October 2024

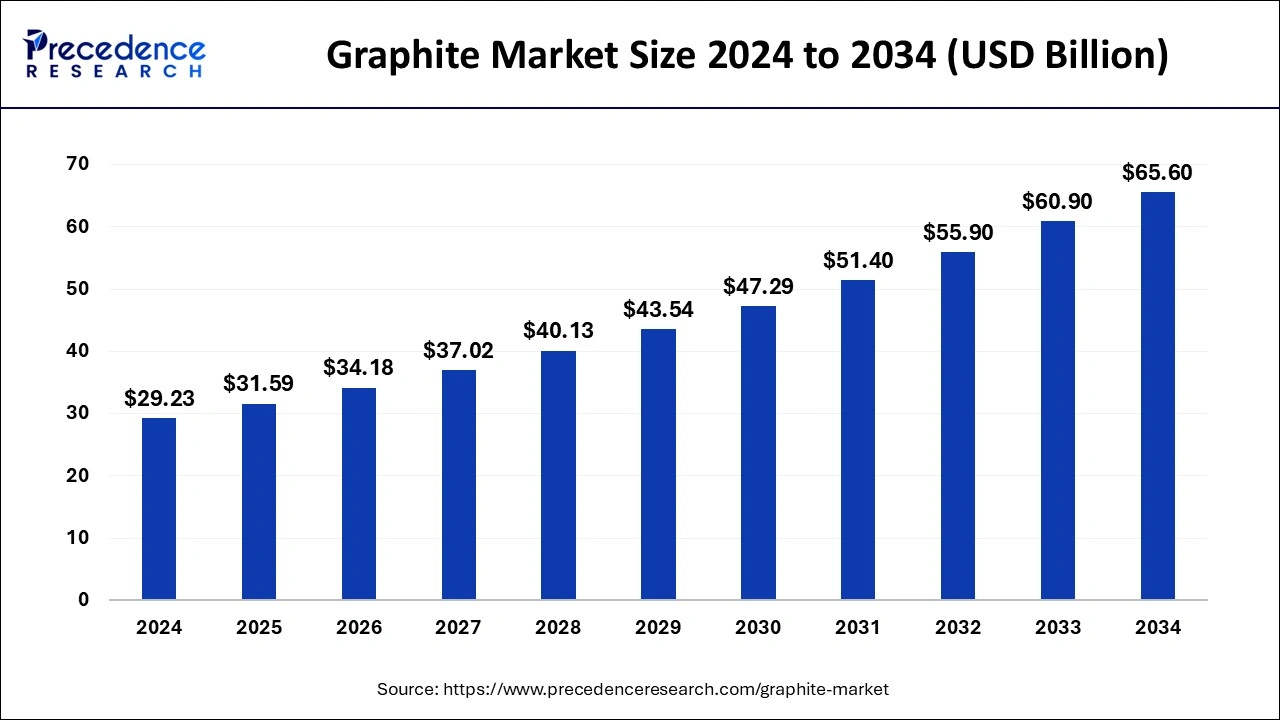

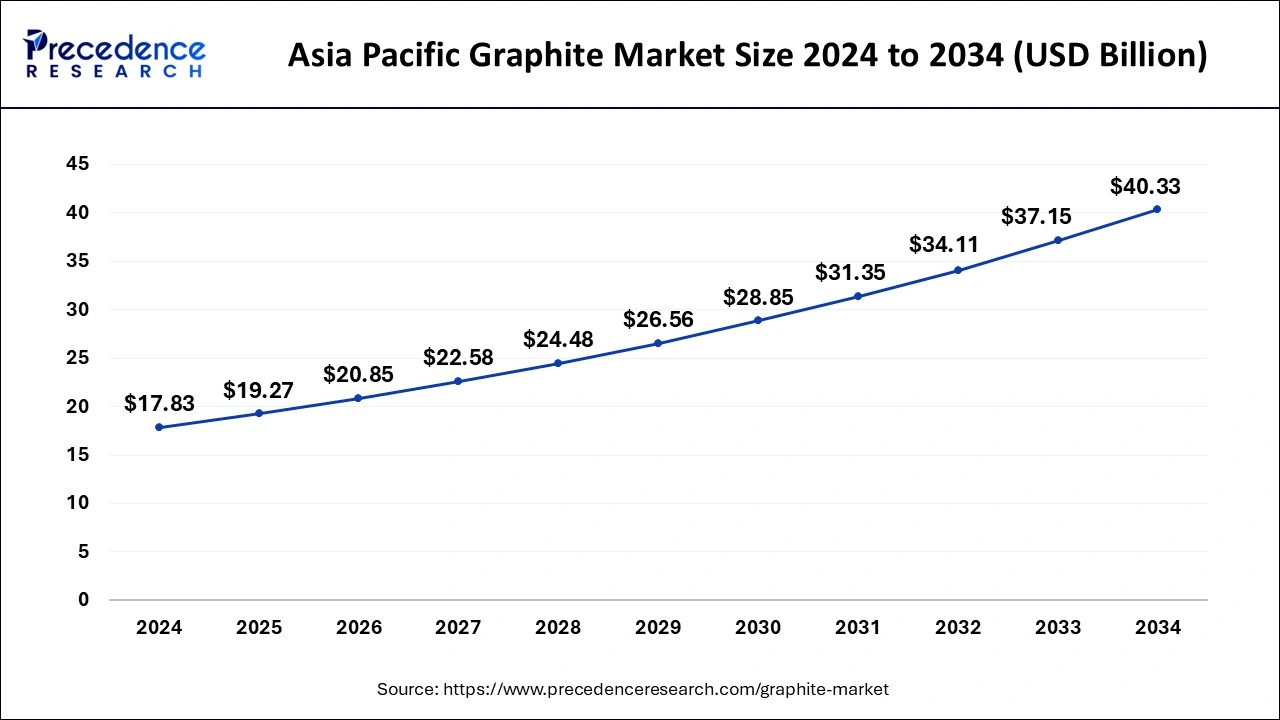

The global graphite market size is recorded at USD 31.59 billion in 2025 and is forecasted to hit around USD 65.60 billion by 2034, growing at a CAGR of 8.42% from 2025 to 2034. The Asia Pacific market size was accounted at USD 17.83 billion in 2024 and is expanding at a CAGR of 8.50% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global graphite market size was estimated at USD 29.23 billion in 2024 and is predicted to increase from USD 31.59 billion in 2025 to approximately USD 65.60 billion by 2034, expanding at a CAGR of 8.42% from 2025 to 2034.

The Asia Pacific graphite market size was evaluated at USD 17.83 billion in 2024 and is projected to be worth around USD 40.33 billion by 2034, growing at a CAGR of 8.50% from 2025 to 2034.

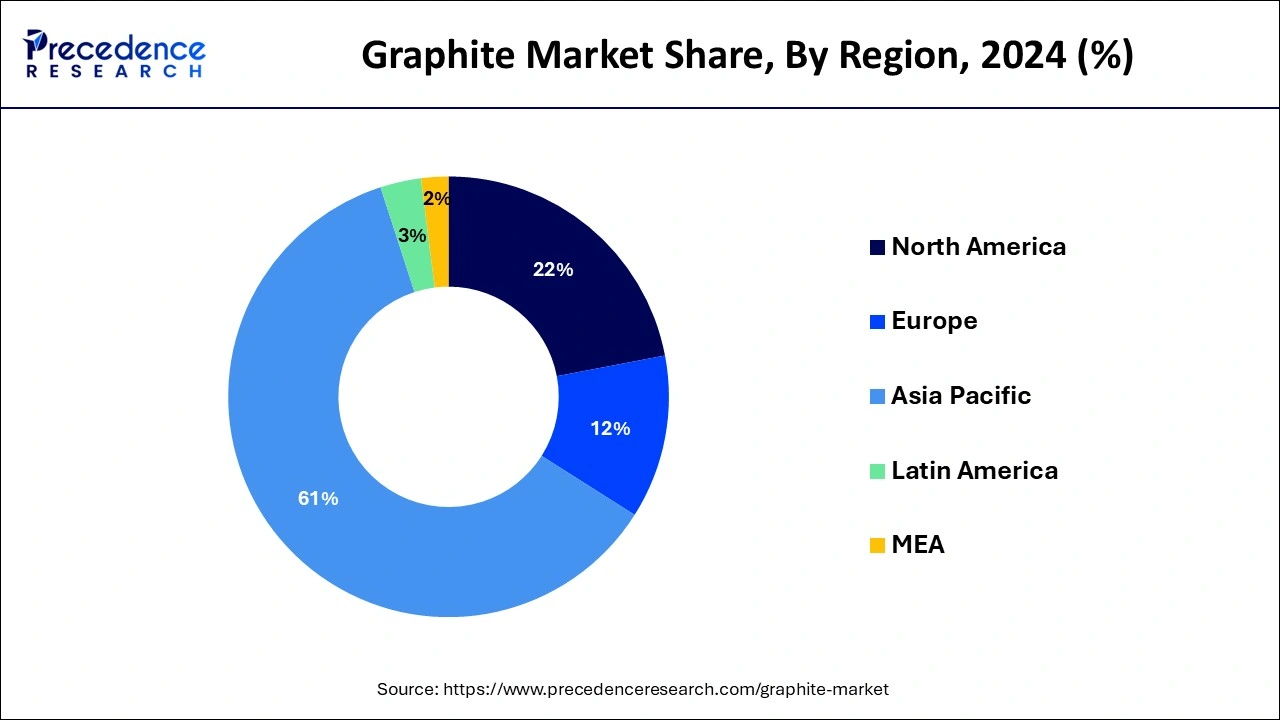

Asia-Pacific held the largest share of 61% in the graphite market due to a combination of factors. Asia-Pacific commands a significant share in the graphite market due to a confluence of factors. Rapid industrialization and urbanization in countries like China and India drive the demand for graphite in diverse applications, from steel production to electronics manufacturing. The region's robust automotive and energy storage sectors further contribute to graphite consumption. Additionally, favorable government policies, increased investments in infrastructure, and a growing emphasis on renewable energy solutions amplify the demand for graphite in the Asia-Pacific region, solidifying its dominant position in the global graphite market.

North America is poised for rapid growth in the graphite market due to increasing demand from key industries. The region's emphasis on electric vehicle production, coupled with advancements in battery technologies, propels graphite demand. Additionally, the growing aerospace sector's reliance on lightweight materials, where graphite plays a vital role, contributes to the market's expansion. The region's focus on renewable energy and sustainable practices further boosts graphite applications. With these factors aligning, North America stands as a promising market for graphite growth in the coming years.

Meanwhile, Europe is witnessing significant growth in the graphite market due to several factors. The region's increased focus on electric vehicles, renewable energy, and aerospace applications has led to a surge in graphite demand. The push towards sustainability and the growing need for lightweight materials in manufacturing contribute to this growth. Additionally, innovations in graphite technologies, including graphene research, and a robust emphasis on environmental initiatives further propel the graphite market in Europe, creating a favorable landscape for its expansion in various industries.

Graphite is a specialized form of carbon characterized by its crystalline structure. Known for its slick and nonstick properties, it plays a vital role in various industries. With exceptional electrical conductivity and thermal stability, graphite is integral in the production of electrodes, batteries, and electrical components.

In metallurgy, it serves as a crucial element, acting as a refractory material in the creation of crucibles and molds for steel manufacturing. Beyond that, graphite's lightweight yet durable nature finds applications in the aerospace, automotive, and energy sectors. Its ability to withstand high temperatures and provide lubrication positions it as a fundamental material in industries ranging from machinery to cutting-edge technologies involving graphene-based materials.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.42% |

| Market Size in 2025 | USD 31.59 Billion |

| Market Size by 2034 | USD 65.60 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Surge in electric vehicle (EV) adoption

According to the International Energy Agency, in 2024, global electric car sales soared by 35% year-on-year, increasing to almost 14 million new cars. While demand remained largely concentrated in China, Europe, and the United States, growth also picked up in some emerging markets such as Vietnam and Thailand, where electric cars accounted for 15% and 10%, respectively, of all cars sold.

The upsurge in the widespread adoption of electric vehicles (EVs) stands as a dynamic force driving the graphite market to new heights. This surge finds its roots in the essential role that graphite plays within the composition of lithium-ion batteries. As the automotive sector undergoes a transformative shift towards sustainable mobility, the demand for lithium-ion batteries has witnessed an unprecedented surge. Graphite, serving as a vital element in the anodes of these batteries, significantly contributes to their enhanced performance and augmented energy storage capabilities. Notably, data from the International Energy Agency highlights a significant milestone, with over 10 million electric cars navigating global roads in the year 2020.

This not only underscores the pivotal position of graphite in the automotive domain but also serves as a catalyst for innovations in battery technology, fostering a growing demand for graphite on the global stage. Positioned at the forefront, the graphite market is poised for sustained growth, driven by the ongoing electrification revolution in the rapidly expanding electric vehicle market.

Limited graphite resources

The restricted availability of graphite resources significantly hinders market demand. Graphite being a finite resource implies that certain deposits may deplete over time, raising concerns about sustained availability. This scarcity affects industries, especially in sectors like electric vehicles and energy storage, where graphite is crucial. It not only increases production costs but also intensifies competition among industry players for access to these limited resources.

Moreover, the finite nature of graphite resources emphasizes the need for strategic resource management and exploration efforts to discover new deposits. Companies in the graphite market must navigate the challenge of balancing current demand with the imperative to secure a sustainable supply chain, emphasizing the importance of recycling initiatives and exploring alternative sources to mitigate the impact of resource limitations on market dynamics.

Innovations in lightweight materials for aerospace

Advancements in creating lighter materials for aerospace are opening significant doors for the graphite market. As the aerospace sector emphasizes fuel efficiency and improved performance, manufacturers are increasingly incorporating graphite-based composites in aircraft components. This integration helps reduce overall weight while enhancing structural integrity, aligning with the industry's goal of achieving better fuel economy and minimizing environmental impact.

Graphite's adaptability extends beyond traditional uses, with ongoing exploration into its potential for emerging technologies like additive manufacturing for aircraft parts. As the aerospace industry seeks innovative and sustainable solutions, graphite's distinct features position it as a preferred material, unlocking new opportunities for growth in an environment where weight savings and performance are paramount.

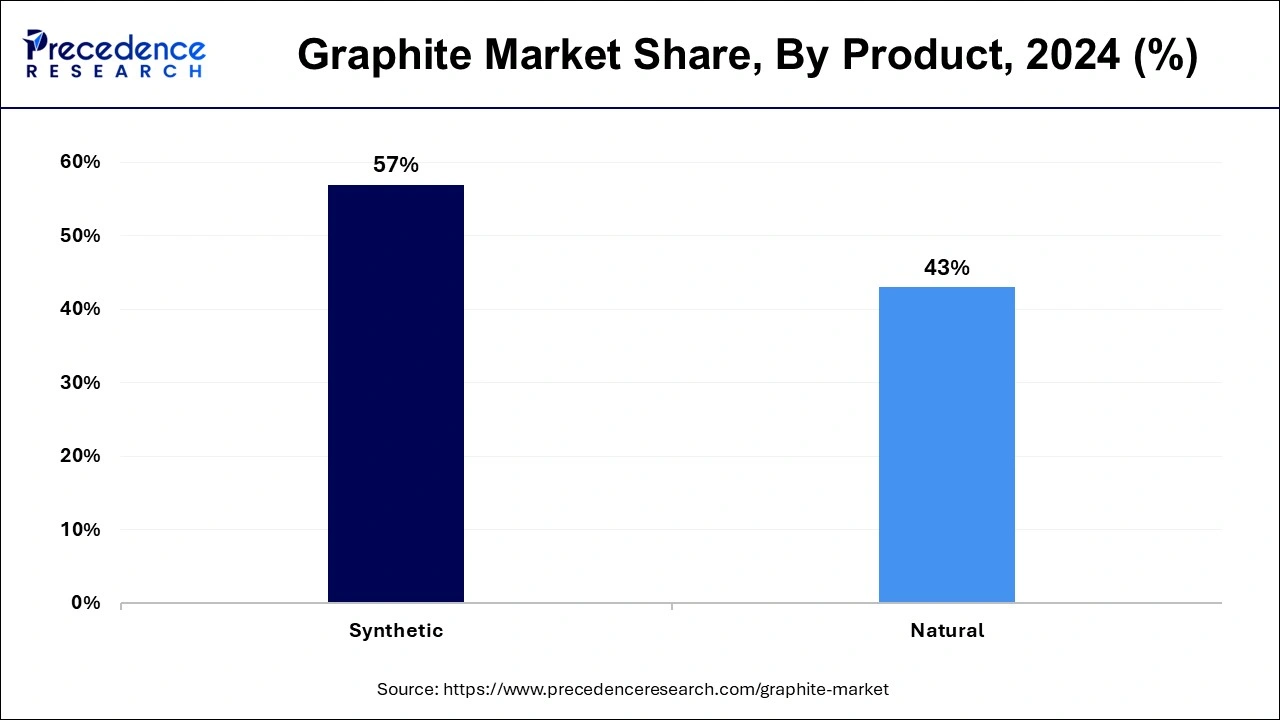

The synthetic segment had the highest market share of 57% in 2024. The synthetic graphite segment in the graphite market refers to graphite produced through high-temperature processes using carbon-rich precursors. This method yields high-purity graphite with tailored properties for specific applications. A notable trend in the synthetic graphite sector is the growing demand for this variant in various industries, including electronics, aerospace, and energy storage. As industries seek enhanced performance and consistency, synthetic graphite becomes increasingly favored for its purity and customizable characteristics, reflecting a trend towards precision-engineered materials to meet evolving technological requirements.

The natural segment is anticipated to expand at a significant CAGR of 9.6% during the projected period. Within the graphite market, the natural graphite segment encompasses two key types: flake graphite and amorphous graphite, both sourced from natural deposits. Flake graphite, recognized for its crystalline structure, is commonly utilized in batteries and lubricants. On the other hand, amorphous graphite, distinguished by its non-crystalline form, finds applications in foundries and serves as a carbon additive. A noteworthy trend in this segment is the rising need for natural graphite, particularly in lithium-ion batteries, fueled by the expanding electric vehicle sector and the growing demand for renewable energy storage solutions.

The refractories segment has held a 29% revenue share in 2024. The refractories segment in the graphite market refers to the use of graphite in creating heat-resistant linings for high-temperature industrial processes, such as steel manufacturing. This application demands graphite's exceptional thermal stability. A notable trend in this segment is the increasing adoption of graphite-based refractories to enhance durability and performance in critical applications. As industries seek improved heat-resistant solutions, the refractories segment continues to witness growth, positioning graphite as a crucial material for applications requiring resistance to extreme temperatures in diverse manufacturing processes.

The lubricants segment is anticipated to expand the fastest over the projected period. In the graphite market, the lubricants segment involves using graphite as a crucial element in lubricating materials. Graphite's distinct qualities, especially its effectiveness and durability in providing lubrication, position it as a favored choice across various industries. A notable trend in this sector is the growing preference for graphite-based lubricants in situations with high temperatures, where traditional lubricants might fall short. As industries prioritize efficiency and longevity, the demand for graphite in lubricants underscores a rising trend, driven by its versatile and advantageous features in enhancing lubrication performance.

By Product

By Application

By Reion

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025