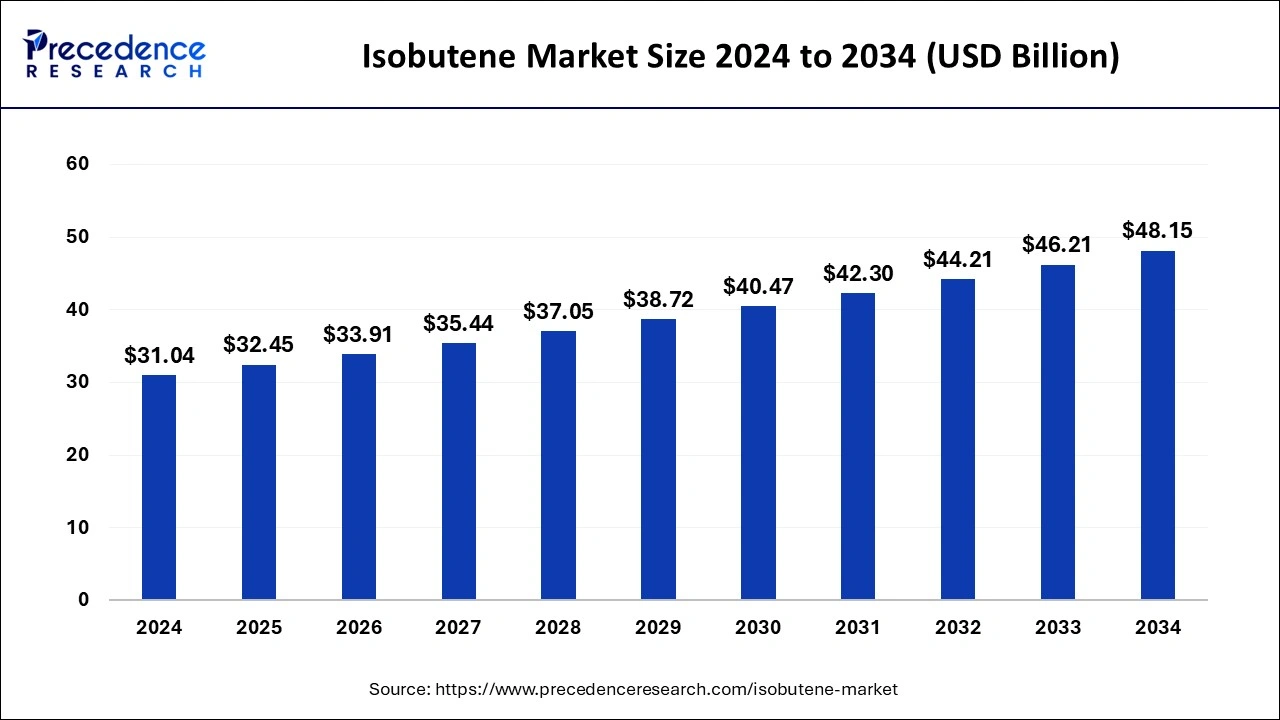

The global isobutene market size is calculated at USD 32.45 billion in 2025 and is forecasted to reach around USD 48.15 billion by 2034, accelerating at a CAGR of 4.49% from 2025 to 2034. The North America isobutene market size surpassed USD 13.35 billion in 2024 and is expanding at a CAGR of 4.61% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global isobutene market size was estimated at USD 31.04 billion in 2024 and is predicted to increase from USD 32.45 billion in 2025 to approximately USD 48.15 billion by 2034, expanding at a CAGR of 4.49% from 2025 to 2034.

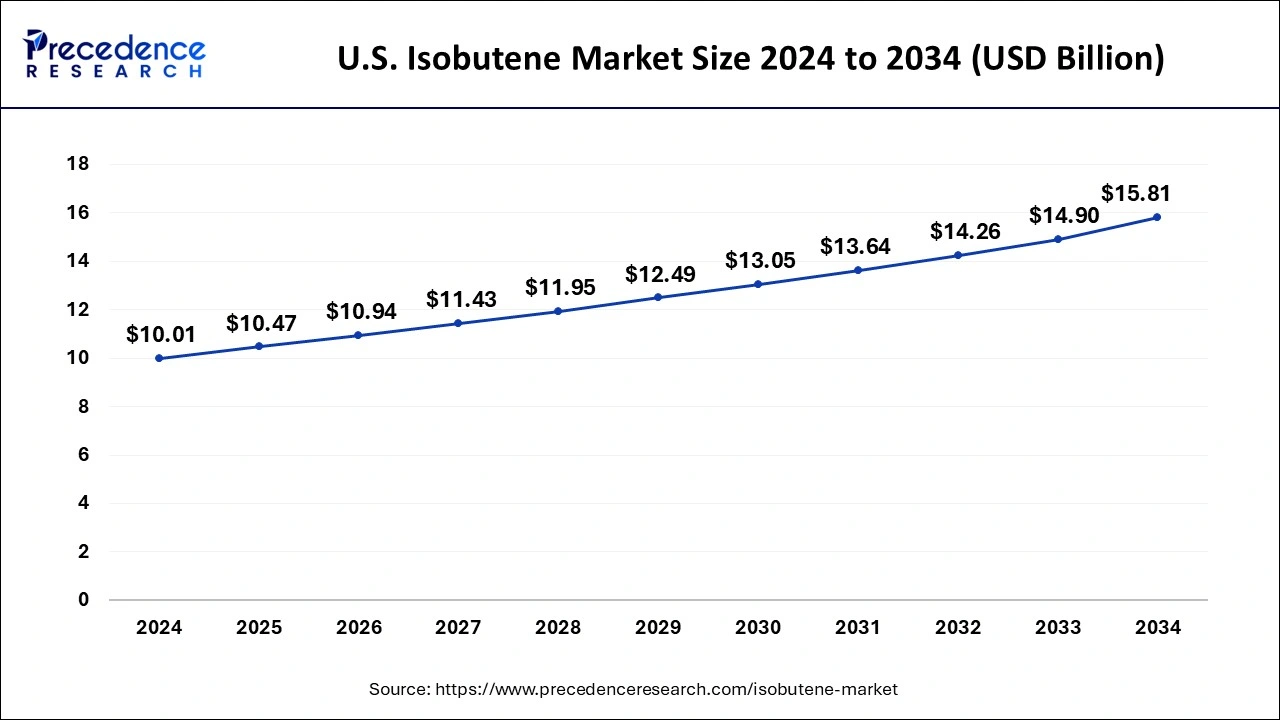

The U.S. isobutene market size was valued at USD 10.01 billion in 2024 and is expected to be worth around USD 15.81billion by 2034, rising at a CAGR of 4.68% from 2025 to 2034.

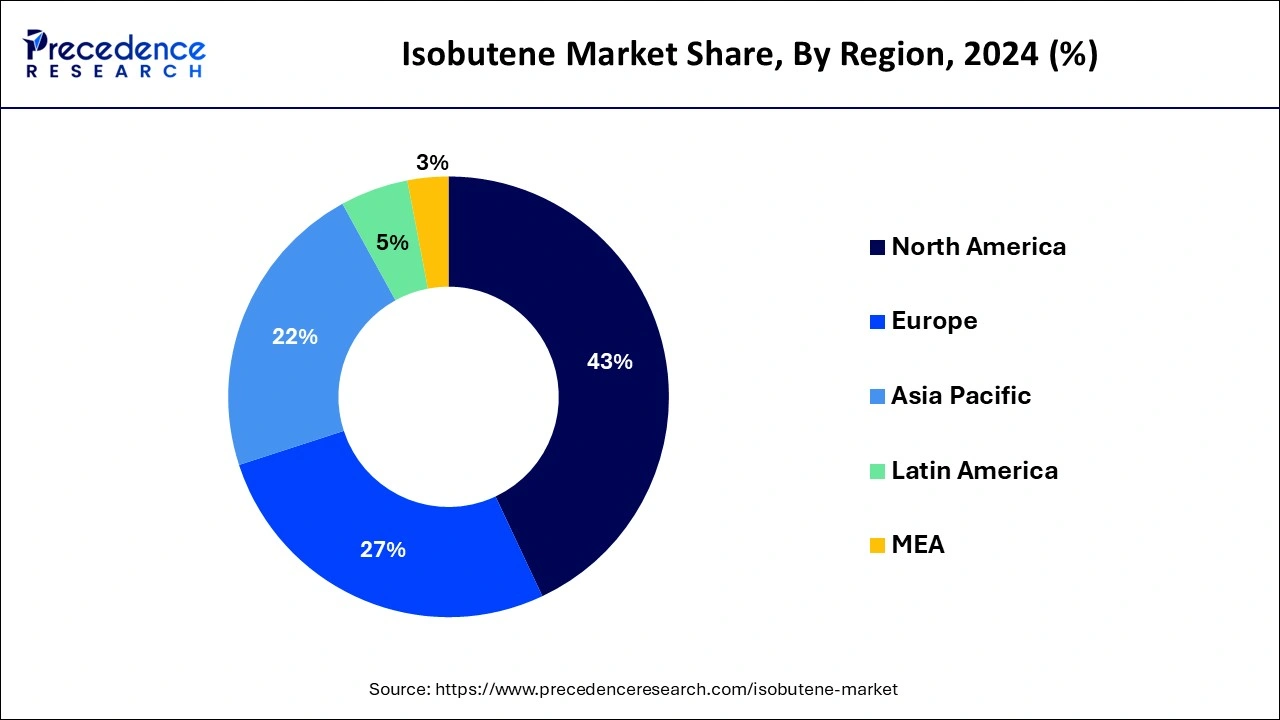

North America dominated the isobutene market in 2023 the largest market share of 43% in 2023 due to the demand for fuel additives, particularly oxygenates like MTBE, in North America being influenced by regulatory requirements and the need for cleaner-burning fuels. Isobutene is involved in the production of these fuel additives, impacting its market dynamics in the region. Moreover, North America has witnessed a surge in shale gas production, providing a source of feedstock for the petrochemical industry. The availability of raw materials influences the production of isobutene and its derivatives in the region.

Additionally, the automotive industry in North America is a major consumer of isobutene-derived products, particularly in the production of synthetic rubber for tires. The growth or contraction of the automotive sector directly impacts the demand for isobutene in the region.

Asia-Pacific is poised for rapid growth in the isobutene market due to the rapid industrialization and urbanization in countries like China, India, and other emerging economies in the Asia-Pacific region contribute to the increased demand for isobutene-derived products. This includes the automotive industry, construction sector, and various manufacturing activities. The Asia-Pacific region is a major hub for the automotive industry, and the increasing production and sales of vehicles drive the demand for isobutene-based products, especially in the production of synthetic rubber for tires.

Meanwhile, Europe is growing at a notable rate in the isobutene market. The market is driven by various factors such as the automotive sector, the chemical industry, and regulatory initiatives promoting cleaner fuels. European regulations addressing air quality and emissions standards play a role in driving the demand for fuel additives. Isobutene is involved in the production of fuel additives, and its usage aligns with regulatory requirements for cleaner-burning fuels. Europe has shown a growing interest in bio-based and sustainable practices. This trend may influence the demand for bio-based isobutene or isobutene-derived products as industries explore environmentally friendly alternatives.

Isobutene Market Overview

The isobutene is also known as isobutylene, it is a hydrocarbon with the molecular formula C4H8. It is an important chemical compound used in various industrial applications. Isobutene is primarily utilized in the production of synthetic rubber, particularly in the manufacturing of butyl rubber, which has diverse applications such as tire inner tubes, inner liners, adhesives and sealants. Additionally, isobutene is employed in the production of methyl tert-butyl ether (MTBE), a fuel additive, and in the creation of various chemicals, including antioxidants, lubricant additives, and plasticizers. The demand for isobutene is influenced by factors such as the automotive industry, petrochemical industry, and overall economic trends. The isobutene market is subject to fluctuations in supply and demand, changes in raw material prices, and regulatory developments affecting its various applications.

Isobutene Market Data and Statistics

| Report Coverage | Details |

| Market Size by 2034 | USD 48.15 Billion |

| Market Size in 2024 | USD 31.04 Billion |

| Market Size in 2025 | USD 32.45 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.49% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Automotive industry growth

The continuous growth of the automotive industry serves as a significant driver for the demand in the isobutene market. As the automotive sector expands globally, the need for isobutene-derived products, particularly butyl rubber, intensifies. Butyl rubber is a vital component in tire manufacturing, and with the escalating demand for vehicles, there is a proportional increase in the consumption of tires, reinforcing the demand for isobutene. Tires, being a critical component in the automotive supply chain, are not only essential for original equipment manufacturers (OEMs) but also contribute to the replacement market, further sustaining the demand for isobutene.

Moreover, the automotive industry's pursuit of innovation and advancements, including the development of high-performance and fuel-efficient vehicles, accentuates the role of isobutene-derived chemicals. Fuel additives like methyl tert-butyl ether (MTBE), produced from isobutene, contribute to achieving higher octane ratings and cleaner-burning fuels, aligning with the automotive industry's objectives for enhanced environmental performance. Therefore, the growth trajectory of the automotive industry acts as a pivotal force propelling the demand for isobutene and its derivatives, fostering a symbiotic relationship between the two sectors.

Environmental concern

Environmental concerns pose a potential restraint on the demand for the isobutene market. The use of isobutene-derived products, notably methyl tert-butyl ether (MTBE) as a fuel additive, has raised ecological issues due to its potential impact on water quality and groundwater contamination. MTBE is known for its solubility in water, making it persistent and challenging to remediate once released into the environment. In response to these concerns, regulatory bodies have implemented stringent guidelines or bans on the use of MTBE in certain regions, influencing the demand for isobutene in this application.

In addition, as global attention increasingly shifts towards sustainable and eco-friendly practices, there is a growing preference for bio-based alternatives to traditional petrochemical-derived products. The environmental footprint associated with the production and utilization of isobutene may drive industries and consumers toward exploring greener alternatives, thus limiting the growth prospects for isobutene in specific applications. To mitigate these challenges, the isobutene industry may need to invest in research and development initiatives focused on developing environmentally friendly production processes or alternative applications for isobutene-derived chemicals. Addressing environmental concerns is crucial for the long-term viability of the isobutene market in a world increasingly prioritizing sustainable practices.

Growing demand for synthetic rubber in various applications

The escalating demand for synthetic rubber across diverse applications presents a significant opportunity for the isobutene market. Synthetic rubber, particularly butyl rubber derived from isobutene, is a versatile material with widespread applications beyond tire manufacturing. Industries such as automotive, construction, and manufacturing increasingly rely on synthetic rubber for its unique properties, including impermeability to gases and resistance to heat and aging.

In the automotive sector, synthetic rubber finds application in the production of various components such as hoses, gaskets, and seals, contributing to improved durability and performance. Moreover, the construction industry utilizes synthetic rubber-based materials for sealants and adhesives due to their adhesive and waterproofing properties. The medical and consumer goods sectors also leverage synthetic rubber in the production of gloves, gaskets, and seals. Thus, as the demand for synthetic rubber continues to surge, propelled by the growth in these diverse industries, the isobutene market stands to benefit significantly.

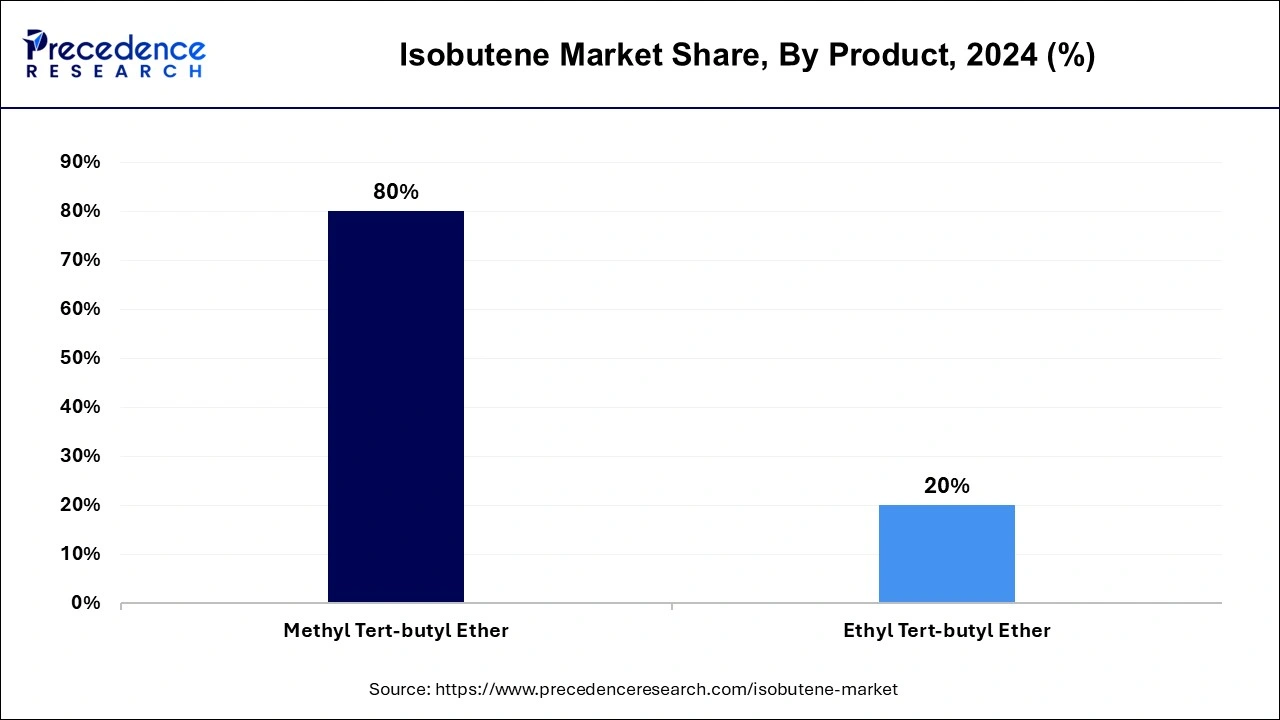

The Methyl tert-butyl ether (MTBE) segment dominated the isobutene market share of 80% in 2024. the segment is observed to continue the trend throughout the forecast period and is expected to grow at a significant rate throughout the forecast period.

MTBE is primarily used as a fuel additive, specifically in gasoline, to enhance octane levels and reduce engine knocking. It improves combustion efficiency and reduces air pollution by lowering emissions of harmful pollutants. It is also utilized in the petrochemical industry as a chemical intermediate for the production of isobutene-based chemicals, including high-octane aviation fuels.

The automotive segment dominated the isobutene market in 2024. Isobutene plays a crucial role in the automotive industry, particularly in the production of butyl rubber used for tire manufacturing. Butyl rubber's impermeability to gases makes it a preferred material for tire inner tubes, inner liners, and other automotive components.

On the other hand, the aerospace segment is expected to generate a notable revenue share in the market. Isobutene-derived products, such as specialty chemicals and elastomers, find applications in the aerospace sector. These materials may be used in the production of seals, gaskets, and other components that require high-performance properties.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client