January 2025

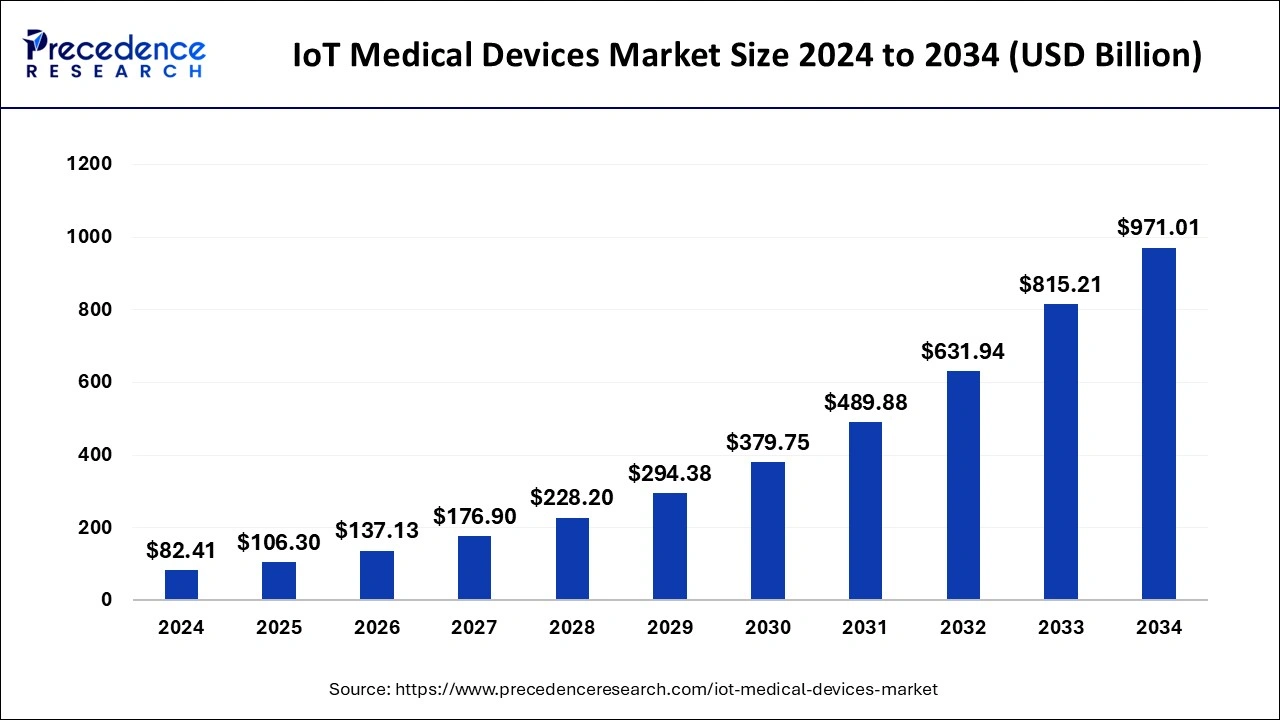

The global IoT medical devices market size is accounted at USD 106.30 billion in 2025 and is forecasted to hit around USD 971.01 billion by 2034, representing a CAGR of 27.97% from 2025 to 2034. The North America market size was estimated at USD 29.67 billion in 2024 and is expanding at a CAGR of 28.00% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global IoT medical devices market size was calculated at USD 82.41 billion in 2024 and is predicted to increase from USD 106.30 billion in 2025 to approximately USD 971.01 billion by 2034, expanding at a CAGR of 27.97% from 2025 to 2034.

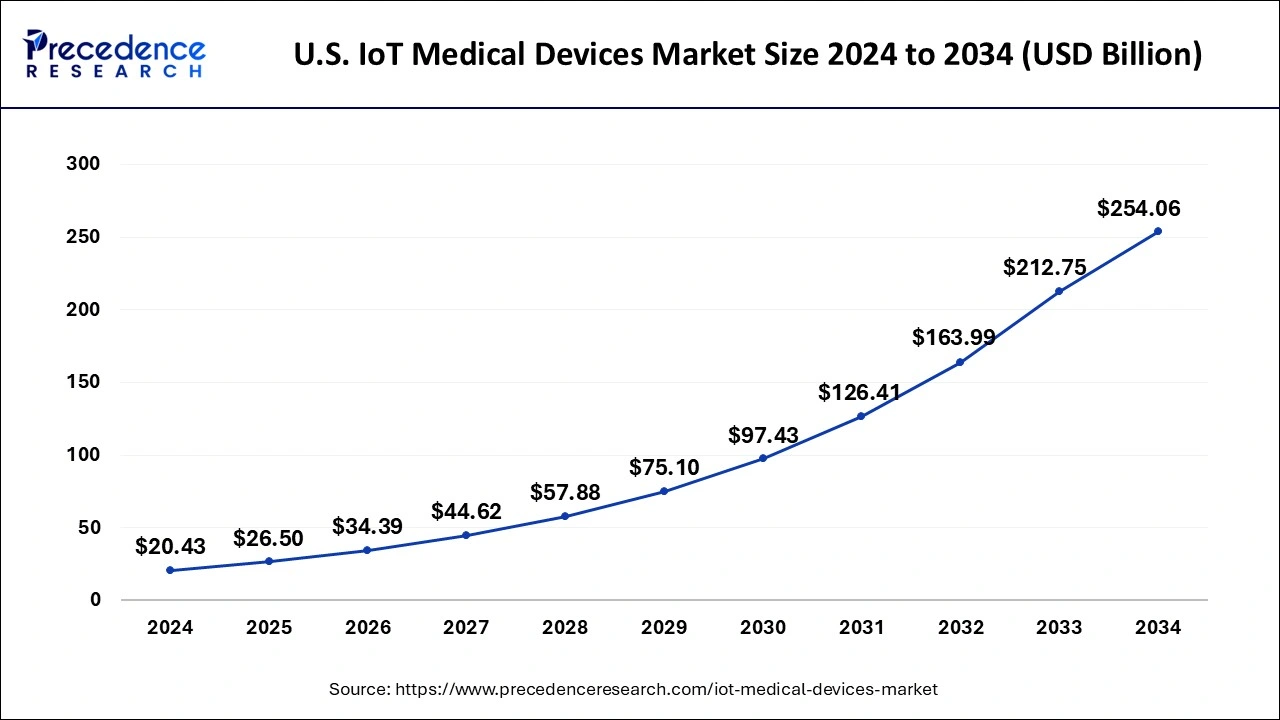

The U.S. IoT medical devices market size was evaluated at USD 20.43 billion in 2024 and is projected to be worth around USD 254.06 billion by 2034, growing at a CAGR of 28.67% from 2025 to 2034.

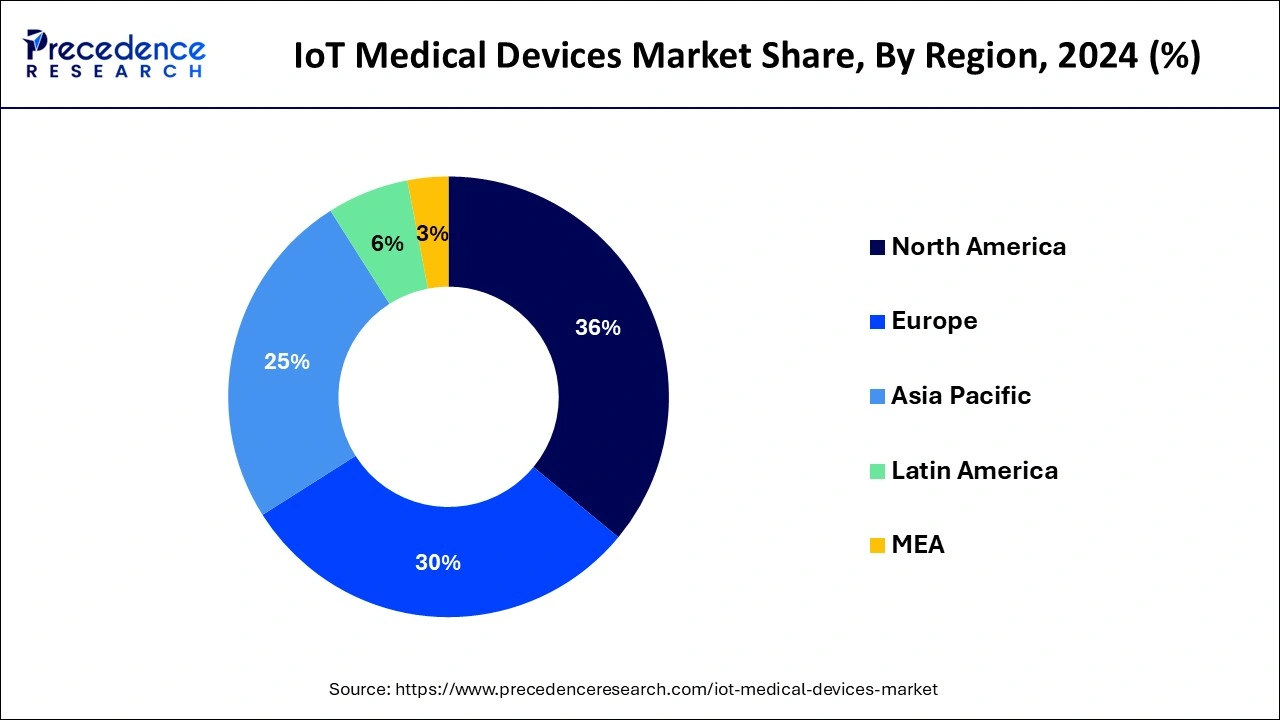

North America has held the largest revenue share 36% in 2024. North America dominates the IoT medical devices market due to advanced healthcare infrastructure, early adoption of digital health technologies, and robust research and development activities. The region benefits from a high level of awareness among both healthcare providers and consumers, fostering widespread acceptance of IoT devices. Favorable government initiatives, stringent data privacy regulations, and a matured telehealth ecosystem further contribute to North America's major market share, positioning it at the forefront of the global IoT medical devices industry.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific commands a significant share in the IoT medical devices market due to rapid technological adoption, expanding healthcare infrastructure, and a growing aging population. Increasing healthcare awareness, coupled with government initiatives promoting digital health, propels market growth.

The region's robust economic development fosters investments in advanced healthcare solutions, driving the demand for IoT devices. Additionally, the diverse and vast patient population creates a conducive environment for the implementation of remote patient monitoring and telehealth solutions, further solidifying region's prominence in the IoT medical devices market.

Internet of Things (IoT) medical devices represent a transformative trend in healthcare by integrating connectivity and data exchange into medical equipment. These devices, ranging from wearable monitors to implantable sensors, leverage the power of the internet to collect, transmit, and analyze patient data in real time. This connectivity enables healthcare professionals to remotely monitor patients, track vital signs, and receive alerts for any anomalies, facilitating proactive and personalized healthcare.

The deployment of IoT medical devices enhances patient care by providing continuous monitoring, early detection of health issues, and improved treatment strategies. Additionally, these devices empower individuals to actively participate in their own healthcare management, promoting preventive measures and timely interventions.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 27.97% |

| Market Size in 2025 | USD 106.30 Billion |

| Market Size in 2024 | USD 82.41 Billion |

| Market Size by 2034 | USD 971.01 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Remote patient monitoring and cost-effective healthcare solutions

Remote Patient Monitoring (RPM) significantly propels the demand for IoT medical devices by revolutionizing healthcare delivery. These devices enable healthcare professionals to remotely track and analyze patient data, fostering proactive care and timely interventions. RPM minimizes the need for frequent hospital visits, especially for chronic disease management, improving patient convenience and reducing healthcare costs.

The continuous monitoring facilitated by IoT devices enhances patient outcomes, making them indispensable tools in modern healthcare systems. Cost-effective healthcare solutions provided by IoT medical devices further contribute to market surges. By enabling remote monitoring, early detection of health issues, and preventive care, these devices optimize healthcare resources, leading to cost savings for both providers and patients.

The emphasis on cost efficiency encourages widespread adoption, particularly as healthcare systems seek innovative approaches to enhance accessibility and affordability, making IoT medical devices pivotal in shaping the future of healthcare delivery.

Lack of standardization and data security concerns

The lack of standardization and data security concerns present significant hurdles to the widespread adoption of IoT medical devices. The absence of universally accepted protocols and interoperability standards complicates the integration of these devices into existing healthcare ecosystems. This lack of standardization results in compatibility issues, hindering seamless communication between different devices and systems.

As a consequence, healthcare providers may face challenges in implementing cohesive and integrated solutions, limiting the overall efficiency and effectiveness of IoT medical devices in patient care. Furthermore, data security concerns pose a critical restraint.

Given the sensitive nature of health data collected by these devices, the risk of unauthorized access and potential breaches becomes a major apprehension. The need for robust cyber security measures becomes paramount to ensure the privacy and confidentiality of patient information. Addressing these issues is pivotal for building trust among healthcare stakeholders and encouraging broader acceptance of IoT medical devices in the evolving landscape of modern healthcare.

Expansion of telehealth services and wearable technology integration

The expansion of telehealth services and the integration of wearable technology present promising opportunities in the IoT medical devices market. The widespread adoption of telehealth is reshaping healthcare delivery, and IoT devices play a pivotal role in facilitating remote patient monitoring and virtual consultations. These devices enable real-time data collection, empowering healthcare providers to offer personalized and timely interventions, particularly for chronic disease management.

The convenience and accessibility of telehealth services further drives the demand for IoT medical devices, making healthcare more patient-centric and adaptable to evolving healthcare models. Additionally, the integration of IoT capabilities into wearable technologies enhances the market's scope.

Wearable devices equipped with health-monitoring features provide continuous data on vital signs, activity levels, and other health parameters. This integration not only promotes individual wellness by encouraging proactive health management but also expands the market into the consumer health and wellness sector. As consumers increasingly prioritize health-conscious lifestyles, the synergy between wearables and IoT medical devices creates opportunities for innovative solutions that cater to both medical and lifestyle needs.

In 2023, the wearable medical devices segment held the highest market share of 34% based on the product type. The wearable medical devices segment in the IoT medical devices market includes devices designed to be worn by individuals for health monitoring. These devices can track vital signs, activity levels, and other health metrics, providing continuous real-time data. Trends in this segment include the integration of advanced sensors for more accurate readings, the development of user-friendly interfaces, and the convergence of medical-grade monitoring with consumer-friendly designs.

The emphasis on preventive healthcare and the increasing demand for personalized health insights contribute to the growing popularity and innovation within the wearable medical devices category.

The implantable medical devices segment is anticipated to expand at a significant CAGR of 31.2% during the projected period. Implantable medical devices in the IoT medical devices market refer to devices embedded within the human body to monitor, record, or transmit health data. These devices, such as smart implants and sensors, offer real-time monitoring of vital signs or specific health parameters.

Trends in this segment include the development of smaller, more sophisticated implants for precise data collection. Advances in biocompatible materials and energy-efficient technologies contribute to longer implant lifespans, driving increased adoption. The implantable medical devices segment showcases a shift towards seamless integration of technology into the human body for enhanced healthcare monitoring and management.

According to the application, the hospitals & clinics segment held 40% revenue share in 2023. The hospitals and clinics segment in the IoT medical devices market involves the integration of connected devices to streamline healthcare operations, enhance patient care, and improve overall efficiency within healthcare facilities. Trends in this segment include the adoption of remote patient monitoring systems, smart medical equipment, and real-time tracking solutions. These IoT devices contribute to proactive patient management, reduce hospital readmissions, and optimize resource utilization. The trend towards interconnected healthcare ecosystems in hospitals and clinics demonstrates the potential for improved patient outcomes and more effective healthcare delivery.

The assisted living facilities segment is anticipated to expand fastest over the projected period. In the IoT medical devices market, the assisted living facilities segment refers to the application of connected devices to enhance the quality of care for residents in assisted living settings. IoT devices in assisted living facilities facilitate remote monitoring of residents' health, ensuring timely assistance and improved safety. A notable trend in this segment involves the integration of smart sensors and wearables to monitor daily activities, medication adherence, and vital signs, enhancing the overall efficiency and personalized care delivery within assisted living environments.

By Product Type

By Application

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2024

August 2024

January 2025