January 2025

Healthcare Laboratory Informatics Market (By Product: Laboratory Information Management System (LIMS), Electronic Lab Notebook (ELN), Scientific Data Management System (SDMS), Chromatography Data System (CDS), Laboratory Executive System (LES); By Deployment: On-premise, Cloud-based; By Component: Service, Software; By End-use: Biotech Companies, Pharmaceuticals, Clinical, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

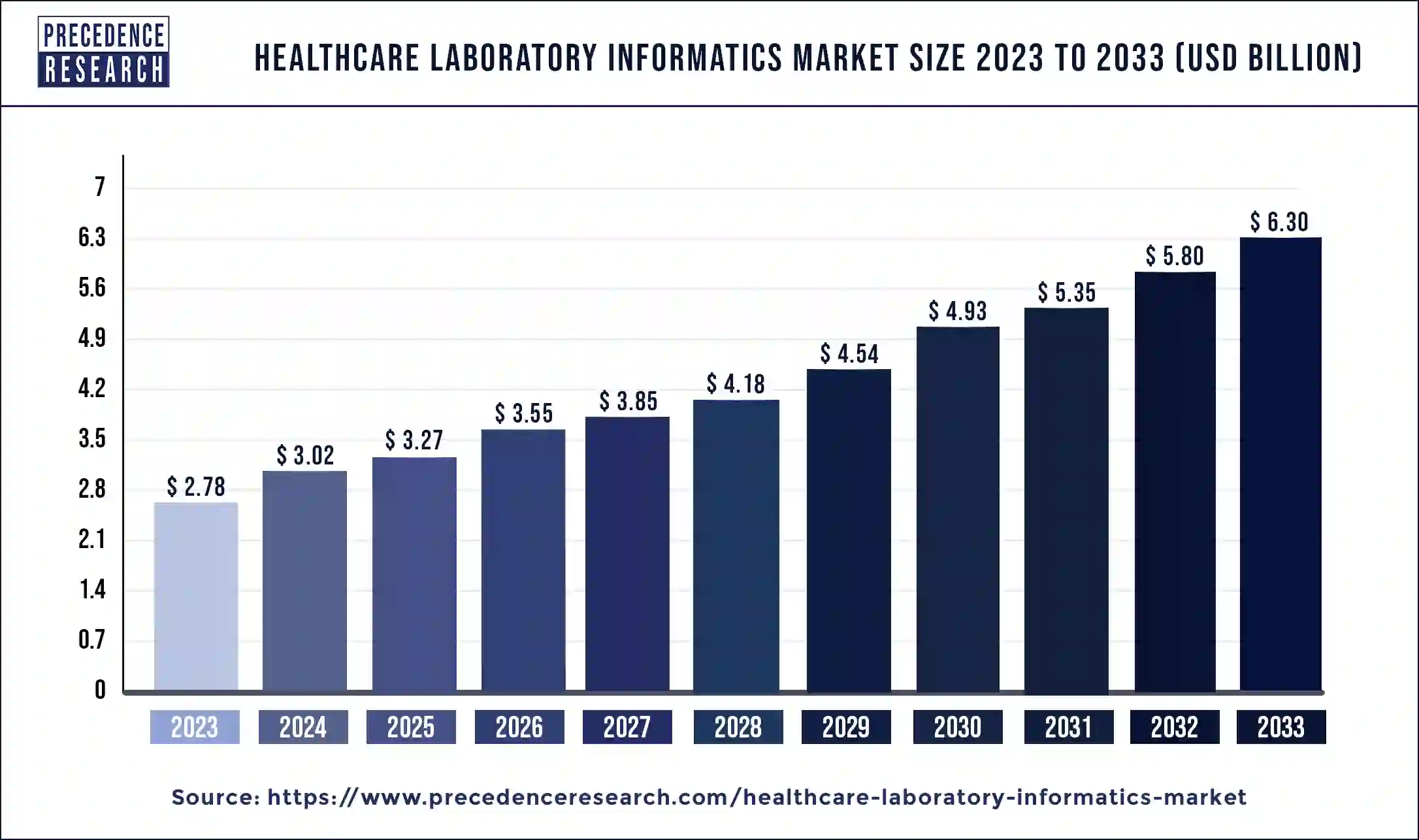

The global healthcare laboratory informatics market size was USD 2.78 billion in 2023, calculated at USD 3.02 billion in 2024, and is expected to reach around USD 6.30 billion by 2033, expanding at a CAGR of 8.53% from 2024 to 2033. The demand of the healthcare laboratory informatics market is driven by the need for reliable informatics solutions for managing, analyzing, and interpreting laboratory data.

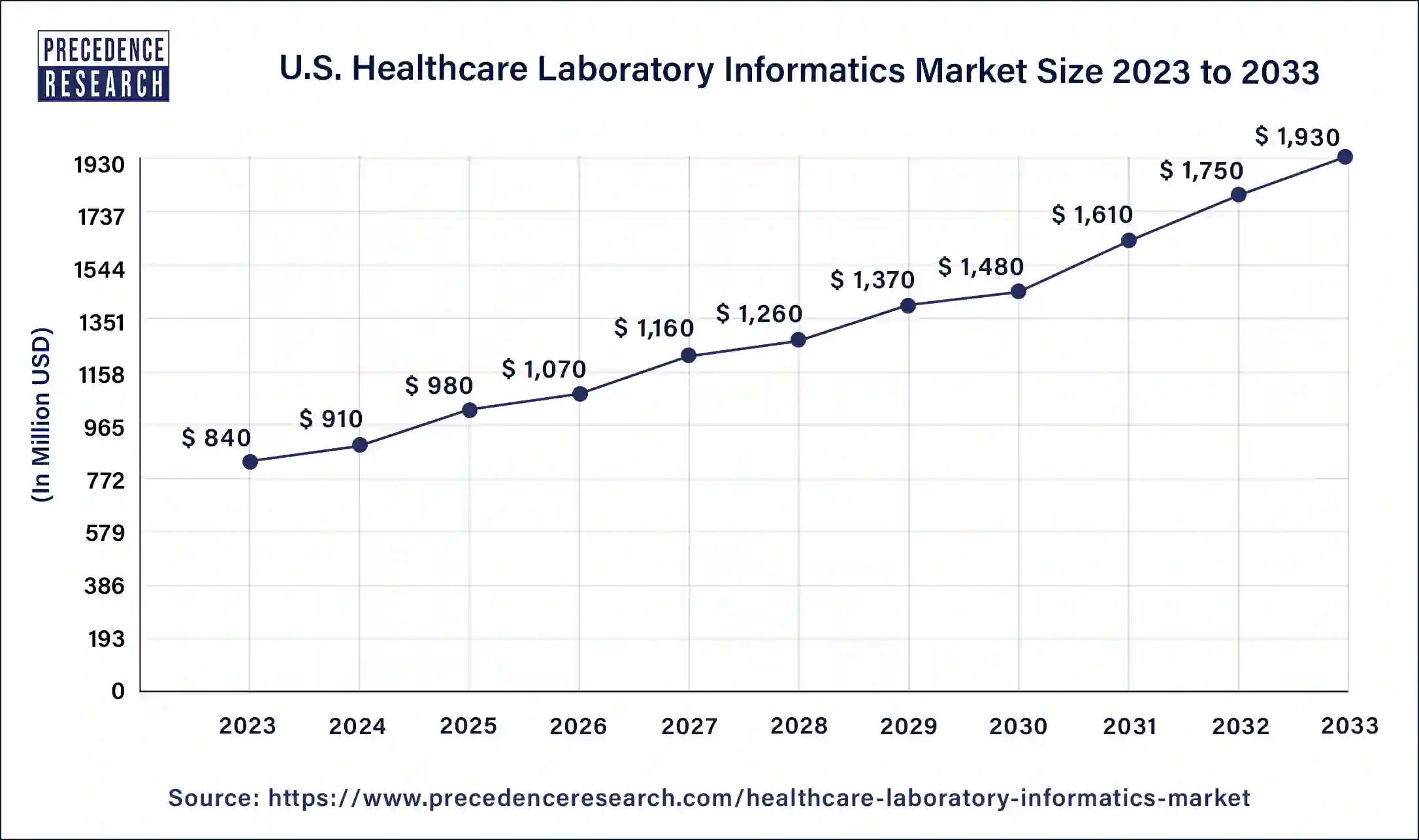

The U.S. healthcare laboratory informatics market size surpassed USD 840 million in 2023 and is projected to attain around USD 1,930 million by 2033, poised to grow at a CAGR of 8.67% from 2024 to 2033.

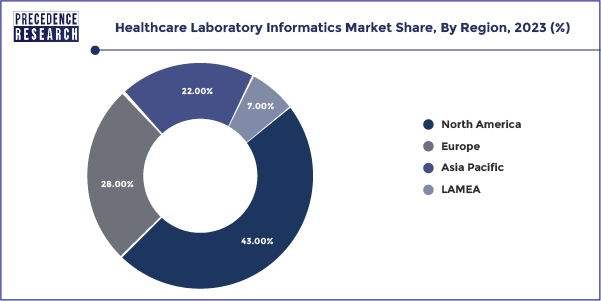

North America dominated the healthcare laboratory informatics market in 2023. North America boasts a highly developed healthcare infrastructure and a high acceptance rate of sophisticated technology, especially in the United States and Canada. This creates a favorable atmosphere for putting advanced laboratory informatics systems into place. The adoption of laboratory informatics systems is fueled by the region's substantial expenditure in healthcare, especially R&D.

The U.S. healthcare system invests a significant amount of money in medical technology. North America serves as the home base or major hub for a large number of the industry's top healthcare laboratory informatics firms. This includes companies that specialize in electronic lab notebooks (ELN), laboratory information management systems (LIMS), and other informatics solutions.

Europe is expected to grow at a significant CAGR in the healthcare laboratory informatics market during the forecast period. The expenditures allocated to healthcare in European nations are gradually rising, and substantial investments are being made in updating healthcare infrastructure, particularly laboratory informatics systems. In order to comply with the strict regulatory criteria of the European Union, sophisticated laboratory informatics systems must be implemented. The demand for safe and effective data management solutions is driven by the General Data Protection Regulation (GDPR) and other laws that are unique to the healthcare industry.

Europe is a leader in the field of healthcare research and development. In order to effectively manage and analyze research data, there is an increased need for sophisticated laboratory informatics systems due to the proliferation of research institutes, universities, and bio-pharmaceutical businesses. The adoption of laboratory informatics solutions is being driven by a number of government initiatives and financing programs that are focused on digitalizing healthcare systems. Better access to and interchange of various forms of health data is the goal of initiatives such as the European Health Data Space.

The healthcare laboratory informatics market refers to the aim of the relatively young discipline of laboratory informatics, which is to use electronic data interchange to speed up laboratory data exchange. Experts in laboratory informatics provide protocols and frameworks to facilitate the collection, retrieval, and exchange of test results and other laboratory data. Just as important as equipment and reagents are to public health laboratories are information systems. The timely distribution of test results and other public health data is essential for making choices about patient care and public health. The necessity for electronic data interchange is increased by the growing hazards posed by terrorism, infectious diseases, and natural catastrophes.

The healthcare laboratory informatics market is fragmented with multiple small-scale and large-scale players, such as Competitive Dashboard, Starlims, Agilent Technologies, Benchling, Inc., LabVantage Solutions, Inc., LabWare, LABLynx, Inc, PerkinElmer, Inc., Tech Mahindra, Thermo Fisher Scientific, Waters Corporation.

| Report Coverage | Details |

| Market Size by 2033 | USD 6.30 Billion |

| Market Size in 2023 | USD 2.78 Billion |

| Market Size in 2024 | USD 3.02 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 8.53% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Deployment, Component, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising awareness about laboratory informatics

The rising awareness about laboratory informatics can boost the healthcare laboratory informatics market. The healthcare laboratory informatics solutions reduce errors and improve accuracy in data handling by streamlining data management. This is particularly important in medical settings where accurate data is necessary for patient diagnosis and care.

Lack of skilled professionals

The lack of skilled professionals may slow down the healthcare laboratory informatics market. The market is growing more slowly than it should be due in large part to a lack of qualified workers. This industry is highly dependent on a specialized labor force capable of managing intricate data management systems, electronic health records, and other informatics solutions necessary for contemporary healthcare operations.

Integration of advanced technologies

The integration of advanced technologies can be an opportunity to boost the healthcare laboratory informatics market. Healthcare laboratory informatics can significantly improve patient care, efficiency, and accuracy by incorporating cutting-edge technology. It can also lower costs and guarantee compliance. Together, these elements propel the market for laboratory informatics’ expansion and growth.

Rising the number of mergers and acquisitions level

The rise in mergers and acquisitions can be an opportunity to grow the healthcare laboratory informatics market. The healthcare laboratory informatics market is only somewhat affected by mergers and acquisitions. Better offers, increased market presence, and enhanced skills are frequently the results of these calculated actions for the participating organizations.

The laboratory information management system (LIMS) segment dominated the healthcare laboratory informatics market in 2023. Master data management, sample lifecycle reporting, stability studies, system and security administration, inventory, instruments, storage capacity & logistics, timetables, and analytical workflow are some of these systems. The need for completely integrated services in the research and life sciences sectors to reduce mistakes in data management and to analyze research data qualitatively is anticipated to drive the growth of this market in the upcoming years. The LIMS sector is anticipated to hold its position for the duration of the forecast period as a result of these factors.

The electronic lab notebook (ELN) segment is expected to grow at the highest CAGR in the healthcare laboratory informatics market during the forecast period. The better electronic lab notebooks (ELN) system sector is also expected to rise significantly since researchers in analytical chemistry laboratories are using it more frequently.

The on-premise segment dominated the healthcare laboratory informatics market in 2023. The important patient data and private research data are handled in healthcare laboratories. In order to preserve direct control over their data and guarantee adherence to strict data security and privacy laws, many firms choose on-premise implementations.

More control over adhering to legal standards, including GDPR in Europe and HIPAA in the U.S., is possible with on-premise solutions. On-premise systems can more readily comply with the strict data protection requirements imposed by these rules. Laboratories may tailor their informatics systems to meet unique requirements and processes with on-premise deployments. With cloud-based systems, it's sometimes more difficult to have this degree of control and personalization.

The cloud-based segment is expected to grow at the highest CAGR in the healthcare laboratory informatics market during the forecast period. The solutions maintained on the cloud provide unmatched flexibility and scalability. Without having to make large purchases of new hardware, laboratories are able to readily adapt their computer resources to meet demand and accommodate growth and changing demands.

Cloud-based deployments lessen the requirement for large upfront infrastructure capital expenditures. Alternatively, labs might choose a subscription-based strategy that lowers entrance barriers by spreading charges over time. Anywhere with an internet connection, laboratory informatics systems can be accessed remotely thanks to the cloud. This makes it easier for researchers and healthcare professionals to collaborate, which is crucial for multi-site operations and during international crises like the COVID-19 pandemic.

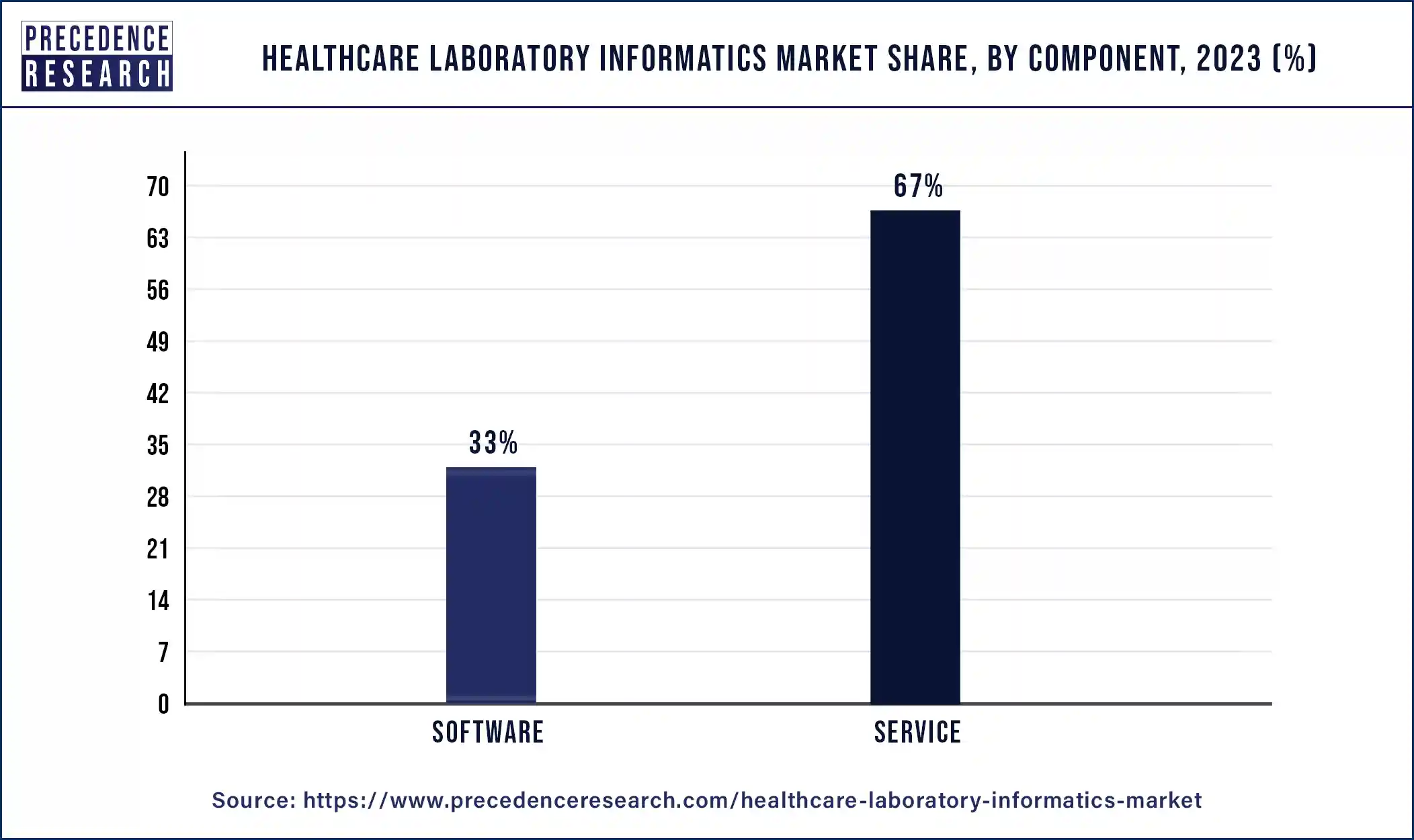

The service segment dominated the healthcare laboratory informatics market in 2023. Innovative solutions that easily interact with current infrastructure are becoming more and more necessary as healthcare laboratories deploy increasingly sophisticated informatics systems. It is important to have services like workflow optimization, system customization, and interaction with other healthcare IT systems. For lab informatics systems to function at their best and adhere to regulations, they need constant upkeep, upgrades, and technical assistance.

The dominance of the service category might be attributed to the constant strong demand for these services. For laboratory staff to use laboratory informatics systems effectively, they must need extensive training. The expansion of the service category is fueled by services that assist users in maximizing the returns on their informatics investments through training and education.

The software segment is expected to grow at the highest CAGR in the healthcare laboratory informatics market during the forecast period. Advanced technologies like cloud computing, big data analytics, machine learning, and artificial intelligence (AI) are being quickly adopted by the healthcare sector. These technologies are essential to the development of contemporary laboratory informatics software.

The digitalization of healthcare activities, particularly laboratory processes, is being strongly advocated. This change calls for advanced software solutions in order to safely and efficiently handle, analyze, and distribute data. Robust data management and analysis software is becoming more and more necessary as laboratory data volumes rise. These tools support managing huge datasets, guaranteeing data integrity, and deriving useful insights.

The pharmaceuticals segment dominated the healthcare laboratory informatics market in 2023. Large volumes of data are produced by pharmaceutical businesses over the course of clinical trials, medication development, and discovery. The demand in this market is driven by the need for reliable informatics solutions for managing, analyzing, and interpreting this data. Strict regulations, such as those enforced by the EMA in Europe and the FDA in the United States, apply to the pharmaceutical business.

The laboratory informatics systems facilitate audits, assure data integrity, and keep correct records all of which contribute to compliance with these laws. The pharmaceutical sector is heavily dependent on research. Businesses spend a lot of money on research and development (R&D) to find and create new medications, which makes sophisticated laboratory informatics systems necessary to optimize workflows, handle data effectively, and shorten time-to-market.

The clinical segment is expected to grow at the highest CAGR in the healthcare laboratory informatics market during the forecast period. The need for diagnostic testing is being driven by the rising incidence of chronic illnesses and the increased emphasis on early diagnosis and preventative healthcare. For clinical laboratories to handle the increasing number of tests and data, sophisticated informatics solutions are required. Large amounts of complicated data are produced by advances in diagnostic technologies, including genetic testing, next-generation sequencing, and molecular diagnostics.

The systems for laboratory informatics are essential for efficiently organizing and interpreting this data. Integration of laboratory information management systems (LIMS) with other healthcare IT systems, such as electronic health records (EHRs) and hospital information systems (HIS), is becoming more and more popular. Overall, clinical workflows are improved, and data exchange is strengthened by this connection.

Segment Covered in the Report

By Product

By Deployment

By Component

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024