List of Contents

What is Implantable Drug Delivery Devices Market Size?

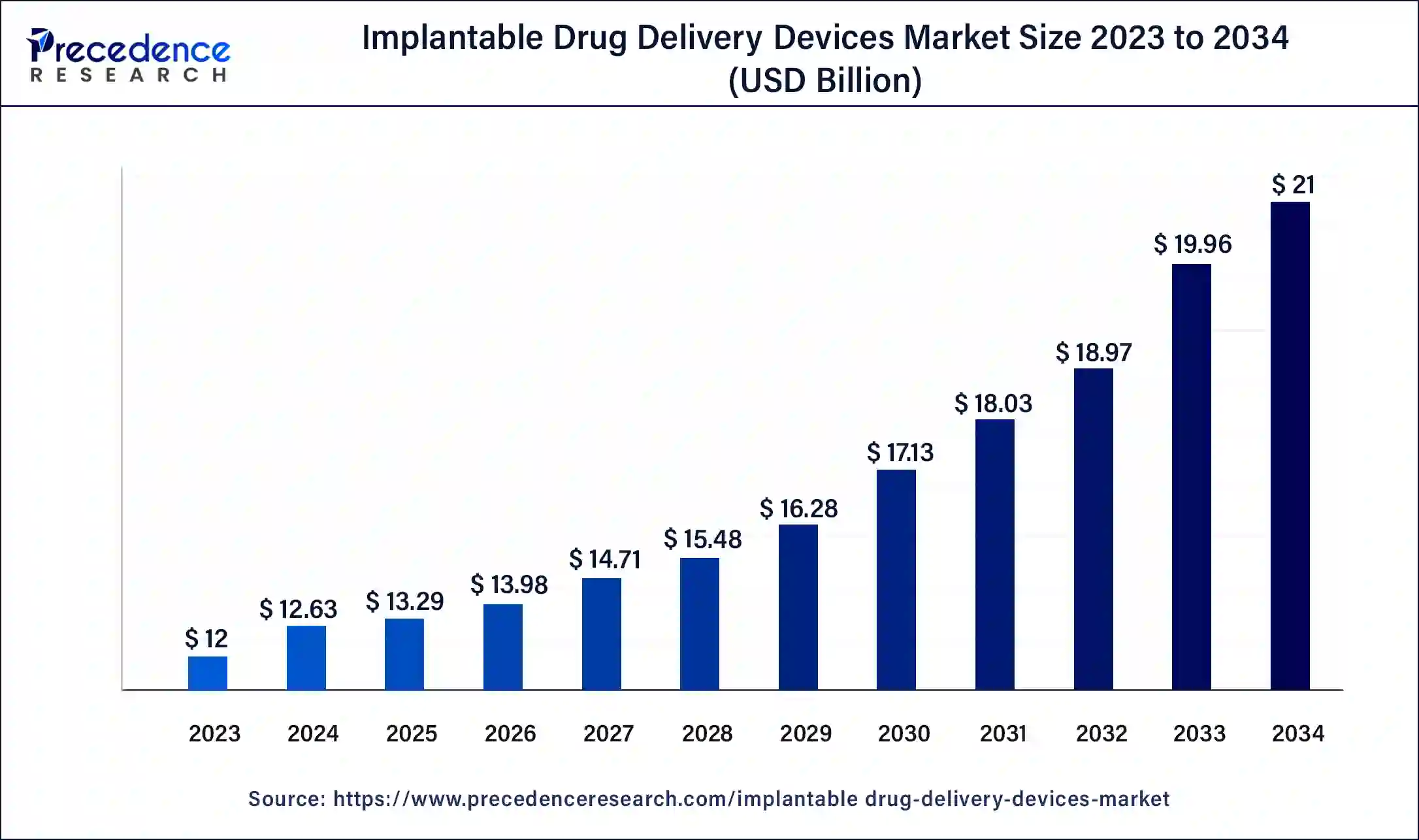

The global implantable drug delivery devices market size is calculated at USD 13.29 billion in 2025 and is expected to reach around USD 21.00 billion by 2034, expanding at a CAGR of 5.22% from 2025 to 2034. The increasing prevalence of chronic diseases globally needs to be tackled at an early stage, creating the urgency to embrace advanced techniques to detect and treat diseases, which are the major factors that are propelling the implantable drug delivery devices market.

Market Highlights

- North America accounted for a significant share of the global implantable drug delivery devices market in 2024.

- Asia Pacific is expected to witness notable growth in the market over the forecasted years.

- By product, the drug-eluting stents segment dominated the global market in 2024.

- By product, the bio-absorbable stents segment is estimated to showcase the fastest growth in the market in the upcoming period.

- By type, the non-biodegradable segment led the global market in 2024.

- By type, the biodegradable segment is expected to showcase significant growth in the market in the foreseeable future.

- By technology, the diffusion segment dominated the global market in 2024.

- By technology, the osmatic segment holds a significant share of the market.

- By technology, the magnetic segment is observed to showcase notable growth in the market in the upcoming period.

- By application, in 2024, the cardiovascular segment held the largest share of the global market.

- By application, the contraception segment is estimated to hold a notable share of the market.

Market Overview

The implantable drug delivery devices market is experiencing significant growth, driven by rising chronic disease prevalence and advances in biotechnology. These devices, offering controlled drug release and improved patient compliance, are increasingly favored in treatments for cancer, diabetes, and cardiovascular diseases.

Technological innovations, such as microchip-based delivery systems and biodegradable implants, are enhancing efficacy and safety profiles. The implantable drug delivery devices market is also benefiting from growing investments in healthcare infrastructure and research and development. North America leads the market due to high healthcare expenditure and robust regulatory frameworks while emerging economies in Asia-Pacific present lucrative opportunities due to improving healthcare access and expanding patient populations.

The World Health Organization (WHO) reported in September 2022 that chronic diseases are responsible for 74% of global deaths, with 41 million fatalities each year. According to the data

- 17.9 million deaths from cardiovascular diseases.

- 9.3 million from cancer.

- 4.1 million from chronic respiratory diseases.

- 2.0 million from diabetes.

Implantable Drug Delivery Devices Market Growth Factors

- Increasing prevalence of chronic diseases like cancer, diabetes, and cardiovascular disorders globally.

- Advances in biotechnology and drug formulation technologies worldwide.

- Growing preference for minimally invasive treatment options.

- Technological innovations, such as microchip-based delivery systems and biodegradable implants.

- Rising healthcare expenditure and improved healthcare infrastructure.

- Increased patient compliance and convenience offered by implantable devices Expanding geriatric population with higher healthcare needs.

- In the implantable drug delivery devices market, robust regulatory frameworks ensure device safety and efficacy.

- Growing research and development investments in the healthcare sector.

- Emerging markets in Asia Pacific with improving healthcare access and infrastructure.

Implantable Drug Delivery Devices Market Trends

- The market is shifting toward biodegradable and biocompatible implants that don't require surgical removal.

- Smart implants with sensors and programmable pumps are becoming common, enabling real-time monitoring and controlled drug release.

- Devices are becoming smaller and less invasive, improving patient comfort and targeting drugs more precisely.

- Advanced polymers and nanotechnology are being used to provide steady, long-term drug delivery.

- Implantable devices are increasingly integrated with digital health tools, allowing remote dose adjustments and better personalized care.

- The growing prevalence of chronic diseases is boosting demand for long-term, controlled drug delivery solutions.

- Minimally invasive surgical techniques are improving, making implantation safer and easier.

- Emerging markets are seeing higher adoption as healthcare infrastructure develops and patient demand rises.

Market Outlook

- Industry Growth Overview: The implantable drug delivery device market is growing due to the rising demand for targeted and controlled drug therapies. Especially for chronic diseases like cancer and cardiovascular conditions. Advancements in minimally invasive procedures and micro pump technologies are further supporting growth. Increasing adoption in emerging markets is also boosting the market globally.

- Sustainability Trends: The focus of sustainability trends is on biodegradable and biocompatible implant materials, which minimize medical waste and the need for surgical removal. Manufacturers are looking for energy-efficient production techniques for these devices, and reusable and environmentally friendly components are being developed.

- Startup Economy:Smart programmable implants with sensors for individualized treatment and real-time monitoring are being developed by startups. For accurate medication delivery, many are creating microscale and nanotechnology-based devices. These solutions are reaching patients more quickly thanks to partnerships with medical facilities and pharmaceutical firms.

Implantable Drug Delivery Devices Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 13.29 Billion |

| Market Size in 2026 | USD 13.98 Billion |

| Market Size by 2034 | USD 21.00 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.22% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Prevalence of chronic diseases

The growing incidence of chronic conditions such as cancer, diabetes, and cardiovascular diseases drives the demand for implantable drug delivery devices. These conditions often require long-term medication, making controlled and consistent drug delivery crucial. Implantable devices offer a reliable solution by providing sustained drug release, reducing the need for frequent dosing, and improving patient adherence. This growing patient population and the need for effective long-term treatment options significantly boost the implantable drug delivery devices market growth.

- In October 2022, the World Health Organization reported a more than 2.5% rise in the burden of drug-resistant tuberculosis (DR-TB) with 450,000 new cases of rifampicin-resistant TB (RR-TB).

Technological advancements

Innovations in drug delivery technology, including the development of advanced materials and improved device designs, are a major driving factor. Technologies such as microchip-based systems, biodegradable materials, and precision-controlled release mechanisms enhance the efficacy and safety of implantable devices. These advancements address previous limitations, such as drug stability and targeted delivery, and offer new treatment possibilities. Consequently, they expand the range of applications and attract investments, accelerating the implantable drug delivery devices market expansion.

Restraint

Implementation complexities

One major restraint of the implantable drug delivery devices market is the high cost of development and implementation. The research and development phase for these devices involves significant investment in advanced materials, technology, and clinical trials, which can be prohibitively expensive. Additionally, the complexity of manufacturing and ensuring regulatory compliance adds to the overall cost. High costs can limit market access and affordability, particularly in low- and middle-income countries, affecting the widespread adoption of these technologies. Furthermore, the need for ongoing innovation to address issues such as device biocompatibility and efficacy can strain resources and slow down market growth. These financial barriers can also impact smaller companies, limiting competition and slowing the pace of technological advancements in the sector.

Opportunity

Emerging markets expansion

Rapid economic growth and improving healthcare infrastructure in emerging markets, particularly in Asia-Pacific, offer significant opportunities. As these regions develop and healthcare access increases, the demand for advanced implantable drug delivery devices is expected to rise. Companies can capitalize on this growth by tailoring products to local needs and investing in these expanding markets.

Proliferation of digital health technologies

The integration of digital health technologies, such as remote monitoring and smart implants, presents a promising future opportunity. These innovations enable real-time tracking of device performance and patient adherence, enhancing treatment outcomes. Developing devices with integrated digital capabilities can improve patient management and open new avenues for market growth and advanced healthcare solutions.

Segment Insights

Product Insights

The drug-eluting stents segment dominated the global implantable drug delivery devices market in 2024. This is due to its effectiveness in treating coronary artery diseases. These stents release medication that prevents artery blockage and reduces the risk of restenosis, improving patient outcomes compared to traditional stents. The high prevalence of cardiovascular diseases globally drives demand for these devices. Additionally, advancements in stent technology, such as improved drug formulations and biocompatible materials, enhance their efficacy and safety. Strong clinical evidence supporting their benefits further boosts their adoption, solidifying their market dominance.

- In August 2022, the Onyx Frontier drug-eluting stent (DES) was launched by Medtronic, after receiving CE Mark approval. This stent features an innovative delivery system and is built upon the success of their previous DES products.

The bio-absorbable stents segment is estimated to showcase the fastest growth in the implantable drug delivery devices market in the upcoming period. Bioabsorbable stents are rapidly growing in the market due to their ability to gradually dissolve after restoring blood flow, reducing long-term complications associated with permanent stents. They offer advantages such as decreased risk of late stent thrombosis and the potential for natural vessel healing. Technological advancements and favorable clinical outcomes are driving their adoption, along with increasing patient and physician preference for safer, innovative cardiovascular treatment options.

Type Insights

The non-biodegradable segment led the global implantable drug delivery devices market in 2024. The non-biodegradable device segment dominates the market due to its established efficacy, durability, and reliability in long-term treatments. These devices provide consistent drug delivery over extended periods, making them suitable for chronic conditions such as cardiovascular diseases and diabetes. Their proven track record, supported by extensive clinical data, has led to widespread adoption among healthcare providers.

- A study published in 2022 proposed the use of 3D-printed implants in combination with biodegradable rate-controlling membranes to produce devices capable of sustained delivery of hydrophobic drugs.

The biodegradable segment is expected to showcase significant growth in the implantable drug delivery devices market in the foreseeable future. Biodegradable devices are showing a fast growth rate due to their ability to naturally dissolve in the body, reducing long-term complications and eliminating the need for removal surgeries. They offer enhanced safety and patient compliance alongside innovations in biodegradable materials and positive clinical outcomes, driving their increasing adoption in various medical applications. Additionally, ongoing technological advancements in biodegradable materials enhance their performance and safety profiles, further solidifying the segment's position in the market.

Technology Insights

The diffusion segment dominated the global implantable drug delivery devices market in 2024. The diffusion segment dominates the market by technology due to its simplicity, reliability, and effectiveness in controlled drug release. Diffusion-based implantable drug delivery systems allow for a steady and predictable release of medication over time, enhancing therapeutic outcomes and patient adherence. This technology is particularly advantageous for chronic conditions requiring long-term medication, such as cardiovascular diseases and diabetes. The well-established nature of diffusion technology, supported by extensive clinical research and regulatory approvals, fosters its widespread adoption. Additionally, continuous improvements in material science and drug formulation techniques enhance the performance and safety of diffusion-based devices, further solidifying their market dominance in the implantable drug delivery devices sector.

The osmotic segment holds a significant share of the implantable drug delivery devices market. Osmotic devices use osmosis to control the release rate, ensuring a stable and predictable drug administration over extended periods. This technology is particularly effective for chronic conditions requiring continuous medication. The reliability and controlled release offered by osmotic systems improves patient outcomes and compliance. Additionally, advancements in osmotic pump design and material innovations contribute to their growing popularity and substantial market share.

The magnetic segment is observed to showcase notable growth in the implantable drug delivery devices market in the upcoming period. Magnetic implants are showing notable growth due to their non-invasive control and targeted drug delivery capabilities. By using external magnetic fields, these devices can precisely control the release and localization of medication within the body. This technology enhances treatment accuracy and patient comfort, leading to increased adoption and significant market growth.

Application Insights

The cardiovascular segment held the largest share of the global implantable drug delivery devices market. The cardiovascular segment dominates the global market due to the high prevalence of cardiovascular diseases, such as coronary artery disease and hypertension, which drive demand for effective drug delivery solutions. Implantable devices, like drug-eluting stents, are crucial for managing these conditions by ensuring localized and controlled medication release. The ongoing advancements in cardiovascular technology, improved patient outcomes, and the growing need for innovative treatments further boost the segment's dominance. Additionally, increased awareness and screening programs contribute to the high demand for cardiovascular implantable drug delivery devices.

The contraception segment is estimated to hold a notable share of the implantable drug delivery devices market due to the high demand for effective and convenient birth control methods. Implantable contraceptives offer long-term, reliable solutions with minimal user intervention, enhancing their appeal. Innovations in drug delivery technology, such as hormonal implants, provide improved efficacy and reduced side effects. Additionally, increasing awareness and accessibility to family planning options contribute to the growing adoption of contraceptive devices, supporting their significant market presence. Innovations such as the intrauterine device (IUD) transformed the reproductive healthcare scene, providing an effective, long-term, yet fully reversible method of birth control.

Regional Insights

North America accounted for a significant share of the global implantable drug delivery devices market in 2024 due to several key factors. The region boasts high healthcare expenditure, which supports the adoption of advanced medical technologies. A robust healthcare infrastructure and the presence of leading pharmaceutical and biotechnology companies drive innovation and the development of cutting-edge implantable devices.

- In February 2022, Second Sight Medical Products, a California-based prosthetic device manufacturer, merged with Nano Precision Medical, a developer of NanoPortal drug implant technology. This merger paves the way for collaborative efforts in the development of drug-delivery medical implants.

North America also benefits from a well-established regulatory framework that ensures the safety and efficacy of medical devices, fostering trust and widespread adoption among healthcare providers and patients. Additionally, the region has a high prevalence of chronic diseases such as cancer, diabetes, and cardiovascular conditions, creating a substantial demand for effective drug delivery solutions. Moreover, strong investment in research and development further propels market growth, making North America a dominant player in this sector.

Asia Pacific is expected to witness notable growth in the implantable drug delivery devices market over the forecasted years. Improving healthcare infrastructure and access are driving demand for advanced medical technologies. The region's large and aging population is increasing the prevalence of chronic diseases, necessitating effective treatment solutions. Economic growth and rising healthcare expenditures enable greater investment in healthcare technologies. Additionally, increasing awareness and adoption of innovative medical devices, coupled with supportive government initiatives and regulatory frameworks, are fuelling market expansion. The presence of emerging markets with a growing middle-class population further boosts the demand for advanced healthcare solutions.

- In May 2022, Opharmic Technology, a Hong Kong-based medtech company, partnered with CeramTec, a Germany-based chemical industry company, to develop innovative technology for non-invasively delivering drugs to the eyes.

Value Chain Analysis

- R&D: Research and development is focused on making smaller, smarter implants with precise, programmable drug delivery. Innovations in advanced polymers and nanotechnology are improving device performance, safety, and reliability.

Key Players: Companies leading R&D in this field include Medtronic and Boston Scientific, which are developing next-generation programmable implants and micro-pump systems. - Distribution to Hospital Pharmacies: These devices are supplied through hospital pharmacies and specialized medical channels to ensure patients receive timely access to therapies. Efficient logistics and hospital partnerships are essential for maintaining supply and readiness.

Key Players: Leading distributors include Abbott Laboratories and Bayer, both of which provide implantable drug delivery systems and extensive hospital support networks. - Patient Support & Services: Patient support now includes remote monitoring, dosage reminders, and telehealth integration, helping patients manage their implants safely and effectively. These services improve treatment adherence and allow timely adjustments.

Key Players: Companies excelling in patient support include Bausch + Lomb and Delpor Inc., which offer comprehensive programs to enhance safety and treatment outcomes.

Implantable Drug Delivery Devices Market Companies

- Medtronic

- Boston Scientific Corporation

- Abbott Laboratories

- Allergan

- Merck & Co. Inc.

- Bausch

- Lomb Incorporated

- Bayer AG

Recent Developments

- In June 2024, in a paper published in Biomaterials Research, a team led by researchers from the Daegu Gyeongbuk Institute of Science and Technology (DGIST) in the Republic of Korea presented data on their non-biodegradable, ultrasoft, and flexible balloon implant for drug delivery.

- In February 2023, FDA approval was received by Boston Scientific for their Eluvia drug-eluting stent intended for the treatment of coronary artery disease. This stent employs a novel polymer designed to control drug release and potentially enhance patient outcomes.

Segments Covered in the Report

By Product

- Contraceptive Implants

- Spinal Implants

- Brachytherapy Seeds

- Drug-eluting Stents

- Bio-absorbable Stents

- Intraocular Stents

- Infusion Pumps

- Others

By Type

- Biodegradable

- Non-biodegradable

By Technology

- Diffusion

- Osmotic

- Magnetic

- Others

By Application

- Contraception

- Ophthalmology

- Cardiovascular

- Diabetes

- Oncology

- Autoimmune Diseases

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client