February 2025

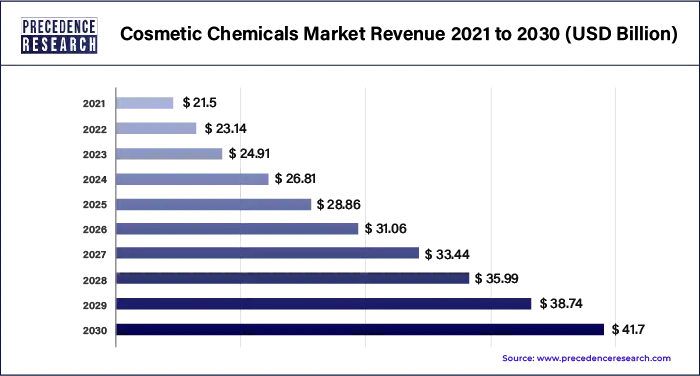

The global cosmetic chemicals market was valued at USD 24.91 billion in 2023. The market demand is anticipated to grow from USD 26.81 billion in 2024 to USD 41.7 billion by 2030, exhibiting a CAGR of 7.64% during the forecast period.

The cosmetic chemicals market is the industry that manufactures and supplies chemicals used to develop cosmetics and personal care products. Preservatives, emollients, surfactants, colorants, and perfumes are some substances produced by the market. It is an essential component of the beauty and personal care industry's ability to supply a wide range of cutting-edge cosmetic products.

The cosmetic chemical market involves the public and private sectors in significant ways. The public sector frequently establishes guidelines and standards to guarantee consumer protection and product safety through regulatory organizations. On the other hand, private businesses work on creating, producing, and marketing chemicals used in cosmetics.

Complete ingredient labeling mandates are a vital part of the growing consumer awareness of the products they use. Nations are pooling together several informative resources to aid this awareness. In accordance with the fair packaging and Labeling Act (FPLA), the U.S. FDA requires cosmetics to have an ‘ingredient declaration.’ This law requires companies to have transparency on most ingredients, providing their consumer with a sense of safety and trust while allowing them to protect their trade secret.

Within the cosmetics chemical market, the participation of individual businesses greatly impacts the overall market landscape.

Anherb Natural

Renowned skincare authority Anherb Natural hopes to significantly impact the beauty industry thanks to its vast knowledge and proficiency in skincare. The brand's steadfast dedication to offering outstanding skincare solutions is reflected in the new products, which are expertly designed to improve and revitalize.

In April 2023, building the premier platform for cell programming and biosecurity, Solvay, a global scientific and materials firm whose products improve many parts of daily life, announced a strategic alliance with Ginkgo Bioworks. Using this multi-year strategic collaboration agreement, Ginkgo and Solvay will work together to unleash the potential of synthetic biology as a catalyst for the development of more sustainable materials and chemicals, assisting in the shift towards more ecologically friendly solutions. The alliance's initial focus will be on novel sustainable biopolymers, which are niches with the potential to significantly influence various markets, including food, personal care, and agriculture.

Amyris, an artificial biotechnology and renewable chemical firm, signed a long-term partnership with Givaudan, the world leader in fragrance and beauty innovation. Under the terms of the deal, Amyris will continue manufacturing ingredients for Givaudan to utilize in cosmetics and offer access to its innovation capabilities. In February 2023, Givaudan will join forces with other companies to commercialize sustainable beauty ingredients.

As a result of developments in formulation technologies, the chemicals used in cosmetics are changing to emphasize efficacy, safety, and sustainability. Biotechnology, natural ingredients, and environmentally friendly packaging are becoming increasingly popular. New developments, such as smart cosmetics that use technology to improve skin care advantages, are also gaining popularity in the rapidly evolving cosmetics market.

By product type, it is anticipated that the polymer category will dominate. Emollients become the predominant category because they are polymer molecules. Emollients make the skin softer by preventing water loss. They are in many cosmetics and personal care products, such as skin moisturizers, face creams, body lotions, and lipsticks. Synthetic and natural versions of these emollients are available for purchase.

Considering the skincare area had so many options, it had the most significant market share by application. The popularity of skincare cosmetics, including face creams, body lotions, body creams, powders, and sunscreen lotions, is rising. This is the primary factor that most affects market share. The noteworthy attractiveness of personalized skincare products in developed countries such as the U.S. and the UK also contributed to the segmental expansion. The market's growth was further aided by the availability of skincare products with active ingredients that have therapeutic and nurturing qualities.

North America

the global cosmetic chemicals market is led by North America. The growth of organic personal care products in the area is the primary driver of the demand for cosmetic chemicals. The region's demand for cosmetic chemicals has been driven mainly by rising R&D costs from manufacturers and related technological developments in the cost-effective processing of components and production of organic personal care products.

Asia Pacific

Asia-Pacific has emerged as a powerhouse in the global beauty industry, fueled by a combination of factors including changing consumer preferences, rising disposable incomes, and a growing emphasis on personal grooming and self-care. With a diverse population and a rich cultural heritage, the region's beauty market is as dynamic and multifaceted as its people, offering a plethora of opportunities for cosmetic chemical manufacturers and suppliers.

Collaboration is key to driving innovation and growth in the cosmetic chemicals market in Asia-Pacific. From multinational conglomerates to small-scale startups, companies across the region are forging partnerships, sharing resources, and pooling expertise to accelerate product development and expand market reach. By collaborating with suppliers, formulators, and regulatory experts, beauty brands in Asia-Pacific can stay ahead of the curve and deliver products that resonate with consumers.

According to a report published by the India Brand Equity Foundation, the Indian cosmetics industry is projected to grow to USD 20 billion by 2025.

Environmental and ethical considerations

Consumers are seeking out eco-friendly and cruelty-free cosmetics due to an increasing awareness of sustainability, vegetarianism, and ethical issues impacting their shopping decisions. The need for plant-based materials has surged due to the trend toward vegan cosmetics, prompting the cosmetics industry to investigate and embrace sustainable substitutes for conventional chemical components.

Companies that support veganism, sustainability, and ethical business practices are seeing tremendous development in the market as customers actively look for goods that support their beliefs and encourage a greener way of living. Due to market demand, firms seek certificates to indicate to consumers that their products are cruelty-free and in line with ethical issues.

Natural living trends

With the growing awareness of the global, multifaceted impacts of the cosmetics industry, consumers are breaking away from the mainstream trends. People are moving towards natural living and body positivity ideologies. These promote unadulterated lifestyles devoid of chemicals and artificial conveniences. Combined with lower income in developing countries and rising concerns related to consumer health, the cosmetics industry has taken a significant hit. The cosmetics chemicals market is further subjected to criticism for the testing procedures that subject living organisms to intentional harm.

Hazardous properties of some cosmetic components

To produce cutting-edge and secure products, private enterprises in the cosmetic chemicals sector make research and development investments. They have cosmetics, evaluate their products for safety, and advertise them to customers. For instance, the presence of unlisted label ingredients such as 1,4-dioxane, a cosmetic contaminant has been linked to several health hazards universally.

The public and private sectors are expected to work together, with businesses abiding by legal requirements and governments drawing on industry knowledge to enhance laws. According to the FDA, Mercury is a toxic compound that can lead to a variety of conditions ranging from slight rashes to severe metal toxicity. This metal is often used as a cosmetic ingredient and marketed as a skin-lightening or anti-aging agent.

In conclusion, customer choices, technology developments, and sustainability concerns are driving the ongoing evolution of the cosmetics chemicals business. Industry participants must adjust to these shifting dynamics as demand for creative and environmentally friendly components grows. To ensure the security of products and environmental sustainability, manufacturers, regulatory agencies, and consumers will need to work together to shape the cosmetics chemicals market in the future. In the coming years, the industry may overcome obstacles and take advantage of growth prospects by strongly emphasizing research and development and maintaining transparency.

View Full Report@ https://www.precedenceresearch.com/cosmetic-chemicals-market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

February 2025

November 2024

November 2024

October 2024