January 2025

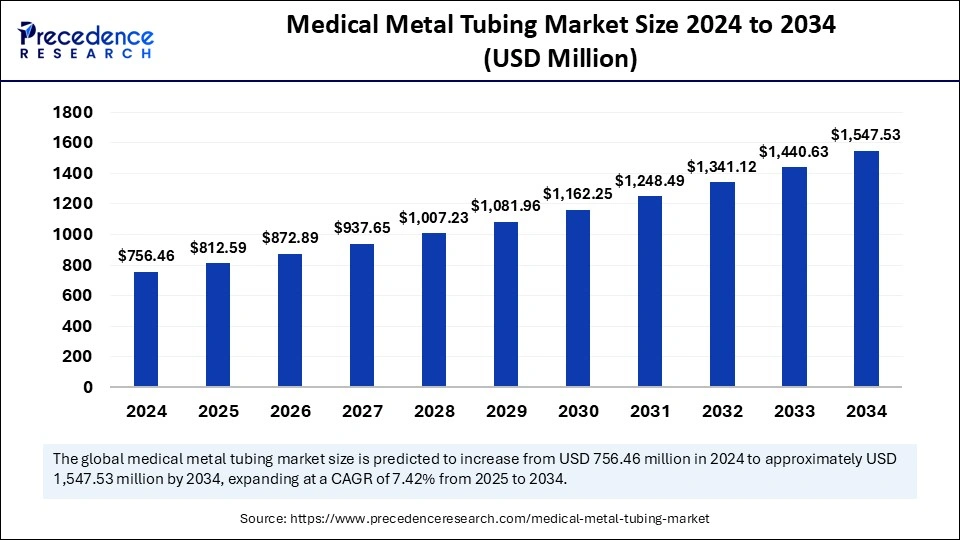

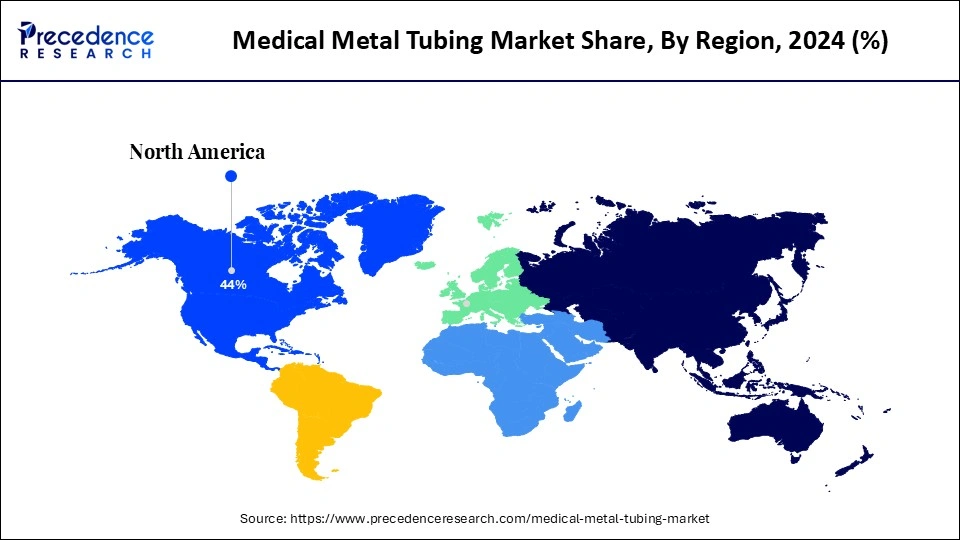

The global medical metal tubing market size is calculated at USD 812.59 million in 2025 and is forecasted to reach around USD 1,547.53 million by 2034, accelerating at a CAGR of 7.42% from 2025 to 2034. The North America market size surpassed USD 332.84 million in 2024 and is expanding at a CAGR of 7.54% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical metal tubing market size accounted for USD 756.46 million in 2024 and is predicted to increase from USD 812.59 million in 2025 to approximately USD 1,547.53 million by 2034, expanding at a CAGR of 7.42% from 2025 to 2034. The medical metal tubing market is growing rapidly due to the increasing government funding to improve healthcare infrastructure and the rising demand for medical devices.

AI-based medical equipment has proven effective in improving patient outcomes, treatment customization, and diagnostic accuracy. Integrating Artificial Intelligence algorithms in tubing-based medical devices, such as drug delivery systems, enables monitoring vital signs, detecting anomalies in fluid flow, and predicting potential complications. This further helps healthcare professionals in making informed decisions. Moreover, AI can optimize the design of medical devices, significantly improving performance and lowering the risk of failure.

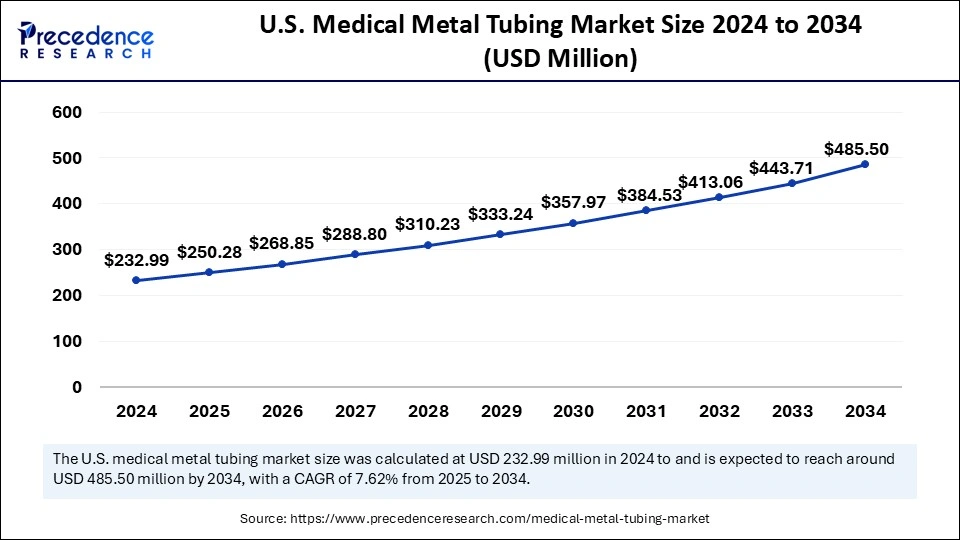

The U.S. medical metal tubing market size was exhibited at USD 232.99 million in 2024 and is projected to be worth around USD 485.50 million by 2034, growing at a CAGR of 7.62% from 2025 to 2034.

North American Medical Metal Tubing Market Trends

North America held the largest market share in 2024 due to the rise in the number of cases of chronic diseases and the aging population. The region’s well-established healthcare infrastructure further bolstered the market in the region. There is a high adoption of medical devices, in which medical tubing plays a crucial role. The U.S. is a major contributor to the market. With the rise in popularity of minimally invasive surgery, the demand for medical tubing has increased in the U.S. According to the U.S. National Institutes of Health (NIH), more than 6 million minimally invasive surgeries were performed in the U.S. in 2023. In addition, the region is at the forefront of healthcare technology, leading to rapid innovations in medical devices and supporting market growth.

Asia Pacific Medical Metal Tubing Market Trends

Asia Pacific is projected to witness the fastest growth in the coming years. The rising burden of chronic diseases, specifically diabetes and cardiovascular disorders, and the growing geriatric population are key factors boosting the market growth in the region. The availability of a huge patient population, affordable healthcare services, and rising research and development activities are changing the landscape of the market in the region. With a high focus on patient-centric care, the demand for sophisticated medical devices is increasing. India can have a stronghold on the region’s market. The increasing patient volume undergoing diagnostic testing and surgical procedures and the rising inpatient admissions support market growth. Moreover, the rising government initiatives to improve healthcare infrastructure contribute to market expansion.

European Medical Metal Tubing Market Trends

Europe is observed to grow at a significant rate in the foreseeable period. The regional market growth is attributed to the region’s well-established healthcare sector. With the rising disposable income, healthcare spending is increasing in the region. This, in turn, boosts the demand for medical devices. The growing aging population, rising number of surgical procedures, and increasing adoption of advanced medical devices drive the growth of the market. Moreover, the presence of some of the leading medical device manufacturing companies in the U.K. and Germany contributes to market growth.

Medical metal tubing plays a significant role in many applications, such as the production of needles, intravenous lines, catheters, and stents. Metal tubing is the best solution due to its high strength, flexibility, and biocompatibility, all of which are required for the safety and efficiency of medical procedures. Tubing is also used as a supporting device and as a drug delivery method for other devices. The excellent flexibility of the metal alloy makes metal tubing suitable for various surgeries, requiring replacing a biological structure or delivering fluids to targeted areas.

Metal tubes are more compatible for healthcare purposes than other traditional tubes. They are increasingly used in surgical instruments and implants like stents, cannulas, spinal cages, and endoscopy equipment. The medical metal tubing market is witnessing rapid growth due to the rising demand for minimally invasive surgery (MIS). Moreover, technological advancements in medical devices and rising healthcare spending support market expansion.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,547.53 Million |

| Market Size in 2025 | USD 812.59 Million |

| Market Size in 2024 | USD 756.46 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.42% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing Aging Population

The growing geriatric population around the world is a major factor driving the growth of the medical metal tubing market. Geriatric people are more prone to chronic diseases, such as diabetes and cardiovascular diseases (CVDs), which often require medical devices made from metal tubing to manage these conditions. Moreover, older adults often experience orthopedic conditions, such as osteoporosis and arthritis, that require medical intervention like surgeries. This, in turn, boosts the demand for implants that are made from metal tubing. The rising prevalence of chronic diseases among older adults further drives the market growth.

According to the research report published by the National Council on Aging (NCOA) in May 2024, about 95% of adults aged 60 and above have at least one chronic condition, while 80% have two or more.

Regulatory Compliance

Medical equipment manufacturers face major challenges in navigating stringent government frameworks, ensuring device traceability and meeting safety standards. Compliance requirements create complexities in approval processes, which delay the product's reach in the market. Furthermore, securing government funding, tax incentives, and subsidized research and development remains a challenge, limiting innovation and increasing production costs.

Demand for Small-diameter Stainless Steel Tubing and Technological Innovations

The increasing demand for small-diameter stainless steel medical metal tubing creates significant opportunities in the market, expanding the scope of applications in diagnostic and surgical instruments. Small-diameter stainless steel tubing finds applications in syringe needles, implantable device components, in vitro diagnostic probes, and marker bands for catheters and guidewires. Advances in material properties and tube design are boosting the development of minimally invasive medical devices, enhancing patient outcomes while reducing technical trauma. Furthermore, innovations such as heat-exchange tubes for blood temperature regulation during surgery, microtools for precision surgical procedures, and stents are expanding the market opportunity.

The stainless steel segment dominated the medical metal tubing market with the largest share in 2024. Stainless steel has high corrosion resistance properties, strength, durability, formability, and reliability. This material is also considered biocompatible. All these factors make stainless steel ideal for medical devices, including medical tubing. Stainless steel can be sterilized easily, reducing the risk of HAIs and surgical site infections (SSIs). Moreover, it can be recycled, reducing waste generation.

The titanium segment is expected to grow at the fastest rate in the coming years. Titanium exhibits great strength-to-weight ratio and corrosion resistance, making it an ideal choice for healthcare applications. It is also lightweight in nature and offers excellent fatigue resistance. Medical equipment exposed to harsh conditions in the body and insufficient durability may lead to device failure or rejection by the body. To address this challenge, titanium tube is the best solution because it is a non-hazardous and biocompatible material, making it suitable for medical applications.

The dialysis or intravenous tubing segment dominated the medical metal tubing market in 2024. This is mainly due to the rise in the prevalence of chronic and kidney failure diseases, which often require intravenous therapies to remove body fluids. These tubing systems are used in dialysis, which removes blood from the patient’s body, purifies it by removing extra fluid and waste, and then returns it to the body. This is also helpful in concentrating on a diluted medical solution. The tubing comes in different dimensions and a broad range of molecular weight cut-offs (MWCO).

The drug delivery systems segment is likely to witness the fastest growth over the studied period. Tubing plays a crucial role in drug delivery systems, ensuring drugs are delivered to the targeted areas, further enhancing patient outcomes. Drug delivery systems have emerged as an alternative to traditional dosing, extending the efficacy of drugs and maintaining drug plasma levels in the therapeutic with negligible adverse effects. The rising demand for targeted therapies is expected to boost segmental growth.

The hospitals segment dominated the medical metal tubing market with the largest share in 2024. The segment growth is driven by the rise in healthcare expenditure and the surge in patient volume in hospitals. The easy availability of advanced medical devices, including drug delivery systems and other tubing-based devices, and skilled healthcare professionals are key factors boosting the volume of patients. In addition, the rise in hospital admissions bolstered the segment’s growth.

The ambulatory surgical centers segment is anticipated to expand at the fastest rate during the forecast period. The segment growth can be attributed to the rapid shift toward outpatient care facilities due to the low cost of care and shorter wait times. Moreover, the rising number of surgeries performed in ambulatory surgical centers boosts the demand for medical metal tubing.

By Product Type

By Application

By End-User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025