February 2025

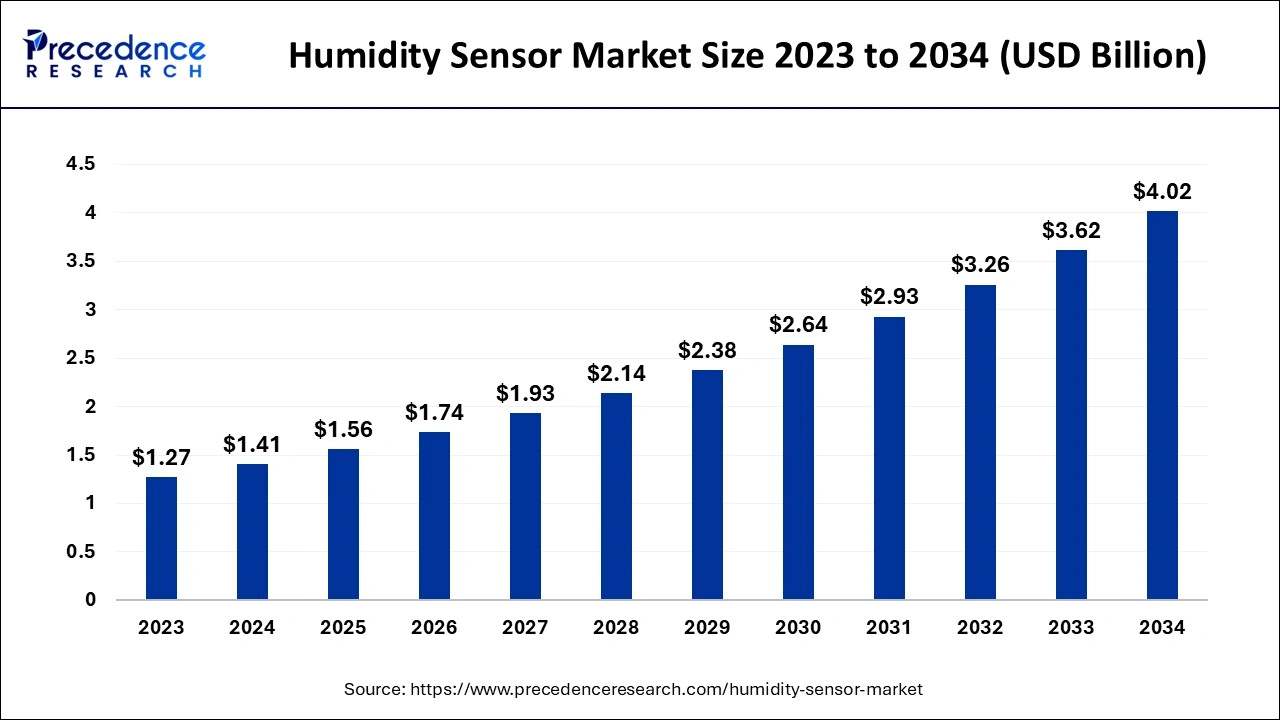

The global humidity sensor market size accounted for USD 1.41 billion in 2024, grew to USD 1.56 billion in 2025 and is projected to surpass around USD 4.02 billion by 2034, registering a CAGR of 11.06% between 2024 and 2034. The North America humidity sensor market size is valued at USD 520 million in 2024 and is expected to grow at a CAGR of 11.19% during the forecast year.

The global humidity sensor market size is calculated at USD 1.41 billion in 2024 and is anticipated to reach around USD 4.02 billion by 2034, growing at a CAGR of 11.06% from 2024 to 2034. The demand for the humidity sensor market is increasing because of the increased usage, which includes smart homes, climate control in automobiles, IoT devices and applications, industrial climate control and monitoring, and emissions control and air quality regulation.

Artificial intelligence (AI), in the production of high accuracy and real-time tracking of data, improves performance in the humidity sensor market. The use of sensors in manufacturing processes results in higher yield rates; hence, it is cheaper to implement these sensors in these industries. With upgrades possible later in the design process, as well as advancements in AI and machine learning, AI-enabled sensors can allow for sensing systems to be formed into adaptive and intelligent that may function differently depending upon the surrounding conditions. In water quality monitoring, the sensors can be programmed to have an inbuilt artificial intelligence that can change its sensitivity and detection range in response to changes in the environment.

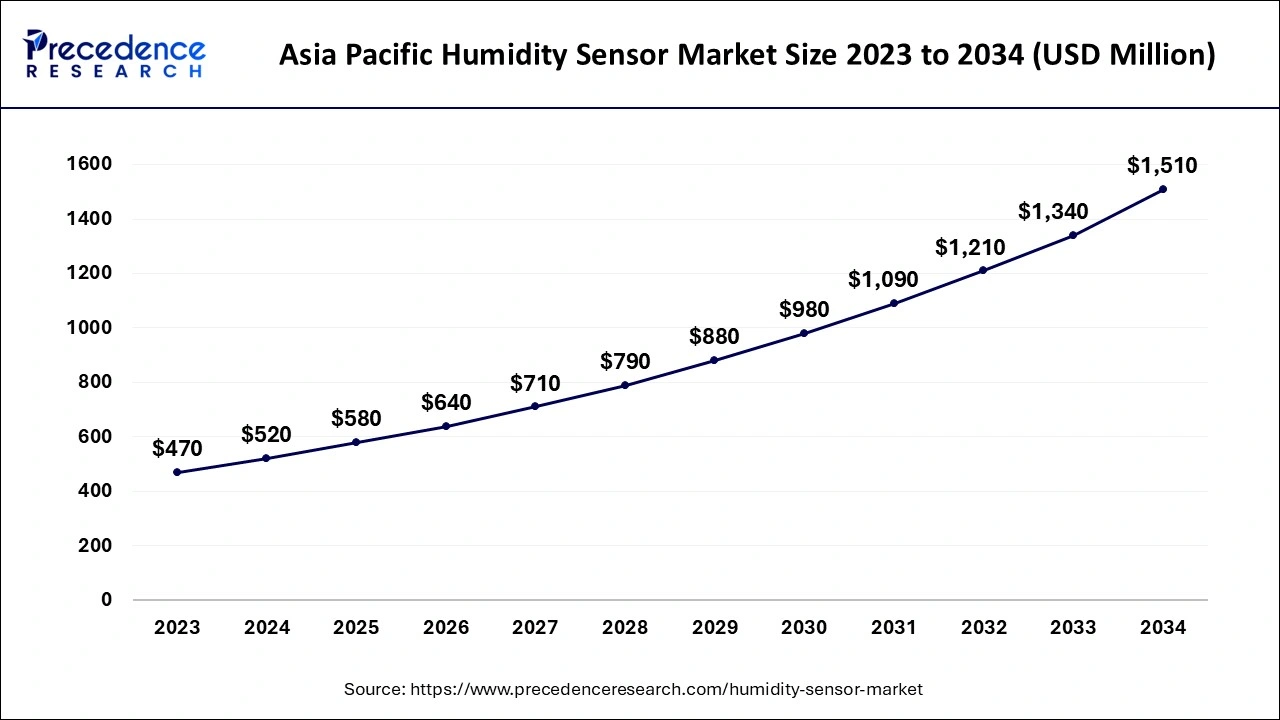

The Asia Pacific humidity sensor market size is exhibited at USD 520 million in 2024 and is expected to be worth around USD 1,510 million by 2034, growing at a CAGR of 11.19% from 2024 to 2034.

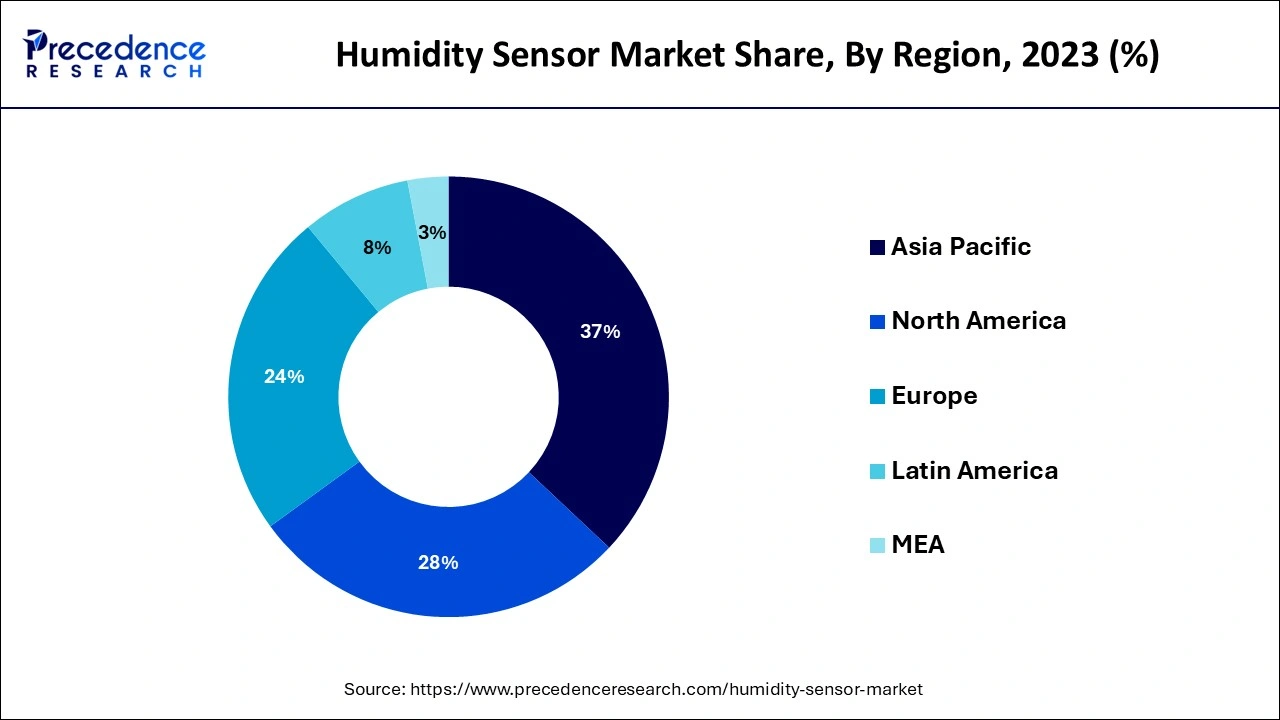

Asia Pacific accounted for the largest share of the humidity sensor market in 2023. The growing population of individuals living in urban areas is demanding HVAC equipment on residential and business premises, forcing up the demand for humidity sensors. There is an upsurge in the scale of urbanization in emerging markets such as China and India, as well as the concept of smart cities in this region. The growth of the HVAC industry comes from the developments in infrastructure, technology, tourism activities, an increase in disposable income, and government energy efficiency endorsement. There is an adoption of automation, IoT, and AI integration in the industry, while the need for better-performing and efficient systems is on the rise.

North America is anticipated to witness the fastest growth in the humidity sensor market during the forecasted years. The rising integration of smart structures in the building process is extending the market for humidity sensors in HVAC systems to enhance energy consumption and indoor environment quality. The healthcare facility environment in the USA and Canada requires accurate humidity to create an environment suitable for patients and storage of medical equipment.

The humidity sensor market in North America is also projected to boom due to the rising use of these sensors across various industries. The application of humidity sensors is found in industries where processes occur in pharmaceuticals, food and beverages, and air conditioning and heating systems.

A humidity sensor is an electronic component that measures the density of water molecules in the air. It works based on the ability to sense variations in temperature or electrical current within the surrounding air. These sensors are also called hygrometers. A humidity sensor is a type of transducer in that the object of a humidity sensor is to detect the humidity in the surrounding environment and then put its observations into electrical form. It is available in various sizes and forms; while some are designed to be attached to the palm, others are designed to be part of other larger systems (like the air quality monitoring system). There are so many uses for humidity sensors in the fields of meteorology, medicine, vehicles, heating, ventilating, and air conditioning systems, as well as industries.

The increasing use of such sensors in several moisture-conscious sectors, including food & beverage, healthcare, and textile, amongst others, is expected to help the humidity sensor market grow. The control of building ventilation, environmental chambers for the testing of electrical devices, controlled environment SEMI and automobile manufacturing, drying, and momentum in chemical, electronics, food and beverage, pharmaceutical, cosmetics, and biomedical analysis industries are only but a few of the numerous commercial and industrial applications for which humidity is one of the chief physical parameters.

Humidity sensor market manufacturers

| Manufacturers | Headquarter | Product Portfolio |

| TEGAM Inc. | Geneva, Ohio, U.S. | Precision measurement tools, temperature and humidity measurement devices, and RF power sensors |

| Chino Works America Inc. | Naperville, Illinois | Temperature sensors, recorders, infrared thermometers, controllers, systems, and various accessories |

| Setra Systems, Inc. | Massachusetts, U.S. | Various sensors and instruments, such as differential pressure sensors, absolute pressure sensors, relative pressure sensors, and more |

| RH Systems | Gilbert, Arizona, U.S. | SF6 gas analyzers, humidity generation instrumentation, and robust chilled mirror technology for on-site measurement of humidity, pressure, and purity in SF6 gas-insulated equipment |

| FuehlerSysteme eNET International GmbH | Nuremberg, Germany | Temperature sensors, humidity sensors, pressure sensors, air quality sensors, and flow sensors |

| E+E Elektronik | Austria | Humidity sensors, temperature sensors, transmitters, and CO2 sensors |

| Report Coverage | Details |

| Market Size by 2034 | USD 4.02 Billion |

| Market Size in 2024 | USD 1.41 Billion |

| Market Size in 2025 | USD 1.56 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.06% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Growing Health and Comfort Awareness

Strengthening concern with regard to the effects of the quality of internal air on human health and level of comfort is stimulating the humidity sensor market. Relative humidity sensors protect indoor environments from mold and bacteria and prevent airborne infection agents and bad breath. Moreover, rising consciousness toward health and comfort problems caused by humidity also serves as an impactful driver for the market growth of humidity sensors. This indicates that the humidity levels cause several illnesses of the respiratory system, allergies, and others related to the skin.

There is increased adoption of the humidity sensor market applications for residential, health, and general business applications. AIR humidity sensors are applied to medical devices and surroundings to allow for the measurement of the humidity level that is likely to cause diseases among patients or reduce the functionality of the equipment. These sensors assist in keeping the right humidity levels, which leads to healthier and more comfortable conditions in homes and other places where people gather to work.

Cost constraints

The development of new, high-performance sensors is expensive, and the use of these technologies in cost-sensitive applications can be disadvantageous for the humidity sensor market. Depending on the type of the sensors, some could be less accurate or precise, specifically under harsh environmental conditions or low or high humidity ranges. Some of the sensors may need different installation and calibration methods, which makes the whole process costly and lengthy.

Growing implementation of IoT and smart homes

The increasing trend in the usage of products across sectors, thereby facilitating IoT and smart devices, also acts as a driver in the humidity sensor market. Technological development in the IoT sector is raising the need for real-time sensors, particularly environmental factors like humidity. These sensors are installed in smart homes, industrial automation, and healthcare devices. In smart homes, humidity sensors are introduced as part of the HVAC systems that provide the best living conditions as people attempt to be power-conscious.

Increasing demand for connected, smart living spaces is exciting for companies that deal in humidity sensors because they are critical to devices like smart thermostats, air purifiers, and dehumidifiers. The current trends in the growth of IoT solutions and improvement in the availability and affordability of smart devices foster market growth. Other factors include increasing trends in using wireless sensors in climate control in greenhouse farming and multiple benefits of using humidity sensors, such as ease of installation and low energy consumption.

The absolute humidity sensors segment noted the largest share of the humidity sensor market in 2023. Thermal Humidity Sensors are also referred to as Absolute Humidity (AH) Sensors because they measure the Absolute Humidity. They also quantify the thermal conductivity of dry air plus air that contains water vapor. It indicates the amount of water vapor per cubic meter of air in grams. These sensors are poised to experience tremendous growth in demand due to innovation in technology as well as the need for high-precision measurement of the environment in several industries. Advanced sensor technology, such as miniaturization of the sensor devices, as well as improved accuracy, are improving the modern absolute humidity sensors.

The relative humidity sensors segment is projected to witness the fastest growth in the humidity sensor market during the forecast period. In HVAC systems, these devices monitor the relative humidity levels and get appropriate feedback that allows for adjustments to be made to maintain desired humidity levels. These are sensors that tell the amount of humidity in the air, determining the possible highest amount that can be vaporized in air at a given temperature. RH sensor data are needed in real-time to make sure that conditions within can be kept at their optimal to avoid deterioration, contamination, or equipment damage where even a slight change in moisture level is critical. Also, proper humidity storage is important to avoid the growth of molds and mildew, as well as for the integrity of building structures and the health of people living in those structures.

The automotive segment contributed the largest share of the humidity sensor market in 2023. The automotive industry applied humidity sensors to control the climate within the car, while demands from electric vehicles and self-driving cars originated from the need for high-performance environmental control systems because these vehicles need accurate data to run properly and ensure the safety of the passengers inside. These particular sensors significantly contribute to controlling the air conditioning and venting of automobiles, with the windows’ defrosting improved for safety. Such devices also assist in preventing the recirculation of air that may be excessively drier or too humid, helping to increase comfort for the occupants of the vehicle.

The environmental segment is projected to witness the fastest growth in the humidity sensor market during the forecast period. Environmental control and public comfort are important aspects of people’s lives, and humidity sensors play a central role in making industries and homes more comfortable, safe, and energy efficient. They determine the extent of water vapor in the air or relative humidity. In addition, the increasing popularity of smart homes and the Internet of Things (IoT) has boosted the progress of this industry because these sensors are used together with other products like temperature sensors and gas sensors to provide a complete view of the environment.

By Type

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2024

November 2024

October 2024