Healthcare Interoperability Solutions Market Size and Forecast 2025 to 2034

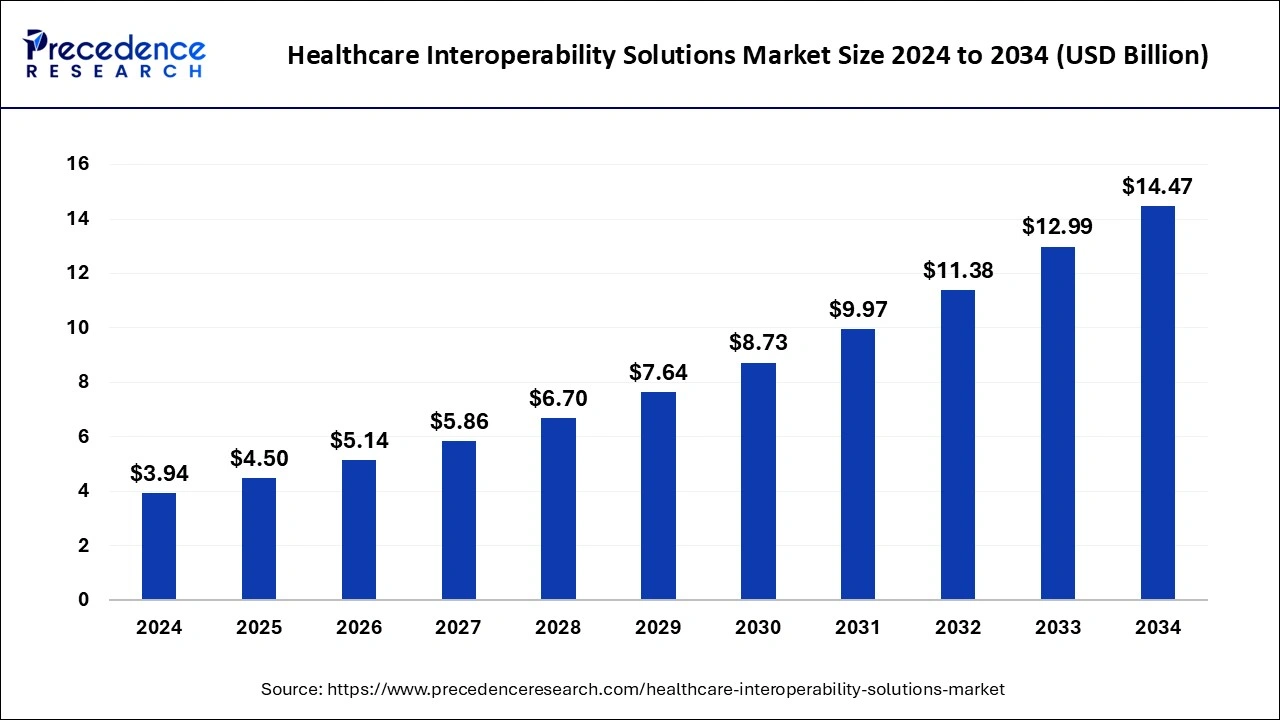

The global healthcare interoperability solutions market size was estimated at USD 3.94 billion in 2024 and is predicted to increase from USD 4.50 billion in 2025 to approximately USD 14.47 billion by 2034, expanding at a CAGR of 13.89% from 2025 to 2034. The capacity of interoperability solutions is improved by the quick development of technologies likecloud computing, big data analytics, and artificial intelligence. These technologies make it easier to integrate and transmit data between various healthcare systems.

Healthcare Interoperability Solutions Market Key Takeaways

- In terms of revenue, the global healthcare interoperability solutions market was valued at USD 3.94 billion in 2024.

- It is projected to reach USD 14.47 billion by 2034.

- The market is expected to grow at a CAGR of 13.89% from 2025 to 2034.

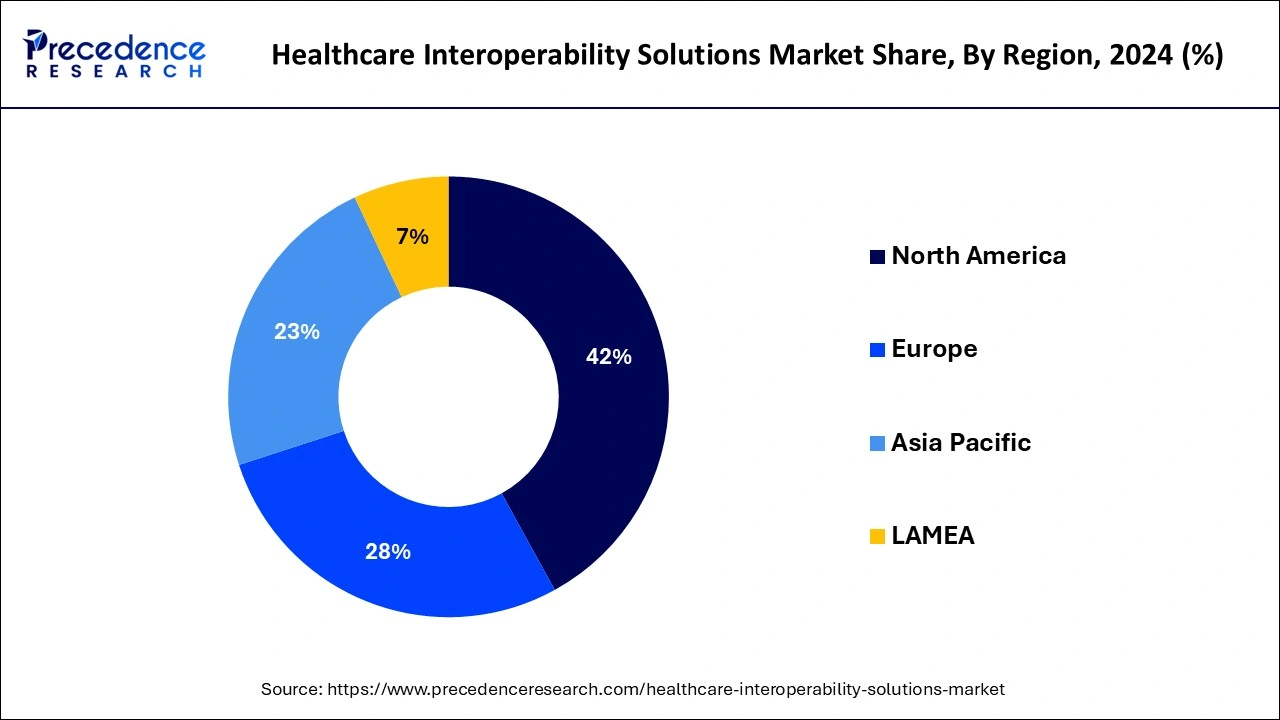

- North America dominated the market with the largest revenue share of 42% in 2024.

- Europe is expected to host the fastest-growing market during the forecast period.

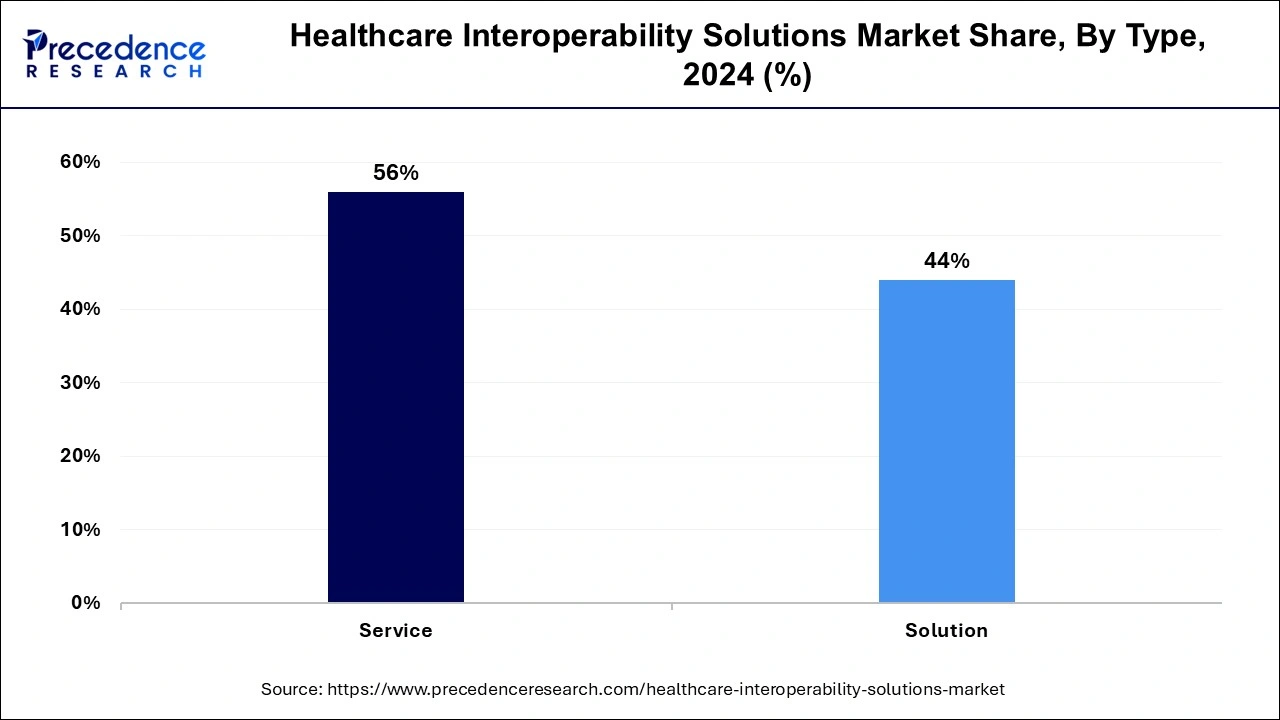

- By type, the service segment has held a biggest revenue share of 56% in 2024.

- By type, the solution segment is expected to witness the fastest growth in the market during the forecast period.

- By level, the structural segment led the market in 2024.

- By level, the foundational segment is expected to grow rapidly in the market during the forecast period.

- By deployment method, the on-premise segment held the largest share of the market in 2024.

- By deployment method, the cloud-based segment is expected to grow rapidly in the market during the forecast period.

- By application, the diagnosis segment led the market in 2024.

- By application, the other segment is expected to expand rapidly in the market during the forecast period.

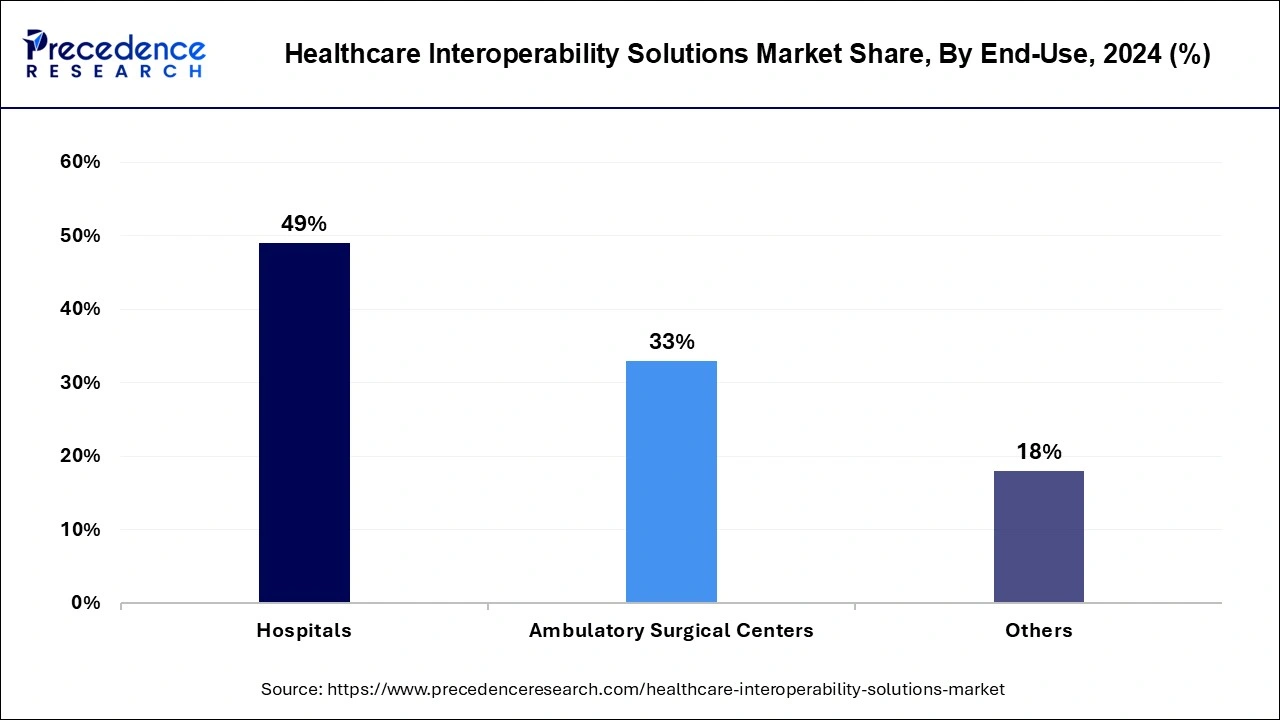

- By end use, the hospital segment has contributed more than 49% of revenue share in 2024.

- By end use, the ambulatory surgical centers segment is expected to grow rapidly in the market during the forecast period.

U.S. Healthcare Interoperability Solutions Market Size and Growth 2025 to 2034

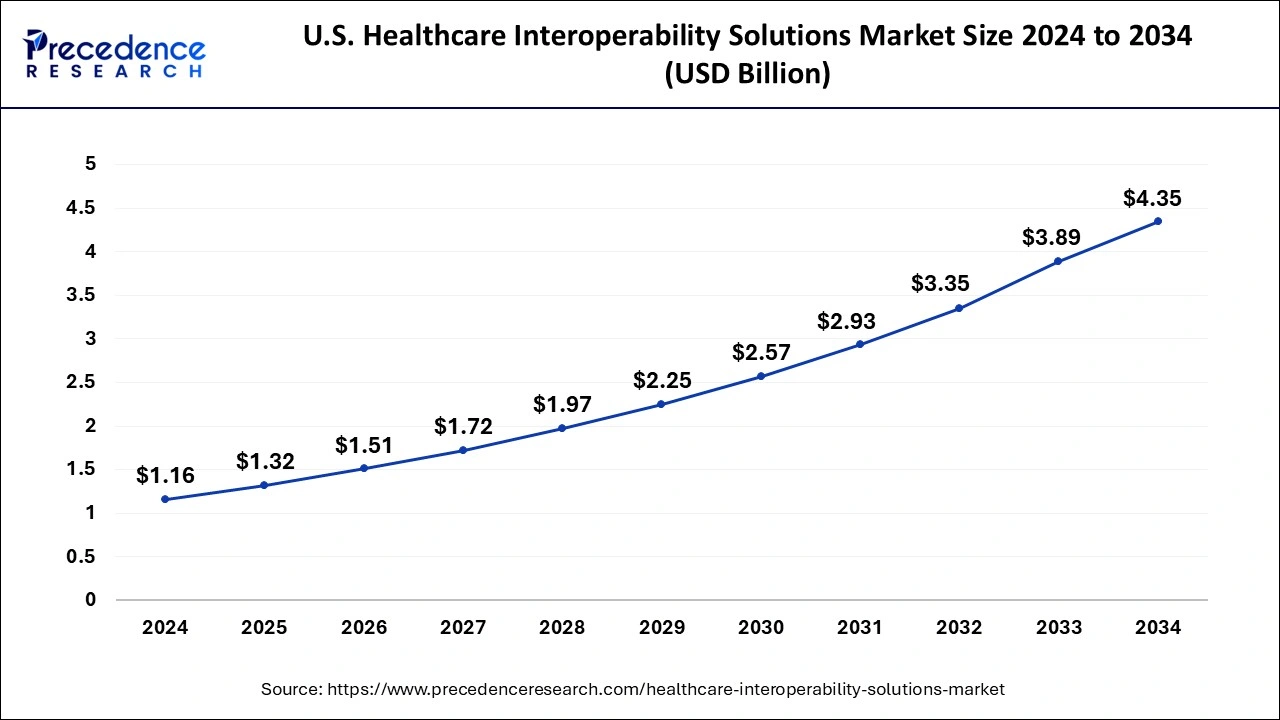

The U.S. healthcare interoperability solutions market size surpassed USD 1.16 billion in 2024 and is projected to attain around USD 4.35 billion by 2034, poised to grow at a CAGR of 14.13% from 2025 to 2034.

North America held the largest share of the healthcare interoperability solutions market in 2024. Interoperability solutions are used because of government rules and initiatives such as the 21st Century Cures Act and the Health Information Technology for Economic and Clinical Health (HITECH) Act in the United States. Healthcare providers must implement EHR systems and encourage the sharing of health information in order to comply with these obligations.

The market for healthcare interoperability solutions in North America is anticipated to rise further due to the country's continuous regulatory needs, technological developments, and greater focus on patient care. Because cloud-based solutions are more affordable and scalable, their use is anticipated to increase. North America's market for healthcare interoperability solutions is expected to increase significantly over the next several years, providing a wealth of chances for innovation and advancement in the healthcare industry.

Europe is expected to host the fastest-growing healthcare interoperability solutions market during the forecast period. Better healthcare interoperability is being facilitated by the adoption of cloud-based solutions and advanced data integration technologies. Interoperability solutions help reduce operational costs and improve efficiency by enabling seamless data sharing across different healthcare systems.

The market includes on-premises, cloud-based, and hybrid models; on-premises solutions currently hold a larger market share due to their widespread use in hospitals and other large healthcare facilities. The European healthcare interoperability solutions market is expected to continue growing, supported by regulatory frameworks, and technological innovations.

Market Overview

To encourage interoperability, governments and regulatory agencies around the world are enforcing rules and standards. For example, the United States' Health Information Technology for Economic and Clinical Health (HITECH) Act solutions for interoperability make it easier to communicate data, which improves patient outcomes and streamlines care coordination. Interoperability is required when EHR systems are used more often in order to guarantee data integration between various healthcare systems. Interoperability solutions are getting more powerful thanks to advances in blockchain, artificial intelligence, and cloud computing. Healthcare industry mergers and acquisitions necessitate integrated systems.

With developments in artificial intelligence (AI) and machine learning, growing government initiatives for healthcare IT infrastructure, and rising demand for high-quality, affordable healthcare, the healthcare interoperability solutions market appears to have a bright future. The requirement for seamless data transmission and interoperability will continue to be driven by the emphasis on patient-centric care and value-based healthcare models. In summary, the market for healthcare interoperability solutions is expanding and has a lot of room to develop due to factors including growing regulations, advancing technology, and the constant desire for better healthcare results. However, continuing business progress will need to address the obstacles pertaining to cost, standards, and data security.

Healthcare Interoperability Solutions Market Growth Factors

- Globally, governments are putting laws and rules into place to encourage the adoption of healthcare systems that are interoperable. For example, the United States' Health Information Technology for Economic and Clinical Health (HITECH) Act promotes interoperability and provides incentives for the use of electronic health records (EHRs).

- The need for a smooth and effective healthcare information exchange is growing. Interoperability solutions contribute to better patient care, lower medical mistake rates, and increased operational effectiveness.

- The emergence of cloud-based solutions, blockchain technology, artificial intelligence, and other technological innovations in healthcare IT are driving the expansion of interoperability solutions. Data exchange is made safe and effective by these technologies.

- Patient-centered care is receiving more attention, and this calls for extensive and well-coordinated information sharing amongst different healthcare systems and providers. This smooth transmission of information is made possible via the healthcare interoperability solutions market.

- In order to enhance patient outcomes and lower healthcare costs, value-based care models have replaced volume-based care models, which highlights the significance of data sharing and interoperability.

- Growing alliances and partnerships between IT companies, healthcare providers, and other stakeholders are promoting the creation and application of interoperability solutions.

- Patients now want access to their health data and are taking a more proactive approach to their health. Patient involvement is enhanced via interoperability technologies, which give patients easy access to full health information.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.50 Billion |

| Market Size by 2034 | USD 14.47 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.89% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, level, Deployment Method, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing adoption of electronic health records

The necessity of the healthcare interoperability solutions market is driven by regulatory requirements, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in the European Union. Interoperability lowers healthcare costs by eliminating unnecessary tests and procedures, and efficient data exchange made possible by interoperable EHR systems improves overall operational efficiency within healthcare organizations. The shift to value-based care models emphasizes coordinated care across multiple healthcare providers, and interoperability solutions enable the sharing of patient data across different systems, supporting a more holistic approach to patient care.

Restraint

Data quality and integrity issues

Gaps in patient information caused by incomplete data can lower the standard of care. Negative effects on health can arise from missing information on medications, allergies, or previous medical history. Real-time data is routinely used to inform healthcare choices. Patient outcomes may suffer as a result of prompt medical interventions being hampered by data sharing or updating delays. Interoperability may be hampered by disparate healthcare systems' lack of uniform data formats and protocols.

However, there are standards such as HL7, FHIR, and DICOM, but not all systems fully conform with them or apply them consistently. It is essential to make sure that all systems always reflect the same data. Inconsistent patient records between systems can result from desynchronized data. To ensure the legitimacy and dependability of data, it is crucial to monitor its source and any modifications made over time.

Opportunity

Data analytics and AI integration

One trend that is revolutionizing the healthcare sector is the incorporation of artificial intelligence (AI) and data analytics into healthcare interoperability solutions. Improvements in patient care, operational effectiveness, and overall healthcare outcomes are fueled by this improved capacity to exchange, understand, and use healthcare information among diverse systems and stakeholders. Robust interoperability solutions are required due to the exponential growth of healthcare data, which is being driven by wearable devices, genomics, and electronic health records (EHRs). Better diagnosis, individualized treatment plans, and proactive care are the results of enhanced data exchange and analytics, which eventually improve patient outcomes. Effective data interchange avoids test duplication, lowers administrative expenses, and maximizes resource use.

Type Insights

The service segment held the largest share of the healthcare interoperability solutions market in 2024. The market for healthcare interoperability solutions is driven by products and services that facilitate the easy usage and interchange of patient data between various healthcare organizations and systems. Because they make it easier to build, integrate, and maintain interoperability solutions, services in this industry are essential. Supporting the strategic planning and execution of interoperability initiatives by healthcare organizations.

Integrating newly developed interoperability solutions with current healthcare IT systems, including radiology information systems (RIS), laboratory information systems (LIS), and electronic health records (EHRs). Providing continuing technical support, including troubleshooting and issue resolution, for interoperability solutions. Offering complete interoperability solution management, encompassing data management, hosting, and security.

The solution segment is expected to witness the fastest growth in the healthcare interoperability solutions market during the forecast period. In order to improve the efficient provision of healthcare for people and communities, the market for healthcare interoperability solutions is concentrated on enabling various healthcare information systems to collaborate both within and across organizational boundaries. Patient data may be easily accessed and shared between various healthcare providers and systems thanks to EHR integration.

Adoption of interoperable EHR systems, API implementation, and data format standardization are among the solutions in this field. Cloud platforms provide affordable, adaptable, and scalable alternatives for interoperability in healthcare. They offer a centralized location for data storage that authorized users can access from any location. Blockchain provides a transparent, safe method of managing patient data across several systems. In addition to securing patient permission, it can be utilized to expedite administrative procedures and guarantee data integrity.

Level Insights

The structural segment led the healthcare interoperability solutions market in 2024. The market for healthcare interoperability solutions has a structural segment that can be classified according to a number of variables, such as end users, deployment modalities, interoperability solution types, and geographic locations. Solutions for healthcare information exchange (HIE), lab system interoperability, EHR/EMR interoperability, and PACS interoperability are a few of them.

The dominant market is a result of the existence of important market participants, government programs encouraging the implementation of EHRs and sophisticated healthcare infrastructure. Governments all around the world are pushing for healthcare interoperability in an effort to save costs and enhance patient care. The demand for interoperability solutions is driven by rising healthcare expenses and the need for effective patient data management.

The foundational segment is expected to grow rapidly in the healthcare interoperability solutions market during the forecast period. The fundamental components and frameworks that allow various healthcare systems and apps to function together seamlessly are referred to as the foundational sector. This section is essential because it guarantees the safe and effective sharing of healthcare data among various platforms, organizations, and stakeholders. Guidelines for the management, archiving, printing, and transmission of medical imaging data. Software technologies that make it easier for data to be shared between various healthcare IT systems. Rhapsody, Cloverleaf, and Mirth Connect are a few examples. Organizations that help different entities, like hospitals, clinics, and laboratories, communicate healthcare information are known as health information exchanges, or HIEs.

Deployment Method Insights

The on-premise segment held the largest share of the healthcare interoperability solutions market in 2024. Solutions that are implemented on the physical infrastructure of healthcare organizations, such as servers and data centers situated on their premises, are referred to as on-premise solutions in the market. On-premise solutions give businesses direct control over their IT environments and data, in contrast to cloud-based solutions.

Greater customization freedom is available with on-premise systems to match the unique requirements of the healthcare provider. Because of this, businesses may customize the interoperability solutions to mesh perfectly with their current workflows and systems. Healthcare providers frequently favor on-premise solutions because of the strict restrictions and the requirement to uphold high standards of patient privacy and data security.

The cloud-based segment is expected to grow rapidly in the healthcare interoperability solutions market during the forecast period. The market for healthcare interoperability solutions is seeing tremendous growth in the cloud-based segment due to the growing demand for smooth data transmission between different healthcare systems and stakeholders. Cloud-based healthcare interoperability solutions make use of cloud computing technologies to facilitate patient data integration, exchange, and retrieval between various healthcare systems, guaranteeing patients, healthcare providers, and other authorized entities access to the data.

The market for healthcare interoperability solutions is expanding significantly as a result of the growing need for better patient care and effective data management. Healthcare professionals can obtain full patient data with the help of interoperability solutions, which improves patient outcomes and helps them make more educated clinical decisions.

Application Insights

The diagnosis segment led the healthcare interoperability solutions market in 2024. In this market, the diagnostics sector is very important since it makes sure that diagnostic data is exchanged accurately and effectively across healthcare professionals, which improves patient outcomes. There is an increasing need for reliable diagnostic tools that can easily communicate and integrate patient data across various healthcare systems due to the rising prevalence of chronic illnesses like cancer, diabetes, and cardiovascular diseases.

Better data integration and interoperability are made possible by the ongoing development of health information technology (IT), which includes the creation of complex EHR systems and health information exchanges (HIEs). It is crucial to protect patient data when it is being sent. Strict data protection laws such as GDPR in Europe and HIPAA in the United States require interoperability solutions to adhere to, which can be expensive and complicated.

The other segment is expected to expand rapidly in the healthcare interoperability solutions market during the forecast period. In order to provide smooth data flow and accessibility for precise diagnosis, interoperability solutions aid in the integration of data from several diagnostic tools. These solutions help to ensure continuity and coordination of care by facilitating the communication of patient treatment plans and histories among various healthcare professionals. Solutions make it easier to integrate care plans and patient information, which enhances patient management and individualized treatment.

Solutions for interoperability make it possible to combine and analyze healthcare data from several sources, advancing medical research and development. These technologies give medical practitioners patient information and insights to help them make well-informed clinical decisions. Healthcare workflows are streamlined by interoperability solutions, which integrate systems and procedures to increase efficiency and decrease administrative responsibilities.

End-use Insights

The hospital segment held the largest share of the healthcare interoperability solutions market in 2024. Hospital segments are generally used to describe the many kinds of healthcare institutions or organizations that make use of interoperability solutions to improve data sharing, communication, and healthcare information system integration. These categories may change depending on things like the facility's size, the services provided, and the particular requirements of the patient group. Community hospitals offer a variety of general medical and surgical services to the local populace.

In these situations, interoperability solutions concentrate on enhancing care coordination between community-based primary care physicians, specialists, and other healthcare professionals. Specialty hospitals concentrate on particular medical specialties, such as orthopedics, oncology, or cardiology. Specialty hospitals' interoperability solutions are designed to accommodate the distinct workflows and data needs of specialized care environments.

The ambulatory surgical centers segment is expected to grow rapidly in the healthcare interoperability solutions market during the forecast period. In the healthcare interoperability solutions market, the ambulatory surgery centers (ASCs) segment usually concentrates on software and technology solutions designed to meet the unique requirements of outpatient surgery centers. These technologies are designed to facilitate communication and data exchange between ASCs and other healthcare organizations, including hospitals, clinics, labs, and imaging centers, as well as to streamline procedures and increase efficiency.

ASCs can effectively manage patient flow, cut down on wait times, and enhance patient satisfaction by implementing solutions that support appointment scheduling, resource allocation, and workflow optimization. Revenue cycle operations, including coding, claims submission, and reimbursement, are streamlined by integration with billing and finance systems, increasing revenue and lowering administrative costs.

Healthcare Interoperability Solutions Market Companies

- Allscripts Healthcare Solutions

- InterSystems Corporation

- NextGen Healthcare Inc.

- Oracle Cerner

- Epic Systems

Recent Developments

- In February 2024, in order to help healthcare companies meet the requirements for Generative AI (Gen AI) solutions related to quality, trust, and reliability, CitiusTech, a leading provider of healthcare technology services and solutions, announced that it has introduced an industry-first solution.

- In April 2024, The Netsmart Marketplace is unveiled by Netsmart, a market leader in healthcare IT solutions and services for community-based providers. One of the biggest networks of technology and service providers is housed within the Netsmart Marketplace, providing a wide range of integrated products and services to support the changing demands of value-based healthcare delivery.

Segment Covered in the Report

By Type

- Service

- Solution

By level

- Structural

- Foundational

- Semantic

By Deployment Method

- On-premise

- Cloud-based

By Application

- Diagnosis

- Treatment

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting