Medium-chain Triglycerides Market (By Type: Caproic Acid, Caprylic Acid, Capric Acid, Lauric Acid; By Source: Palm Kernel Oil, Coconut Oil, Others; By Application: Dietary & Health Supplements, Personal Care & Cosmetics, Pharmaceuticals, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

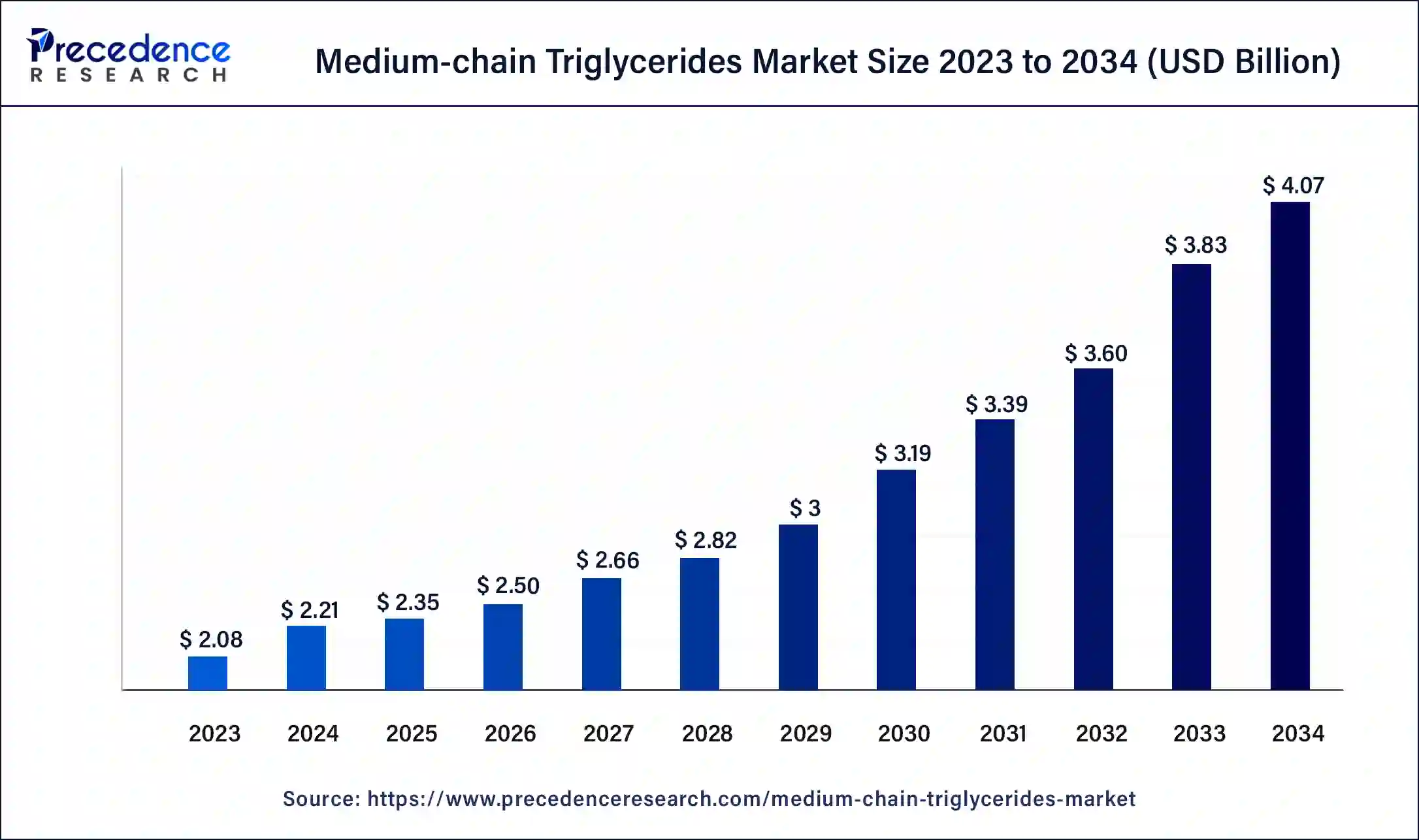

The global medium-chain triglycerides market size was USD 2.08 billion in 2023, accounted for USD 2.21 billion in 2024, and is expected to reach around USD 4.07 billion by 2034, expanding at a CAGR of 6.3% from 2024 to 2034. The medium-chain triglycerides market is driven by expanding awareness of the potential beneficial health effects of medium-chain triglycerides.

The medium-chain triglycerides market revolves around the businesses that include lipids that are frequently found in dairy products and some oils. Triglycerides are medium-length fat chains that make up their composition. In contrast to long-chain triglycerides (LCTs), which comprise most fat in diets, medium-chain triglycerides (MCTs) undergo distinct metabolism within the body. MCTs are swiftly absorbed and sent straight to the liver, where their shorter chain length allows for a speedy conversion into energy.

The medium-chain triglycerides market often offers services that are employed as part of specific ketogenic diets used to treat epilepsy along with other neurological illnesses, as well as in medical nutrition therapy for those with malabsorption disorders such as cystic fibrosis. It is also utilized in agricultural applications like crop protection and enhancement and in animal feed as an energy source for cattle and poultry. Furthermore, because of its possible health advantages, such as enhanced energy, better weight management, and improved cognitive function, it is also frequently offered as a stand-alone dietary supplement.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.3% |

| Global Market Size in 2023 | USD 2.08 Billion |

| Global Market Size in 2024 | USD 2.21 Billion |

| Global Market Size by 2034 | USD 4.07 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Source, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for weight management supplements

More people are utilizing weight management supplements to help them achieve their fitness objectives as there is a growing emphasis on health and wellness. Through boosting fat oxidation, elevating energy expenditure, and encouraging satiety, medium-chain triglycerides (MCTs) aid in weight loss and management. Businesses aggressively advertise MCT-containing supplements for managing weight through advertising campaigns and educational initiatives.

The demand for goods containing MCTs is driven by heightened consumer knowledge of their role in weight management. Because of their unique qualities, MCTs are accepted as a valuable component of diet pills. They are well-liked by customers looking for effective fat-burning remedies because they are quickly absorbed and easily digested. Thereby, the rising demand for weight loss management supplements acts as a driver for the medium-chain triglycerides market.

Rising public awareness of the health advantages of the medium-chain triglycerides

Customers actively seek alternatives to conventional dietary fats and oils as the emphasis on natural and functional components grows. MCTs fit nicely with this trend because they are mainly made from natural sources like coconut and palm kernel oil. Furthermore, MCTs' functional qualities, such as their quick absorption and metabolism by the body, draw in health-conscious customers.

Healthy fat consumption is emphasized by dietary trends like paleo, low-carb, and ketogenic diets, which have led to an increase in demand for MCTs. MCT oil is frequently suggested as a mainstay item in these diets because it promotes ketosis, improves fat burning, and offers long-lasting energy.

The need for goods that enhance performance, facilitate recovery, and promote general health has led to a notable surge in the fitness and sports nutrition business. MCTs have become more prevalent in this market because of their ability to boost muscle repair, operate as a fast energy source, and encourage fat-burning during exercise.

Increasing usage of mineral oils as substitutes

Mineral oils are frequently less expensive than medium-chain triglycerides. Businesses may choose mineral oils to reduce costs because price is essential in many sectors, particularly in the food and cosmetics industries, where profit margins can be narrow. Although consumers and businesses are becoming more aware of the health benefits of MCTs, there may still be a lack of acceptance or understanding. Companies might choose mineral oils because of their well-established track record and widespread acceptance in these situations. Thereby, the increasing utilization of mineral oils as substitutes acts as a restraint for the medium-chain triglycerides market.

Mineral oils can function similarly to MCTs in some situations. Mineral oils and MCTs, for instance, can serve as transporters and emollients for the active components in cosmetics. Companies may choose mineral oils over MCTs due to their functional similarity, especially if they are more readily available or inexpensive.

Rise in demand for natural cosmetic products

A more informed customer base has resulted from increased awareness of the advantages of natural substances and the possible hazards linked with synthetic chemicals. This offers a chance for businesses to use marketing campaigns, instructional materials, and clear labeling to convey the benefits of MCT-based cosmetic products effectively. Additionally, many customers are looking for products with the least possible negative environmental impact. MCTs work well with this philosophy, particularly those derived from palm kernels or coconuts that are farmed responsibly. Companies that put sustainability first in the sourcing and manufacturing of their ingredients stand to gain from this shifting customer attitude.

For cosmetics, medium-chain triglycerides have several valuable advantages. They are the perfect ingredients for lotions, creams, and serums because they are non-greasy, lightweight, and quickly absorbed by the skin. Additionally, MCTs have moisturizing qualities that are useful in skin care products since they can help moisturize and nourish the skin. Thereby, rising demand for natural cosmetics products acts as an opportunity for the medium-chain triglycerides market.

The caprylic acid segment held the largest share of the medium-chain triglycerides market in 2023. Caprylic acid, a medium-chain fatty acid, offers various health benefits, including improved cognitive function, increased energy levels, and potential antimicrobial properties. As consumers become more health-conscious, there is a growing demand for products containing caprylic acid, driving its dominance in the MCT market.

Caprylic acid is easier to digest compared to long-chain fatty acids, making it a popular choice for individuals seeking quick and efficient sources of energy. This digestibility factor contributes to its dominance in the MCT market, especially in applications such as dietary supplements and sports nutrition.

The coconut oil segment led the medium-chain triglycerides market in 2023. The segment is observed to sustain the position during the predicted timeframe. Coconut oil is naturally rich in medium-chain fatty acids, particularly lauric acid, which is a valuable component in MCTs. This abundance makes coconut oil a primary source for MCT production. MCTs derived from coconut oil have been associated with various health benefits, including weight management, improved cognitive function, and increased energy expenditure. These perceived health benefits drive consumer demand for coconut oil-derived MCT products. Coconut oil has good stability and a long shelf life, which makes it a preferred choice for MCT production.

The dietary and health supplements segment dominated the medium-chain triglycerides market with the largest share in 2023. MCTs' potential health benefits, such as enhanced energy, better digestion, and enhanced cognitive function, have been validated by scientific research, which has increased their appeal as supplements. Because MCTs can boost metabolism and encourage fat burning, they have become increasingly popular weight management tools. This aligns with the growing consumer trend toward fitness and weight control. Because MCTs are so adaptable, customers may simply incorporate them into their daily routines by using them in various supplement forms, including drinks, powders, and capsules.

North America had the largest share in the medium-chain triglycerides market in 2023. Customers in North America are becoming more conscious of the health advantages of MCT oil, which is driving up demand for MCT-based goods. It offers a broad selection of MCT-infused goods to suit the tastes and lifestyles of a broad spectrum of customers, including functional meals, beverages, and nutritional supplements.

Further, there has been a strong trend in health and wellness, with customers actively looking for items that support MCT consumption-related benefits like weight control, energy enhancement, and cognitive function.

Asia-Pacific shows a significant growth in the medium-chain triglycerides market during the forecast period. Asia-Pacific consumers are becoming more health-conscious and are looking for functional foods and components like MCTs, which have been shown to provide potential health benefits such as better energy and weight management. Because of their moisturizing qualities and excellent skin penetration, MCTs are also finding use in the personal care industry, notably in skincare and haircare products.

Segments Covered in the Report

By Type

By Source

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client