September 2024

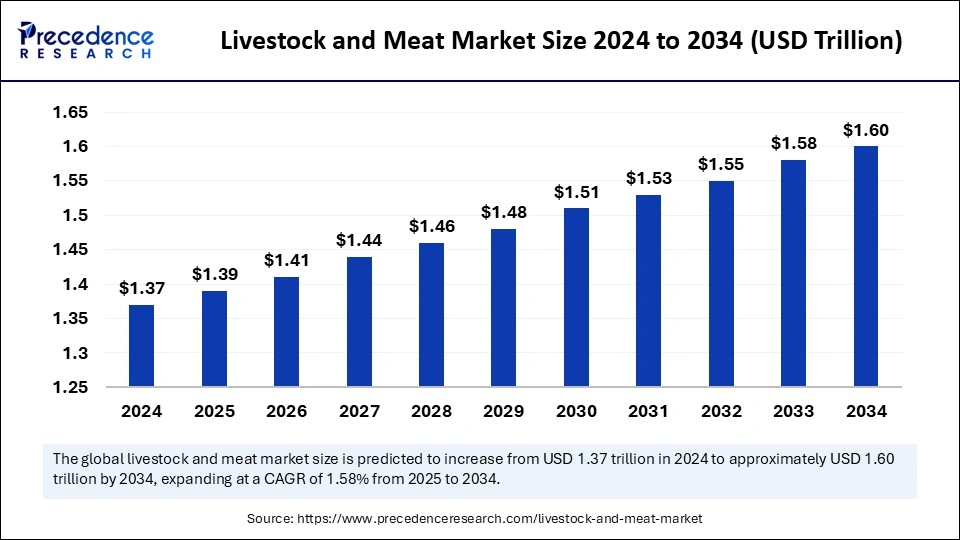

The global livestock and meat market size is calculated at USD 1.39 Trillion in 2025 and is forecasted to reach around USD 1.60 Trillion by 2034, accelerating at a CAGR of 1.58% from 2025 to 2034. The North America market size surpassed USD 479.5 billion in 2024 and is expanding at a CAGR of 1.73% during the forecast period. The market sizing and forecasts are revenue-based (USD Trillion/Billion), with 2024 as the base year.

The global livestock and meat market size was estimated at USD 1.37 Trillion in 2024 and is predicted to increase from USD 1.39 Trillion in 2025 to approximately USD 1.60 Trillion by 2034, expanding at a CAGR of 1.58% from 2025 to 2034. The growth of the livestock and meat market is driven by increasing consumption of processed and frozen meat and the rapid expansion of the food & beverage industry.

Artificial intelligence plays a significant role in the growth of the market by improving livestock farming practices and meat production processes. AI-driven tools enhance livestock farming practices while improving efficiency, operations, and sustainability. Integrating AI-driven technologies in livestock farming enables animal health and feed management analysis. A combination of AI and Machine Learning-based systems helps in predictive analysis and understanding market trends. These systems can analyze large datasets to identify patterns that help make informed decisions. Remote monitoring is a reality with AI-driven tools. A livestock farmer can monitor animal health, manage feeding schedules, and even predict disease outbreaks through AI-based technologies.

Food safety and handling is a major concern in the food processing industry. AI technologies can enable automation to maintain consistent quality and safe handling of meat. AI and ML technologies can help with the predictive maintenance of machines and detect anomalies in products quickly. Utilizing AI technology in the meat processing industry will help with regulatory compliance, quality consistency, increase in production, and operation optimization.

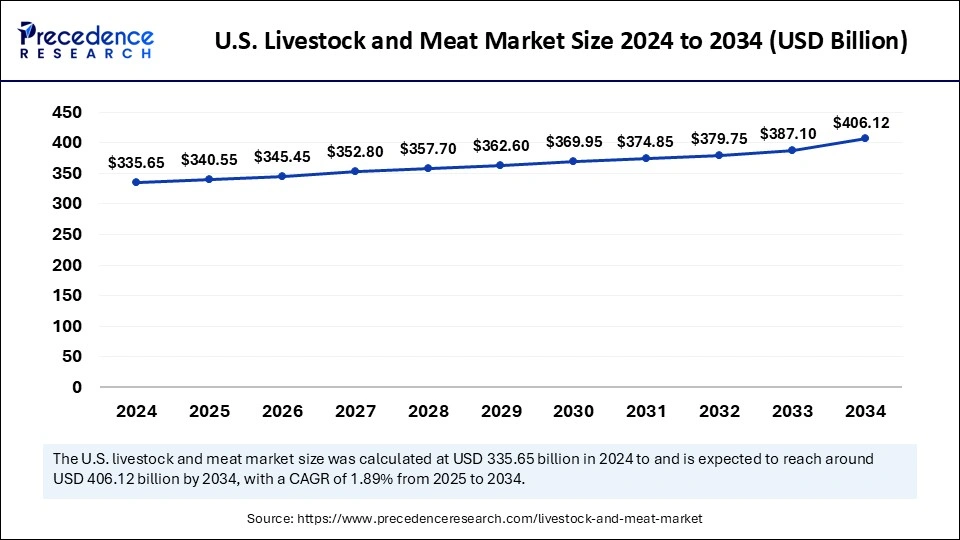

The U.S. livestock and meat market size was exhibited at USD 335.65 billion in 2024 and is projected to be worth around USD 406.12 billion by 2034, growing at a CAGR of 1.89% from 2025 to 2034.

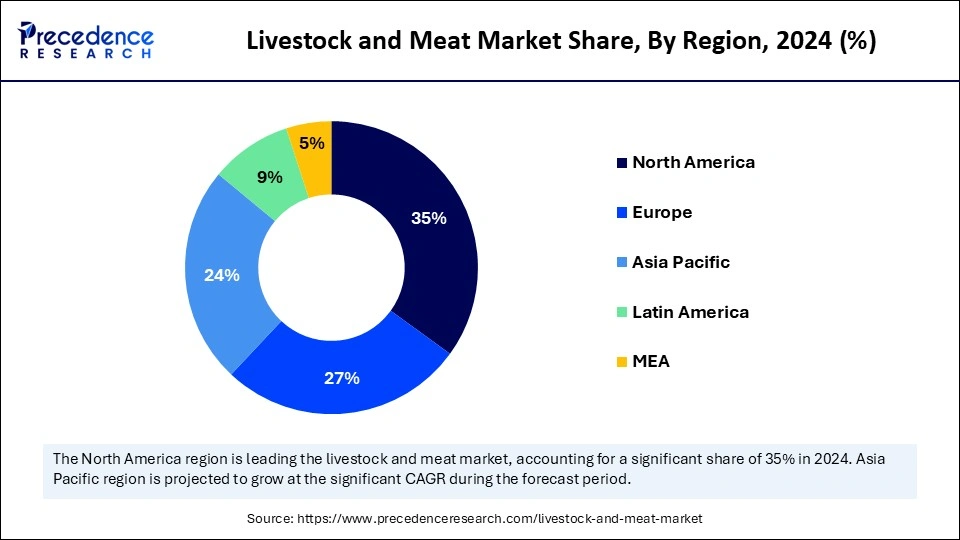

North America dominated the market by capturing the largest share in 2024. This is mainly due to the busy lifestyle of the population and preference for quick, processed, and ready-to-eat meals. There is a high consumption of meat on a regular basis. The favorable support from the government for livestock farming further supports regional market growth.

The U.S. plays a major role in the North American livestock and meat market. The presence of established meat processing companies in the U.S. is supporting the market growth. The rising integration of advanced technologies in livestock farming and meat production influences the market. The consumption of beef is significantly rising in the country. For instance, according to the U.S. Department of Agriculture, beef production is estimated at 26.565 billion pounds in February 2025, already up 775 million pounds from January 2025. Such a steady rise in the consumption of beef and other meat products supports regional market growth.

Asia Pacific is expected to witness the fastest growth during the forecast period. The massive population and rapid urbanization are boosting the growth of the market in the region. Changing lifestyles and higher disposable income encourage consumers to spend heavily on food items. The support from the governments in the region for establishing food processing plants is helping the market. Many countries in the region have huge agricultural and animal husbandry sectors supporting regional market growth.

Countries like China and India play a crucial part in the Asia Pacific livestock and meat market.

China is the world’s largest meat producer. For instance, in 2024, China produced approximately 96.63 million metric tons of pork, beef, poultry, and lamb/mutton. India is also one of the top producers of meat in the world, ranked eighth. The Basic Animal Husbandry statistic estimated that 48.96% of meat production in India is poultry, followed by 48.96% buffalo meat, goat/sheep at 11.3%, and cattle at 2.60%. These numbers are anticipated to increase during the forecast period.

The livestock and meat market focuses on the production, processing, and distribution of animal products for human consumption. It involves raising animals for meat, dairy, and other products, as well as processing and distributing meat and meat products. Meat is considered an essential food item for fulfilling protein requirements for many people across the world. The rising awareness regarding proper nutrition and health consciousness is one of the key factors boosting the growth of the market worldwide. Meat plays a crucial role in attaining the necessary nutrients for people. The expansion of the food & beverage industry and changing dietary patterns influence the market.

The rapid urbanization in emerging countries is boosting the demand for meat and meat products, supporting market growth. The rising global trade activities and improvements in food storage technologies are further fueling the growth of this market. Food manufacturers are focusing on streamlining the supply chain, which impacts the market. The ongoing technological advancements in food processing technologies are enhancing the production and quality of meat, contributing to the market's growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 1.60 Trillion |

| Market Size in 2025 | USD 1.39 Trillion |

| Market Size in 2024 | USD 1.37 Trillion |

| Market Growth Rate from 2025 to 2034 | CAGR of 1.58% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Livestock, Meat Type, Product Form, Distribution Channel and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Population and Rapid Urbanization

The exponential growth of the population across the world and rapid urbanization, especially in emerging countries, are major factors that drive the growth of the livestock and meat market. More people are moving to the urban areas, and disposable income is rising, boosting food spending. As disposable income increases, consumers spend more on convenient and healthy items like protein-rich food, ready-to-eat meals, pre-cooked meals, and processed products. This, in turn, boosts the demand for processed meat products. Moreover, the rising awareness about health and nutrition leads to increased demand for processed, frozen meat. For instance, according to the Government of India’s Department of Animal Husbandry and Dairying, meat production grew 4.95% (year-over-year) between 2022 and 2024.

Environmental Impact

The livestock and meat market has been facing several challenges. Environmental impact is one of them. Livestock production contributes to greenhouse gas emissions, water pollution, and deforestation, which raises environmental raising concerns. Thus, governments around the world are taking initiatives by implementing stricter regulations to reduce the environmental impact of animal husbandry. Moreover, the rising awareness amongst the population and continuous push toward environmentally sustainable practices are limiting the growth of this market.

Focus on Sustainable Practices

The rising awareness amongst consumers about food safety is boosting the demand for organic processed meat products free from any antibiotics and chemical residues. The demand for processed meat products that are organically produced is creating immense opportunities in the livestock and meat market. The worries regarding the effects of unnaturally processed meat and its effect on human health have made consumers aware of the benefits of organically sourced food. Moreover, adopting sustainable practices helps to reduce greenhouse gas emissions and environmental impact of livestock production.

The cattle segment dominated the livestock and meat market with a major share in 2024. This is mainly due to a significant rise in the demand for beef and various dairy products across the world. With the growing population and changing dietary preferences, the consumption of dairy products has increased over the years. Cattle produce a large amount of meat per animal compared to other species. This makes cattle economically efficient, contributing to segmental growth.

The poultry segment dominated the market in 2024. The lower production cost of poultry is a major factor that supported the segment’s dominance. Poultry products are highly preferred for their high proteins. It is a staple meat item in many households. Moreover, poultry grows much faster than other species, making them more efficient. Poultry also requires less feed to produce, further contributing to the segment’s growth.

The processed meat products held the largest share of the livestock and meat market in 2024. The changing lifestyle patterns and rise in preference for ready-to-eat meals, quick meals, and cooked or semi-cooked products have boosted the demand for processed meat. The rapid pace of urbanization in the developing country is further contributing to segmental growth. Quality and convenience are major factors consumers sought after while purchasing meat products. However, the longer life and the easy availability of processed meat in food retail stores and online shops continue to boost the segment.

The supermarkets segment accounted for the dominant share of the market in 2024. Supermarkets are the preferred choice amongst consumers due to the ease of accessibility. The convenience of finding everything under one roof with a focus on standard quality and personalized service contributes to segment growth. Supermarkets often give discounts and offers on bulk purchasing, attracting more consumers. Supermarkets also emphasize freshness of products, supporting segment growth.

The online retail segment is expected to witness the fastest growth during the forecast period. The growing trend of online grocery shopping is a key factor boosting the growth of the segment. These stores provide easy doorstep delivery. This convenience factor attracts a wider consumer base.

By Livestock

By Meat Type

By Product Form

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

February 2025

August 2024