November 2024

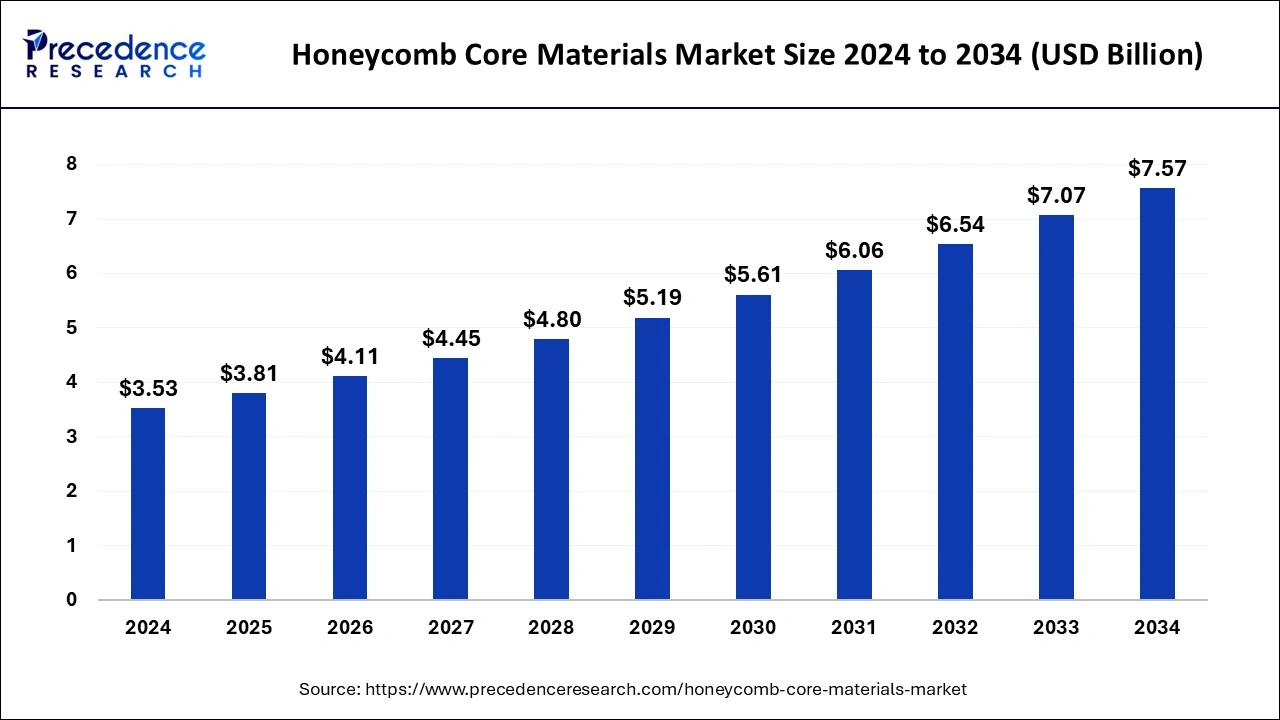

The global honeycomb core materials market size is calculated at USD 3.81 billion in 2025 and is forecasted to reach around USD 7.57 billion by 2034, accelerating at a CAGR of 7.93% from 2025 to 2034. The Asia Pacific honeycomb core materials market size surpassed USD 1.56 billion in 2025 and is expanding at a CAGR of 8.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global honeycomb core materials market size was estimated at USD 3.53 billion in 2024 and is predicted to increase from USD 3.81 billion in 2025 to approximately USD 7.57 billion by 2034, expanding at a CAGR of 7.93% from 2025 to 2034. The honeycomb core materials are useful in the driving panels, walls, furniture, energy absorbers, galley and sanitary modules, floors, and doors applications of automotive, aerospace and defense, construction, and infrastructure industries.

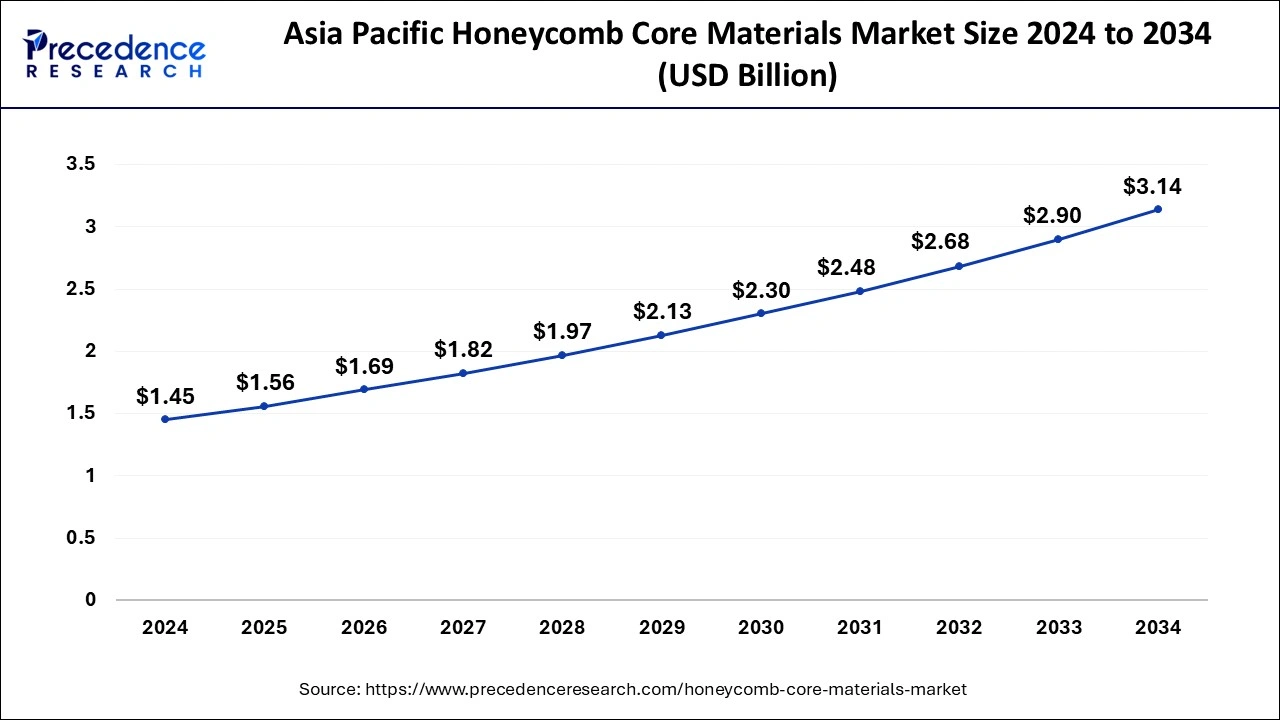

The Asia Pacific honeycomb core materials market size was estimated at USD 1.45 billion in 2024 and is predicted to be worth around USD 3.14 billion by 2034, at a CAGR of 8.03% from 2025 to 2034.

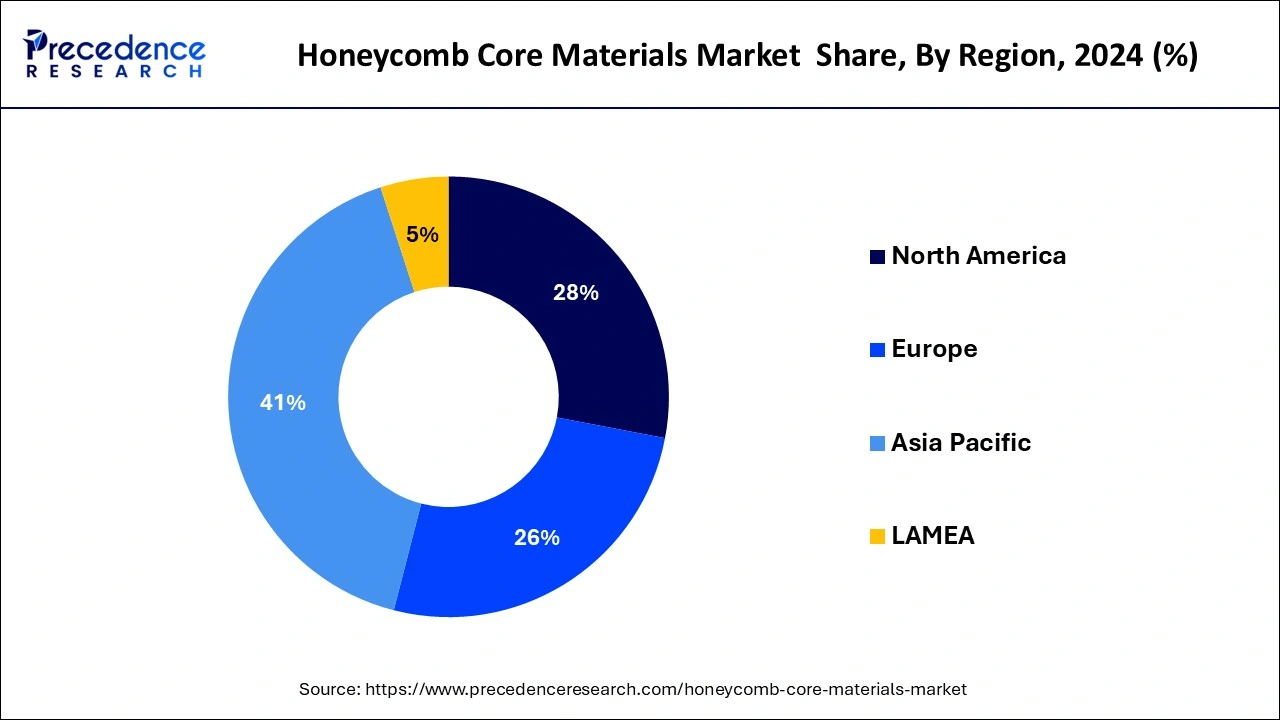

Asia Pacific led the market with 41% market share in 2024. India, China, and Japan are the leading countries for the honeycomb core materials market in the Asia-Pacific region. In India, there are many industries that use honeycomb core materials. In China, many industries supply aramid honeycomb core materials for racing boats, high-speed trains, and aircraft applications. Currently, the largest application sector of Chinese honeycomb core material is the furniture market. Their lightweight nature helps in environmental protection and resource conservation, and it also helps in lightweight furniture production. China exports honeycomb panels to Vietnam, India, and the United States. China is the second largest honeycomb panel exporter in the world. These factors help the growth of the market in the Asia Pacific region.

North America is observed to grow at a significant rate in the honeycomb core materials market during the forecast period. In the North American region, honeycomb core materials are used more frequently. North American companies continuously invest in honeycomb core materials. Due to their high strength and lightweight properties, it is used in the aerospace and defense industries.

In Canada, a wide variety of honeycomb core materials are manufactured, including polypropylene, thermoplastics, aluminum, and Nomex. In Composites Canada, core materials are used to stiffen the product without adding extra weight. Products include laminate bulkers, honeycomb, foam, and balsa. Key players in Canada include companies Rayplex Ltd, Composites Canada, etc. These factors help the growth of the market in the North American region.

Honeycomb core materials are a type of lightweight and high-strength material used in various industries for structural applications. The honeycomb core materials market deals with industries that include automotive, construction and infrastructure, sporting goods, aerospace and defense, packaging, and others that have various applications. Honeycomb cores are made from many materials like paper, cloth, thermoplastics, and cardboard that are used to supply low stiffness and low strength for low-load applications and higher stiffness and strength for improving application performance.

Honeycomb core materials and honeycombs are used to manufacture sandwich panels in the company of honeycomb core, which have very high compression strength. Honeycomb core materials are used for honeycomb, which has various applications, including train doors, bulkheads, snowboards, automobile structures, telescope mirror structures, loudspeaker technology, LED technology, rocket structures, jet aircraft, helicopters, gliders, and racing shells. These applications contribute to the growth of the market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.93% |

| Market Size in 2025 | USD 3.81 Billion |

| Market Size by 2034 | USD 7.57 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type and By End-use Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

High-strength and lightweight materials demand

Industries are striving for high-strength and lightweight materials, and honeycomb core materials are the best option. The lightweight properties allow for better fuel efficiency in transportation and reduce weight structures. Lightweight materials are also used to improve energy efficiency in buildings and construction. These materials have high demand in the automotive, aerospace, defense, and packaging industries. These materials help to improve structural efficiency, life span, and load capacity. These factors help in the growth of the honeycomb core materials market.

Rising demand for the aerospace sector

Honeycomb core materials are in high demand in the aerospace sector due to their structural materials and lightweight materials. The structural honeycomb materials used in the aerospace sector are made of hexagonal cells made from materials like fiberglass, aluminum, and Nomex due to their dampening, dimensional accuracy, lightweight, and higher strength properties. Types of honeycombs, including aluminum honeycombs, are used due to their corrosion resistance and high strength for architectural, transportation, and industrial applications. Aramid type of honeycomb is used in aerospace and high-performance racing applications due to its heat resistance properties. These factors help the growth of the honeycomb core materials market.

Limitations of honeycomb core materials

Honeycomb core manufacturing has difficulties, including liquid ingression, which results in core corrosion (when the aluminum core is used), skin-to-core unbound, core migration, and sometimes face sheet separation. Honeycomb cores are expensive. Some defects occur in honeycomb panels, the fasteners, or themselves, which cause safety hazards and difficulty in expanding the system. It is frequently observed that the accumulation of the condensate inside the panel increases the process of corrosion. Corrosive environments, structural limitations, and moisture absorption by honeycomb core are the barriers to the growth of the market. These factors can restrict the growth of the honeycomb core materials market.

Research and development

Improving honeycomb core materials for environmental sustainability. Innovation in the honeycomb core towards blast protection, packing, re-entry landing, impact resistance, high-speed train crash, and other engineering applications can be an opportunity for the honeycomb core materials market. Use of Nomex and aluminum honeycomb core sandwich panels for future applications in various industries, including renewable energy testing, the medical industry, construction, and aerospace, to ensure durability and performance. These factors help to the growth of the market.

The aluminum core segment dominated the honeycomb core materials market in 2024. Aluminum honeycomb core material is a highly used honeycomb core material. Aluminum core is used due to their bonding and excellent strength properties. Aluminum core has an excellent strength-to-weight ratio than other type of honeycomb core materials. Aluminum honeycomb core materials are lightweight and resistant to cuts and compressions. It also has incombustible performance, non-moisture absorbent, and is resistant to molds, fungal growth, and corrosion. It is a recyclable honeycomb core material type.

Advantages of the aluminum core include good fire reaction, stiffness, and light. The aluminum core is used in decorative wall panels, shelves, partitions, modern furniture pieces, and sleek crafting. The lightweight nature of the aluminum honeycomb core helps with installation and transportation, and its excellent strength ensures durability and stability. Due to their properties and range of benefits, the aluminum honeycomb core is helpful in aerospace industrial applications. It is a highly recyclable material, and more than 90 percent of the aluminum core materials are processed yearly, which is obtained from recycled materials. These properties and applications of the aluminum core contribute to the growth of the market.

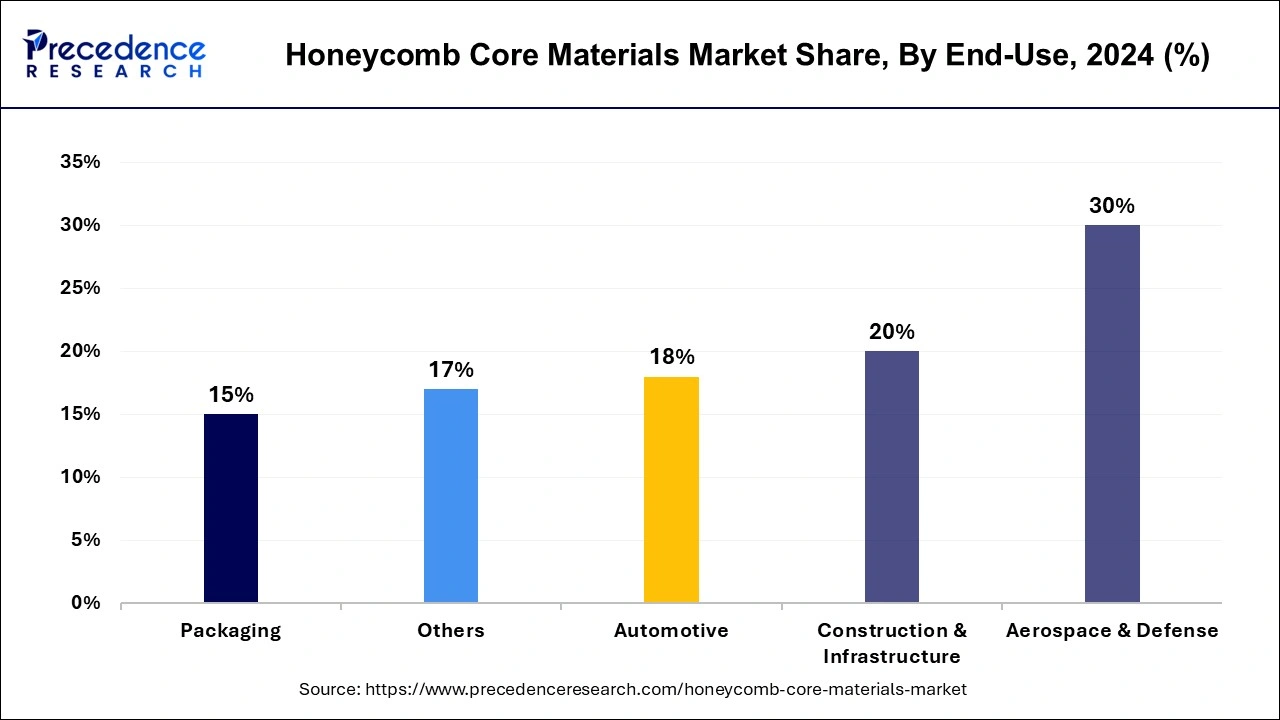

The aerospace and defence segment dominated the honeycomb core materials market in 2024. Aviation honeycomb core materials are highly used in aerospace and defense applications. This sector uses honeycomb core materials because their properties include dampening and dimensional accuracy, high strength to weight, and lightweight. Metallic core is used in aerospace and defense sector applications for its interior components, control surfaces, and other structures.

Normally, Kevlar, Nomex, and Aluminum are honeycomb core materials used in aerospace and defense applications. Reliable and advanced materials are necessary for the aerospace and defense industry to ensure strength, optimal safety, and longevity in challenging applications. Aerospace and defense sector applications in which honeycomb core materials are utilized include critical structures like propellers, jet engines, aircraft, and rockets. These advantages help the growth of the aerospace and defense end-use segment and contribute to the growth of the market.

The construction and infrastructure segment is the fastest growing during the forecast period. Honeycomb core materials are used in construction and infrastructure applications, including furniture, clean rooms, ceilings, flooring panels, and building facades. Paper, stainless steel, and aluminum are used in the construction and infrastructure end-use segment, which contributes to the growth of the segment and helps the growth of the honeycomb core materials market.

By Type

By End-use Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2024

January 2025

September 2024