February 2024

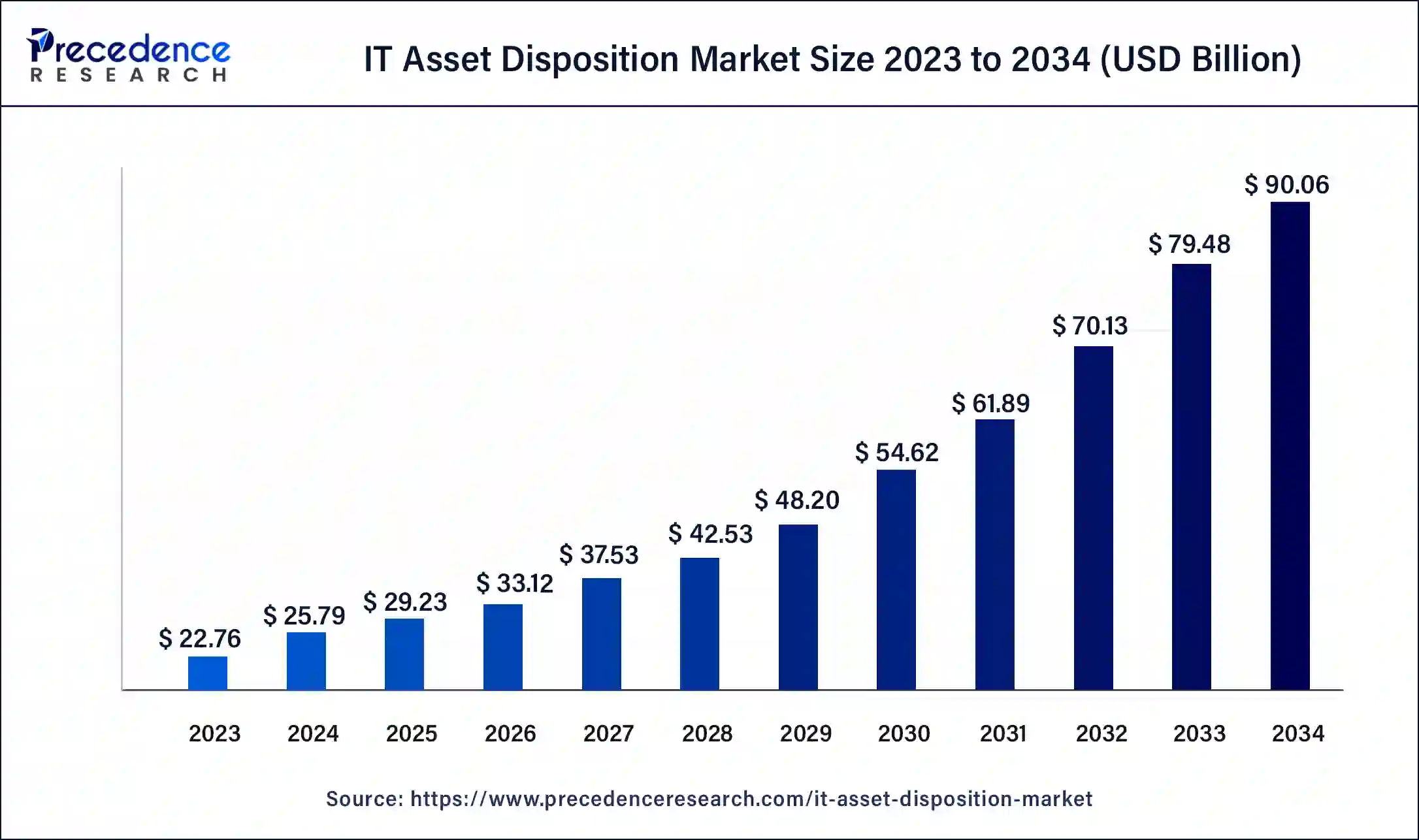

The global IT asset disposition market size reached USD 22.76 billion in 2023 and is predicted to increase from USD 25.79 billion in 2024 to approximately USD 90.06 billion by 2034. The market is expected to grow at a double digit CAGR of 13.32% from 2024 to 2034.

The global IT asset disposition market size is anticipated to be worth around USD 90.06 billion in 2034 increasing from USD 25.79 billion in 2024, at a CAGR of 13.32% between 2024 and 2034. E-waste is rising as a result of the rapid improvements in technology that are shortening the lives of IT assets.

The requirement for responsible management of electronic waste, or ‘e-waste,’ and the expanding digitalization of many industries have led to a steady growth in the ITAD market. The industry is anticipated to keep growing as businesses modernize their IT infrastructure and laws governing the disposal of e-waste become more stringent. Remarketing of assets, recycling, appropriate disposal, and data sanitization are just a few of the services provided by major ITAD service providers.

Prominent players in this field include Dell Technologies, IBM, Sims Lifecycle Services, and Arrow Electronics. Strict laws governing the disposal of e-waste worry about data security, financial savings from asset recovery and resale, and corporate social responsibility programs, which are some of the factors propelling expansion of the IT asset disposition market.

Risks to data security during asset disposal, maintaining regulatory compliance in many jurisdictions, and overseeing logistics for equipment processing and collection are among the difficulties. Services (decommissioning, data destruction, recycling), asset types (servers, laptops, cellphones), and end-users (IT businesses, BFSI, healthcare, government) can all be used to segment the market. Because of their expensive IT infrastructure and strict environmental restrictions, North America and Europe command the largest share of the industry. Due to new regulations and rising digital penetration, Asia Pacific is likewise expanding. The growing demand for sustainable IT practices, regulatory challenges, and technology improvements are driving growth in the IT asset disposition market.

| Report Coverage | Details |

| Market Size by 2034 | USD 90.06 Billion |

| Market Size in 2023 | USD 22.76 Billion |

| Market Size in 2024 | USD 25.79 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 13.32% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Asset Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing adoption of cloud services

As more companies go to cloud services, safe data destruction and regulatory compliance become essential. Secure data erasure and destruction are offered by ITAD services, guaranteeing that private data is protected when IT assets are disposed of. Scalability and flexibility provided by cloud services enable firms to dispose of and manage IT assets more effectively. The IT asset disposition market providers are able to give customized solutions that are in line with the changing requirements of companies that use cloud services.

The adoption of cloud computing frequently results in a move from capital to operating expenses. This change may save money, allowing businesses to devote more funds to ITAD services and guarantee the appropriate recycling and disposal of obsolete equipment.

Cost considerations

When making decisions on how to manage their end-of-life IT assets, enterprises can be greatly influenced by cost considerations in the IT asset disposition market. Using sophisticated software and stringent procedures can help ensure that all data is totally removed from devices. Sometimes, it's essential to physically destroy storage media, which can result in extra expenses for specialist tools or outside services. The distance, volume, and security requirements all affect how much it costs to gather and move IT assets to the disposal site. The cost may increase if environmental and data protection standards are followed. This covers reporting, paperwork, and maybe audits.

Expansion of remote work

Because gadgets are utilized outside of the safe office setting, data security is a problem when working remotely. As a result, there is a greater need for the IT asset disposition market. Companies are spending more on mobile devices, computers, and monitors as a result of more workers working remotely. Because of the increased turnover rate brought about by this rise in assets, effective IT asset disposition services are required to manage the asset lifespan. Businesses must comply with GDPR, HIPAA, and other data protection laws. Encouraging demand for ITAD services is dependent on the proper disposal of IT assets, especially those utilized by remote workers, in order to preserve compliance.

The smartphones & tablets segment held the largest share of the IT asset disposition market in 2023. The constant advancement of tablet and smartphone technology results in regular upgrades, which raises the rate at which outdated gadgets are discarded. Due to the growing use of smartphones and tablets in business operations, there is a rising amount of these devices that need to be disposed of.

The need for ITAD services is fueled by the fact that sensitive data is stored on smartphones and tablets, which makes safe disposal and data erasing essential. Tight e-waste laws require that all electronic gadgets, including tablets and smartphones, be disposed of properly. Electronics recycling and disposal are encouraged by rising corporate accountability and environmental sustainability awareness. Because of their high recycling and resale value, smartphones and tablets encourage appropriate IT asset disposal procedures.

The computers/laptops segment is expected to grow at the fastest rate in the IT asset disposition market during the forecast period. The segment for computers and laptops is very important. This section deals with businesses' and organizations' end-of-life PCs and laptops and their proper disposal or recycling. Quick technical progress results in shorter laptop and computer lifecycles, which raises the number of outdated devices that need to be disposed of.

Safe data deletion and erasure are essential, particularly in light of the growing number of data privacy laws like the CCPA and GDPR. In order to reduce electronic waste (e-waste), there is a growing need for appropriate recycling and disposal techniques due to environmental sustainability. These factors contribute to the growth of the Computers/Laptops category within ITAD, which in turn opens doors for specialized service providers and promotes a more sustainable approach to IT asset management.

The IT & telecom segment held the largest share of the IT asset disposition market in 2023. Regular equipment upgrades by telecom and IT businesses result in a large number of retired IT assets that need to be disposed of. Ensuring safe data erasure or destruction is crucial in this sector since telecom data is sensitive. Telecommunications firms' ITAD plans are influenced by the strict requirements they have to follow regarding data protection and environmental disposal.

Refurbishing and reselling equipment that has resale value, such as servers, networking gear, and mobile devices, is an appealing choice. The demand for ethical recycling and disposal methods is being driven by telecom firms' growing emphasis on sustainability. The rapid technological improvements in telecom infrastructure and the growing industry knowledge of sustainability practices also have an impact on the growth of this category.

The media & entertainment segment is expected to grow at the fastest rate in the IT asset disposition market during the forecast period. Companies in the media and entertainment sector regularly upgrade their hardware and software to meet evolving customer needs and technical breakthroughs. As a result, there is a constant flow of retired IT assets that require ITAD services to safely dispose of or remarket.

Media firms must handle and dispose of corporate and personal data securely in accordance with a number of data protection laws, such as the CCPA and GDPR. ITAD services use recognized procedures and documentation to assist in guaranteeing compliance. There is a growing trend among media and entertainment companies to prioritize sustainability. ITAD suppliers can help with these initiatives by endorsing eco-friendly procedures, including asset recycling and appropriate disposal of electronic trash (e-waste).

Asia Pacific held the largest share of the IT asset disposition market in 2023. Rapid technological improvements in the Asia Pacific area are resulting in shorter IT equipment lifecycles. In order to handle outdated and end-of-life IT assets, there is a strong need for IT asset disposition services. IT assets are proliferating as a result of significant investments made in IT infrastructure by several Asia Pacific nations.

As these assets approach the end of their useful lives, effective disposal strategies become more and more important. The IT asset disposition market is being driven by stricter laws pertaining to data security and electronic waste management. To avoid fines and guarantee the correct disposal of IT assets, including safe data erasure, businesses must abide by these requirements.

Europe is expected to grow at a rapid rate in the IT asset disposition market during the forecast period. Organizations are compelled to implement appropriate IT asset disposal procedures by strict data privacy and environmental rules in Europe, such as the General Data Privacy Regulation (GDPR) and the Waste Electrical and Electronic Equipment (WEEE) Directive. Demand for ITAD services is fueled by growing awareness of data breaches and the significance of safe data removal. A growing emphasis on the circular economy and sustainability pushes businesses to recycle and reuse IT assets appropriately.

Improvements in asset monitoring and data wiping technologies, among other ITAD process developments, increase the dependability and efficiency of services. Businesses in Europe are getting more and more involved in corporate social responsibility (CSR) programs, such as disposing of electronics properly. The increasing amount of e-waste produced by the constant expansion in the use of electronic gadgets calls for efficient disposal methods.

Segments Covered in the Report

By Asset Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2024

February 2025

January 2025

February 2025