January 2025

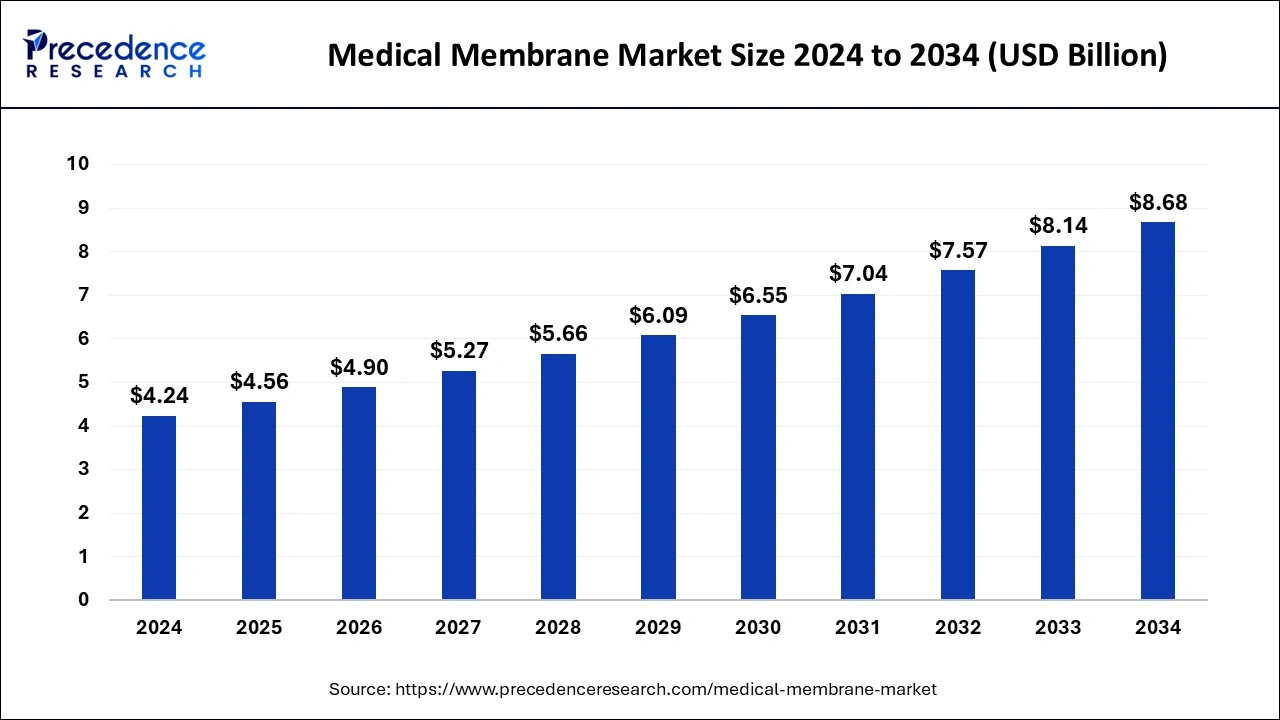

The global medical membrane market size is calculated at USD 4.56 billion in 2025 and is forecasted to reach around USD 8.68 billion by 2034, accelerating at a CAGR of 7.43% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical membrane market size was estimated at USD 4.24 billion in 2024 and is predicted to increase from USD 4.56 billion in 2025 to approximately USD 8.68 billion by 2034, expanding at a CAGR of 7.43% from 2025 to 2034. The market is expected to grow due to an aging global population, which raises the need for medical care, especially sophisticated therapies and operations involving medical membranes.

Due to their biocompatibility, thermal stability, and chemical resistance, polysulfone (PSU) and polyether sulfone (PES) are the leading polymers in the market. These properties make them perfect for use in medical devices such as intravenous filters and hemodialyzers. Modified acrylics, polyethylene (PE), polytetrafluoroethylene (PTFE), and polyvinylidene fluoride (PVDF) are among the additional materials.

Due to its capacity to remove germs and particles, microfiltration commands the greatest market share and is crucial for use in the manufacturing of pharmaceuticals and dialysis solutions. The primary use is in pharmaceutical filtration, which is motivated by the requirement to preserve the purity and safety of medicinal products. Significant market segments are also represented by medication delivery systems and hemodialysis.

Medical membrane demand is fueled by the increased prevalence of chronic illnesses, including diabetes and renal disease, especially in hemodialysis applications. The creation of self-healing membranes and the incorporation of membranes into wearable medical devices are two examples of membrane technology innovations that are driving market expansion. In healthcare settings, there is a rising focus on sustainable manufacturing techniques and the implementation of single-use solutions to reduce cross-contamination and enhance operational efficiency.

The global need for healthcare is growing, and technological improvements will fuel significant expansion in the medical membrane market. The future of this industry will continue to be shaped by the emphasis on high-performance materials and cutting-edge applications.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.43% |

| Market Size in 2025 | USD 4.56 Billion |

| Market Size by 2034 | USD 8.68 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expansion of the pharmaceutical and biotechnology industries

Advanced membrane technologies are becoming more and more necessary as chronic diseases become more common and as demand for tailored medicine and biopharmaceutical goods rises. Membranes are essential for the filtering and purification of biologics, assuring the effectiveness and safety of the final product. More robust, effective, and selective membranes have been created as a result of developments in materials science and nanotechnology. These membranes are essential to pharmaceutical production procedures.

Reliable and scalable membrane technologies are becoming more and more necessary as biopharmaceutical manufacturing facilities see higher investment levels. In order to fulfill the increasing demand for vaccines, monoclonal antibodies, and other biopharmaceuticals on a global scale, businesses are growing their production capacities.

Supply chain disruptions

Due to a number of interrelated causes, the medical membrane industry is now experiencing major supply chain disruptions. One of the primary causes is the persistent geopolitical unrest, like the wars in Ukraine and the Middle East, which have impacted international trade lanes and raised transportation expenses. In addition, the pandemic-exacerbated supply chain inefficiencies and material shortages continue to pose difficulties for the medical device industry. Natural disasters like the drought damaging the Panama Canal, which has caused major delays and limits on vessel transits and impacted the timely delivery of medical supplies, have made the issue even more problematic.

Bio-artificial processes

The medical membrane market is seeing a surge in interest in bio-artificial processes because of their potential to completely transform a range of medicinal applications. In order to develop functioning systems for medicinal applications, these methods integrate biological elements—such as cells, proteins, or genetic material—with artificial membranes. Tissue engineering uses bio-artificial membranes to build scaffolds that resemble the extracellular matrix and assist tissue regeneration and cell proliferation. Drug carriers can imitate biological barriers and interact with the body more efficiently by adding biological components, such as cells or proteins, into the membranes. This might potentially reduce adverse effects and improve therapeutic outcomes.

The polysulfone (PSU) & polyether sulfone segment held the largest share of the medical membrane market in 2024. Excellent characteristics and versatility make polyether sulfone (PES) a desirable polymer for a variety of applications, including the medical membrane industry. PES is frequently utilized in medical membranes because of its chemical resistance, thermal stability, and biocompatibility. PES membranes are commonly found in hemodialysis filters.

These membranes have to effectively filter out unwanted materials and extra fluid from the blood while preserving vital components. PES membranes are used in ultrafiltration applications in medical devices such as dialyzers and blood purification systems. They aid in the purification process by aiding in the separation of colloidal particles and macromolecules from solutions. Because PES membranes can control drug release, they are used in controlled drug delivery systems.

The polypropylene segment is expected to show significant growth in the medical membrane market during the forecast period. Because of polypropylene's well-known biocompatibility, it can be used in medical settings where interaction with biological systems is required. This characteristic guarantees that polypropylene membranes used in implants or medical devices won't result in negative side effects.

Excellent filtration and separation properties of polypropylene membranes enable them to efficiently remove impurities, particles, and microbes from fluids. When exposed to various chemicals and solvents frequently used in medical procedures, polypropylene's strong chemical resistance is crucial for preserving membrane integrity. The long lifespan and durability of polypropylene membranes add to their affordability in medical applications. Their durability makes it possible to use them again in filtering and purification procedures.

The nanofiltration segment dominated the medical membrane market in 2024. Pharmaceutical goods are purified, separated, and concentrated in pharmaceutical production procedures using nanofiltration membranes. They assist in clearing solutions of contaminants like bacteria, viruses, and endotoxins. Hemodialysis devices rely on nanofiltration membranes to remove waste materials and extra electrolytes from the blood while keeping the necessary components. These membranes help patients with renal failure receive hemodialysis treatments that are safer and more effective. Drug delivery systems use nanofiltration membranes to release pharmacological ingredients gradually. They aid in the concentration and separation of medication formulations, guaranteeing accurate dosage and patient-specific delivery. Proteins, enzymes, and nucleic acids are examples of biomolecules that are purified and concentrated in biomedical research labs using nanofiltration membranes.

The ultrafiltration segment is expected to grow rapidly in the medical membrane market in the upcoming years. Hemodialysis machines use ultrafiltration as a critical phase. These devices filter waste materials and extra fluid from the blood of renal failure patients using semipermeable membranes. By exerting pressure across the membrane, ultrafiltration enables the removal of tiny solutes and surplus fluid while retaining larger molecules like proteins and blood cells. Other medical uses for ultrafiltration membranes include medication delivery systems, pharmaceutical product purification, and plasma separation. These membranes are essential for the separation and purification of pharmaceutical chemicals and biomolecules because they offer exact control over particle size and molecular weight cutoff.

The pharmaceutical filtration segment led the medical membrane market in 2024. The growing need for purification and separation technologies in pharmaceutical manufacturing has led to a steady growth in the pharmaceutical filtration industry, especially in medical membrane applications. Medical membranes are essential for several procedures, including protein purification in medication manufacture, virus elimination, and sterile filtering. In order to maintain product integrity and efficacy, the development of biopharmaceuticals—such as proteins, monoclonal antibodies, and vaccines—needs specific filtration techniques.

Increased efforts are being made in the pharmaceutical business to discover new drugs, which is driving up demand for filtration technologies to improve product quality and expedite production operations. The need for appropriate filtering solutions is being driven by the growing usage of bioprocessing techniques in pharmaceutical manufacture, such as tangential flow filtration (TFF) and chromatography.

The IV infusion & sterile filtration segment is expected to grow rapidly in the medical membrane market during the forecast period. Within the medical membrane sector, the IV infusion and sterile filtration markets are sizable and dynamic. The process of administering fluids, drugs, or nutrients intravenously (IV) to a patient is referred to as IV infusion. Microorganisms and particulate matter are eliminated from liquids using sterile filtration, guaranteeing their safety for use in medical applications.

Medical membranes are essential to both procedures because they offer the filtering required to keep things safe and sterile. Globally, there is a growing need for sophisticated medical devices and equipment, such as those for IV infusion and sterile filtration, as healthcare spending rises. The market is expanding as a result of the rising incidence of chronic illnesses like cancer, diabetes, and autoimmune disorders, which call for regular IV infusions and sterile filtration operations.

Europe dominated the global medical membrane market in 2024. Medical membranes find widespread use in processes such as medication delivery, hemodialysis, bio-artificial processes, sterile filtration, intravenous infusion, and pharmaceutical filtration. Because membranes are essential to guarantee the safety and purity of pharmaceutical products, pharmaceutical filtration commands a large share of the market.

Polysulfone (PSU), polyether sulfone (PESU), polyvinylidene fluoride (PVDF), and other materials are utilized in medical membranes. PSU and PESU are especially noteworthy for their superior biocompatibility, heat resistance, and chemical resistance, which contribute to their great performance in medical applications. Europe is a prominent region in the global medical membrane market, owing to its advanced healthcare infrastructure, substantial investments in research and development, and strict regulatory framework that guarantees the production of high-quality medical products.

North America is expected to be a significantly growing medical membrane market. High R&D expenditures, strict regulations governing healthcare facilities, and an increasing need for cutting-edge medical treatments are driving the market's growth. Medical membranes are essential for hemodialysis, drug administration, and pharmaceutical filtration, among other uses. With significant market shares, hemodialysis and pharmaceutical filtration were the two application categories with the biggest sizes in 2023. The development of dialysis, ultrafiltration, and microfiltration technologies is also driving market expansion. Particularly important for many medical procedures is the removal of germs and particles from liquids—a task that requires microfiltration.

By Material

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025