February 2025

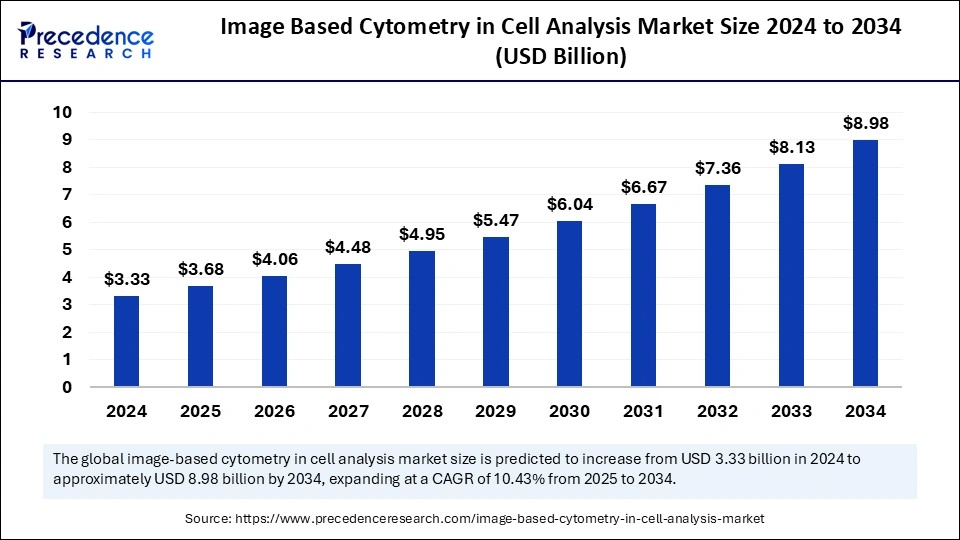

The global image-based cytometry in cell analysis market size is calculated at USD 3.68 billion in 2025 and is forecasted to reach around USD 8.98 billion by 2034, accelerating at a CAGR of 10.43% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global image-based cytometry in cell analysis market size was estimated at USD 3.33 billion in 2024 and is predicted to increase from USD 3.68 billion in 2025 to approximately USD 8.98 billion by 2034, expanding at a CAGR of 10.43% from 2025 to 2034. The increased research activities for enhancing the efficacy of image-based cytometry, growing demand for cell-based therapies and rising adoption across the globe is driving the growth of the image-based cytometry in cell analysis market.

North America dominated the global image-based cytometry in cell analysis market in 2024.

Asia Pacific is estimated to expand the fastest during the forecast period.

By therapeutic, the oncology and immune-oncology segment held the largest market share in 2024.

By therapeutic, the immunology segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

By therapeutic, the cardiovascular and metabolic diseases segment has grown at notable CAGR in 2024.

By end-user, the biotechnology and pharmaceutical companies segment captured the largest market share in 2024.

By end-user, the contract research organizations segment is expected to expand at a notable CAGR over the projected period.

Artificial intelligence has a multitude of advantages in image-based cytometry for cell analysis such as for assessing disease progression, understanding complicated cell morphologies, and for analysing multicellular data and distribution of cell cycle among others. The advancements in lab-on-chip technologies and microfluidics with the integration of deep learning and machine learning methodologies have enhanced the accuracy and efficiency of image-based cytometry while reducing costs.

The implementation of AI algorithms for automating cell detection and segmentation, in classifying phenotypes on the basis of morphological characteristics, enhanced high-throughput screening of cell populations and drug candidates, development of predictive models based on past cytometry data and in multiplexed analysis for enhancing analysis of cellular markers is further enabling applications drug discovery, immunology research, stem cell studies and cancer research.

Image-based cytometry is a cell analysis technique applied for capturing images of individual cells by merging it with the high-throughput capabilities of traditional flow cytometry systems which further allows detailed morphological analysis of cellular features with fluorescent marker detection. Potential applications such as analysis of cell cycle, in cell viability assays, for phenotypic profiling, in cellular signalling studies and drug discovery processes are boosting the adoption and utilization of image-based cytometry systems across various fields in the healthcare industry.

The ongoing advancements in imaging technologies with enhanced potential for cytometry applications, surge in the development of genomic libraries for enhancing patient care and providing personalized treatment strategies, increased accessibility and availability to huge volumes of datasets and increased focus on R&D activities for developing novel therapies are the factors fuelling the growth of the image-based cytometry in cell analysis market.

Integration of microfluidics platforms: The merging of microfluidic devices containing miniaturized chips with imaging capabilities has enabled high-performance analysis synchronized with monitoring and quantification of several biological samples on a single chip further enhancing and accelerating the efficiency of experiments with minimum usage of reagents in contrast to the traditional methods on a microscopic scale. Fluorescence microscopy, confocal microscopy and brightfield microscopy are imaging techniques utilizing microfluidics for cell analysis in various fields such as genetics and environmental monitoring among others.

Expansion of bioanalytical service providing facilities: Increased healthcare expenditure across various regions of the world, rising investments for adoption of advanced cell imaging techniques, growing demand for cell and gene therapies, supportive government initiatives and the active involvement of major as well as emerging pharmaceutical and biopharmaceutical industries, research organizations for strengthening market presence and expanding product portfolios is driving the expansion of bioanalytical facilities offering advanced facilities with regulatory compliance.

Augmented multiplexing capabilities: Ongoing advancements for the detection and visualization of various protein markers in a single experiment and the maintenance of spatial information in a tissue allow researchers to analyse precise locations of protein targets within a cellular context with the increased implementation of multiplexing capabilities further improving discovery of biomarkers for disease diagnosis and prognosis, in tailoring treatments strategies and also in gaining extensive biological insights for researchers.

| Report Coverage | Details |

| Market Size by 2034 | USD 8.98 Billion |

| Market Size in 2025 | USD 3.68 Billion |

| Market Size in 2024 | USD 3.33 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.43% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapeutic, End-User, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Ongoing developments in imaging-based technologies

The rising investments for developing advanced imaging-based cytometers with high-performance capabilities, utilization of various fluorescent dyes and probes for measuring different cell parameters, integration of AI and machine learning techniques for automated identification and quantification of cellular features in images, label-free imaging methods, innovations in high-resolution microscopy techniques and accurate cell tracking with microfluidics are the factors driving the market growth. The analysis of tissue and cells in 3D structures with advancements in optical coherence tomography, quantitative phase microscopy and optical projection tomography is enabling researchers to study protein localization, cellular morphology and various other features with better understanding compared to the traditional 2D analysis methods.

The advancements in image cytometry systems have paved way for potential applications in stem cell biology, oncology research, neurobiology, drug discovery, clinical diagnostics, immunology, developmental biology and various other fields. Additionally, the development of image-based cell sorting (IBCS) for classification and isolation of single cells from samples, array-based systems separating cells by utilizing real-time kinetic information and high-spatial resolution and the BD (Becton, Dickinson and Company) FACSDiscover S8 Cell Sorter which is a spectral flow cytometer which allows researchers to sort cells on the basis of real-time spatial and morphological characteristics further enhancing the potential for analysing and interpreting imaging data and a better understanding of complex biological phenomena.

Complexities and high costs involved in cell analysis procedures

Examination of the intricate components and functions inside a cell is a complex process and requires sophisticated techniques for measuring several molecular parameters such as protein levels, cellular morphologies and genetic expressions. The high costs associated with the use of instruments and software with further maintenance can act as a significant restraint for many biopharmaceutical industries, research laboratories and clinics for entering the market.

Additionally, the problems in analysing huge volumes of complex datasets requiring skilled technicians with bioinformatics expertise, limited access to qualified personnel, difficulties in preparing samples while ensuring the optimal imaging conditions, lower throughput of image-based cytometry techniques compared to flow cytometry and lack of harmonization such as discrepancies in imaging protocols and analysis algorithms throughout various platforms leading to difficulties for comparison of generated data from different laboratories are few other restraints which inhibit the market growth.

Increased Implementation in Research Studies

The growing demand for personalized medicine and the need to reduce the chronic disease burden across the globe is driving research and development activities across various medical fields. Cell analysis is being implemented for several applications such as for advancing cancer research, neurobiology studies, assessing stem cell pluripotency in stem cell research, rare disease research, immunological studies and screening of drug candidates in drug discovery and development processes which is further creating opportunities for market growth.

The oncology & immune-oncology segment dominated the market with the largest share in 2024. The market dominance of this segment is driven by the ability of image-based cytometry for detecting multiple protein markers in a single section of tissue, preservation of dimensional relationships between cells over traditional flow cytometry and comprehensive analysis of tumour microenvironments such as the occupancy and distribution of stromal cells, immune cells and blood vessels and extracellular matrix components which essentially influence the progression of cancer and immunotherapy feedback.

Furthermore, enhanced applications for developing personalized treatment strategies, increased implementation by researchers for drug development and discovering biomarkers, for evaluating immune checkpoint expressing molecules such as PD-L1 on immune cells and tumour cells as well as for identifying tumour infiltrating lymphocytes (TILs) are the factors driving the market growth of this segment.

The immunology segment is expected to witness lucrative growth over the forecast period. The multidimensional analysis of immune cell phenotypes, enhanced morphological insights for specifically detecting immune cell subsets, improved comprehension of immune response dynamics with improved analysis of tissue environment, ongoing advancements in the development of sophisticated image analysis algorithms and platforms and the potential to examine rare cell populations with the use of image-based cytometry in cell analysis for immunology is boosting the market growth. Additionally, the increased investments in developing novel immunotherapies, ongoing clinical trials and rising collaborations among biopharmaceutical industries are the factors anticipated to boost the market growth of this segment in the upcoming years.

The cardiovascular & metabolic diseases segment has seen notable growth in 2024. The high efficiency, ability to distinguish false-positive and false-negative events and avoidance of size-dependent factors in cell analysis by using image-based cytometry techniques are driving their implementation for studying cardiovascular and metabolic diseases. Moreover, the rising burden of cardiovascular diseases and metabolic disorders such as diabetes and Gaucher disease among others, increased research on metabolic anomalies contributing to the dysfunction of tissues and therapies targeting metabolic flexibility, the surge in testing procedures for these diseases and growing economies across the globe foster the growth of this segment.

The biotechnology & pharmaceutical companies segment accounted for the largest market share in 2024. The rising collaborations and acquisition activities among companies for strengthening market presence by expanding product portfolios, emergence of innovative technologies such as high-dimensional flow cytometry and spectral flow cytometry with multiple analysis parameters as well the increase in a number of clinical trials for developing therapies and treatments for chronic diseases and genetic disorders is driving the growth of this segment. Moreover, the increased emphasis on utilizing advanced cell analysis tools in drug discovery and the growing demand for personalized medicine foster innovation.

The Contract research organizations (CROs) segment is anticipated to expand at the fastest rate during the forecast period. CROs offer outsourcing services through advanced infrastructure and integrated platforms with enhanced regulatory compliance allowing their customers including pharmaceutical and biopharmaceutical companies as well as research organizations to focus on core competencies.

Moreover, specialized services in various aspects such as apoptosis analysis, cell cycle analysis, cell viability assays and cellular migration studies offered by these organizations, increased emphasis on utilizing AI-enabled data analysis software, surging demand for oncology and stem cell research and the availability of industrial experts are the factors fostering the growth of this segment.

North America led the global image-based cytometry in cell analysis market in 2024. The increased focus of research organizations and pharmaceutical companies on developing new cell and gene-based therapies, growing emphasis on developing personalized treatment strategies, surging use of image-based cytometry for diagnosis and monitoring of diseases in clinical settings, presence of advanced healthcare infrastructure and the ongoing advancements in image-based cytometry cell analysis techniques is driving the market dominance of the region.

U.S. is dominating the market in North America owing to the ongoing advancements in imaging techniques in various medical fields. The integration of AI technologies for developing innovative platforms, growing influence of the government for developing new software and analysis techniques, the surging number of outsourcing providers such as Contract Development and Manufacturing Organizations (CDMOs) and support from FDA and other government bodies is fuelling the market growth.

Asia Pacific region is expected to witness lucrative growth in the global market over the forecast period. The growth of the region is driven by the growing number of advanced diagnostics facilities and laboratories, increased emphasis on research funding, the need for personalized medicine, the rising burden of chronic diseases such as diabetes and cancer, regulatory flexibility, government-led initiatives fostering the adoption of advanced cell imaging technologies and increased healthcare expenditure. Regional market players like China, India and Japan are driving the market expansion.

China is leading the Asian market owing to the significant growth in R&D activities as well as the surging demand for sophisticated cell analysis techniques for cancer research, drug discovery, stem cell research, toxicology testing and precision medicine. Furthermore, the availability of domestic production facilities for image-based cytometry systems, supportive government initiatives and the expansion of the pharmaceutical industries is driving the demand for high-performance cell analysis platforms for accelerating the drug discovery and development processes.

By Therapeutic Area

By End User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

January 2025

September 2024