June 2025

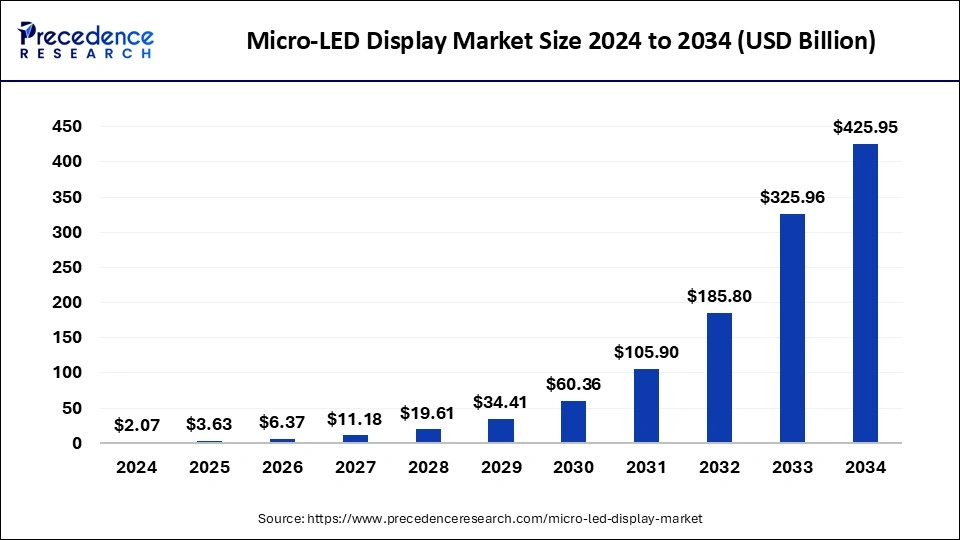

The global micro-led display market size is calculated at USD 3.63 billion in 2025 and is forecasted to reach around USD 425.95 billion by 2034, accelerating at a CAGR of 70.35% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global micro-led display market size was estimated at USD 2.07 billion in 2024 and is predicted to increase from USD 3.63 billion in 2025 to approximately USD 425.95 billion by 2034, expanding at a CAGR of 70.35% from 2025 to 2034. When it comes to contrast ratios and brightness, micro-LED displays outperform conventional LCD and OLED displays. Images, as a result, are sharper and more colorful.

The business sector and industry involved in the development, production, and distribution of micro-LED display technology and goods is referred to as the micro-LED display market. In comparison to more conventional display technologies like LCD and OLED, micro-LED or microLED is a newly developed flat-panel display technology that uses tiny light-emitting diodes (LEDs) to produce high-resolution displays with improved brightness, color accuracy, and energy efficiency. Micro-led technology research and innovation encompass advancements in materials, production techniques, and device architectures. Improvements in transfer methods for precisely positioning micro-LEDs on surfaces. Specialized uses for virtual reality (VR) and augmented reality (AR) headsets, car displays, and medical equipment.

When compared to OLED and LCD technologies, micro-LEDs provide superior brightness, color accuracy, energy economy, and lifespan. Market expansion is being driven by the rising utilization of high-end smartphones, smartwatches, and TVs. Costs are coming down, and yield rates are increasing because of improvements in production techniques. The growing popularity of augmented reality and virtual reality applications is driving up demand for small, high-resolution displays. The micro-LED display market is expected to develop significantly due to its excellent performance attributes and growing ubiquity in a wide range of applications. Even if scalability and manufacturing present certain difficulties, continuous improvements in technology and manufacturing techniques are anticipated to resolve these problems, positioning micro-LEDs as a major force in the development of display technology.

| Report Coverage | Details |

| Market Size by 2034 | USD 425.95 Billion |

| Market Size in 2024 | USD 2.07 Billion |

| Market Size in 2025 | USD 3.63 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 70.35% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Applications, Panel Size, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Longevity and durability

The micro-LED display market is gaining momentum quickly because of its better performance features than LCD and OLED, two conventional display technologies. Micro-led screens are renowned for having an extended working life often more than 100,000 hours. This is a substantial increase over LCD and OLED screens combined. Micro-led screens are significantly less prone to burn-in than OLED displays, which, over time, can result in irreversible damage from static pictures. They are, therefore, appropriate for uses in which static content is shown for long stretches of time. Compared to OLEDs, which can deteriorate in such circumstances, micro-LEDs are more resilient to environmental variables like humidity and temperature swings, as well as physical damage.

Limited production capacity

The primary cause of the low production capacity of the micro-LED display market is the intricate nature of the manufacturing process. Compared to conventional LED and OLED displays, micro-LED technology has many benefits: greater brightness, reduced power consumption, quicker response times, and improved color accuracy. However, creating micro-LED displays necessitates complex semiconductor manufacturing processes, such as placing tiny LEDs precisely on a substrate—often with the aid of sophisticated pick-and-place equipment. Micro-LED display manufacturing entails a number of complex processes, such as chip processing, pixel testing, transfer printing, and epitaxial growth. Scaling up production is difficult since each stage requires specialized tools and knowledge.

Augmented reality (AR) and virtual reality (VR)

Within the display technology industry, integrating virtual reality (VR) and augmented reality (AR) with micro-LED displays is an intriguing path. Products of the micro-LED display market are perfect for immersive AR and VR experiences because of their many benefits, including high brightness, low power consumption, and excellent contrast ratio. Micro-LED displays have the ability to superimpose digital data onto the physical world in augmented reality (AR) with remarkable brightness and clarity, improving user experiences in applications such as gaming, navigation, healthcare, and education. One of the main advantages of micro-LED AR displays is the smooth integration of virtual objects into the actual surroundings. Micro-LED displays minimize the risk of motion sickness by lowering latency and motion blur in virtual reality applications. They also offer high pixel density and quick response times.

The smartphones & tablets segment dominates the micro-LED display market. The market for micro-LED displays, which includes tablets and smartphones, is a growing industry propelled by customer desire for better display quality and technological breakthroughs. Higher brightness and contrast ratios can be attained using micro-LED displays, improving visibility under a range of lighting circumstances. When compared to OLED displays, micro-LED displays are more robust and have a longer operational lifespan. The need for screens with better image quality is growing as more people use their devices for work-related tasks, gaming, and media consumption. We anticipate a large cost drop as manufacturing techniques advance, bringing micro-LED screens closer to the mainstream.

The heads-up display segment is expected to be the fastest-growing micro-LED display market during the forecast period. Within the micro-LED display market, Heads-Up Displays (HUDs) represent a large and developing market segment. There are a number of benefits to integrating micro-LED technology into head-up displays (HUDs), especially in the automotive, aviation, and augmented reality (AR) industries. Using a transparent surface like a windshield or visor, HUDs project information directly onto it so users may access data without shifting their normal angles of view. Micro-LEDs are perfect for visibility in a variety of lighting settings, including direct sunshine, because of their extreme brightness and contrast. This market is expected to be dominated by automotive HUDs because of the growing popularity of smart and driverless cars.

The micro-displays segment held the largest share of the micro-LED display market in 2024. Within the micro-LED display market, the micro-displays segment is a specialized and quickly expanding field that focuses on miniature displays that are often utilized in applications that call for high resolution and efficiency in a small form factor. These micro-displays differ from larger displays in that they have unique features and uses. Micro-displays are able to provide sharp, detailed images even on very small screens because of their exceptionally high pixel density. Because of the energy economy of micro-LED technology, micro-displays are perfect for battery-operated gadgets. Micro-displays are advantageous for wearable devices like fitness trackers and smartwatches because of their compact size and low power consumption.

The small & medium-sized panels segment is observed to grow at a notable rate in the micro-LED display market during the forecast period. When compared to OLED and LCD, micro-LEDs provide better brightness, contrast, and energy efficiency, which makes them very popular for high-end applications. Compact, high-quality displays are becoming more and more in demand as smartwatches, fitness trackers, and AR/VR headsets gain traction. The viability of micro-LED technology for small and medium-sized panels is increasing due to advancements in production procedures, including yield management and mass transfer. One major growth driver in consumer electronics is the demand for lighter, more energy-efficient, and higher-resolution screens. Potential development areas outside of consumer electronics include industrial applications, medical devices, and vehicle displays where the special benefits of micro-LEDs can be used.

The consumer electronics segment held the largest share of the micro-LED display market in 2024. Within the micro-LED display market, the consumer electronics segment is a dynamic and quickly developing industry. The adoption of advanced display technologies, such as micro-LEDs, is driven by a growing customer appetite for high-quality display experiences. Micro-led screens are becoming more practical and affordable due to ongoing advancements in manufacturing techniques. Since micro-LEDs use less power than their predecessors, there is an increasing demand for energy-efficient devices. Because of their longer longevity and resistance to burn-in, micro-LEDs are a desirable option for devices with extended operational lifespans. Although the cost of manufacturing micro-LED displays is now higher than that of other technologies, expenses should go down when economies of scale and breakthroughs are realized.

The entertainment segment is expected to grow at the fastest rate in the micro-LED display market during the forecast period. High-end television sets are starting to use micro-LED technology, which offers unparalleled picture quality. With its modular design, the "The Wall" micro-LED TV from Samsung, for example, enables users to alter the dimensions and appearance of their screen. Because of their tremendous brightness and scalability, micro-LEDs are utilized for large-scale displays in stadiums, concert halls, and other large venues. They also work well both indoors and outdoors. Micro-LEDs' high pixel density and low latency make them perfect for VR and AR applications, resulting in images that are sharper and more responsive. This is essential for improving the virtual environment user experience and lowering motion sickness.

Asia Pacific held the dominating share of the micro-LED displays market. The use of micro-LED screens in smartphones, smartwatches, and AR/VR gadgets propelled this category to hold the highest market revenue share in 2024. This growth is being driven by the growing need for energy-efficient, high-resolution displays with improved performance and design. Micro-led technology is being quickly embraced by the APAC automotive industry, especially for advanced lighting systems seen in electric and driverless vehicles.

Several display manufacturers unveiled new micro-LED display prototypes that mainly target public displays, automotive, and virtual studios, accelerating the adoption of micro-LED displays in the region. For instance, in May 2024, Samsung Electronics unveiled Korea’s largest 114-inch MICRO LED and strengthened its presence in the ultra-premium TV market, delivering the best picture quality and providing an immersive viewing experience in any environment.

Applications, like advanced forward lighting (AFL) and advanced driver assistance systems (ADAS), are included in this, as they are essential for improving the operation and safety of vehicles. The Asia Pacific micro-LED market is expected to grow as a result of strategic government backing, growing demand from a variety of industries, and technological improvements.

North America is expected to host the fastest-growing micro-LED display market over the foreseeable future. The application, pixel pitch, and end-user industry segments of the North American micro-LED display market are separated. Digital signage, vehicle displays, professional displays, and consumer electronics (smartphones, TVs, and smartwatches) are some of the major applications. Displays are further divided into small, medium, and big categories by pixel pitch in the market, which aids in focusing on certain client preferences and market demands.

Automakers are investigating because of their brightness, color accuracy, and robustness, which make them ideal for instrument clusters and infotainment systems. Digital signage applications benefit from the versatility of micro-LED displays since they allow for big, seamless displays with brilliant colors and the possibility of transparent display solutions.

By Applications

By Panel Size

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2025

October 2023

December 2024

August 2024