January 2025

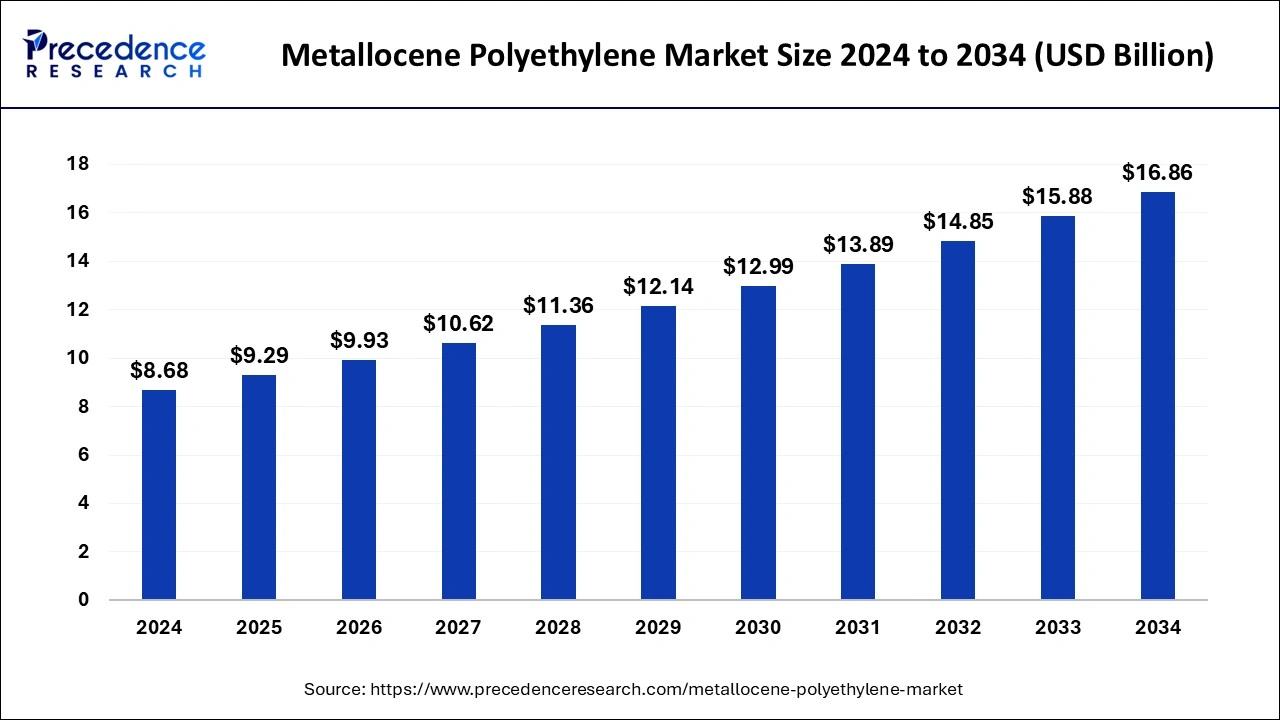

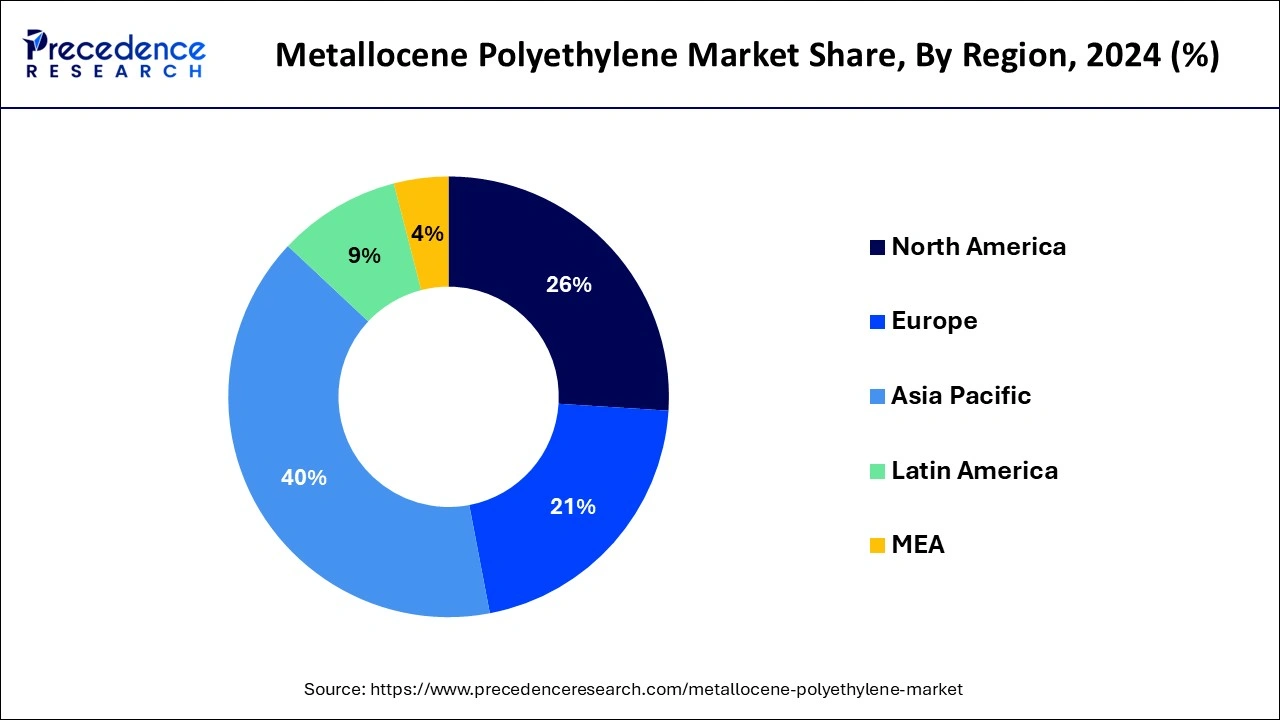

The global metallocene polyethylene market size is accounted at USD 9.29 billion in 2025 and is forecasted to hit around USD 16.86 billion by 2034, representing a CAGR of 6.86% from 2025 to 2034. The North America market size was estimated at USD 3.47 billion in 2024 and is expanding at a CAGR of 7.01% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global metallocene polyethylene market size was calculated at USD 8.68 billion in 2024 and is predicted to increase from USD 9.29 billion in 2025 to approximately USD 16.86 billion by 2034, expanding at a CAGR of 6.86% from 2025 to 2034. Metallocene polyethylene is used in industrial, building, construction, agriculture, and packaging applications.

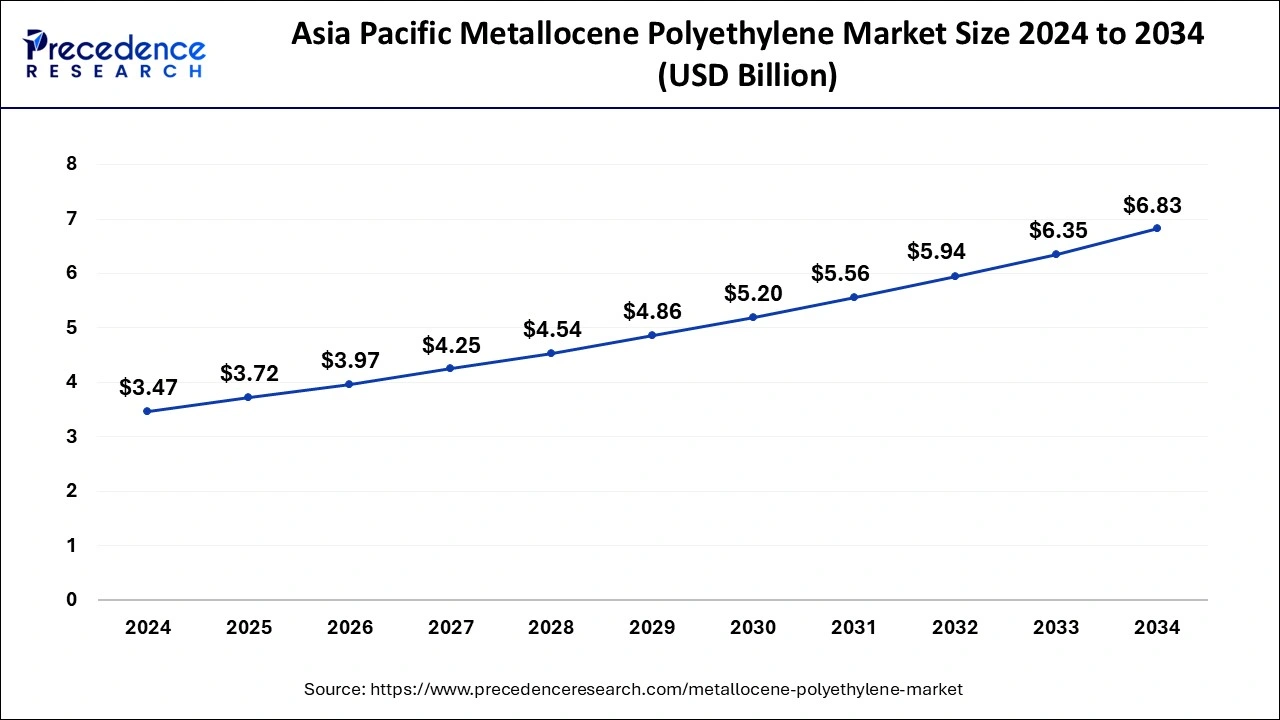

The Asia Pacific metallocene polyethylene market size was exhibited at USD 3.47 billion in 2024 and is projected to be worth around USD 6.83 billion by 2034, growing at a CAGR of 7.01% from 2025 to 2034.

Asia Pacific held the largest share of the market while contributing 40% of the market share in 2024. Increasing demand for disposable products, consumer products, and packaged products helps the growth of the market in this region. In infrastructure development, the materials that are needed are wrapped or packed with the help of metallocene polyethylene. China and India are the leading countries in the metallocene polyethylene market of the Asia Pacific region. China’s leading polypropylene and polyethylene manufacturers company in July 2023 launched the NXBF Chemical Technology Group. It has easily achieved metallocene polyethylene mass production, uses metallocene polyethylene as a polymerization catalyst, and is different from the traditional catalysts. It has a better toughness degree, transparency, flexibility, and texture.

Currently, the annual growth rate in Western developed countries is 15% of the metallocene polyethylene products, and in developed countries, it is expected that half of the growth comes from the metallocene products of linear low-density polyethylene production. In January 2024, in India, quality control measures were established for the polyethylene regulations under the Bureau of Indian Standards (BIS) Act, 2016. It includes LDPE extrusion coating, LDPE film grades or pharma, LLDPE butene grades, LLDPE hexene or octene grades, metallocene grades, base resins of jacketing, power cable, and other applications.

North America is observed to grow at a CAGR of 6.14% during the forecast period. America’s polyethylene division, Chevron Phillips Chemicals, produces metallocene polyethylenes, MDPE, LLDPE, LDPE, and HDPE. Packaging is in high demand due to its eco-friendly alternative to food packaging. The United States in the North American region is the largest market for the market. This is due to the versatile applications and unique properties among the many industries. Metallocene polyethylene is highly used for different purposes in different industries like healthcare, food and beverages, renovation, and building industries. These factors help the growth of the market in the North American region.

The metallocene polyethylene is prepared by utilizing metallocene catalysts during the polymerization process and normally includes copolymers such as hexene or ethene and has exceptionally high toughness, narrow molecular weight distribution, uniform comonomer content, and excellent optical properties. The metallocene polyethylene market deals with various industries like healthcare, agriculture, building and construction, automotive, food and beverages, and packaging for different applications.

Metallocene polyethylene applications such as medical products, polymer modification, hose or tubing, cable or wire, stretch or shrink films, rigid food packaging, flexible food packaging, consumer or industrial packaging, non-packaging films, and non-food packaging. In automotive products, it is used in greenhouse film, silage, bale wrap, tunnels, and mulching. These applications of various industries lead to the growth of the market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.86% |

| Market Size in 2025 | USD 9.29 Billion |

| Market Size in 2024 | USD 8.68 Billion |

| Market Size by 2034 | USD 16.86 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Catalyst Type, and End-use Industry Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Expansion of applications

Metallocene polyethylene has increasing demand in numerous industries due to its various advantages, which include increased toughness, reduced haze, elimination of the non-targeted molecular weight species in resins, offering control of the MWD (molecular weight distribution), and it also provides excellent organoleptic, which contributes to the growth of the market.

The products made from metallocene polyethylene include the elimination of very low and very high molecular weight polymer components and structural uniformity. These are used in hygiene for disposals and diapers, in medical for operation covers and gowns, in filtration for air purification systems, in wet wipes, in households for disposable products, upholstery, mattress covers, and in geotextiles. These various applications of metallocene polyethylene in different industries help the growth of the metallocene polyethylene market.

Environmental impacts

Metallocene polyethylene has the bad effects on the environment. The degradation of metallocene polyethylene can produce toxins that contaminate the waterways and soils, enter into the food chain, and are harmful to animals and plants. It is harmful to human health and environmental sustainability. Some limitations of metallocene polyethylene include poor temperature capability, flammability, difficulty in bonding, subject to stress cracking, poor weathering resistance, and high thermal expansion. Metallocene polyethylene has insufficient recycling efficiency, which has negative effects on the environment. Million tons of metallocene polyethylene impurities accumulate in the marine or terrestrial environments. These factors may restrict the growth of the metallocene polyethylene market.

Rising investments in research and development

Increasing investment in research and development for lowering production costs, increasing metallocene polyethylene properties, and expanding the applications that can help the growth of the market. Development of new technologies for the reduction of bad environmental effects. Improvement in the technologies for degradation of the metallocene polyethylene for environmental sustainability and human health. These factors help the growth of the metallocene polyethylene market.

Demand for specialized materials

The metallocene catalysts can allow the synthesis of polyolefin composite materials, atactic polymers, stereoblock polymers, syndiotactic, isoblock, and isotactic with a low content of extractables and superior properties. Metallocene polyethylene is used in specialized materials production due to its improved mechanical properties. The properties also include strength, processability, toughness, stiffness, and narrow molecular weight distribution. These help with the production of specialized materials and contribute to the growth of the market.

The mLLDPE segment dominated the market in 2024. Metallocene linear low-density polyethylene (mLLDPE) is an efficient performance polymer that offers increased flexibility, processability, and mechanical properties than conventional LLDPE. It has improved mechanical properties like tear strength, puncture resistance, and higher tensile strength. The benefits include state-of-the-art optical properties, excellent sealing properties, very good tear resistance, very dart drop value, processability because of the next-generation mLLDPE technology, and highly demanding industrial films.

The applications of metallocene polyethylene include high-demanding industrial films, lamination films, multi-layer films for food and non-food applications, stretch hood or stretch films, and cast-blown films. When maintaining performance at thinner gauges, mLLDPE products provide cost reduction through remarkable down gauging. These contribute to the growth of the segment and help the growth of the metallocene polyethylene market.

The mHDPE segment is the fastest growing during the forecast period. Metallocene high-density polyethylene (mHDPE) exhibits environmental stress crack resistance, impact strength, and excellent stiffness properties. It also has some advantages, including pipe extrusion, injection molding, and blow molding. mHDPE advantages include stiff materials, resistance to most chemical solvents, dishwasher safe, UV-resistant, non-leaching, may withstand temperatures from -148°F to 176°F, and cost-effective. Other properties of metallocene polyethylene include UV resistance and many times; it is used in children's outdoor playground types of equipment.

It is an appropriate option for outdoor applications. It can produce opaque packaging products. It is used in blown mold containers and extruded packaging films. These factors contribute to the growth of the segment and help the growth of the metallocene polyethylene market.

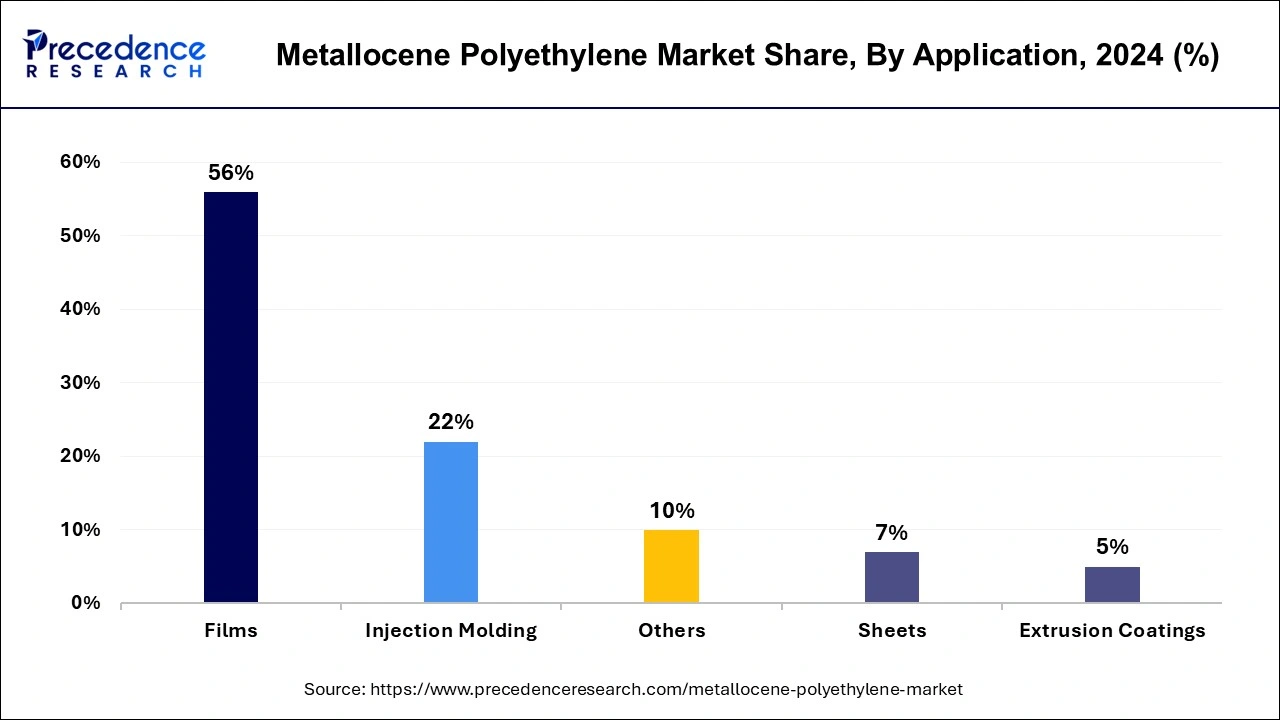

The films segment dominated the metallocene polyethylene market in 2024. In the medical packaging industry, metallocene polyethylene is used in film. The films have improved clarity and reduction of crystallinity and initial seal temperatures. It provides many advantages to the packaging industries. The properties of the film include clarity, toughness, strength, and uniform molecular structure. The film is used in food packaging to replace cellophane in tobacco and snack packaging because of its low cost and favorable properties.

The films are used in shrink-wrap applications as heat-shrinkable films. Metallocene polyethylene is a new generation of polyethylene that is utilized in many film applications, including industrial, building, construction, agriculture, and packaging. These factors help the growth of the segment and contribute to the growth of the market.

The sheets segment is the fastest growing during the forecast period. Metallocene polyethylene is used in the sheets due to their properties like thermoformability, elasticity, dead fold properties, printability, confirmability, drape, stress relaxation, heat sealability, mechanical properties, and processability which helps the growth of the metallocene polyethylene market.

The zirconocene segment dominated the metallocene polyethylene market in 2024. The synthesis of the polypropylene is done with the help of three types of zirconocene catalysts. The zirconocene catalysts include advantages such as low cost, low toxicity, high catalytic activity, and strong coordination ability. These are used in the organic reactions. The zirconocene catalyst is 10 to 100 times more active than the Ziegler catalyst. The zirconocene catalysts are used in the polymerization of the ethylene. These factors help the growth of the segment and contribute to the growth of the market.

The packaging segment dominated the market in 2024. Metallocene polyethylene is used for food packaging such as candies, deli bags or wraps, cheese wrap, poultry, meat, frozen foods, baked goods, and fresh produce. Metallocene polyethylene is generally used in the world for packaging and various industrial applications. It is mostly used in the product packaging. Metallocene polyethylene is used in the production of containers, geomembranes, bottles, plastic films, and plastic bags. It has a very low density that may help the manufacturers save money while distributing large quantities of products. These factors help the segment grow.

By Type

By Application

By Catalyst Type

By End-use Industry Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

February 2025