July 2024

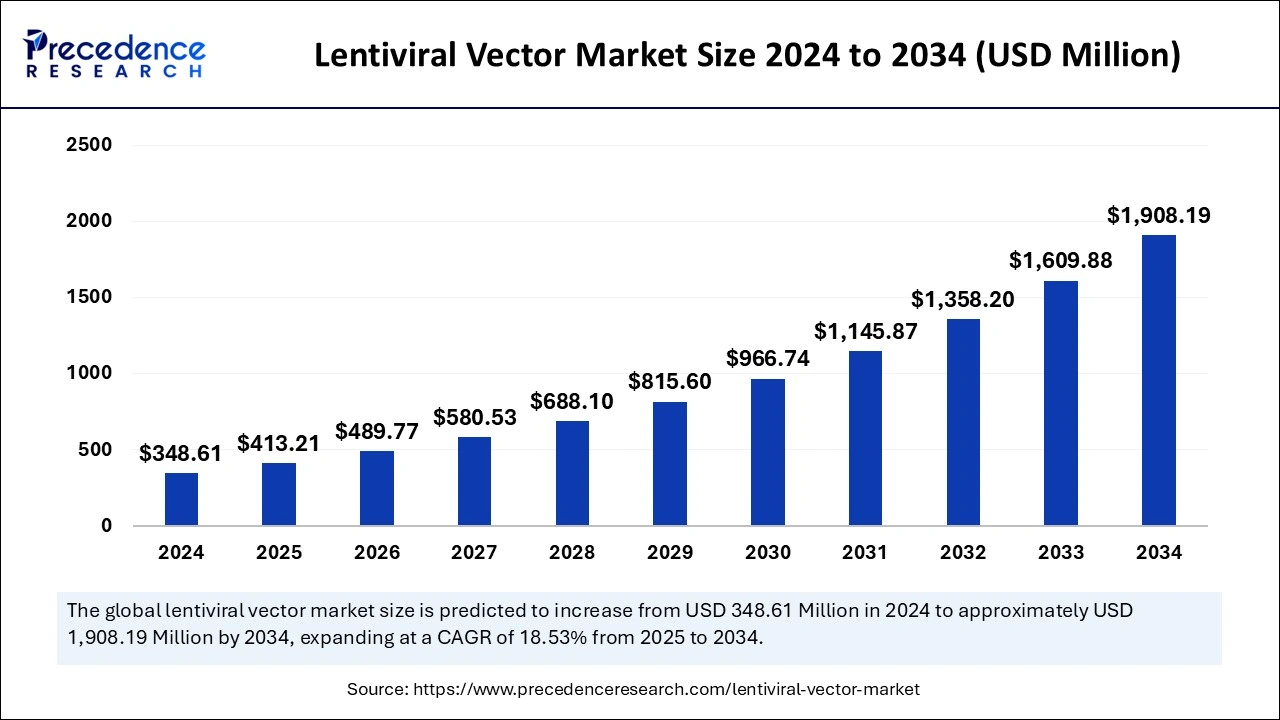

The global lentiviral vector market size is calculated at USD 413.21 million in 2025 and is forecasted to reach around USD 1,908.19 million by 2034, accelerating at a CAGR of 18.53% from 2025 to 2034. The North America market size surpassed USD 156.87 million in 2024 and is expanding at a CAGR of 18.66% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global lentiviral vector market size accounted for USD 348.61 million in 2024 and is expected to exceed around USD 1,908.19 million by 2034, growing at a CAGR of 18.53% from 2025 to 2034. The market is driven by growth in gene therapy, enhanced research, artificial intelligence integration, FDA approval, and target-specific diseases.

Artificial Intelligence applications in the lentiviral vector market are improving the speed and accuracy of gene delivery technologies. Recent advances include using machine learning algorithms to design vectors, predict vector cell interactions, and enhance the steps of transgene delivery. It also assists in handling extensive genomic data and speeds up the research of gene therapies and vaccines. It enhances the creation of lentiviral vectors by providing immediate feedback on potential problems with quality control in the manufacturing process.

The innovations in artificial intelligence and automation are improving lentiviral vector production through precision, efficiency, and cost-effectiveness. This integration is leading to progress on the molecular level of personalized medicine, accelerating the advancement of novel treatments, and broadening the usage of lentiviral vectors for many diseases in medical practice.

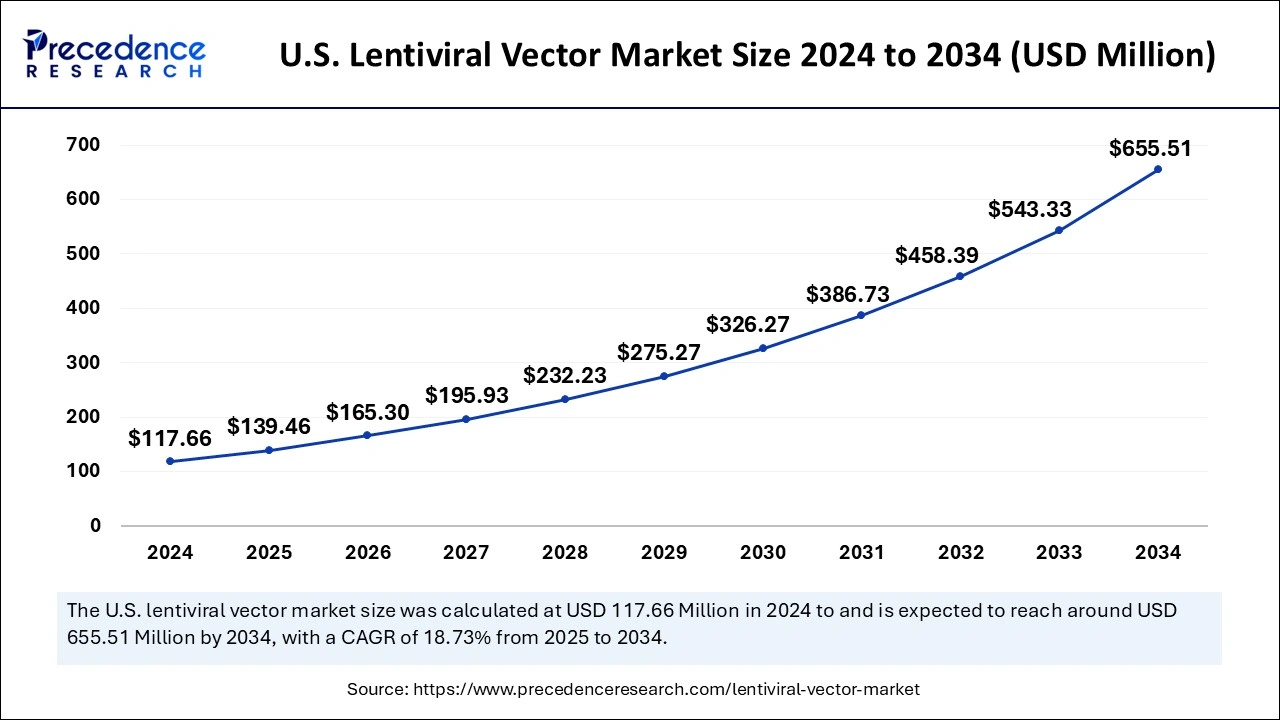

The U.S. lentiviral vector market size was exhibited at USD 117.66 million in 2024 and is projected to be worth around USD 655.51 million by 2034, growing at a CAGR of 18.73% from 2025 to 2034.

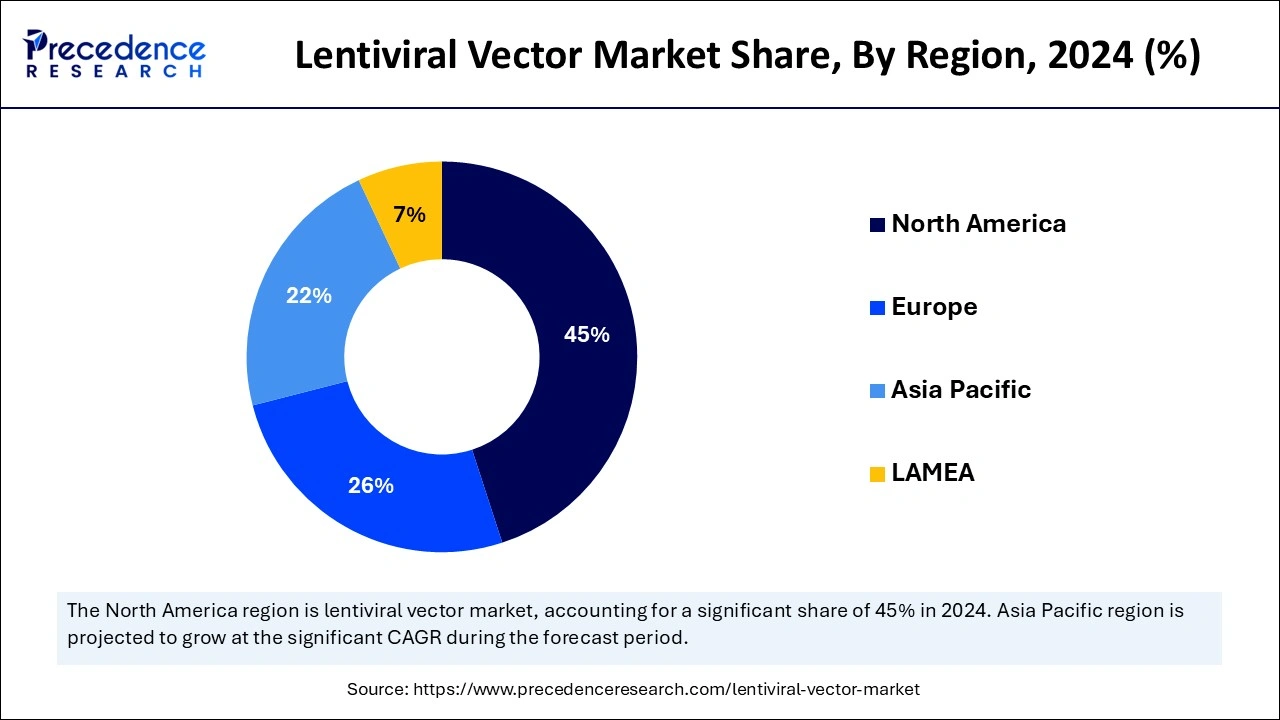

North America accounted for the largest share of the lentiviral vector market in 2024 due to well-developed biotechnology and pharmaceutical companies, strong R&D inputs, and appropriate policies and guidelines. Business organizations in North America are involved in collaborations or joint ventures with universities, research agencies, and other businesses. These collaborations foster the interchange of knowledge and provide access to new technologies.

The United States has a vigorous lentiviral vector market due to its strong biotech industry and advancements in gene therapy. Thus, increasing adoption of cell and gene therapy, significant funding, and strategic mergers and acquisitions will be the key drivers that will further propel the growth of the North American market over the coming years.

Asia Pacific is anticipated to witness the fastest growth in the lentiviral vector market during the forecasted years. The rising trend in healthcare research for adopting viral vector manufacturing techniques, increasing incidence of chronic diseases and viral infections, advancement in technology, focus on viral vector-based CGTs, and increasing trend of outsourcing drug discovery services are the dominant factors subsidizing the market growth of this region.

China, Japan, and South Korea are notable regions investing heavily in biotechnological research and development. In addition, the large number of clinical trials, the enhancement of research and production facilities equipped with modern technologies, and the increased government support in this region are expected to drive the demand for lentiviral vectors further.

Lentiviral vectors are genetic vectors that are used to transfer genes into target cells. They originate from the human immunodeficiency virus and are a type of retrovirus. Lentiviral vectors are found useful in gene therapy for immunodeficiency, cancer, and many other genetic disorders. Lentiviruses are human and animal parasites producing long periods of latency and chronic infection. Scientists employed viral vectors while performing molecular biology to introduce genetic material into the cells. Viruses have evolved specialized molecular mechanisms to transport their genomes inside the cells they infect efficiently. The procedure can be done in vivo (within a living organism) or in cell culture (in vitro).

The lentiviral vector market is growing due to the rising usage of therapies based on genes in several hereditary diseases and cancers. Lentiviral vectors that helped to introduce genetic material into the cells are the most suitable for the stable and long-term expression of transgenes. As a result of biotechnology and molecular medicine technique improvements, lentiviral vectors are now a critical tool in gene therapy and enable researchers to alter the genetic composition of cells to either correct genetic disorders or improve therapeutic effectiveness.

| Report Coverage | Details |

| Market Size by 2024 | USD 348.61 Million |

| Market Size in 2025 | USD 413.21 Million |

| Market Size in 2034 | USD 1,908.19 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Indication, End-User, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Demand in Gene Therapy

The major factor that fuels the lentiviral vector market is the rapidly growing end-user segment of gene therapy. Lentiviral vectors are used because of their comparative advantages of integrating into non-dividing cells; they are ideal tools used in gene therapy. Their ability to transduce and maintain the corrective gene within the host genome makes it possible to obtain long-term expression of genes intended for therapy, hence benefiting the affected patients. With the future progression of the gene therapy industry due to the development of personal treatment, lentiviral vectors need to be produced with improved productivity, enabling their application in the entire healthcare sector.

Lack of scalability and downstream purification

The factors that limit the expansion of the lentiviral vector market include scalability and challenges that are coupled with downstream purification. Lentiviral vectors (LVVs) for gene and cell therapies can be expensive and time-consuming to produce, particularly concerning the issue of viral titers and the lack of uniform manufacturing procedures in the field. These challenges do not allow for large-scale production of lentiviral vectors, which slows down the use of lentiviral vectors in massive therapies. Moreover, elevated levels of stringency in regulations and possible side effects linked with lentiviral vector products present a challenge to market adoption.

Surging demand for T cell engineering for cancer treatment

The increasing trend in T-cell engineering procedures for cancer applications constitutes a major growth opportunity for the lentiviral vector market. Lentiviral vectors have a prominent role in generating gene-engineered T-cell products, including Chimeric Antigen Receptor (CAR) T-cell therapies that are transforming the management of certain blood cancers, particularly B-cell malignancies. As CAR T-cell therapies maintain high efficacy, the necessity for effective lentiviral vectors to shuttle CARs or T-cell receptors into T-cells becomes a need. Thus, the increasing global trend in people seeking better treatments for cancer and the growth of CAR T cell therapy in other types of cancer also fuels the market of lentiviral vectors.

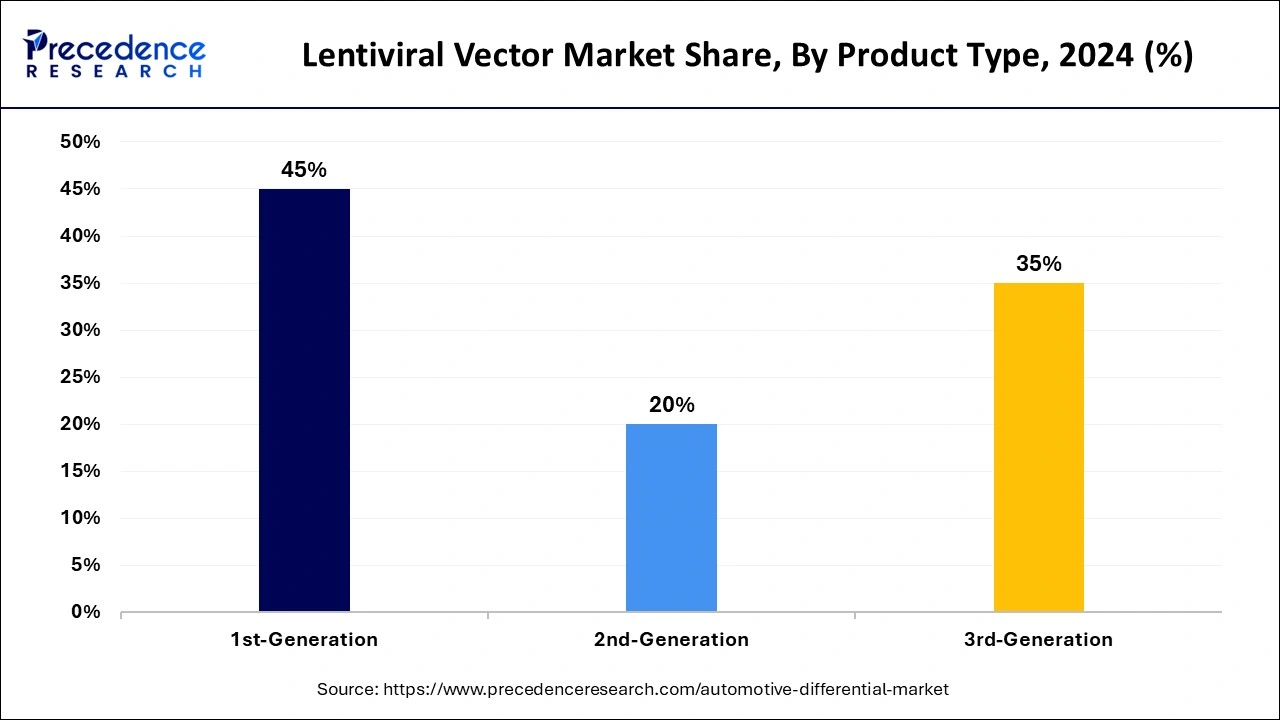

The 1st-generation segment accounted for the largest lentiviral vector market share in 2024. The vectors derived from the elimination of pathogenic aspects of HIV remain capable of effectively integrating therapeutic genes into target cells. They are useful in inherited disorders such as hemophilia and sickle cell disease. First-generation lentiviral vectors are also the best for their tropism for integrating genes into the host cell genome and the durability of their therapeutic impacts.

The 3rd-generation segment is projected to witness significant growth in the market during the forecast period. This growth is driven by an increase in new gene therapies and gene editing therapies aimed at treating genetic diseases, cancers, and chronic illnesses. The rising prevalence of genetic disorders, the expanding range of oncology indications, and increased funding for gene therapy development all contribute to this trend. Additionally, 3rd-generation lentiviral vectors represent the most advanced class of viral vectors, offering significant improvements in safety, efficacy, and reduced immunogenicity compared to earlier generations.

The HIV segment noted the largest lentiviral vector market share in 2024. Lentiviral vectors, which are mostly based on modified HIV, are preferred for use in many research laboratories due to their high transduction efficiency or the ability to integrate the desired genetic material called transgenes into both dividing and non-dividing target cell genomes. This makes it preferable for use in gene therapy, genetic studies, as well as in vaccine development. HIV is harmless and efficient, allowing researchers to detect and treat many diseases by improving upon the virus, including genetic disorders and cancers.

The research institutes segment held the largest lentiviral vector market share in 2024. The prime consumers are the research institutes because lentiviral vectors are important in gene therapy, genetic studies, and vaccine production. These institutions employ lentiviral vectors in several processes, including the ability to deliver material into a cell for research into diseases, therapeutic purposes, and improvement of biomedical technologies. The research institutes have high shares in the market because lentiviral vectors are capable of transducing both dividing and non-dividing cells, making them highly valuable in academic and clinical research.

By Product Type

By Indication

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024