February 2025

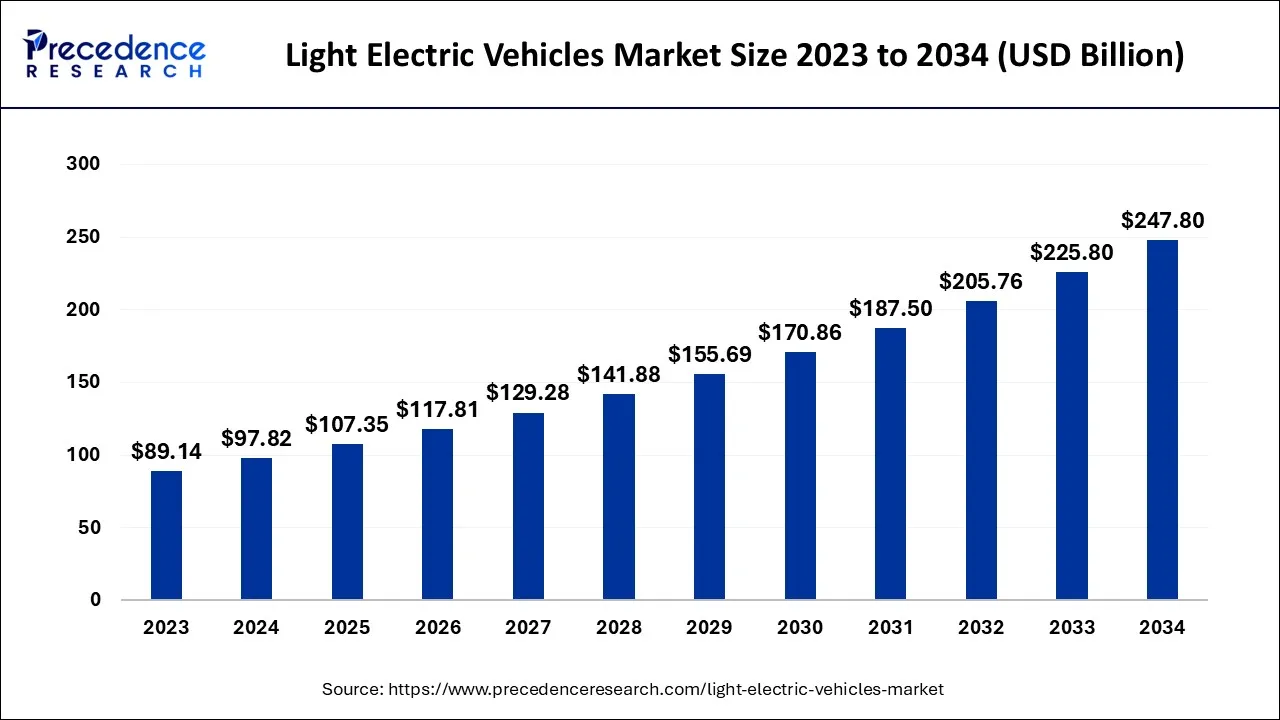

The global light electric vehicles market size accounted for USD 97.82 billion in 2024, grew to USD 107.35 billion in 2025 and is expected to be worth around USD 247.80 billion by 2034, registering a CAGR of 9.74% between 2024 and 2034.

The global light electric vehicles market size is calculated at USD 97.82 billion in 2024 and is projected to surpass around USD 247.80 billion by 2034, growing at a CAGR of 9.74% from 2024 to 2034.

The light electric vehicles (LEVs) market refers to the segment of the electric vehicle industry that includes electric bicycles, electric scooters, electric motorcycles, and other similar forms of transportation. These vehicles are typically smaller and lighter than traditional automobiles, and electric motors and rechargeable batteries power them. The global LEVs market has been growing in recent years due to increasing demand for sustainable and low-emission transportation options, advancements in battery technology and the availability of government incentives for purchasing electric vehicles. The market includes consumer and commercial applications and is anticipated to increase.

Furthermore, The global light electric vehicles market is anticipated to grow considerably in the coming years due to the growing demand for low-emission transportation and sustainable options. As concerns about air pollution and climate change have grown, consumers and governments alike have become more interested in electric vehicles to reduce greenhouse gas emissions and improve air quality.

The growth of the LEVs market is another factor contributing to the increasing availability of government incentives for purchasing electric vehicles. Many countries and municipalities have implemented policies to encourage the adoption of electric vehicles, such as tax incentives, rebates, and subsidies. These policies have helped to make LEVs more affordable for consumers and encouraged manufacturers to invest in developing new products. In addition, advancements in battery technology have made LEVs more practical and reliable than ever. Lithium-ion batteries, in particular, have become more efficient and affordable, allowing LEVs to travel longer distances on a single charge and reducing the overall cost of ownership.

However, a limited range and safety concerns are anticipated to impede the market growth. Despite advancements in battery technology, most LEVs still have a limited range compared to traditional gasoline-powered vehicles. This can be a significant barrier for consumers who need to travel long distances or live in areas with limited charging infrastructure. While the number of charging stations for electric vehicles is growing, there is still a significant lack of charging infrastructure in many parts of the world. This can limit the market's potential, especially in areas where people do not have access to a private charging station.

The COVID-19 pandemic have accelerated the adoption of digital transformation technologies. It has also increased demand for LEVs as consumers have sought safe and sustainable transportation forms. Also, the pandemic has disrupted the global supply chain, causing shortages of components and delaying the production and delivery of LEVs. This has led to increased prices for some models and delays in shipments. In addition, the economic uncertainty caused by the pandemic has led some consumers to delay purchasing decisions, which has slowed growth in the market.

The increasing demand for fewer greenhouse gas emissions and air pollutants than traditional vehicles, making them an attractive option for environmentally-conscious consumers, propelled the market demand. The various factors are helping to drive the market are sustainable transportation options, government regulations, and convenient & affordable mode of transportation

| Coverage | Details |

| Market Size in 2024 | USD 89.14 Billion |

| Market Size by 2034 | USD 205.76 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9.74% |

| Largest Market | North America |

| Base year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Vehicle Category, Application, Power Output, Component, Vehicle Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing government incentives to brighten the market prospect:

Government incentives are critical in driving demand for Light Electric Vehicles (LEVs) market. These incentives take many forms, including tax credits, rebates, grants, and subsidies, and they are designed to make LEVs more affordable and accessible to consumers. Many governments offer financial incentives to encourage consumers to purchase LEVs. Some countries offer tax credits or rebates to purchase electric bicycles or scooters. This can make these vehicles more affordable and competitive with traditional gasoline-powered vehicles. For instance, in 2019, the French government introduced a tax credit of up to €500 to purchase an electric bicycle or scooter. The credit can be claimed by individuals or businesses and applies to purchases made after 1 January 2018. Similarly, in 2020, California introduced a $10 million e-bike incentive program, which provides rebates of up to $1,000 to purchase an electric bicycle. The program aims to reduce air pollution and traffic congestion in the state.

Furthermore, governments also provide incentives to build electric vehicle charging infrastructure, including LEVs. These incentives include grants, tax credits, or subsidies to companies or individuals installing charging stations. By promoting the development of a robust charging infrastructure, governments can help to increase the convenience and appeal of LEVs. Moreover, governments can also provide regulatory incentives to encourage the adoption of LEVs. For instance, some cities have implemented policies to promote electric bicycles and scooters, such as dedicated bike lanes or reduced parking fees for LEVs. These policies can help to make LEVs a more attractive and convenient transportation option.

Advancements in Battery Technology:

As the primary power source for these vehicles, batteries play a critical role in determining their performance, range, and overall value to consumers. As battery technology has improved, producing batteries that can store more energy and last longer between charges has become possible. This has made LEVs more practical for commuting, running errands, and other everyday activities. In addition to longer ranges, advancements in battery technology have also improved the overall performance of LEVs. For instance, newer batteries are lighter and more efficient, leading to better acceleration, handling, and braking. This has helped to make LEVs more fun and engaging to ride.

Furthermore, advancements in battery technology have steered to the emergence of new LEVs categories. For example, electric scooters and bicycles have become increasingly popular as battery technology has improved. Additionally, new categories of LEVs, such as electric skateboards and hoverboards, have emerged thanks to advancements in battery technology.

The limited range of the light electric vehicle is causing hindrances to the market:

Advancements in battery technology have significantly improved, and LEVs typically have a shorter range than traditional gasoline-powered vehicles. This can limit the appeal of LEVs for consumers who need to travel long distances or are concerned about running out of power while on the road. The limited range of LEVs can also be a barrier to entry for consumers considering these vehicles. For instance, electric bicycles and scooters may not be practical for commuters traveling long distances to work or living in areas with limited charging infrastructure. In addition, consumers who frequently take longer trips may be hesitant to purchase LEVs due to concerns about range anxiety. Another factor that can contribute to the limited range of LEVs is their size and weight. Smaller LEVs, such as electric bicycles and scooters, may have smaller batteries than larger vehicles, which can limit their range. Additionally, the weight of the vehicle and the rider can impact the vehicle's overall range, as more energy is required to move a heavier load.

Increase in urban mobility

With the rapid growth of urbanization and the increase in traffic congestion, LEVs can provide a convenient and sustainable alternative to traditional modes of transportation such as cars and buses. They can help reduce traffic congestion and pollution while also improving accessibility for people who may not have access to public transportation. LEVs are easy to operate, affordable, and require low maintenance which in turn increases the demand and creates huge growth opportunities for the market players. Additionally, they offer flexibility in terms of parking, as they can be easily stored and charged in small spaces. This makes them ideal for short commutes, running errands, and other daily activities. LEVs represent a promising opportunity for urban mobility as they have the potential to improve transportation efficiency, reduce carbon emissions, and enhance the quality of life for people in urban areas.

Growing demand for efficient last-mile delivery e-commerce solutions

with the rise of online shopping, there has been an increasing demand for faster and more efficient last-mile delivery. With the rise of online shopping, there has been an increasing demand for faster and more efficient last-mile delivery. LEVs, particularly electric bicycles and electric scooters are becoming popular among delivery companies as they offer a cost-effective and environmentally friendly solution for last-mile delivery. They are particularly well-suited for urban areas where traffic congestion and limited parking can be a challenge for larger vehicles. Additionally, LEVs can also offer faster and more flexible delivery times compared to traditional delivery vehicles, as they can navigate through narrow streets and avoid traffic jams. They are also easier to park and can be charged quickly, which makes them ideal for delivery operations that require multiple stops. Due to these reasons, the light electric vehicles market is projected to grow exponentially over the forecast period.

LEV’s increasing popularity among tourists

As the demand for sustainable tourism grows, we can expect to see a further increase in the popularity of LEVs among tourists. This presents a significant opportunity for companies that specialize in the development and distribution of LEVs, as well as for cities and tourism boards that want to promote eco-friendly and sustainable tourism practices. In addition, tourists often need to navigate urban areas and tourist attractions, which can be difficult and expensive with traditional modes of transportation. LEVs, such as electric bicycles and electric scooters, offer a more convenient and eco-friendly solution for tourists to explore their surroundings. Furthermore, many cities around the world are implementing bike-sharing and scooter-sharing programs, allowing tourists to rent LEVs for short periods of time. These programs provide an affordable and accessible way for tourists to explore the city, without having to worry about parking or navigating public transportation. Hence, the rising popularity of electric vehicles is expected to create huge growth opportunities over the forecast period.

LEVs can be used for fleet management in various industries

Delivery companies can use electric bicycles and electric scooters for last-mile delivery, reducing their carbon footprint and improving efficiency in urban areas where traffic congestion and limited parking can be a challenge for larger vehicles. Similarly, LEVs can be used in the hospitality and tourism industries for tasks such as maintenance, room service, and guest transportation. Electric golf carts, electric bicycles, and electric auto-rickshaws are all examples of LEVs that are commonly used in these industries. In addition, LEVs are also suitable for campus and corporate fleets, where employees or students need to travel short distances within the premises.

Furthermore, LEVs can be used for rental services in various industries, such as tourism, recreation, and mobility. Electric bicycles, electric scooters, and electric cars can be rented out for short periods of time, providing a convenient and eco-friendly alternative to traditional car rental services. The use of LEVs in fleet management presents a significant opportunity for businesses to reduce their carbon footprint and operating costs, while also improving efficiency and customer satisfaction.

On the basis of vehicle category, the 2-wheelers account for most of the market because they are more agile and maneuverable than three-wheelers, making them ideal for navigating crowded urban areas. They are also more affordable and energy-efficient than traditional vehicles, creating them an attractive option for cost-conscious consumers. The primary growth factor creating extensive growth opportunities is the increasing demand for eco-friendly transportation options. The rising concern for environmental issues and increasing fuel prices are pushing consumers towards more sustainable options.

Additionally, the ease of maneuvering through heavy traffic and low maintenance cost is attracting more consumers towards 2-wheelers. The availability of government subsidies and incentives for electric 2-wheelers is also driving the growth of this segment. Furthermore, 3-wheelers, such as e-trikes and e-cargo bikes, are less common than two-wheelers but offer unique advantages for certain use cases. E-trikes are popular among seniors and individuals with mobility issues who need stable and reliable transportation.

On the basis of application, the commercial segment accounts for most of the market. Commercial light electric vehicles are ideal for urban areas where traditional delivery vehicles, such as vans and trucks, are impractical due to traffic congestion and parking limitations. They offer a more efficient and cost-effective alternative to traditional delivery vehicles. They are also eco-friendly, which is increasingly important for industries looking to decrease their carbon footprint.

The commercial application of LEVs is driven by several factors, including cost savings, environmental concerns, government incentives, and convenience and efficiency. These factors are making LEVs an attractive option for businesses looking to reduce costs, improve their environmental impact, and increase efficiency.

On the basis of the power output, the 6–9 kW accounting for most of the market. These vehicles are designed for personal and commercial use and are ideal for longer-distance commutes. They offer more power and speed than vehicles in the less than 6 kW segment, and they are increasingly popular among consumers looking for a more powerful and faster mode of transportation.

The primary driving factor for the growth of this segment is the increasing demand for eco-friendly and cost-effective transportation options for medium-distance travel, especially in urban areas.

On the basis of components, the light electric vehicles market is divided into the battery pack, electric motor (propulsion motor), motor controller, inverters, power controller, E-brake booster, and power electronics, with the battery pack accounting for most of the market because the battery pack is a critical component of any light electric vehicle. It stores the electrical energy required to power the vehicle's electric motor, and its performance determines the range and performance of the vehicle. Battery packs are available in various chemistries, including lithium-ion, lead-acid, and nickel-metal hydride.

On the basis of vehicle type, the e-bike accounting for most of the market. E-bikes are ideal for short-distance commutes and are popular among urban commuters, college students, and older adults. They come in various styles, including mountain, road, and city, and are powered by an electric motor that provides pedal assistance. The primary driving factors for the growth of the e-bikes segment include increasing concerns about air pollution and traffic congestion, rising fuel prices, and the need for affordable and eco-friendly personal transportation options. E-bikes are energy-efficient and eco-friendly, offering a more affordable and convenient alternative to traditional bicycles.

On the basis of geography, North America dominates the market, primarily driven by the growing demand for eco-friendly transportation solutions. The United States and Canada are the key providers to market growth in this region. The increasing government support in the form of subsidies and tax incentives for electric vehicles is also expected to drive market growth. The demand for electric scooters and bicycles is also increasing in this region, such as in urban areas traffic congestion is a vital issue. Key players such as Tesla, General Motors, and Ford are expected to drive market growth in this region.

Europe is a significant market for light electric vehicles, with Germany, the United Kingdom, and France being the major contributors to the market's growth. The increasing demand for sustainable transportation solutions drives the growth in this market. The favorable government policies, such as tax incentives, subsidies, and regulatory norms promoting the adoption of electric vehicles, are driving market growth in this region. The growing focus on decreasing carbon emissions is also expected to drive market growth. The demand for electric bicycles and scooters is also increasing in this region, especially in urban areas.

The region in Asia-Pacific is anticipated to have the greatest CAGR. This growth is primarily driven by the increasing demand for affordable, eco-friendly transportation solutions. China is the largest market for light electric vehicles in this region, accounting for a significant market share. The increasing government support in the form of subsidies and tax incentives for electric vehicles is driving market growth in this region. The increasing urbanization and rising disposable income levels of consumers are also expected to drive market growth. The demand for electric bicycles and scooters is particularly high in this region, especially in densely populated urban areas with limited parking space.

Segments Covered in the Report

By Vehicle Category

By Application

By Power Output

By Component

By Vehicle Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

February 2025

November 2024

January 2025