January 2025

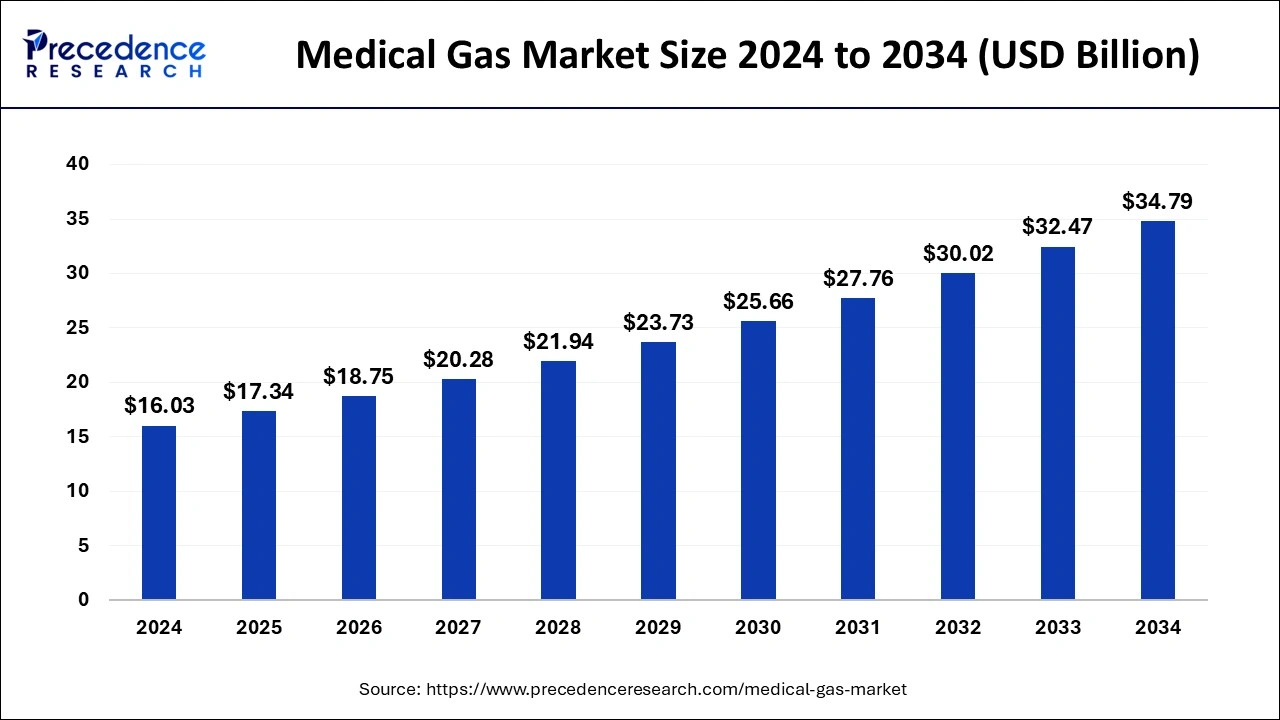

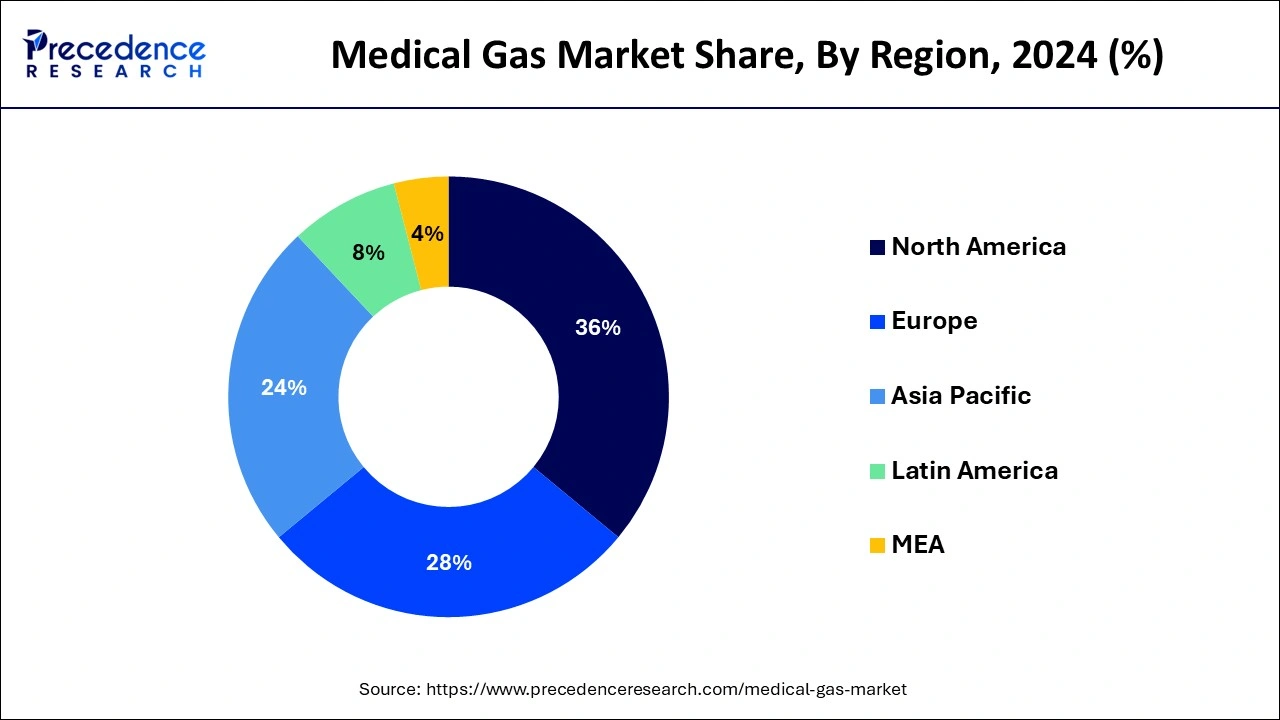

The global medical gas market size is calculated at USD 17.34 billion in 2025 and is forecasted to reach around USD 34.79 billion by 2034, accelerating at a CAGR of 8.06% from 2025 to 2034. The North America medical gas market size surpassed USD 5.77 billion in 2024 and is expanding at a CAGR of 8.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical gas market size was estimated at USD 16.03 billion in 2024 and is predicted to increase from USD 17.34 billion in 2025 to approximately USD 34.79 billion by 2034, expanding at a CAGR of 8.06% from 2025 to 2034. The medical gas market is driven by the increasing rates of long-term respiratory conditions.

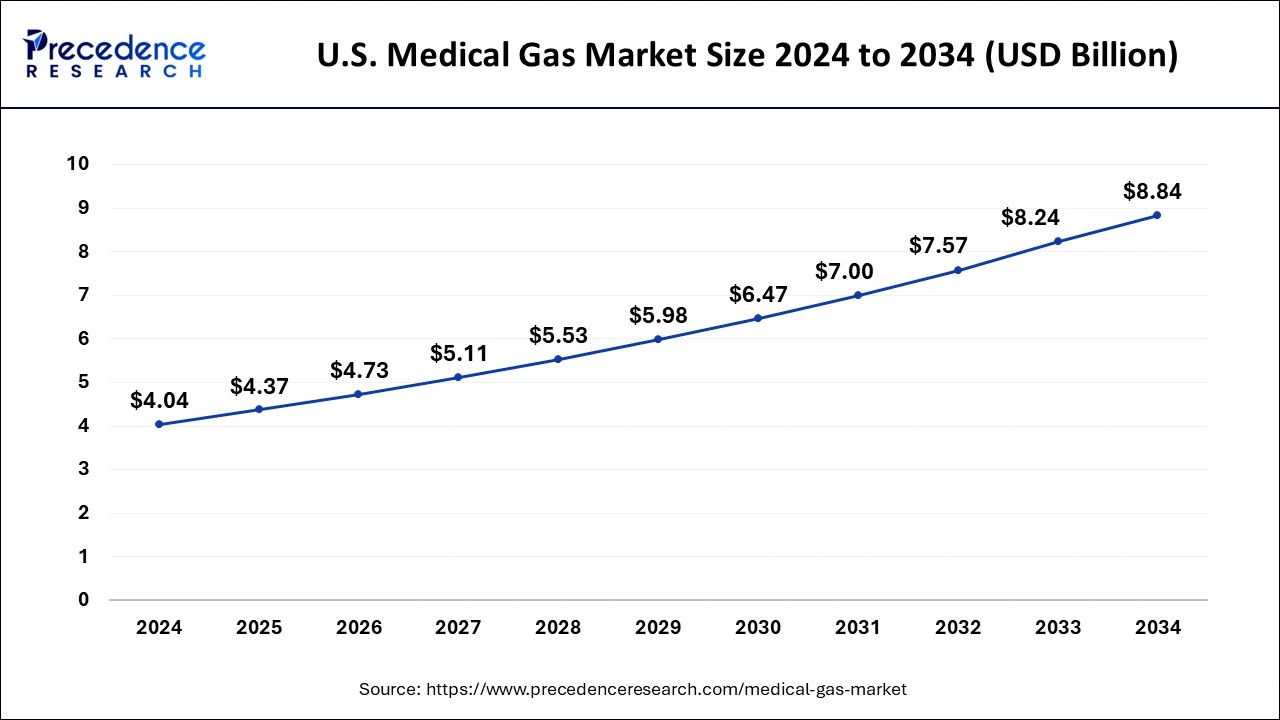

The U.S. medical gas market size was estimated at USD 4.04 billion in 2024 and is predicted to be worth around USD 8.84 billion by 2034, at a CAGR of 8.15% from 2025 to 2034.

North America led the medical gas market with the largest share in 2024. The region is observed to continue the position throughout the forecast period. Strict regulations imposed by agencies like Health Canada and the Food and Drug Administration (FDA) in the US govern the medicinal gas market in North America. Healthcare professionals are encouraged to purchase medical gases from reputable suppliers since these regulations guarantee these gases' purity, safety, and quality. Medical gases are used in various healthcare facilities, such as clinics, hospitals, ambulatory surgery centers, and home healthcare. Medical gases are widely used and generate revenue due to their adaptability in treating a wide range of medical problems and the diverse healthcare landscape in which they operate.

Asia Pacific is expected to be the fastest growing medical gas market during the forecast period. Asia Pacific is going through a demographic shift due to an aging population, just like many other regions worldwide. Due to the increased prevalence of age-related health problems and chronic diseases brought on by this demographic trend, there is a more vital need for medical gases in treatment and therapy. The region's governments are putting more and more emphasis on expanding access to high-quality healthcare. This comprises legal safeguards to guarantee medicinal gas's efficacy, safety, and quality. Implementing cutting-edge gas handling, storage, and delivery systems is necessary to comply with these laws.

The medical gas market includes the production, distribution, and use of different gases for therapeutic, diagnostic, and pharmacological reasons in healthcare settings. These gases include many medical-grade gases, as well as oxygen, nitrogen, carbon dioxide, nitrous oxide, and helium. Medical gases like oxygen are essential for patients in need of respiratory assistance, such as those experiencing respiratory failure or having surgery. They are indispensable in operating rooms, critical care units, and emergency departments. Certain medical gases are utilized in specialized treatments, like nitric oxide therapy for pulmonary hypertension, carbon dioxide therapy for certain skin disorders, and hyperbaric oxygen therapy for wound healing. Medical gases are essential for resuscitation attempts in emergency care, especially when patients are experiencing cardiac arrest or respiratory distress.

In India, one million newborns are released from Special Newborn Care Units (SNCUs) annually, while about 3.5 million babies are born too soon. These babies still have a significant chance of dying, malnutrition, and delayed development. Medical gases like oxygen are frequently needed by premature babies and neonates experiencing respiratory distress to support their breathing and raise their oxygen levels.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.06% |

| Market Size in 2025 | USD 17.34 Billion |

| Market Size by 2034 | USD 34.79 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of respiratory diseases

The COVID-19 pandemic and other recent worldwide health emergencies have brought attention to the significance of respiratory care and medicinal gases, especially oxygen, in treating respiratory distress and severe sickness. The need for medical gases for treatment and supportive care is further fueled by environmental factors, including urbanization, industry, and climate change, which all contribute to air pollution and respiratory health concerns. Notable technological developments in respiratory care have developed more efficient medical gas delivery systems and treatments. Ventilators, nebulizers, and oxygen concentrators are the cutting-edge medical equipment increasingly used to treat respiratory conditions. Technological advancements drive the need for medical gases as vital parts of these devices.

Rise in the number of surgeries

No matter how big or small the surgery is, medical gases like oxygen, nitrous oxide, and air frequently need to be administered. These gases are essential for patient breathing, anesthetic distribution, and oxygenation during surgical procedures. The demand for medical gases is rising while the number of surgeries conducted globally is increasing because of factors such as an aging population, a growth in the frequency of chronic diseases, and improvements in surgical procedures.

Safety concerns

Leaks or ruptures can occur by mishandling gas cylinders, such as dropping them or subjecting them to extreme heat. Healthcare personnel must also be adequately trained in safely administering medicinal gases to patients, including correct dosage, monitoring for adverse reactions, and avoiding overuse. Medical gases can accidentally expose patients and healthcare personnel if not delivered or stored adequately. Thereby, the safety concerns are observed to act as a hindering factor for the medical gases market.

For instance, breathing in some gases at high concentrations can cause respiratory problems or other adverse effects, whereas exposure to high oxygen concentrations might raise the fire risk. Safety equipment, handling procedures, and proper training are crucial to reducing the chance of unintentional exposure.

Advancements in medical gas delivery systems

There is rising interest in medical gas delivery systems that are both environmentally and energy efficient as sustainability takes center stage in the healthcare industry. Greener solutions that optimize energy use, decrease gas waste and lessen environmental impact are being developed by manufacturers through innovation. Modern gas distribution equipment design increasingly incorporates energy recovery systems, recyclable materials, and automatic shutdown mechanisms, which appeal to environmentally concerned healthcare providers and drive demand for sustainable solutions.

The pure gases segment dominated and sustained to be the fastest growing in the medical gas market. Pure gases, including nitrous oxide, oxygen, nitrogen, and helium, are essential for various medical operations and treatments. For example, oxygen is essential for respiratory support in diseases like respiratory distress syndrome, asthma, and chronic obstructive pulmonary disease (COPD). Nitrous oxide is used in anesthesia, and nitrogen is used in cryosurgery and in the preservation of biological materials.

These gases are always needed because of their vital significance in medical processes. The advantages of medicinal gases in treating various medical disorders are becoming more widely known to patients and healthcare practitioners. Patients are becoming more open to gas-based therapy, and medical gas usage is becoming more commonplace in treatment regimens. In the medical gas market, pure gases continue to grow due to this greater acceptance and knowledge.

The gas mixtures segment is observed to be the fastest growing in the medical gas market during the forecast period. Gas mixtures can be customized over single-component medicinal gases like nitrogen or oxygen. Healthcare professionals can precisely customize gas mixture compositions to satisfy the needs of individual patients and medical procedures. These concoctions are tailored to medical requirements, including respiratory therapy, anesthetic, and diagnostic procedures. This versatility makes specialized gas mixes more appealing in various healthcare settings, which hastens their adoption and expansion as medical research progresses and new methods are developed.

The therapeutic segment dominated and sustained to be the fastest growing in the medical gas market. Medical gases are now used to treat conditions other than respiratory ones despite their historical association with respiratory therapy. For example, nitric oxide is used to treat pulmonary hypertension and nitrous oxide is used to relieve pain during delivery and dental treatments. The significance of medicinal gases in critical care settings has been emphasized by events like the COVID-19 epidemic, underscoring their crucial role in contemporary healthcare. The pandemic-induced spike in demand for oxygen therapy served as a reminder of the vital role that medical gases play, bolstering the industry's expansion.

The diagnostics segment is the fastest growing in the medical gas market during the forecast period. Growing expenditures on healthcare infrastructure are driving the growth of diagnostic centers, especially in emerging markets. The need for medical gases in diagnostic tools and processes rises with establishing or renovating further hospitals, clinics, and diagnostic centers. This infrastructural development is one of the leading causes of the diagnostics segment's explosive expansion.

The hospitals segment dominated the medical gas market in 2024. Hospitals are frequently the first to respond when handling medical emergencies, such as those involving mass casualties, natural disasters, and public health crises. Medical gases play a critical role in emergency preparedness and response activities to ensure that hospitals can promptly mobilize resources to treat a spike in patients requiring respiratory support or other medical interventions. Hospitals treat patients with a wide range of medical ailments and are open around the clock.

Various medical gases, such as oxygen, nitrogen, nitrous oxide, carbon dioxide, and medical air, are frequently needed for this all-encompassing therapy. To meet the needs of their patients, hospitals must have a steady and dependable supply of these gases.

The pharmaceutical and biotechnology companies segment is the fastest growing in the medical gas market during the forecast period. The discovery of innovative biologics and biosimilars is driving the rapid expansion of the global biopharmaceutical manufacturing business. Specialized gases are frequently needed to manufacture biopharmaceuticals, including therapeutic proteins, antibodies, and vaccines. These procedures include fill-finish operations, fermentation, and purification. The global biopharmaceutical industry's need for medical gases is growing along with its manufacturing capability.

The home healthcare segment shows a significant growth in the medical gas market during the forecast period. Home healthcare services have increased even more due to the COVID-19 pandemic. Due to concerns regarding infection risk in healthcare institutions, healthcare providers are investigating alternate care delivery models, with a focus on home-based care whenever feasible. The treatment of COVID-19 patients in hospitals and at home requires medical gases, especially oxygen, which has increased demand for home healthcare services.

By Product

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025