August 2024

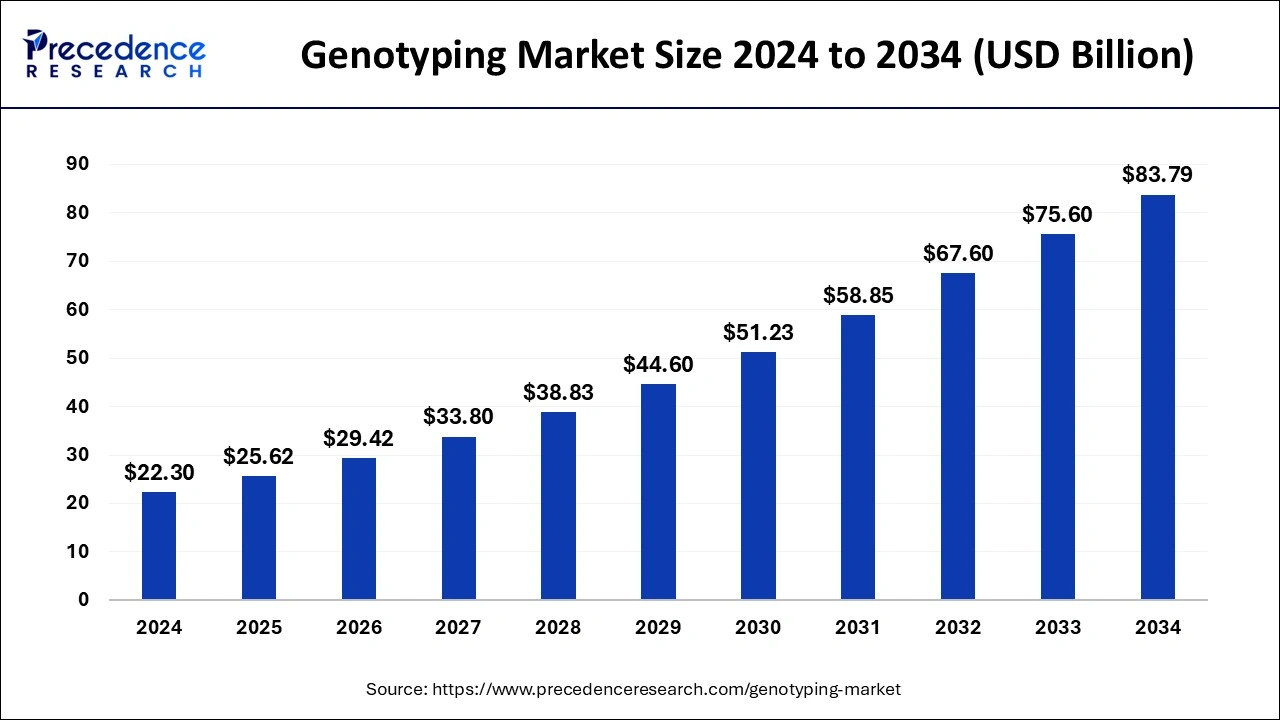

The global genotyping market size is accounted at USD 25.62 billion in 2025 and is forecasted to hit around USD 83.79 billion by 2034, representing a CAGR of 14.15% from 2025 to 2034. The North America market size was estimated at USD 9.14 billion in 2024 and is expanding at a CAGR of 14.18% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global genotyping market size was calculated at USD 22.30 billion in 2024 and is predicted to reach around USD 83.79 billion by 2034, expanding at a CAGR of 14.15% from 2025 to 2034. The genotyping market has grown because genotyping at birth can verify paternity and correct errors. Acknowledging parental errors before registration can prevent future problems and screenings.

Artificial Intelligence (AI) promises to solve problems by performing the task of calculating phenotypes and correlating them with genotypes. Collaboration between biomedical and cognitive scientists to describe early successes and look ahead. AI techniques have been used to extract information about the structural components of genomic sequences that affect cellular transcriptional processes. In particular, deep learning methods have been used to predict the specificity of DNA and RNA binding proteins. The AI approach scans DNA and RNA for motifs and identifies protein promoter regions that alter binding properties based on changes in single nucleotide polymorphisms, deletions, or insertions. AI, when combined with phenomic information, can improve disease detection in the state when used to identify drivers. AI technology for decision support will improve early detection and improve medical decisions. It will also improve phenotype identification from images, identify new genotypes and phenotypes, and thus support the development of the genotyping market.

For Instance,

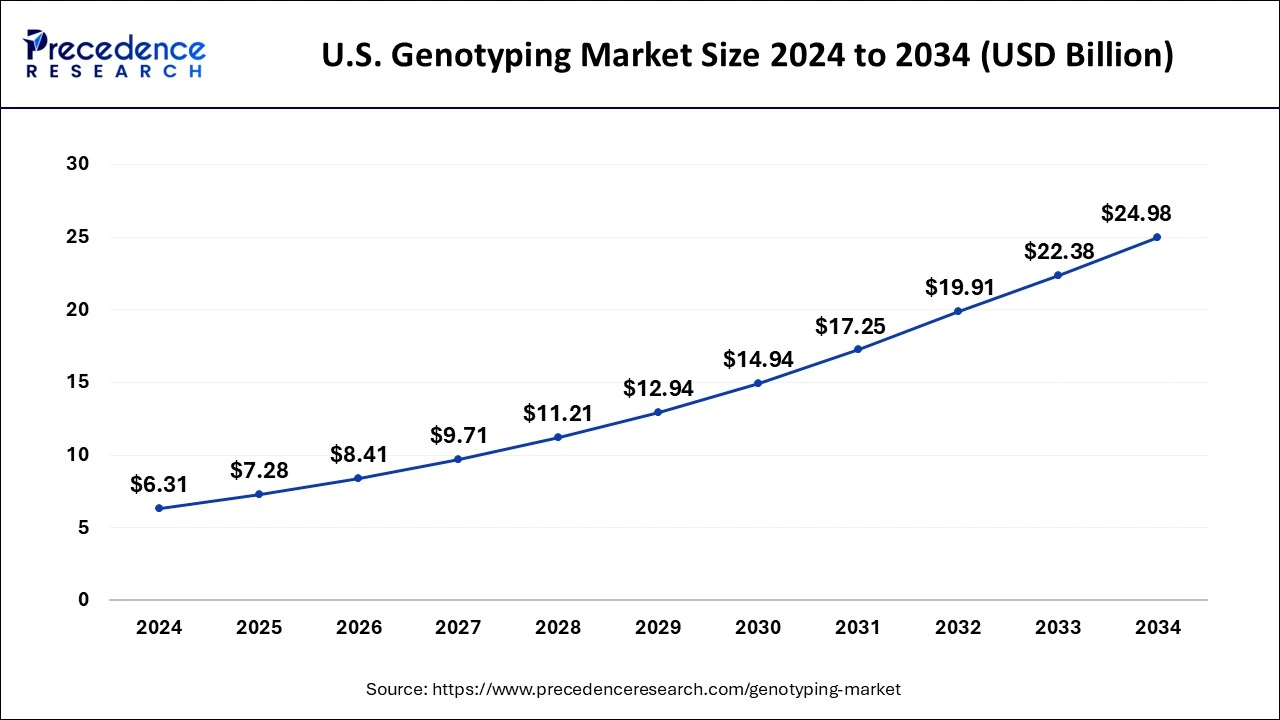

The U.S. genotyping market size was evaluated at USD 6.31 billion in 2024 and is projected to be worth around USD 24.98 billion by 2034, growing at a CAGR of 14.75% from 2025 to 2034.

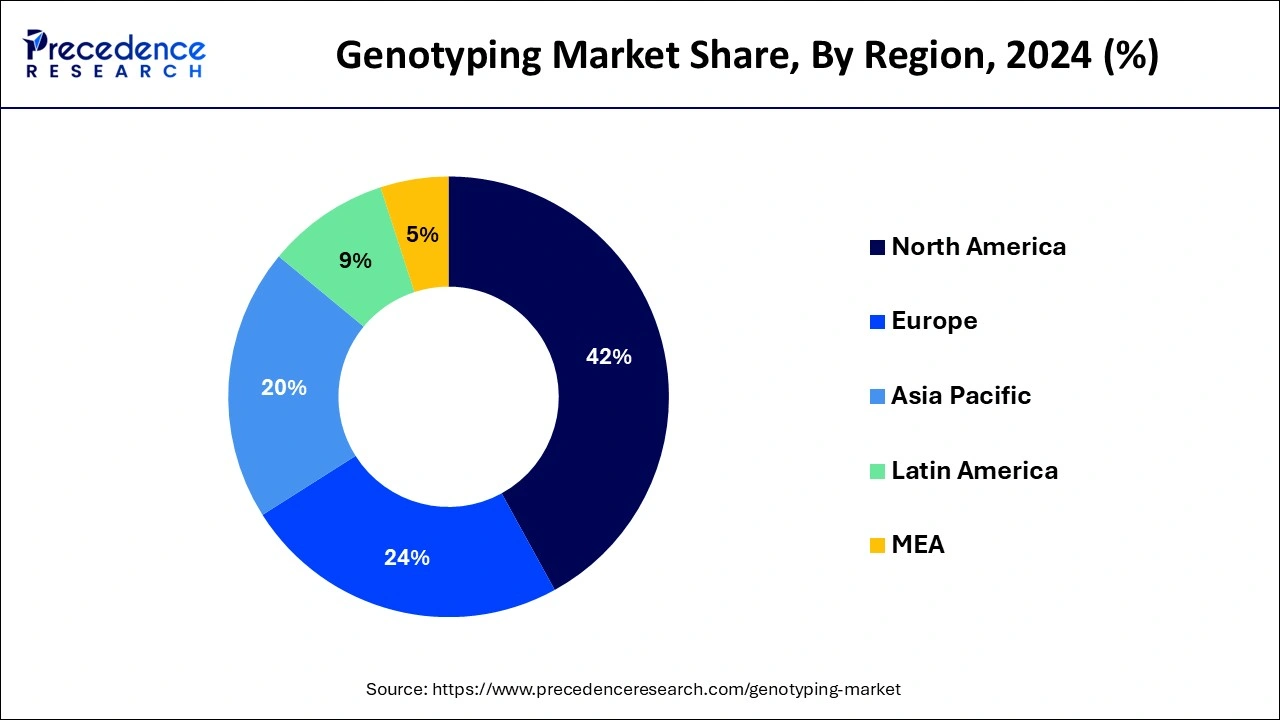

North America accounted for the largest market share in 2024. The region is expected to maintain its dominance owing to the advancements in the healthcare infrastructure, the presence of prominent market players such as Illumina Inc., Thermo Fisher Scientific Inc. Agilent Technologies, and others, growing adoption of technologically advanced products, increasing government funding, and rising prevalence of chronic diseases in the region. For instance, As per the National Center for Chronic Disease Prevention and Health Promotion, 6 out of 10 Americans live with at least one chronic disease. Genotyping techniques are used for the early diagnosis and treatment of chronic disorders.

On the other hand, the Europe market is expected to grow at a significant CAGR during the forecast period due to the rapid growth of the pharma and biopharma companies, technological advancements, and an increase in research and development activities in the region. Furthermore, the Asia Pacific market is projected to register a considerable CAGR during the forecast period owing to the increase in government investment, increasing research projects, and the rise in the number of clinical trials being performed in the region.

The global genotyping market revolves around the product, services and technologies associated with genotyping. Services and products offered by the global genotyping market are further used in multiple fields, including medical research, drug development, agriculture and consumer genetic testing.

Genotype is the heritable information that is carried by all living organisms. Genotyping allows the identification of genetic variants. Genotyping refers to the technology that helps detect small genetic differences which lead to major changes in phenotype, it includes both physical differences that make us different as well as pathological changes. By comparing a DNA sequence to that of another sample or a reference sequence, genotyping detects variations in genetic complement. It identifies minor changes in genetic sequence within populations such as SNPs. SNPs are single base-pair variations in DNA that occur at particular areas in the genome.

Made up of double helix structure, the human genome carries nucleotide base pairs. They can explain features such as eye colour and inherited diseases like cystic fibrosis and sickle cell anaemia, as well as serve as indicators of risk of developing complex common diseases such as Alzheimer's disease and diabetes. By forecasting an individual's risk of contracting specific diseases or developing targeted therapies based on the genetics of the disease, SNP genotyping can speed up the era of personalized medicine. As Single-nucleotide polymorphisms (SNPs) are also linked with individual therapeutic responses, SNP-based assays may be useful in determining the most appropriate course of treatment.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 14.15% |

| Market Size in 2025 | USD 25.62 Billion |

| Market Size by 2034 | USD 83.79 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 To 2034 |

| Segments Covered | Product, Application, Technology, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Decreasing prices of DNA sequencing due to technological developments

Advancements in technology such as next-generation sequencing (NGS) has reduced the entire costs of DNA sequencing and lowered the overall cost of genomic and genotyping projects. Technological improvements have enabled miniaturization, automation and helped in decreasing the overall total costs. Such technological advancements have boosted the chances of accuracy in sequencing along with the boosted speed in the sequencing procedures.

These factors have expanded the uses of DNA sequencing and permitted clinicians to focus on decision making processes such as choosing and prioritizing therapeutic targets through several genotyping studies. It has also increased the use of sequencing, PCR, capillary electrophoresis, and microarrays in areas such as clinical research and drug development.

High-cost equipment for genotyping is restraining the market growth

The high cost of genotyping is expected to restrain the genotyping market growth. Genotyping equipment is expensive as it has advanced features. The installation and maintenance costs of this equipment are considerably high. As a result, advanced technology such as NGS technology has slowed adoption in many middle and lower-income countries.

Increasing government support in genotyping research

The rising government support in genotyping research is expected to offer a set of opportunities for the global genotyping market. Several governments across the globe are focused on implementing numerous initiatives to support research institutions that focus on personalized medicine. For instance, in September 2018, the National Institutes of Health granted $28.6 million to the ‘All of Us Research Program’ for the establishment of three genome centers across the United States which will be dedicated to precision medicine research.

Furthermore, the strategic initiatives undertaken by prominent players are expected to accelerate the market’s growth. For instance, in September 2022, a leader in DNA sequencing technologies, Illumina announced the launch of the NovaSeq X Series, new production-scale sequencers. The recent launch platform from Illumina aims to boost the limits of genomic medicine by making it faster, more sustainable, and more powerful. This new technology by the company can generate more than 20,000 genomes per year.

On the basis of products & services, the global genotyping market is segmented into instruments, reagents & kits, software & services, and genotyping services. The reagents & kits segment is expected to expand at a robust growth rate during the forecast period owing to the rising increasing genotyping testing, increasing R&D investments, and increasing adoption of reagents & kits for genotyping in pharmaceuticals and diagnostic centers. On the other hand, the software & services segment is projected to expand at a rapid rate due extensive adoption of software-based services by academic and research institutions.

Based on the application, the global genotyping market is segmented into pharmacogenomics, diagnostics and personalized medicine, agricultural biotechnology, animal genetics, and others. The pharmacogenomics segment is expected to dominate the market over the forecast period. Pharmacogenomics is an example of the field of precision medicine, which tends to customize treatment to an individual person or to a group of people. Pharmacogenomics examines how the individual’s DNA affects and how the individual reacts to drugs. Pharmacogenomics can help an individual to know in advance whether a drug is beneficial and safe for an individual to take or not. In addition, prominent market players are offering solutions for pharmacogenomics studies.

On the other hand, the diagnostics and personalized medicine segment is growing at a significant CAGR during the forecast period due to the wide adoption of genotyping products for research activities and the rising demand for the diagnosis of genetic disorders. Personalized medicine involves the combination of molecular, genetic, and environmental variability in the existing method for the proper management of disorders or illnesses.

Based on the technology, the global genotyping market is segmented into Polymerase Chain Reaction (PCR), capillary electrophoresis, microarrays, sequencing, matrix-assisted laser desorption/ionization-time of flight (Maldi-TOF) mass spectroscopy, and others. The Polymerase Chain Reaction (PCR) segment is expected to grow at a significant rate during the forecast period owing to the increasing number of CROs, growing demand for advanced diagnostic techniques, and growing prevalence of genetic disorders. Genotyping allows researchers to examine large structural variations in DNA to small genetic changes in DNA like single nucleotide polymorphisms (SNPs). Real-time PCR offers a high throughput solution for genotyping using molecular probes for rapid and accurate results.

On the other hand, the sequencing segment is anticipated to expand at a rapid rate owing to its ability to detect low expression & differentially expressed genes than any other methods. Genotyping by sequencing is a genetic screening method for discovering SNPs and performing genotyping studies.

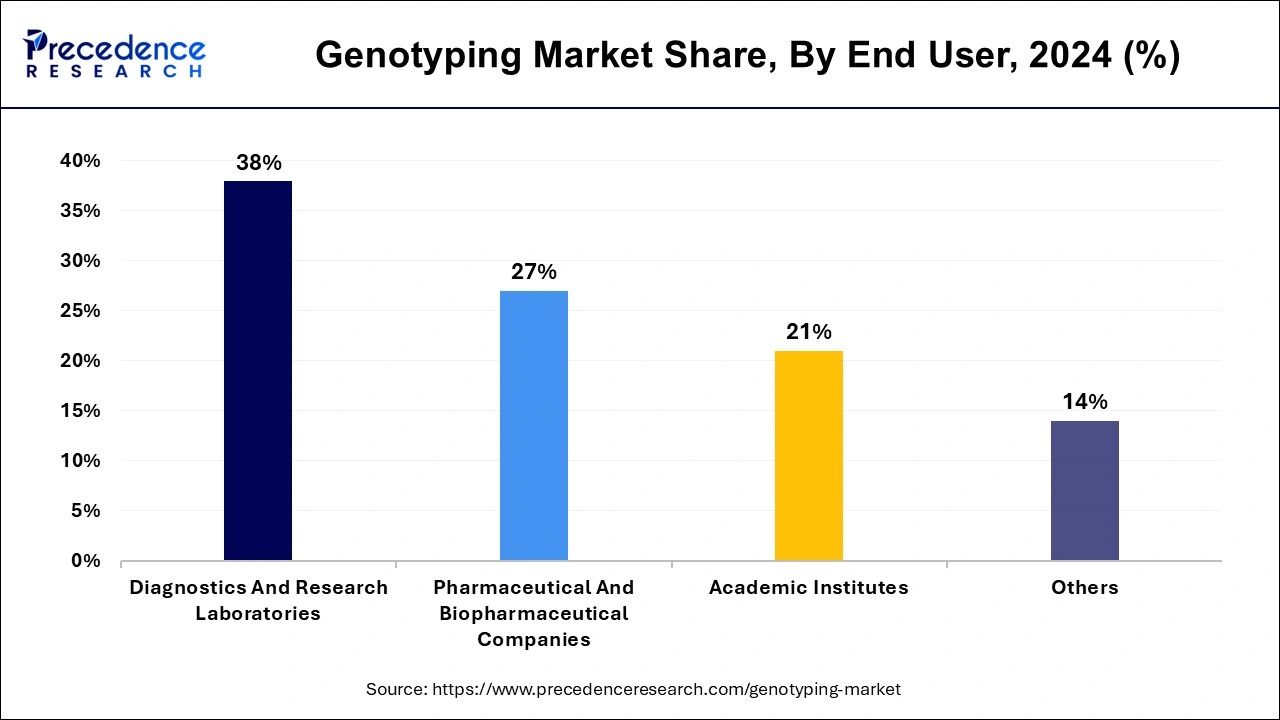

Based on the end user, the global genotyping market is segmented into pharmaceutical and biopharmaceutical companies, diagnostics and research laboratories, academic institutes, and others. The diagnostics and research laboratories segment is expected to capture a significant market share over the forecast period due to the increasing use of genotyping products for research, the growing demand for the diagnosis of genetic disorders, and the increasing incidence of cancer rises the demand for diagnostic tests are projected to boost the market.

On the other hand, the biopharmaceutical and pharmaceutical companies segment is expected to expand at a robust growth rate in the coming years owing to the increasing number of biopharmaceutical and pharmaceutical companies. Companies actively use pharmacogenomics to develop innovative drugs. The increasing need for pharmacogenomics in the drug development process and FDA suggestions to include pharmacogenomics studies and genotyping in the drug discovery process.

Segments Covered in the Report:

By Product

By Application

By Technology

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024