September 2024

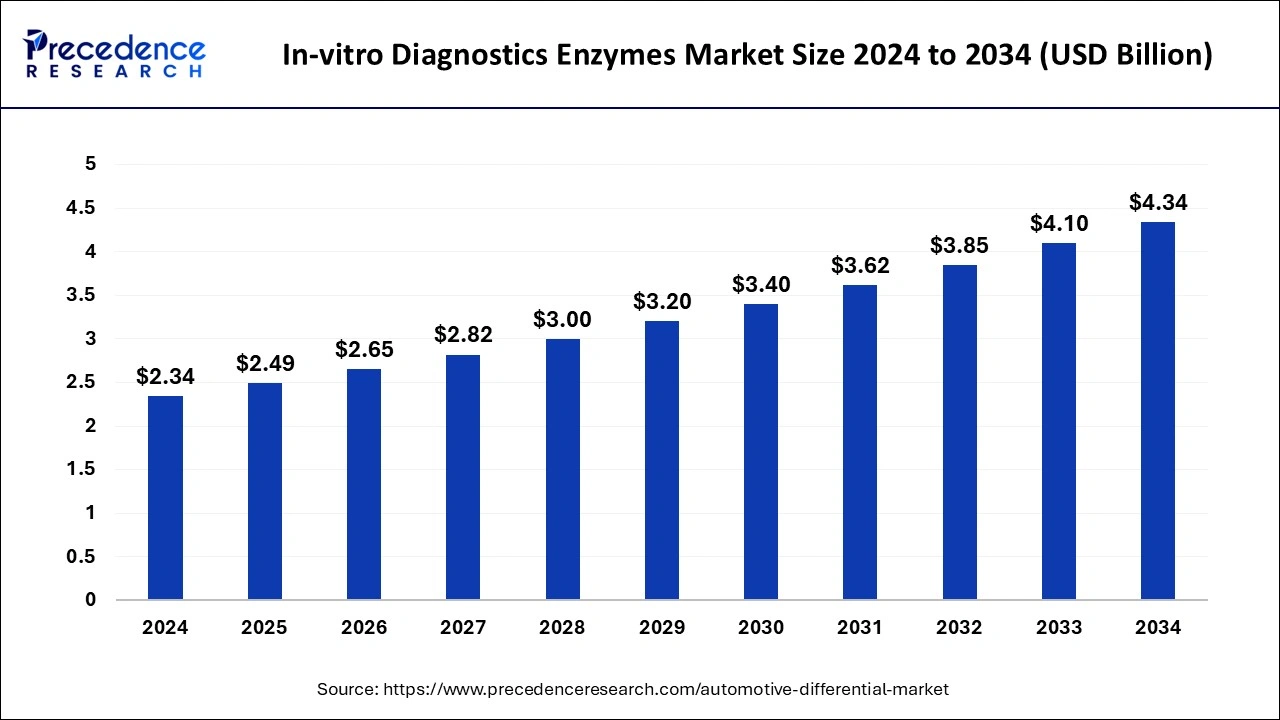

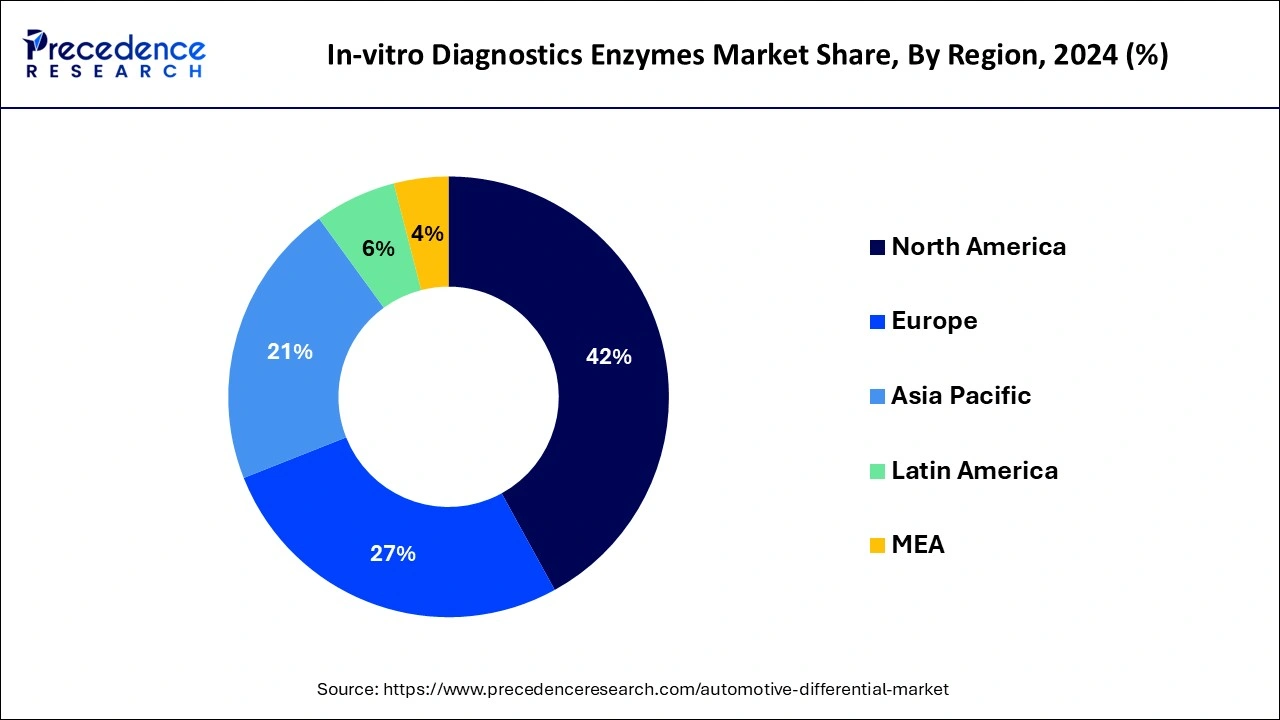

The global in-vitro diagnostics enzymes market size is calculated at USD 2.49 billion in 2025 and is forecasted to reach around USD 4.34 billion by 2034, accelerating at a CAGR of 6.37% from 2025 to 2034. The North America in-vitro diagnostics enzymes market size surpassed USD 980 million in 2024 and is expanding at a CAGR of 6.39% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global in-vitro diagnostics enzymes market size was estimated at USD 2.34 billion in 2024 and is predicted to increase from USD 2.49 billion in 2025 to approximately USD 4.34 billion by 2034, expanding at a CAGR of 6.37% from 2025 to 2034.

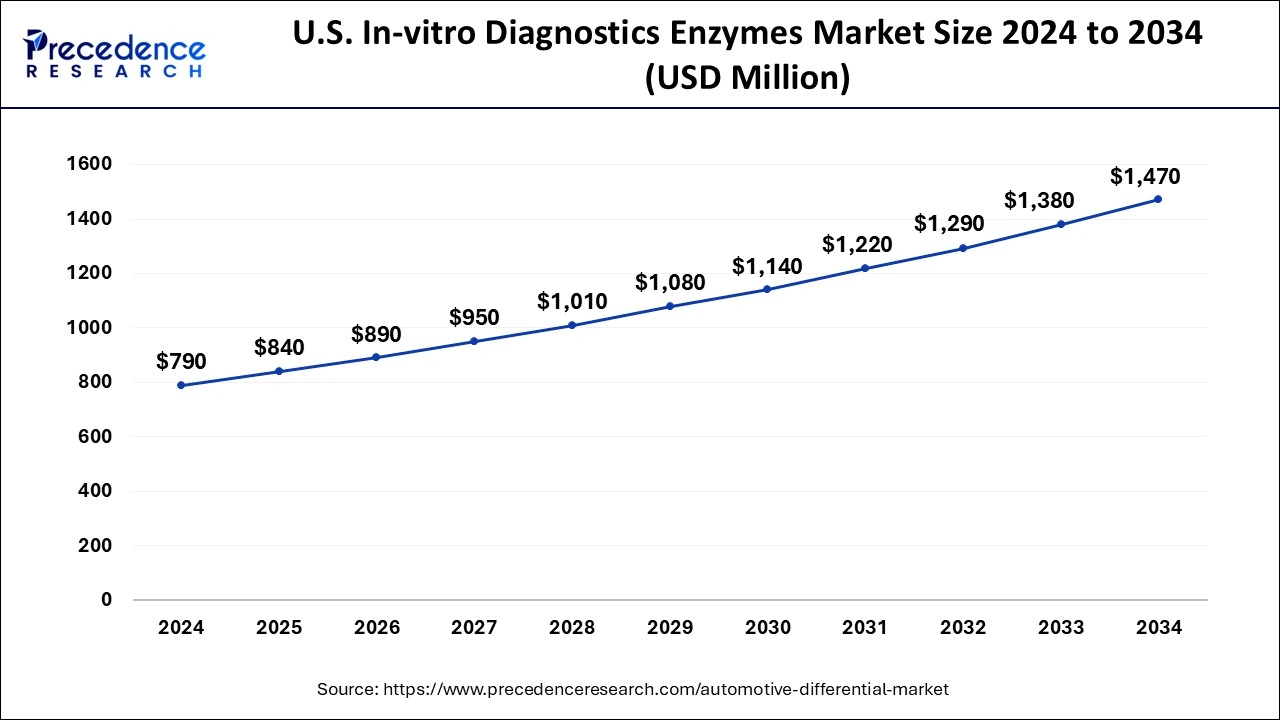

The U.S. in-vitro diagnostics enzymes market size was estimated at USD 790 million in 2024 and is projected to surpass around USD 1,470 million by 2034 at a CAGR of 6.41% from 2025 to 2034.

North America dominated the in-vitro diagnostics enzymes market in 2024 due to a robust healthcare system that supports the development and use of in-vitro diagnostics. This includes hospitals, labs, and other healthcare facilities that are well-equipped to handle diagnostic procedures. North America also has technological advancements in in-vitro diagnostics. This includes the development of new diagnostic kits and systems that are improving the accuracy and efficiency of disease detection; there's a growing awareness about the importance of early detection of diseases, especially viral diseases like COVID-19. This awareness is driving the demand for in-vitro diagnostics.

Asia Pacific is expected to grow during the forecast period because of the increasing prevalence of chronic diseases, the growing demand for early and accurate diagnosis, and the rise in healthcare expenditure. Countries like China, Japan, and India are particularly notable for their contributions to the market's growth. These countries have large populations and are experiencing a significant increase in the incidence of chronic diseases, creating a huge demand for diagnostic tests. In the Asia Pacific region, Japan holds the largest share of the market due to the adoption of advanced technology and increased chronic conditions, which leads to market growth.

The in-vitro diagnostics enzymes market focuses on using enzymes in laboratory tests to detect, measure, and confirm the presence of specific analytes and disease diagnosis and monitoring. The market is continuously growing due to the growing adoption of enzyme-based diagnostic tests in biotechnology. There are new developments and innovations and increasing investments by key players in research & development in biotechnology to develop new products. Technological advancements are also increasing the market opportunities. Companies are developing diagnostic kits, identifying and analyzing spike proteins, and developing new enzyme-based treatment methods.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.37% |

| Market Size in 2025 | USD 2.49 Billion |

| Market Size by 2034 | USD 4.34 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Enzyme Type, By Disease Type, By Technology Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The increasing geriatric population and chronic diseases

The increasing number of chronic diseases in the geriatric population is driving the growth of the in-vitro diagnostics enzymes market. The elderly population is more commonly diagnosed with chronic and infectious diseases, and as people age, they are more likely to develop health conditions that require proper regular monitoring and testing. There is a high demand for in-vitro diagnostics enzymes to test these chronic diseases early. The prevalence of chronic diseases will increase more in the future due to changing lifestyles, eating habits, pollution, genetic modification, lack of physical activities, and so on.

Government regulations

Government regulations can be a big restraint on the In-vitro diagnostics enzymes market. Many enzymes are difficult to purify or are found in rare species. In many cases, the diagnostic procedures or tests need human-based enzymes, which are produced using recombinant DNA technology in laboratories. All these factors lead to strict government regulations which hinders the processes and takes a lot of time for approval and other formalities.

Technological inventions and increased investments

Advancements in biotechnology and molecular diagnostics are making it easier to use enzymes to detect diseases such as diabetes and cancer. These diseases can be diagnosed more quickly and accurately. Also, the use of AI and automation in diagnostic procedures is making these tests more efficient and reliable. All these advancements are not only improving the quality of diagnostics but also making them more accessible and cost-effective.

The ongoing investments in research and technology are also introducing more effective and automated diagnostic solutions, which is driving the market growth. The combination of new technologies and more investment is creating a lot of opportunities for the In-vitro diagnostics enzymes market.

The polymerase and transcriptase segment dominated the In-vitro diagnostics enzymes market in 2024. Polymerase (PCR) is a laboratory technique to amplify DNA or RNA. The PCR technique is also used in different disciplines, such as medicine and biology, medical diagnostics, molecular biology research, and more. One of the advantages is PCR's high fidelity, which gives precision in detecting mutations or low-abundance genes. Enzymes like DNA polymerase, RNA polymerase, ligase, and reverse transcriptase are involved in the PCR technique, which increases market growth.

The proteases segment is expected to grow at a CAGR of 8.1% during the forecast period. This is because proteases are super helpful in breaking down proteins, which is a key step in many diagnostic tests. Proteases are needed during enzyme-linked immunosorbent assay testing, amino acid detection, protein sequencing, and many other processes.

The infectious disease segment dominated the in-vitro diagnostics enzymes market in 2024. Infectious diseases are disorders spread by bacteria, fungi, viruses, and parasites. They can be passed from one person to another or spread by eating contaminated food, water, or soil. HIV, flu, strep throat, measles, and COVID-19 are examples of infectious diseases. These diseases are growing, and in-vitro diagnostics enzymes are needed to test them, which leads to market growth.

The oncology segment is expected to grow in the in-vitro diagnostics enzymes market during the forecast period. Oncology focuses on cancer diagnosis, treatment, and prevention. In-vitro diagnostics enzymes are used to diagnose cancer. Cancer has become one of the major causes of death across the world and needs continuous attention from researchers and healthcare professionals. Many tests, including PCR, ELISA, RNA sequencing, and DNA sequencing, are done in oncology, which need enzymes.

The histology assays segment dominated the in-vitro diagnostics enzymes market in 2024. Histology assays help in medical diagnosis. This technology allows the visualization of tissue structure and characteristic changes. This technology enhances processes and provides effective patient outcomes. This technique improves workflow, such as remote access and flexible work schedules, and also reduces time, which means providing fast access to samples. Due to these benefits, this segment is significantly growing in the market.

The molecular diagnostics segment is expected to grow in the in-vitro diagnostics enzymes market during the forecast period. This technique allows for the early detection of any disease. Molecular diagnostics are used in fields such as infectious disease, cancer, and congenital abnormalities. This molecular diagnostic takes less time, and molecular laboratories can efficiently purify nucleic acid for testing. This technology is growing continuously.

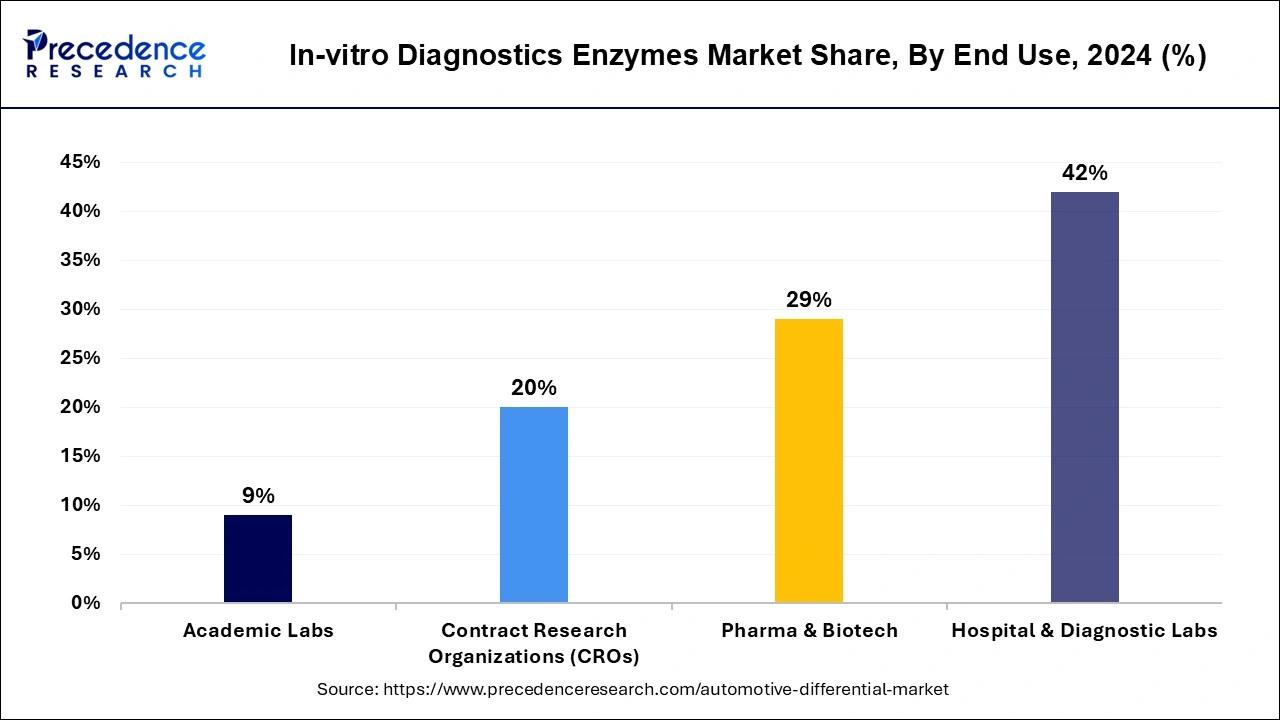

The hospitals and diagnostic segment dominated the in-vitro diagnostics enzymes market in 2024 with a revenue share of 42%. It involves biotech companies, pharma, hospitals, diagnostic labs, contract research organizations, and others. The in-vitro diagnostic enzymes are used in a wide range of diagnostic tests such as tissue analyses, blood test, and molecular diagnostics. Increasing infectious and chronic disease needs advanced diagnostic abilities. Pharma and biotech companies rely heavily on these enzymes. Pharmaceutical companies are responsible for large scale production of these enzymes while biotechnology field is the most prominent field which uses the enzymes.

The academic segment is expected to grow at a CAGR of 9% during the forecast period. This includes research institutes, small diagnostic centers, and government agencies that use IVD enzymes for testing and a variety of purposes. The use of enzymes in these small diagnostic centers and research institutes is increasing, which leads to market growth.

By Enzyme Type

BY Disease Type

By Technology Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

March 2025

January 2025