Masterbatch Market (By Carrier Polymer: Biodegradable Plastics, Polyethylene Terephthalate, PUR, PS, Polyvinyl Chloride, Polyethylene, Polypropylene, Other Carrier Polymers; By Type: Biodegradable, Filler, Additive, Color, Black, White; By End-use: Building & Construction, Consumer Goods, Automotive & Transportation, Agriculture, Packaging) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

The global masterbatch market size was accounted for USD 6.29 billion in 2023, calculated at USD 6.69 billion in 2024 and is expected to reach around USD 12.36 billion by 2034, expanding at a CAGR of 6.33% from 2024 to 2034. The replacement of metal with plastics in end-use industries such as consumer products, building, and construction, automotive and transportation, and packaging is expected to play a significant role in the growth of the global masterbatch market over the course of the forecast period.

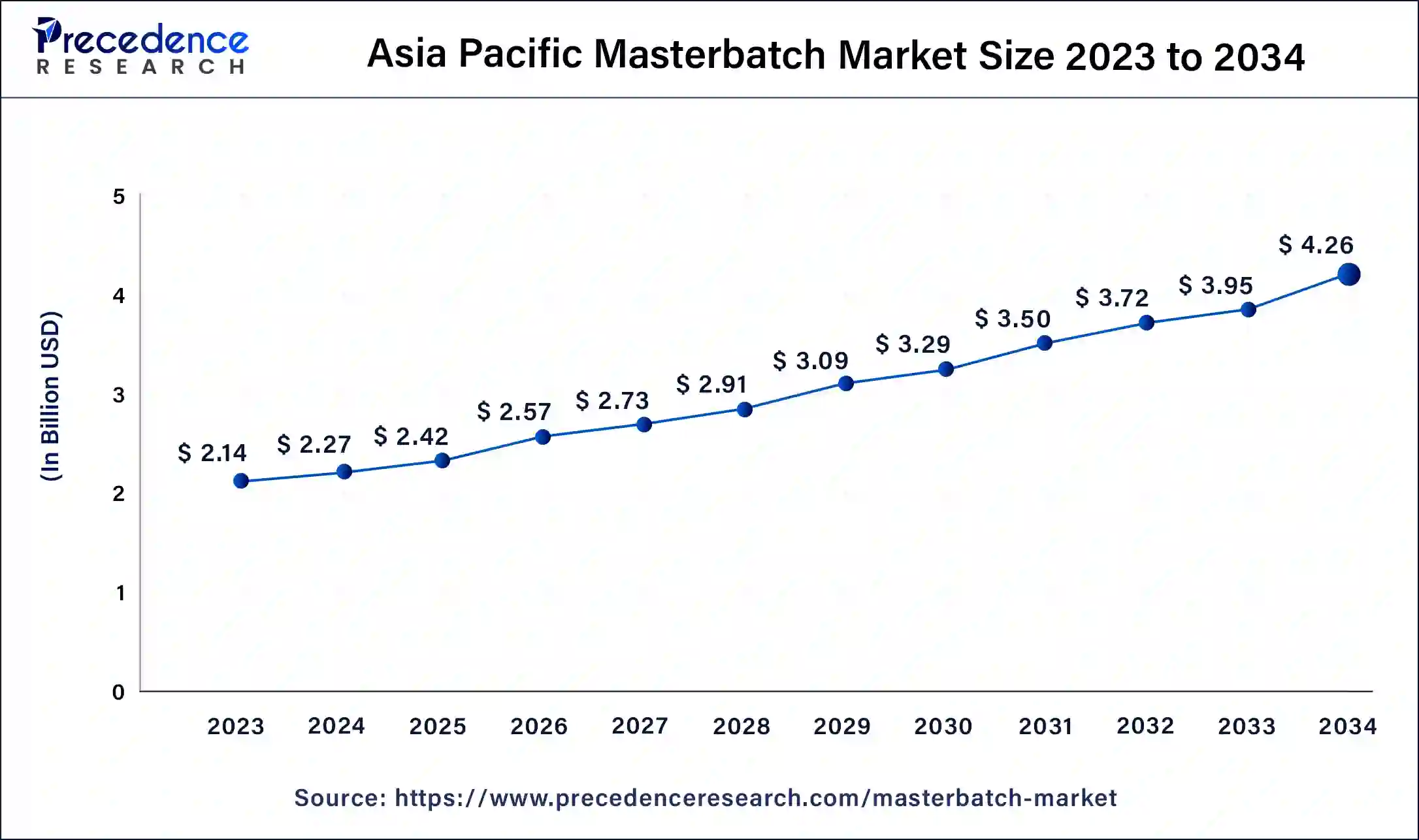

Asia Pacific Masterbatch Market Size and Growth 2024 to 2034

The Asia Pacific masterbatch market size was exhibited at USD 2.14 billion in 2023 and is projected to be worth around USD 4.26 billion by 2034, poised to grow at a CAGR of 6.45% from 2024 to 2034.

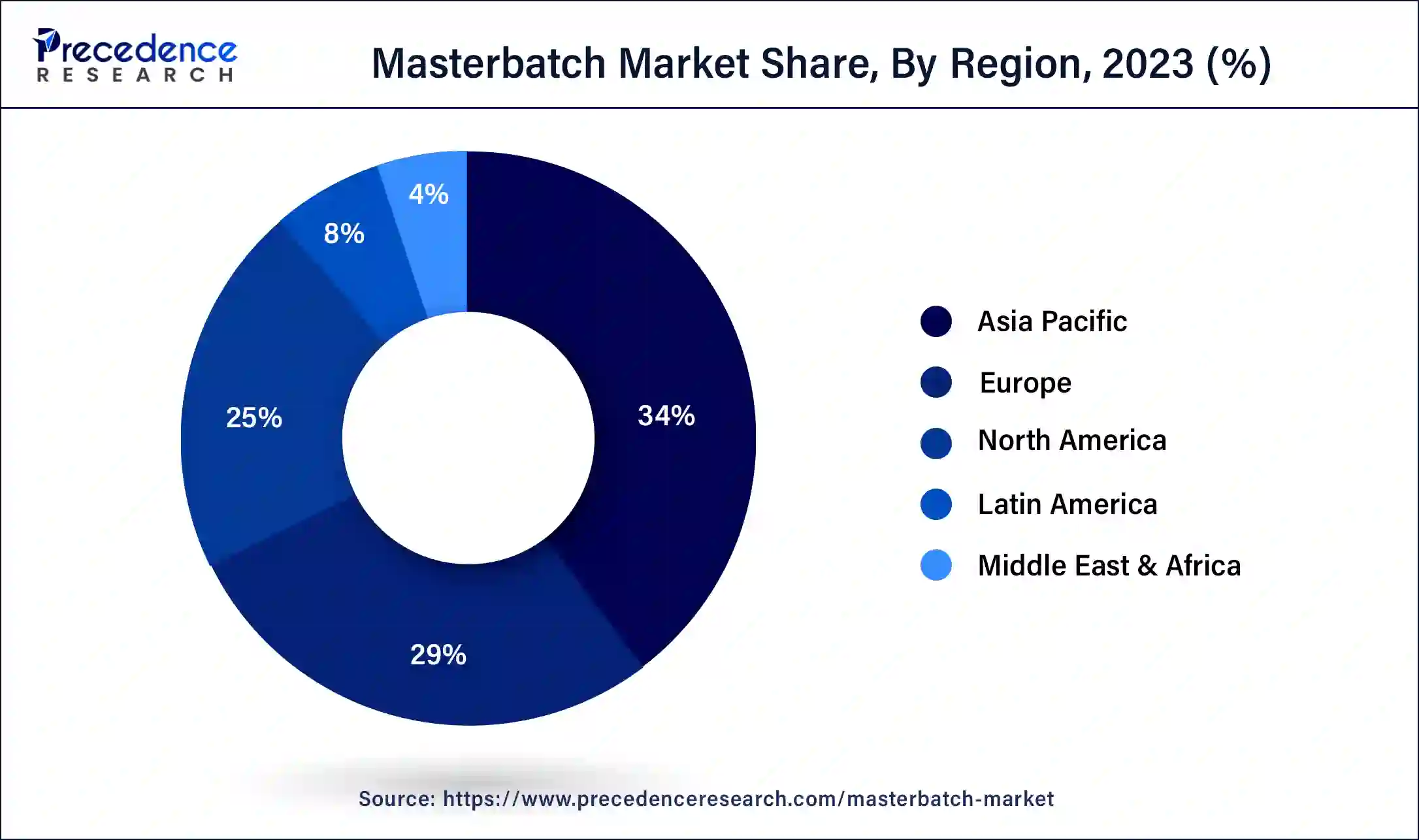

Asia Pacific dominated the masterbatch market in 2023. Significant growth opportunities exist in the region for industry participants from multiple countries. It is projected that a number of factors, including continuous innovation, affordable labor costs, an expanding population in Asia-Pacific, a rise in the use of recently developed technology, affordable and easily accessible land, and easily accessible raw resources, will propel considerable market expansion in the area.

When it comes to automobile production, Asia Pacific is the leader, which has greatly increased the need for masterbatches in the automotive sector. The increasing innovation and design of electric vehicles in the region has raised the demand for the different types of masterbatch, which is estimated to drive the growth of the Asia Pacific masterbatch market in the near future.

Europe is expected to grow at a significant rate in the market during the forecast period due to the increasing launch of new carrier polymers. Furthermore, the key players operating in the region are adopting inorganic growth strategies like agreements in order to distribute their products worldwide and expand their geographic presence, which is expected to drive the growth of the masterbatch market over the forecast period.

Masterbatch is a solid product that is typically made of rubber, plastic, or elastomer that contains additives or colors that have been carefully distributed at high concentrations within a carrier material. In polymer processing, masterbatches are frequently used to mix antimicrobials, color pigments, or additives into liquid polymer resin. A concentrated mixture of an additive enclosed in a carrier material, such as polyethylene (PE) or polypropylene (PP), is called a masterbatch. Usually, the carrier is a polymer resin in the form of chips or pellets, although liquid masterbatches are also offered for specific materials and purposes.

The final plastic product will inherit the color and qualities of the masterbatch from the carrier material, which is compatible with the primary plastic in which it will be blended during molding. A masterbatch is a concentrated combination made with a high-shear mixing extruder and heat treatment to distribute additives and colors into a polymer carrier. After cooling, the mixture is chopped with a pelletizer to shape it into granules.

Masterbatches dilution properties enable more precise dosing of pricey components. Since the solvent in the polymer won't evaporate, masterbatches solid crystals are solvent-free and typically have a longer shelf life. In general, masterbatch has between 40 and 65 percent additives, but in a few more instances, the range may change to 15 to 80 percent. Between machine runs liquid masterbatches provide extremely accurate dosing and rapid color changes.

The masterbatch is available in several types, such as black masterbatch, additive masterbatch, white masterbatch, color masterbatch, and special Effect Masterbatch, among others. The top five benefits of the masterbatch are as follows: easier incorporation of additives, better process stability and consistency in products, cleaner production, greater additive stability and shelf-life, and easier integration of antimicrobial technology.

| Report Coverage | Details |

| Market Size by 2034 | USD 12.36 Billion |

| Market Size in 2023 | USD 6.29 Billion |

| Market Size in 2024 | USD 6.69 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.33% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Carrier Polymer, Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Advantages associated with the use of masterbatch

The key players operating in the market are influenced by the advantages associated with the use of masterbatch, and hence, the demand for the masterbatch has been found to increase, which is estimated to drive the growth of the global masterbatch market over the forecast period. The masterbatch has the strength to raise volume output as well, and it helps reduce the material cost as masterbatches utilize low energy to run the machine due to higher calcium carbonate-specific heat.

Moreover, masterbatch gets blended easily with plastics during the molding process. Hence, by focusing on masterbatch consistent, economical, and reliable offerings, the key market players are influenced by it and are raising the demand for the same.

Need for extra storage space and longer lead time

Masterbatches require more storage space and longer lead times than pure pigments. An additional disadvantage is that the additive and carrier must be exposed to heat, which can restrict the growth of the market in the near future.

Increase demand for masterbatches in black polyester fibers

The polyester fibers are mostly utilized in the automotive and textile sectors. In the automotive industry, it is accommodated in applications such as interior, seat covers, roof lining, and cladding. Polyester fibers made from polyethylene terephthalate get their desired properties by adding functional pigments and additives, generally in the form of black masterbatches. Hence, the key players operating in the market are focused on the launch of the black masterbatch due to the rise in the demand for the black masterbatch, which is expected to create lucrative opportunities for the growth of the global masterbatch market in the near future.

Geographical expansion of market presence

The key players operating in the market are focused on extending their market presence by launching their company branch presence in another region, which is expected to create lucrative opportunities for the growth of the masterbatch market over the forecast period.

The polypropylene (PP) segment dominated the masterbatch market in 2023 on account of the launch of the new polypropylene polymer in the market. Novel products are built on polypropylene (PP), contain 30% glass fiber reinforcement, and are intumescent and flame retardant (FR). It can be utilized for electric vehicle (EV) battery pack components like enclosures, module separators, and top covers.

The black segment dominated the global masterbatch market in 2023. This significant market share can be attributed to the increasing demand for black masterbatch and its use in products for the automotive, transportation, building, construction, agriculture, and packaging industries, particularly in tires and PVC containers. Furthermore, the market is also expected to witness growth due to the rising need for agricultural products like shade cloth, drip irrigation tubing and tape, geomembranes, and greenhouse films.

The color segment is expected to grow at a significant rate in the masterbatch market during the forecast period. Increasing the launch of new products for the expansion of the product portfolio is estimated to drive the growth of the segment over the forecast period. Moreover, the key players operating in the market are focused on launching new technology for coloring the masterbatch, which is expected to drive the growth of the segment over the forecast period.

The packaging segment dominated the masterbatch market in 2023. Increasing the launch of new carrier polymers for packaging purposes is expected to foster the growth of the segment over the forecast period. Key players are adopting newer technologies, and rapid innovations further add to the segment's dominance.

Segment Covered in the Report

By Carrier Polymer

By Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client