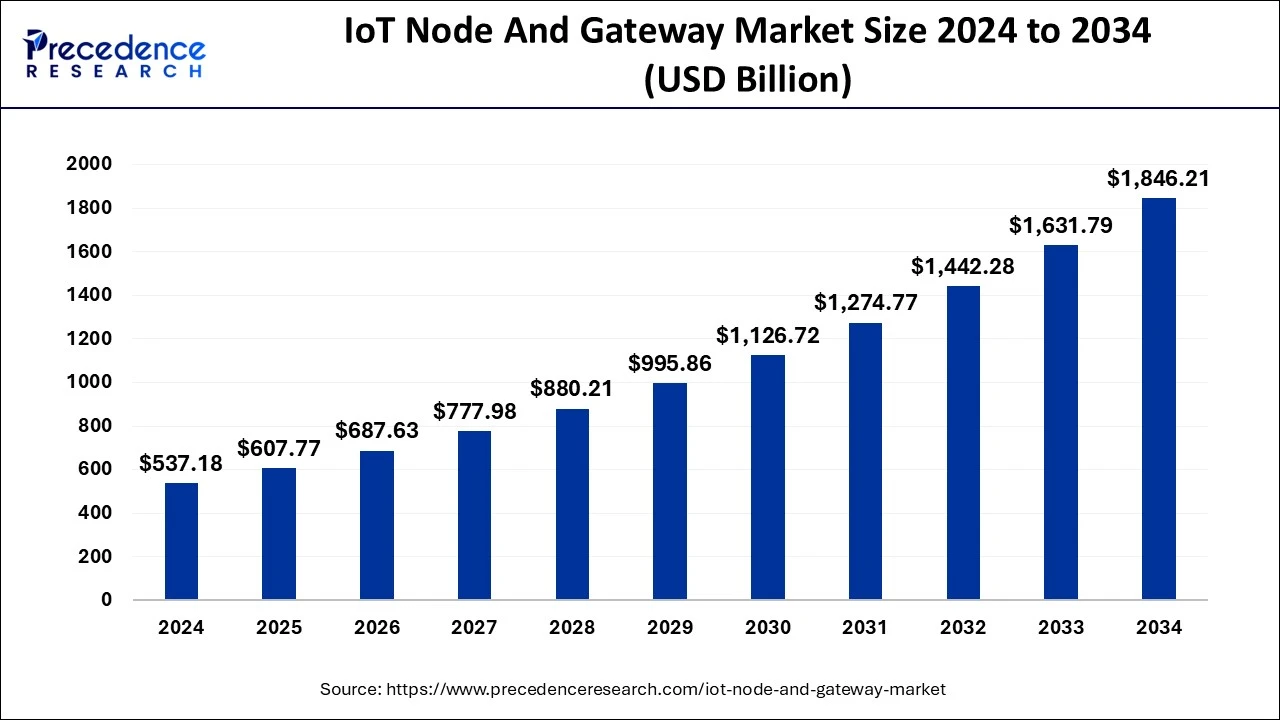

The global IoT node and gateway market size was accounted for USD 537.18 billion in 2024, grew to USD 607.77 billion in 2025 and is projected to surpass around USD 1,846.21 billion by 2034, representing a CAGR of 13.14% between 2025 and 2034. The North America IoT node and gateway market size is calculated at USD 198.76 billion in 2024 and is expected to grow at a CAGR of 13.28% during the forecast year.

The global IoT node and gateway market size was calculated at USD 537.18 billion in 2024 and is predicted to reach around USD 1,846.21 billion by 2034, expanding at a CAGR of 13.14% from 2025 to 2034. The rise in digitization, automation, wireless communication technologies, and integration of AI is enhancing the market's growth.

The integration of artificial intelligence into the IoT node and gateway market is revolutionizing industries, enhancing the smart environment, and accelerating innovations. AI enhanced the IoT gateway functionality, including data analysis, edge computing, adaptive protocol management, and security enhancements. AI integrated IoT gateaway used in the wide range of industries including smart homes, industrial IoT, healthcare, and smart cities.

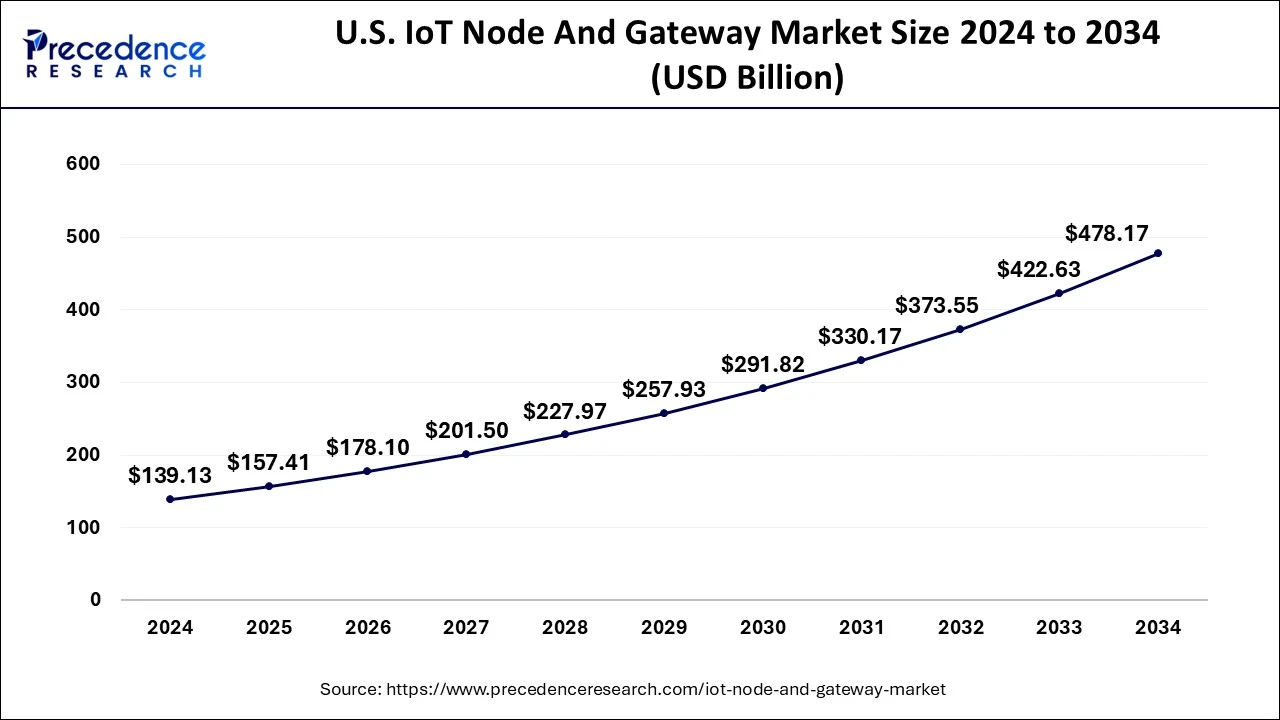

The U.S. IoT node and gateway market size was exhibited at USD 139.13 billion in 2024 and is projected to be worth around USD 478.17 billion by 2034, growing at a CAGR of 13.35% from 2025 to 2034.

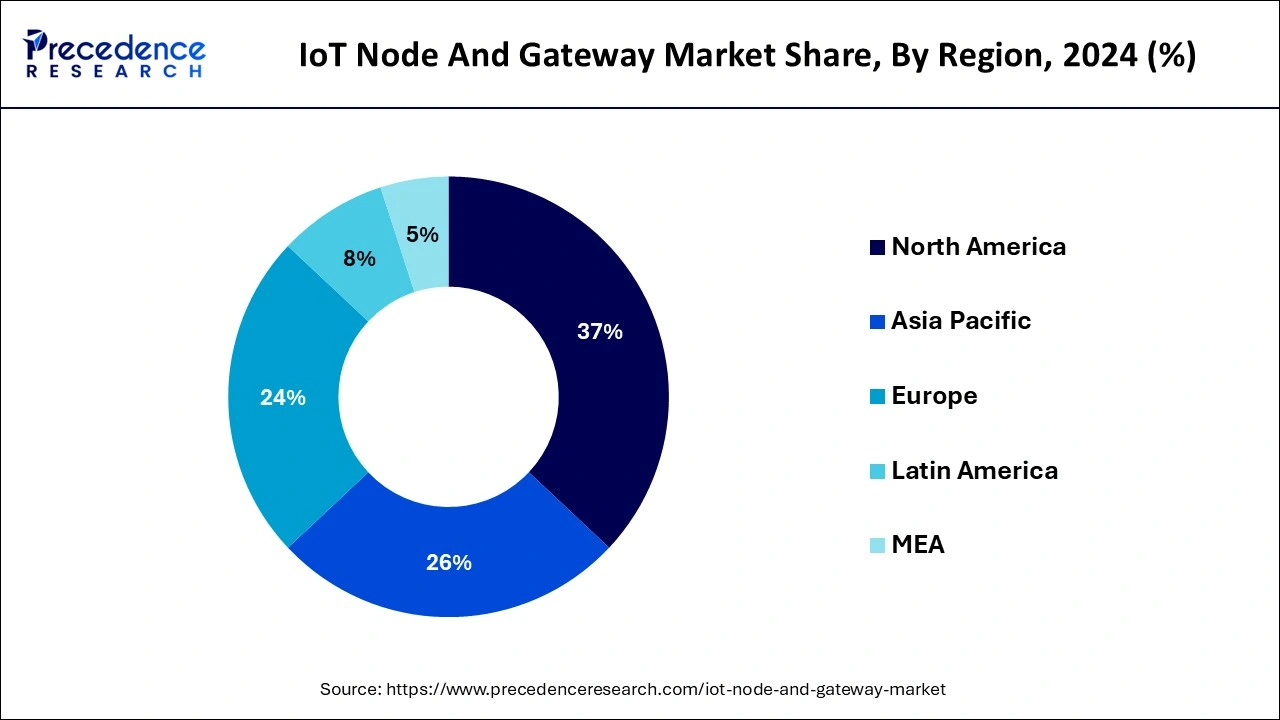

North America dominated the IoT node and gateway market in 2023. The increasing technological advancements and infrastructure development are driving the growth of the market. Regional countries like the United States and Canada are early adopters of the technology, and technological shift acceptance is contributing to the higher demand for the IoT node and gateway. The rising demand for advanced consumer electronics, the integration of IoT sensors in devices, and the increasing presence of technology leaders in the United States are accelerating the growth of the market in the region.

Middle East and Africa will witness significant growth in the IoT node and gateway market during the forecast period. The fast-paced development of smart cities and the integration of cutting-edge technologies into the cities are accelerating the demand for the market. The increasing government intervention in the development of tourism and other industries, including transportation, energy management, and healthcare.

The IoT gateaways are the efficient tool or the technology that is used in the connecting the Internet of Things (IoT) sensors and devices to the data processing and cloud computing. The advancement in the IoT gateaways offers the bidirectional data flow between the cloud and IoT devices. The increasing adaptation of the IoT technology into the industries are accelerating the growth of the IoT node and gateway market.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,846.21 Billion |

| Market Size in 2025 | USD 607.77 Billion |

| Market Size in 2024 | USD 537.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.14% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Connectivity, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Benefits associated with the IoT node and gateway

The rising adaptation of the IoT node and gateway market in a wide range of industries enhances operations and versatility. The inclusion of IoT nodes and gateways into smart homes, industrial automation, agriculture, healthcare, and transportation for enhancing security, connectivity, data management, remote monitoring and management, and cost-effectiveness in operations are driving the growth of the IoT node and gateways market.

Data privacy and security

There are significant challenges associated with the implementation of IoT in the organization, such as security issues, privacy concerns, data management, and others restraining the growth of the IoT node and gateway market.

Increasing development in the IoT infrastructure

The IoT node and gateway market is an important part of the IoT infrastructure that helps efficiently manage different applications, such as data transmission in the cloud and devices, which enhance the overall system security and efficiency. The IoT node and gateway provide an important foundation for small and larger industrial IoT ecosystems.

The hardware segment led the global IoT node and gateway market in 2023. The increasing adoption of the IoT hardware segment in organizations is driving the growth of the segment. The advancement in the hardware components of the Internet of Things. Leading manufacturing industries are investing in technological advancements in hardware components, which are driving the growth of the segment. The IoT hardware component is one of the important parts of any kind of industry, including sensors, microcontrollers, wearable devices, basic devices, integrated circuits, datasheets, and others.

The service segment is expected to grow at the fastest rate in the IoT node and gateway market during the forecast period. The IoT node and gateway are used as important parts of the cloud and data processing infrastructure for connecting different devices and systems. The evolution of smart enterprises and smart living, which delivers connected experiences by integrating the different assets and services in organizations, contributes to the expansion of the segment.

The wi-fi segment dominated the IoT node and gateway market in 2023. The increasing infrastructure and the growing investment in the development of advanced and smart technology, digitization, and other advancements are accelerating the growth of the wi-fi technology. Wi-Fi is one of the important parts of delivering several advantages to IoT devices, such as offering seamless communication and connecting devices. Wi-Fi helps enhance and optimize performance and ensure seamless assurance of IoT projects.

The Z-wave segment will witness the fastest growth in the IoT node and gateway market during the predicted period. The Z-wave applications are used in different applications; the Z-wave is the wireless communications system that is used in automatic and automobile appliances for communications and connection purposes. The Z-wave is used in several applications, such as home automation devices, which offer the Z-wave devices for communicating devices with each other.

The consumer electronics segment dominated the IoT node and gateway market in 2023. The increasing population and the rising lifestyle in the people due to the in increasing disposable income is driving the growth of the consumer electronics industry. The increasing adoption of the IoT and sensor technology in consumer electronics products. Consumer electronics are used in a wide range of applications, including wearable devices, streaming devices, home management devices, voice command systems, and other electronic devices segment.

The aerospace & defense segment is anticipated to witness the fastest growth in the IoT node and gateway market during the anticipated period. The increasing adoption of the IoT node and gateways in aerospace and defense for different applications such as maintenance of the airport infrastructure, passenger experience, baggage handling, battlefield monitoring, cost reduction, effective and enhanced maintenance, inventory management, fleet management, operational efficiency, and other applications.

By Component

By Connectivity

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client