August 2024

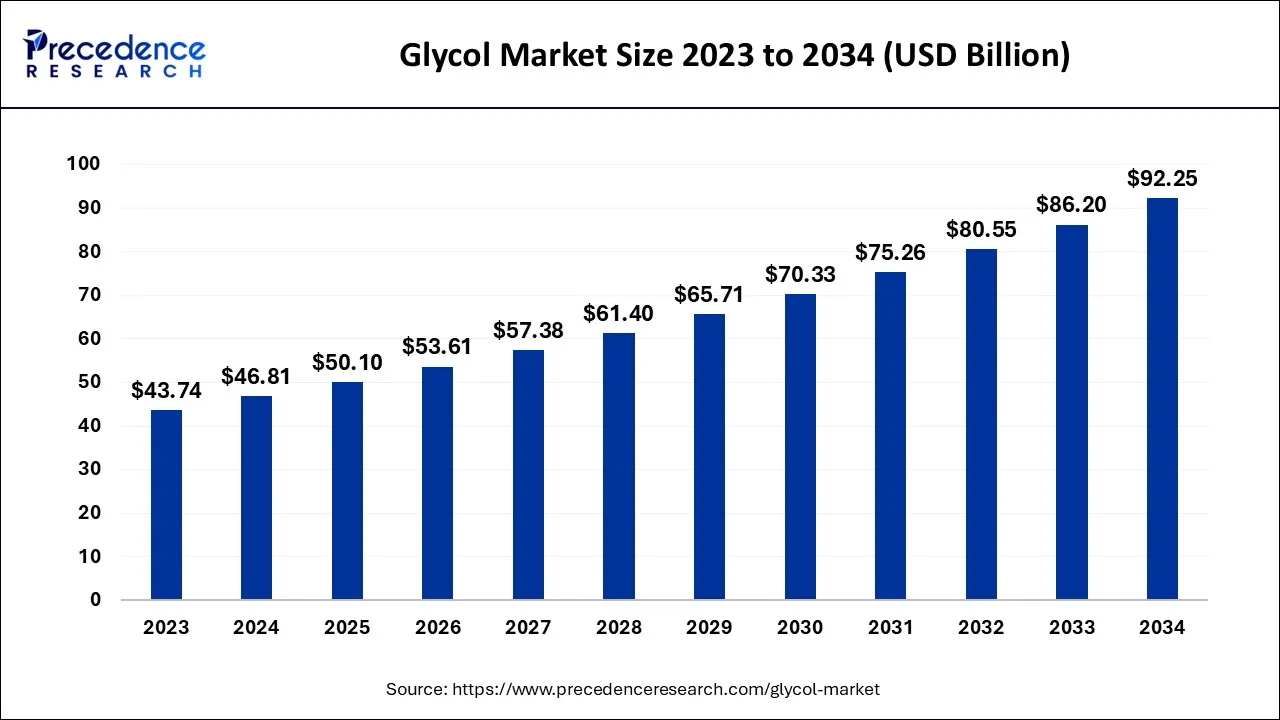

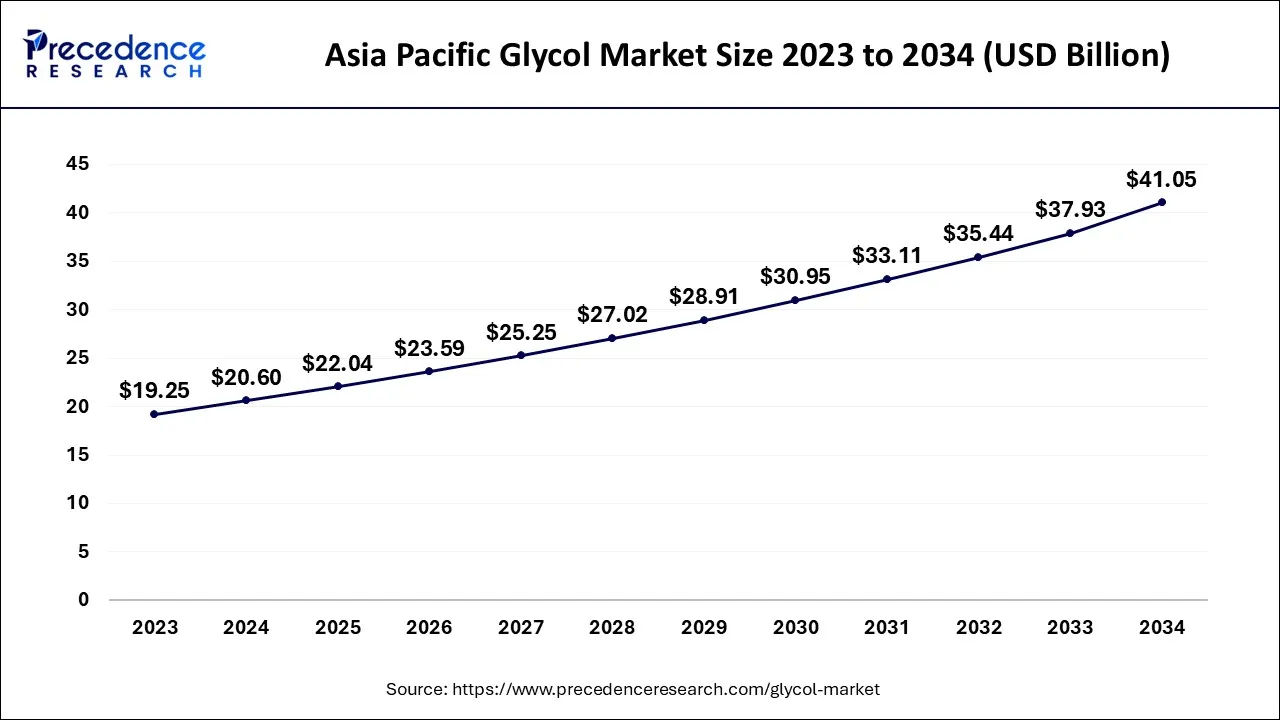

The global glycol market size accounted for USD 46.81 billion in 2024, grew to USD 50.10 billion in 2025 and is expected to be worth around USD 92.25 billion by 2034, registering a CAGR of 7.02% between 2024 and 2034. The Asia Pacific glycol market size is calculated at USD 20.60 billion in 2024 and is estimated to grow at a CAGR of 7.14% during the forecast period.

The global glycol market size is calculated at USD 46.81 billion in 2024 and is projected to surpass around USD 92.25 billion by 2034, growing at a CAGR of 7.02% from 2024 to 2034.

The Asia Pacific glycol market size is exhibited at USD 20.60 billion in 2024 and is projected to be worth around USD 41.05 billion by 2034, growing at a CAGR of 7.14% from 2024 to 2034.

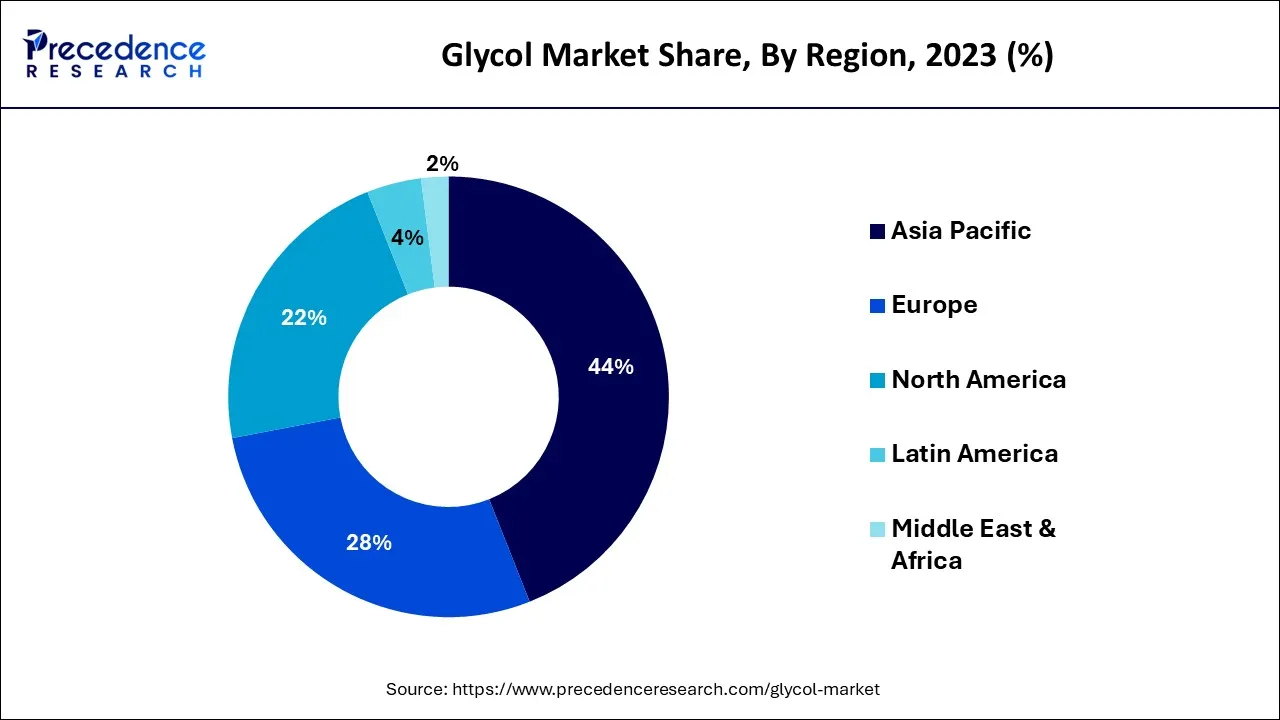

Asia Pacific held the maximum share of the glycol market due to the traditional centres of innovation for manufacturing technologies and ways to create an industrial ecosystem.

The market has seen a significant change in the production landscape towards Asian countries, with China presenting itself as a regional as well as a worldwide centre for manufacturing, despite the fact that these regions combined accounted for close to 50.0% of the global demand.

An organic substance known as glycol has the chemical formula (CH2OH) 2. Glycol is largely utilised for two things: making polyester fibres as a raw material and making antifreeze preparations. Glycol has the qualities of being an odourless, colourless, sweet-tasting, and gluey liquid. It is also utilised as an antifreeze in synthetic fibers, brake fluid, and low-freezing explosives in addition to car cooling systems. Glycol is a non-hazardous, sweetened substance that serves as a solvent, antimicrobial, and moisture-retaining ingredient in foods, dental care, and personal care items.

It is also utilised in a variety of products, including toys, food packaging, film, bottles, pipelines, antifreeze, carpets, insulation, and animal feeds. The automotive and transportation industry, food and beverage processing, heating, ventilation, and air conditioning (HVAC), as well as the production of polyester fibres, all require derivatives of glycol. The recent improvement in the outlook for western markets' economies as a result of resurgent industrial activity has had a beneficial effect on the market's expansion.

Glycols have been under great attention from organisations like the U.S. Environmental Protection Agency (EPA) and FDA due to their harmful impacts on human health during the period of increased regulatory control. Although the FDA has designated propylene glycol as generally recognised as safe (GRAS), the organisation has established appropriate daily intake amounts to protect human health.

Similar research has been done by the EPA about the toxicological profile of glycols and suggested guidelines for their use and handling.

Throughout the projected period, the worldwide glycol market is anticipated to grow due to the rising use of non-perishable resources. Government actions are also anticipated to increase the use of bio-based goods like glycol. They are thought to be secure and environmentally responsible. Furthermore, they adhere to strict governmental rules. Due to their extensive use in the pharmaceutical, food, and cosmetic industries, bio-based glycols are predicted to gain appeal.

The rising demand for processed foods is one of the main driving forces behind the worldwide glycol industry. The growing labour force, modern lifestyle, and population all contribute to an increase in the use of processed foods. The demand for propylene glycol is also fueled by expansion in the transportation and construction sectors.

It is anticipated that technological advancements in the packaging sector will increase the range of food products that are suitable for use, including frozen, chilled, shelf-stable, microwaveable, and prepared mixes. Increased consumer expenditure on personal hygiene and personal care items like moisturizers and sunscreen creams will accelerate market expansion.

| Report Coverage | Details |

| Market Size in 2024 | USD 46.81 Billion |

| Market Size by 2034 | USD 92.25 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.02% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing usage in the textile industry

Glycols are used to make cellophane, leather, and polyester fibres. One substance that is frequently used in textile applications is ethylene glycol. The COVID-19 pandemic had a significant negative impact on global fibre production in 2020, which saw a decline from 111 million tonnes to 109 million tonnes. With improved market activity in 2021, however, as a result of the active recovery in the world economy, it largely recovered. China, the European Union, and India are three of the top exporters of textiles, with a combined market share of more than 65%.

The first ten months of 2021 saw noteworthy growth in China's textile sector. Major companies' combined sales increased by almost 14% year over year to reach USD 650 billion. One of the global industries with the quickest growth rates is the textile industry in India. From April to December 2021, exports of textiles increased by almost 31% over the same period in the previous year. Since COVID-19's breakout, investments in the Indian textile industry have shown a pronounced development.

The government proposed a plan for creating mega textile parks in India in Budget 2021–22 to increase employment and make India more competitive internationally. The Indian textile and apparel sector was valued at USD 152 billion in 2021, according to the Indian government. Additionally, the USD 75 billion domestic consumption was broken down into USD 55 billion for garments, USD 15 billion for technical textiles, and USD 5 billion for home furnishings.

The government announced a new Buy America Act waiver procedure in 2021 in order to increase textile production in the country. The new waiver procedure seeks to increase procurement process transparency, which is expected to be advantageous to textile companies as they can better grasp the possible business prospects and work to improve and supply made-in-America products. All these factors will drive the growth of the market.

Health issues

The main difficulty facing glycol makers is health problems brought on by the use of glycol. The market growth rate may be negatively impacted by a variety of health issues linked to glycol. The allowable daily consumption of glycol as a food additive, according to WHO, should not, however, exceed 25 mg/Kg of weight. The main market restraints that will slow the market's growth rate are health problems brought on by the increasing intake of glycol.

Increasing demand of glycol in the automotive industry

It is projected that the growing demand for glycol in the automotive sector will accelerate the expansion of the global market. Due to its lower melting point than water, ethylene glycol prevents ethylene engines from freezing in the winter and serves as a coolant to prevent overheating in the summer. The global glycol market is anticipated to benefit greatly from the usage of ethylene glycol in cars to absorb combustion heat.

Based on the product, the industry has been divided into ethylene glycol and propylene glycol (1, 2-propanediol) (1, 2-ethanediol). These goods serve a wide variety of industry segments. The production of polyester composites makes extensive use of propanediol, which is also employed as a solvent in the production of food colouring, flavouring, paint dispersions, and plastic resin.

Propylene glycol is increasingly popular and is expected to grow in the projected period as it is used as an alternative to ethylene glycol in antifreeze applications due to its intrinsic low toxicity. 1, 2-propanediol is used as an antifreeze in the chemical, food, and medicinal industries. However, as an alternative to ethylene glycol, the chemical has found increased use as an eco-friendly automotive and marine antifreeze in a 40:60 ratio of 1,2-propanediol: water.

A common antifreeze, coolant, and heat-transfer substance is ethylene glycol. The substance works as a reagent in the creation of polyesters, alkyd resins, synthetic waxes, and explosives in addition to lowering the freezing point of fluids. Additionally, the ethylene-based glycols are used as a component in hydraulic lubricants, paint solvents, and printing inks.

The market primarily serves the automotive, pharmaceutical, food & beverage processing, pipeline repair, textiles, aviation, medical, and HVAC industries. After the global recession, trade policies, localization & sustainability of business, and fiscal mechanisms all experienced fundamental changes.

As of 2018, the global GDP increased by almost 3.7% as industrial activity recovered in established countries and significantly advanced in developing regions. The development of the world economy paved the way for a bright future for glycol producers. During the forecast period, the application sector for automotive will experience the fastest growth. World automotive production increased with double-digit growth rates recorded in a few European nations, notably the Netherlands, Finland, Portugal, Slovenia, Russia, and Ukraine. Positive macroindicators, as mentioned above, should be a source of optimizing the growth outlook for the glycol business. Europe continues to be the region with the highest demand for glycol.

The food and beverage sector is anticipated to experience rapid expansion in the near future as it is used in various food products such artificial sweeteners, ice cream, flavouring & essence, icing, soft drinks, sweets, frostings, and baked goods as an anti-freeze agent, solvent, thickening, flavour enhancer, emulsifier, and stabilizer.

In September 2021, INEOS Oxide was accredited by EXCiPACT for pharmaceutical excipients for ethanolamines produced in Plaquemine, Louisiana, USA. The certification guarantees that all QMS components adhere to GMP standards as outlined in the 2017 EXCiPACT for Pharmaceuticals Excipients. This accomplishment helps to ensure and sustain the sales of specialised products that demand a high level of quality assurance.

The Verbund site, which is managed by BASF-YPC Co., Ltd., a 50/50 joint venture between the two companies in Nanjing, China, was extended by BASF and SINOPEC in August 2021. It entails expanding the targeted chemical factories, including building a new tert-butyl acrylate production to serve the expanding China market.

In October 2022, the INR 100 billion (USD 1.33 billion) expansion and debottlenecking of Reliance Industries Ltd.'s Hazira manufacturing complex received approval from the Ministry of Environment, Forests, and Climate Change panel. In 1991–1992, Mukesh Ambani's RIL's HMD complex was given the go-ahead to produce utilities and other products including Vinyl Chloride Monomer (VCM) and MonoEthylene Glycol.

Petro Rabigh and Gulf Cryo signed a contract in March 2022 to absorb carbon dioxide emissions from the Petro Rabigh complex's Mono Ethylene Glycol MEG unit. The project is in line with Saudi Arabia's ambitious programmes to lower carbon emissions in the Kingdom, including the Saudi Vision 2030 and the Circular Carbon Economy Concept.

Segments Covered in the Report

By Product

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024