June 2024

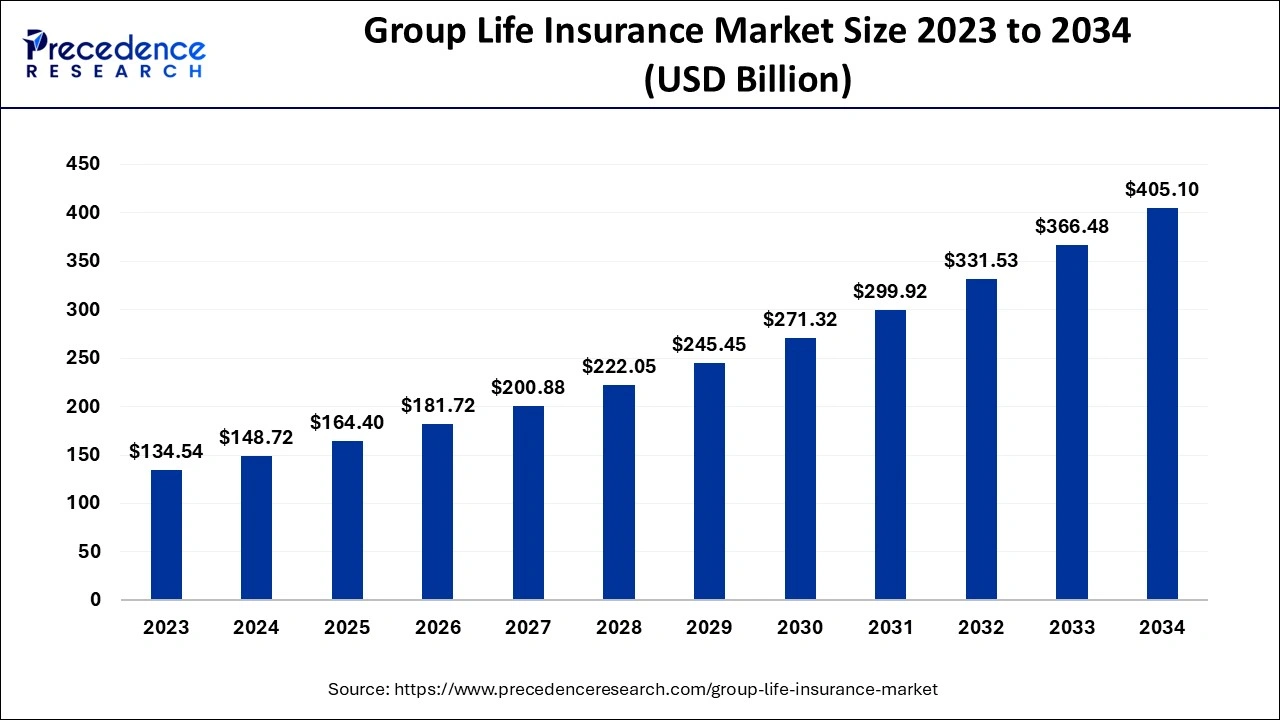

The global group life insurance market size accounted for USD 148.72 billion in 2024, grew to USD 164.40 billion in 2025 and is estimated to hit around USD 405.10 billion by 2034, representing a solid CAGR of 10.54% between 2024 and 2034.

The global group life insurance market size is worth around USD 148.72 billion in 2024 and is expected to hit around USD 405.10 billion by 2034, growing at a notable CAGR of 10.54% from 2024 to 2034. The group life insurance market offers a common employee benefit to fulfill the needs of insured beneficiaries in case of emergency while being part of the organization.

The integration of generative artificial intelligence has the potential to transform the group life insurance market. It allows for analyzing data and creating new content, predictions, and solutions through understanding patterns. If an insurer understands the innate capability and carefully considers the key factors of deployment, it can achieve a new level of efficiency, customer satisfaction, and profitability. Compared to traditional AI, which follows presumed rules, generative AI finds solutions in real time.

Generative AI leverages business value by enhancing underwriting and predictive risk assessment, personalized customer interactions, fraud detection and prevention, and claims processing optimization in the group life insurance market. For instance, New York Life, the largest mutual life insurer in the U.S., has a major focus on areas for AI application within the company’s Foundational Business. The company aims to use innovative gen AI solutions that respond rapidly to a broad range of client and agent questions that span various contract riders and options.

It is common nationwide, inexpensive, and might even be free for certain employees. When an employer purchases group life insurance from an insurance provider on a wholesale basis, the employer saves costs compared to purchasing an individual policy. Group life insurance has a relatively low coverage amount and is commonly offered as a token of a larger employer or membership benefit package. This is a single contract for life insurance coverage that extends to a group of people. Group life insurance is provided by any association or labor organization’s employer or another large-scale entity to its employees, workers, or members.

According to the U.S. Bureau of Labor Statistics, 57% of private company employees and 83% of government employees are provided with group life insurance through the workplace.

| Report Coverage | Details |

| Market Size by 2034 | USD 405.10 Billion |

| Market Size in 2024 | USD 148.72 Billion |

| Market Size in 2025 | USD 164.40 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 10.54% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type of Coverage, Size of Group, Industry Sector, Premium Payment Methods, Benefit Level, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Workforce security shield

The increasing demand for the group life insurance market is much greater than for employee benefits. It acts as a robust security shield that small and medium enterprises can control to attract and retain elite employees. Apart from financial support, it provides an employee and their families with an essential assurance which can provide them with a reliable financial support system in their time of need. At present, it is a challenge for small and medium enterprises to attract and retain skilled employees due to the strong competitive job market. With group life insurance, the employees develop a feeling of being valued, which leads to loyalty and commitment to the company.

No control over the policy

The major drawback of the group life insurance market services is that they do not have any control over the policy. The policy must be an individual’s choice or customized based on their needs. However, in the case of group life insurance, the policy is picked by the employer, bank, or organization owner, who has full control over the policy management.

Forward-Thinking Initiatives

The future of the life insurance industry is expected to notice rapid transformation regarding technological advancement, demographic shift, and changing market dynamics. This approaching essential changing major factor is digital-first consumers. The digital revolution has improved and made customer interaction with life insurance providers much easier. Insurers are integrating big data and advanced analytics to gain a better understanding of customer behaviors, preferences, and risks. This data-driven approach offers more accurate risk assessment, personalized insurance policies, and proactive customer engagement.

The term life insurance segment accounted for the highest share of the group life insurance market in 2023. The dominance of this segment is observed as it is considerably less expensive per person than equivalent individual policies. The term life insurance allows employees to get main coverage that they might not be able to afford. The premium changes with the type of work and age of the employee. Generally, it is between USD 0.05 and USD 0.60 per USD 1,000 of coverage per employee per month.

The whole life insurance segment will grow rapidly in the group life insurance market during the forecast period. The growth of this segment is noted as it provides a level of security compared to term life insurance coverage. Whole life insurance is permanent coverage that helps manage funeral costs, pay off a mortgage, or provide funds for education and other expenses.

The large group segment led the group life insurance market in 2023. The dominance of this segment is owing to various factors, such as the increasing number of small-scale businesses or start-ups, the rising cost of healthcare, and the conscious awareness of the importance of employee benefits.

The medium group segment will witness the fastest growth in the group life insurance market during the predicted period. The expansion of the segment is experienced as insurance companies believe that medium-sized businesses flourish when their teams are well taken care of. It provides a range of benefits, such as health insurance, virtual GP service, life insurance, and business protection.

The healthcare segment noted the largest share of the group life insurance market in 2023. Group life insurance in the healthcare setting is also called corporate health insurance. The group medical policy covers relevant pre-hospitalization and post-hospitalisation expenses, pre-existing diseases, and more. Additionally, there is a rise in demand for employee benefits and an increasing healthcare profession, which contributes to the growth of the market.

The education segment is projected to witness the fastest growth in the group life insurance market during the forecast period. The growth of this segment is linked to the affordability, flexibility, and freedom to modify the coverage amount for education purposes. In case of a financial crisis, the child’s education fees will still be taken care of. Premium-term life insurance plans offer a rate that is constant for a period of time. Choosing the right plan would be helpful. For instance, if the child is in elementary school, then a 20-year term that continues until graduation from college would be the right fit.

The monthly segment contributed the largest share of the group life insurance market in 2023. The dominance of this segment is observed if the individual cannot afford to pay for the full year’s insurance premium, then companies are allowed to pay the premium on a monthly payment plan. The advantages of opting for monthly premium payment are it allows one to save money with limited monthly income, offers better financial stability and is beneficial for senior citizens.

The quarterly segment will witness the fastest growth in the group life insurance market during the predicted period. The growth of this segment is driven by the balance and manageability it creates with payment options. The quarterly premium payment plan involves paying the premium every three months or four times a year.

The enhanced coverage segment contributed the highest share of the group life insurance market in 2023. The dominance of this segment is credited to the ability of offers to customize their policy to meet their needs. This is achieved by adding riders to the policy, which is designed to address specific risks or situations. Enhanced coverage includes higher death benefits, accidental death and dismemberment coverage, and chronic disease. This makes it more attractive for employees who are provided with a comprehensive benefit package.

The supplement coverage segment is predicted to witness significant growth in the group life insurance market over the forecast period. The expansion of this segment is experienced due to the increasing popularity of voluntary benefits such as critical illness insurance and long-term care insurance.

North America led the global group life insurance market in 2023. The dominance of this region is credited to the United States, which owns the biggest life insurance market worldwide. Group life insurance is the primary distribution channel for U.S. employees, surpassing individual life insurance. About half of the American states have life insurance protection, and they opt for a whole life policy, which is considered the most secure form of insurance in America.

Asia Pacific is anticipated to witness significant growth in the group life insurance market during the forecasted years. The growth of this region is linked to the rapidly increasing aging of the population. Insures help to address Asia’s retirement savings shortfall by offering innovative financial support and educating people about how it works.

By Type of Coverage

By Size of Group

By Industry Sector

By Premium Payment Methods

By Benefit Level

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2024

January 2025

September 2024

October 2024