticals contract manufacturing market size was exhibited at USD 29.92 billion in 2024 and is projected to be worth around USD 53.47 billion by 2034, poised to grow at a CAGR of 5.98% from 2025 to 2034.

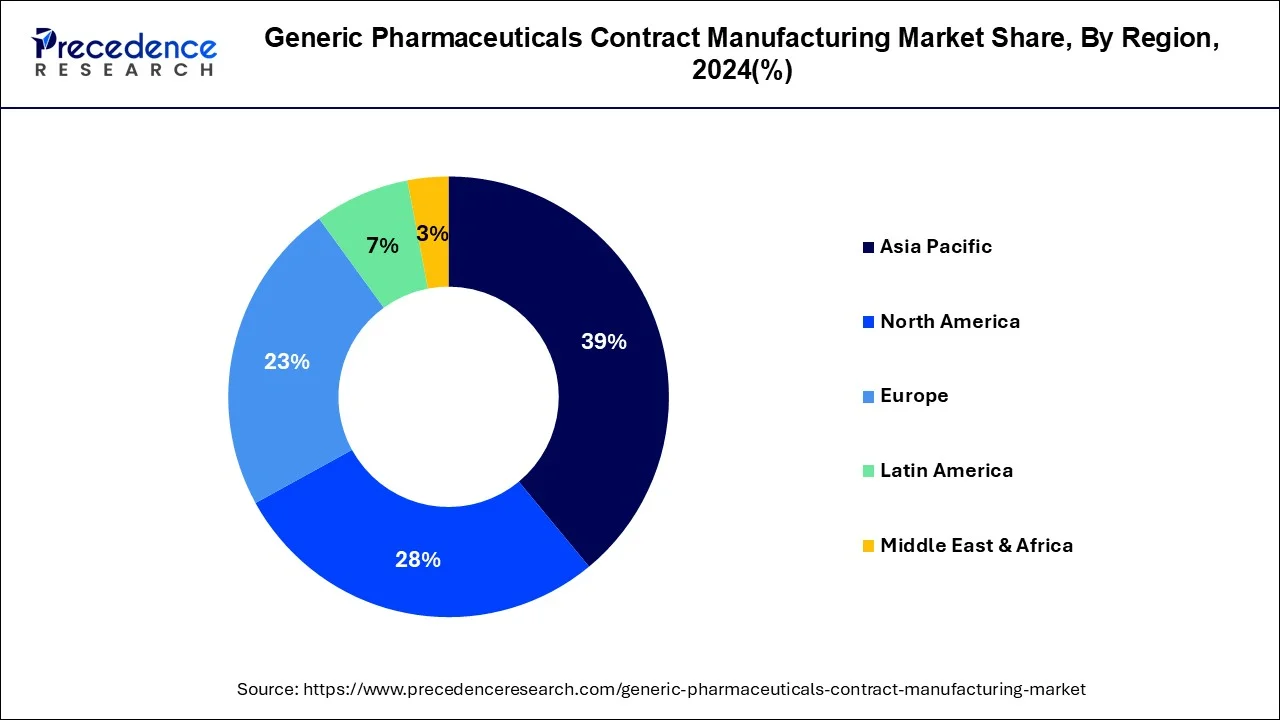

Asia Pacific dominated the generic pharmaceuticals contract manufacturing market in 2024. The rising demand for generic drugs & biologics is due to their cost-efficiency, rising investments in pharmaceuticals R&D, patent expiration, manufacturers’ increasing affection towards the use of cutting-edge technologies, and critical manufacturing requirements of advanced technologies by supporting the industry in the growth of the market in the Asia Pacific region. In India, there is a demand for generic medicines in the drug market. In India, the top generic medicine manufacturers or CMOs include Aurobindo Pharma, Teva Pharmaceutical, Sandoz International, Zydus Cadila Healthcare, Lupin, Cipla, MSN laboratories, Baxter International, Alkem Laboratories, Sun Pharmaceutical, Reddy’s Laboratories Ltd., Protech Telelinks, etc. which help to the growth of the market.

North America is estimated to be the fastest-growing during the forecast period of 2025-2034. In the U.S. and Canada, increasing pharmaceutical industries helped the growth of the generic pharmaceuticals contract manufacturing market in North America. Teva Pharmaceutical Industries Ltd is the leading company in generic manufacturing in the United States.

The generic pharmaceuticals contract manufacturing market involves partnerships between contract manufacturing providers and brand-name pharmaceutical companies to expand the production of generic equivalents and follow-on biosimilars (biologics). The market is a part of the pharmaceutical and biotechnology industries that involves the production and manufacturing of generic pharmaceutical products by pharmaceutical companies to contract manufacturing organizations. This helps pharmaceutical companies to support the expertise and infrastructure of contract manufacturing organizations to produce generic drugs effectively and at low cost. This helps companies to focus on development, research, and marketing. These factors help to the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 135.36 Billion |

| Market Size in 2024 | USD 76.73 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.84% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug, Product, Route of Administration, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising investments in pharmaceutical R&D activities

Rising investment in pharmaceutical R&D activities can help the growth of the market. R&D allows businesses to acquire ever-changing market and consumer needs. R&D may provide a new direction for processes, products, or services, and it can improve productivity and reduce costs, help companies stay ahead or follow market trends, and keep them relevant. These factors help to grow the generic pharmaceuticals contract manufacturing market.

Risks of generic pharmaceutical contract manufacturing

The risks of generic pharmaceutical contract manufacturing include ensuring compliance with regulatory standards may be challenging, depending on a single manufacturing organization, may lead to supply chain risks, sharing of proprietary production and formulation processes with contract manufacturing organizations, raises problems related to intellectual property protection, communication hurdles that helps to maintain quality and ensures compliance with regulatory standards is a priority. These factors help to grow the generic pharmaceuticals contract manufacturing market.

Expansion of complex generic drugs

Pharmaceutical and biotechnology industries look at an increase in the production of complex generic drugs, which are more demanding to test, administer, and manufacture than traditional generics. These drugs include products with delivery systems, complex formulations, active ingredients, devices, or dosages, which are made up of complex molecular structures. These drugs are highly critical to regenerate as its generic version. There is an opportunity for the expansion of complex generic drugs. These factors help to grow the generic pharmaceuticals contract manufacturing market.

Telemedicine and tele-pharmacy

As how healthcare is delivered, telemedicine and tele-pharmacy are changing, allowing remote patient consultations and management of medication prescriptions. The COVID-19 pandemic increased acceptance of these technologies; at that time, virtual care technology was necessary, which led to faster development and made it easy to access essential medicines. The increase in telemedicine and tele-pharmacy may enhance patient faithfulness and eliminate medication-related concerns, especially in underserved or rural areas as local pharmacies have been set down, because various patients may not have the economic conditions to pay expensive brand name costs or to travel for healthcare. Telemedicine and tele-pharmacies' mail-in medicine delivery systems help patients get access to affordable generics anywhere they are located. These telemedicine and tele-pharmacy technology opportunities help the growth of the generic pharmaceuticals contract manufacturing market.

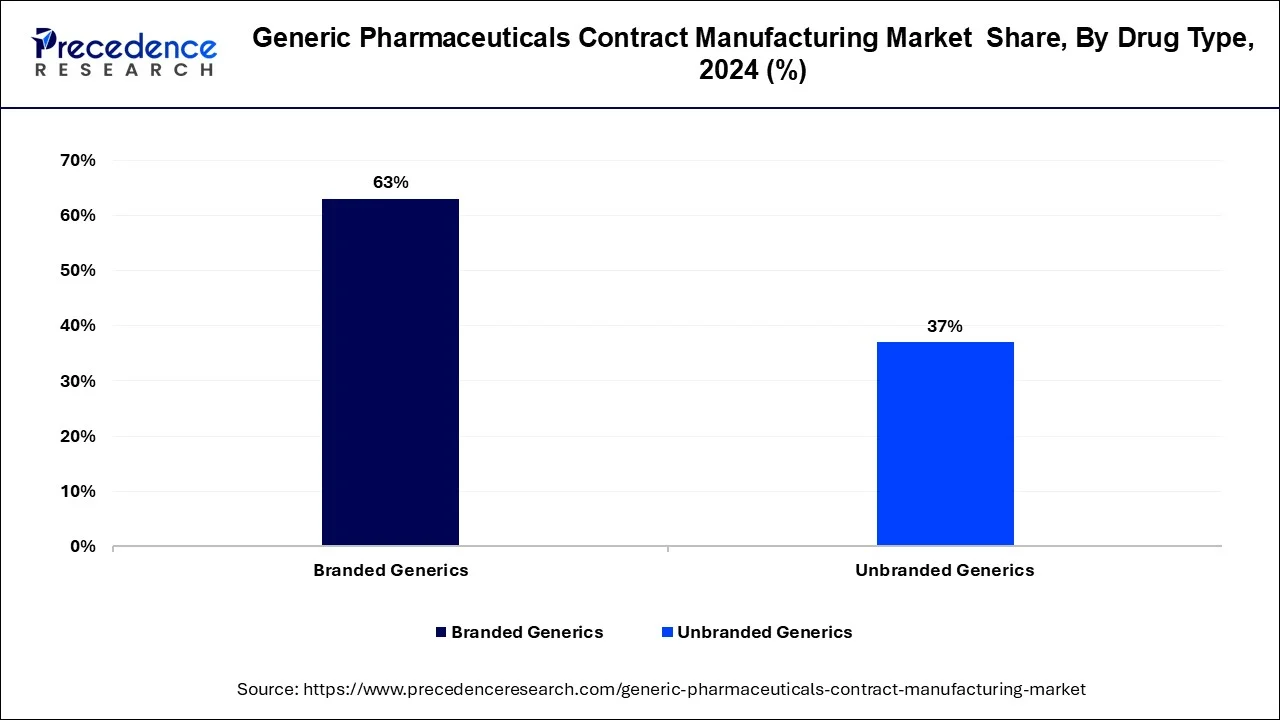

The branded generics segment dominated the market in 2024. Branded generics are not under any patent and are sold using a brand name instead of its chemical name. Branded generics may be developed by the original manufacturer or by a generic drug firm. Branded generics are more costly than unbranded generics. Branded generics are the brand name given to a drug that is bioequivalent to an innovator (original) brand. Once the original brand comes off patent, it is marketed under another company’s brand. These factors help the growth of the branded generics segment and contribute to the growth of the generic pharmaceuticals contract manufacturing market.

The unbranded generics segment is anticipated to grow significantly during the forecast period. An unbranded product is sold under the name of the product itself or the name of the shop, alternately the name of the company that made it. Unbranded generics maybe half the price of big brand names. Unbranded generics have the same active molecule but are sold under the chemical name. The advantages of unbranded generics include that they are more affordable and save money than branded generics, are easily available, safe, and quality, are approved by the drug advisory board, and have insurance coverage.

Companies developing generics do not need to invest high amounts of time and research due to FDA approval and testing of the brand drug’s ingredients already being completed. The unbranded generics may get to market faster and can be sold greatly cheaper than branded generics. These factors help the growth of the unbranded generics and contribute to the growth of the generic pharmaceuticals contract manufacturing market.

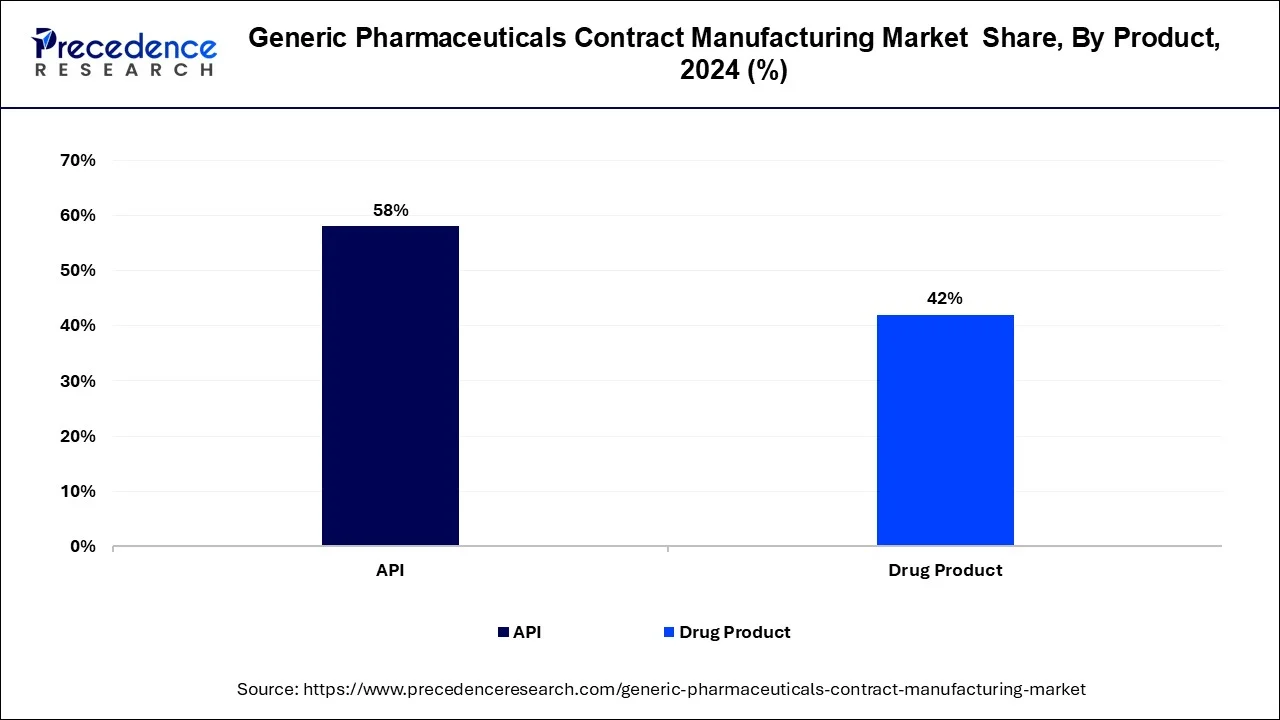

The API product segment dominated the market in 2024. The benefits of API products for organizations: developers use APIs to research and develop new services, enhance business models, reliability, and functionality, access data, and complete their product development. The APIs are the active ingredients contained in the medicine.

The API is that part of the medicine that medicines that produce therapeutic effects. An API to relieve pain is used as a painkiller. These factors help the growth of the API product segment and contribute to the growth of the generic pharmaceuticals contract manufacturing market.

The oral category segment dominated the market in 2024. The oral route of administration is the most preferred drug delivery system. The benefits of the oral category route of administration include less expensive, most convenient, and most convenient. Although, it has limitations due to the way drugs usually move through the digestive tract. The oral route of administration and absorption can begin with the stomach and mouth. The advantages of the oral route of administration are flexibility in dosage forms, high patient compliance, pain-free, cost-effectiveness, and simplicity. The prerequisite for oral drug delivery may be significant aqueous solubility, which leads to improved bioavailability. These factors help the growth of the oral category segment and contribute to the growth of the generic pharmaceuticals contract manufacturing market.

The parenteral segment is estimated to be the fastest-growing during the forecast period. The advantages of the parenteral route of administration include the fact that it can deliver an accurate dose of medication rapidly, it may be directly injected into the tissue or circulatory system, or it bypasses liver metabolism. The benefits of parenteral administration also include the fact that they are more quickly absorbed and have a faster onset of action than the oral route of administration, reliable dosage, better bioavailability, and first-pass metabolism avoidance. Parenteral routes of administration are better for drugs with poor absorption in the GIT (gastrointestinal tract) that are destroyed by digestive secretions or not orally effective. These factors help the growth of the parenteral segment and contribute to the growth of the generic pharmaceuticals contract manufacturing market.

The oncology segment dominated the generic pharmaceuticals contract manufacturing market in 2024. The benefits of generic pharmaceuticals contract manufacturing for oncology include it helps to treat ovarian cancer, blood cancer, lung cancer, testicular cancer, etc. This helps to prevent cancer cell growth. The benefits of cancer treatment include chemotherapy, which can slow down cancer growth or shrink cancer, which can help to live longer and with your symptoms. These factors help the growth of the oncology segment and contribute to the growth of the market.

The immunology segment is estimated to be the fastest-growing during the forecast period. The benefits of generic pharmaceuticals contract manufacturing for immunology drugs include helping to improve immune response by suppressing or enhancing the immune system. These are used to treat and prevent specific diseases and can fight infections. Immunology drugs are used for immunosuppression to prevent immunological response. The immunology drugs treat many conditions, such as autoimmune and cancer diseases. These factors help to the growth of the immunology segment and contribute to the growth of the generic pharmaceuticals contract manufacturing market.

By Drug Type

By Product

By Route of Administration

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

April 2024

January 2025

February 2024