September 2024

Milk Protein Market (By Product Type: Concentrates, Hydrolyzed, Isolates, Others; By Form: Powder, Liquid; By Application: Food & Beverages, Nutraceuticals & Dietary Supplements, Pharmaceutical, Cosmetics & Personal Care, Infant Formula, Pet Care Industry, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

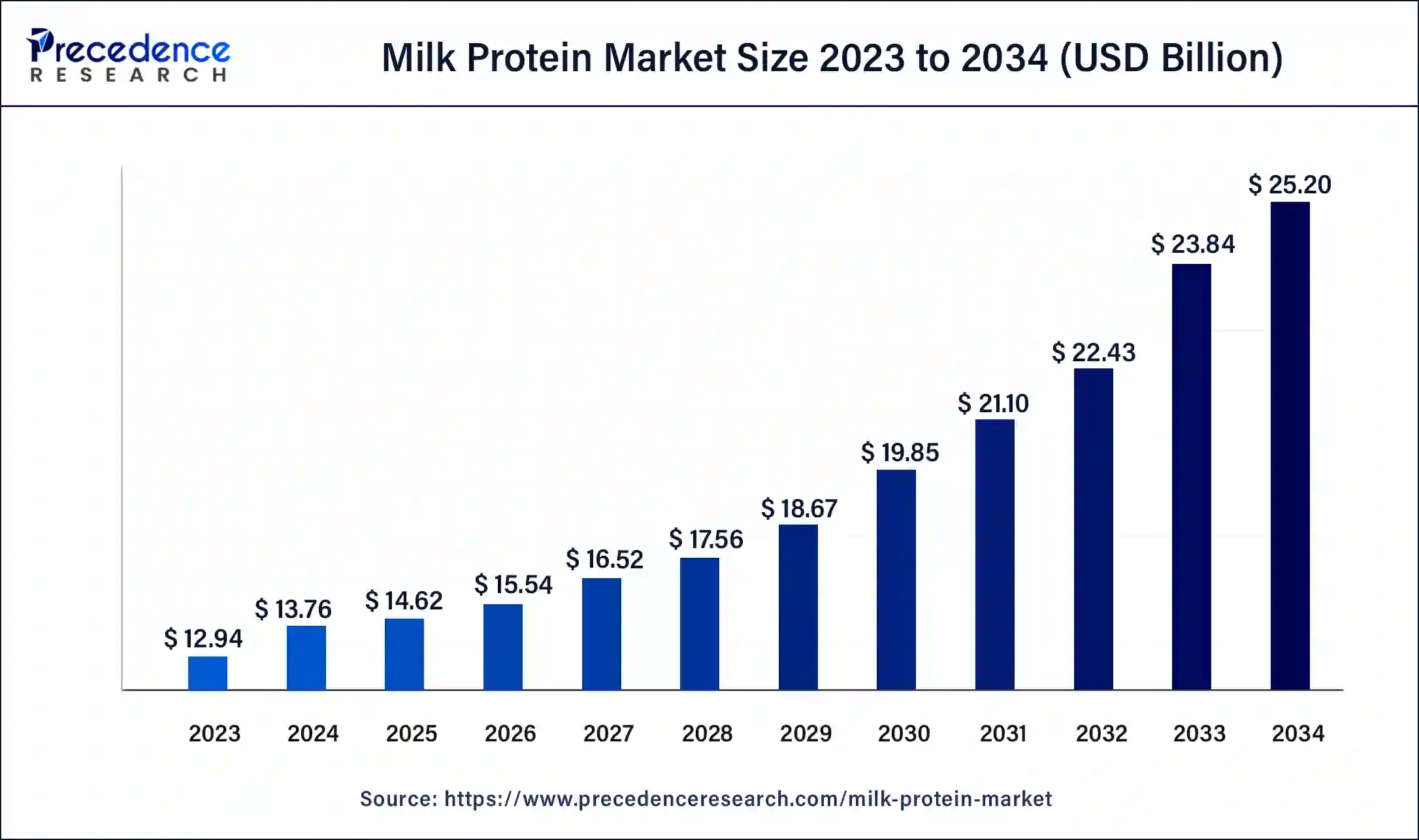

The global milk protein market size was USD 12.94 billion in 2023, calculated at USD 13.76 billion in 2024 and is expected to reach around USD 25.20 billion by 2034, expanding at a CAGR of 6.24% from 2024 to 2034.

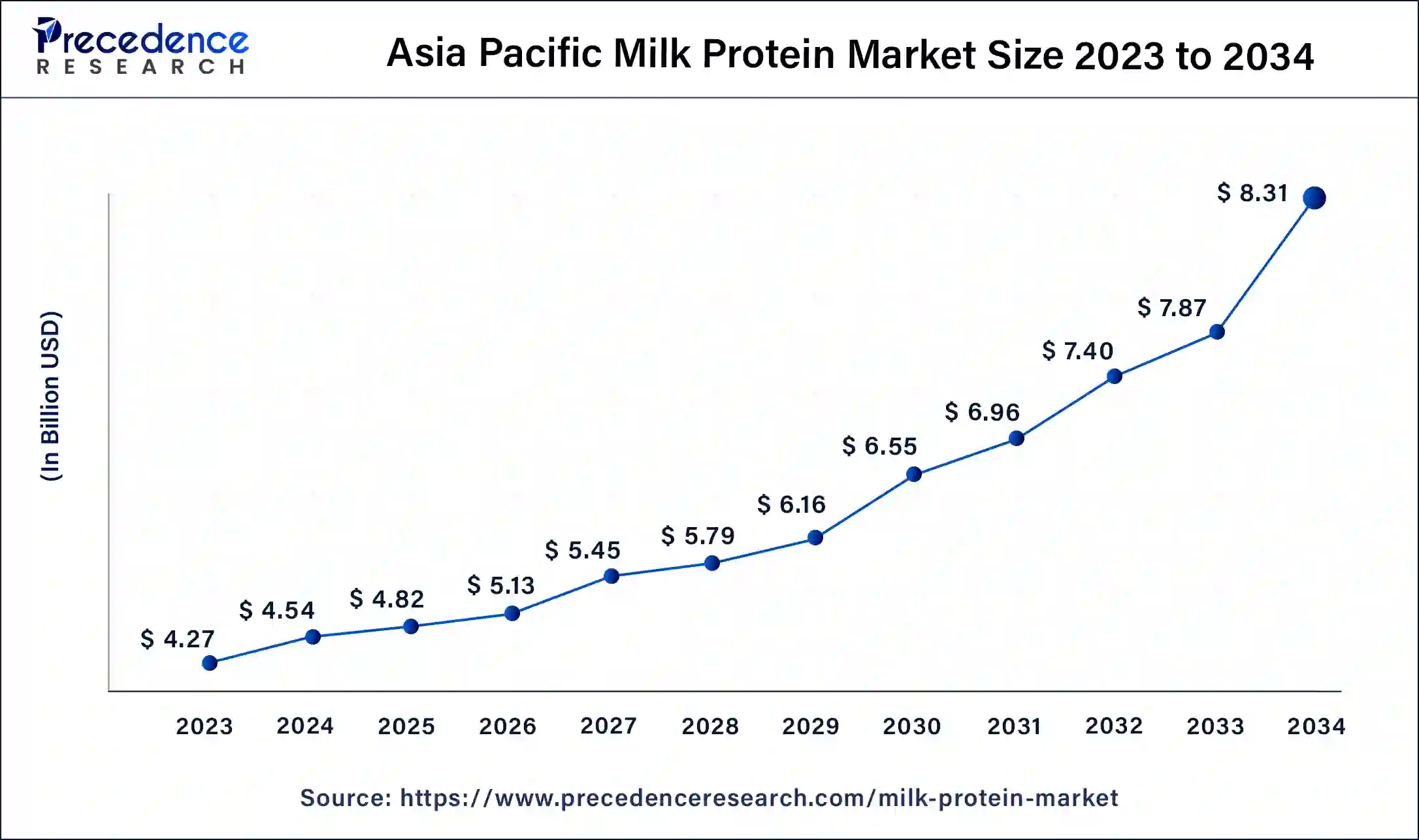

The Asia-Pacific milk protein market size was estimated at USD 4.27 billion in 2023 and is projected to surpass around USD 8.31 billion by 2034 at a CAGR of 7% from 2024 to 2034.

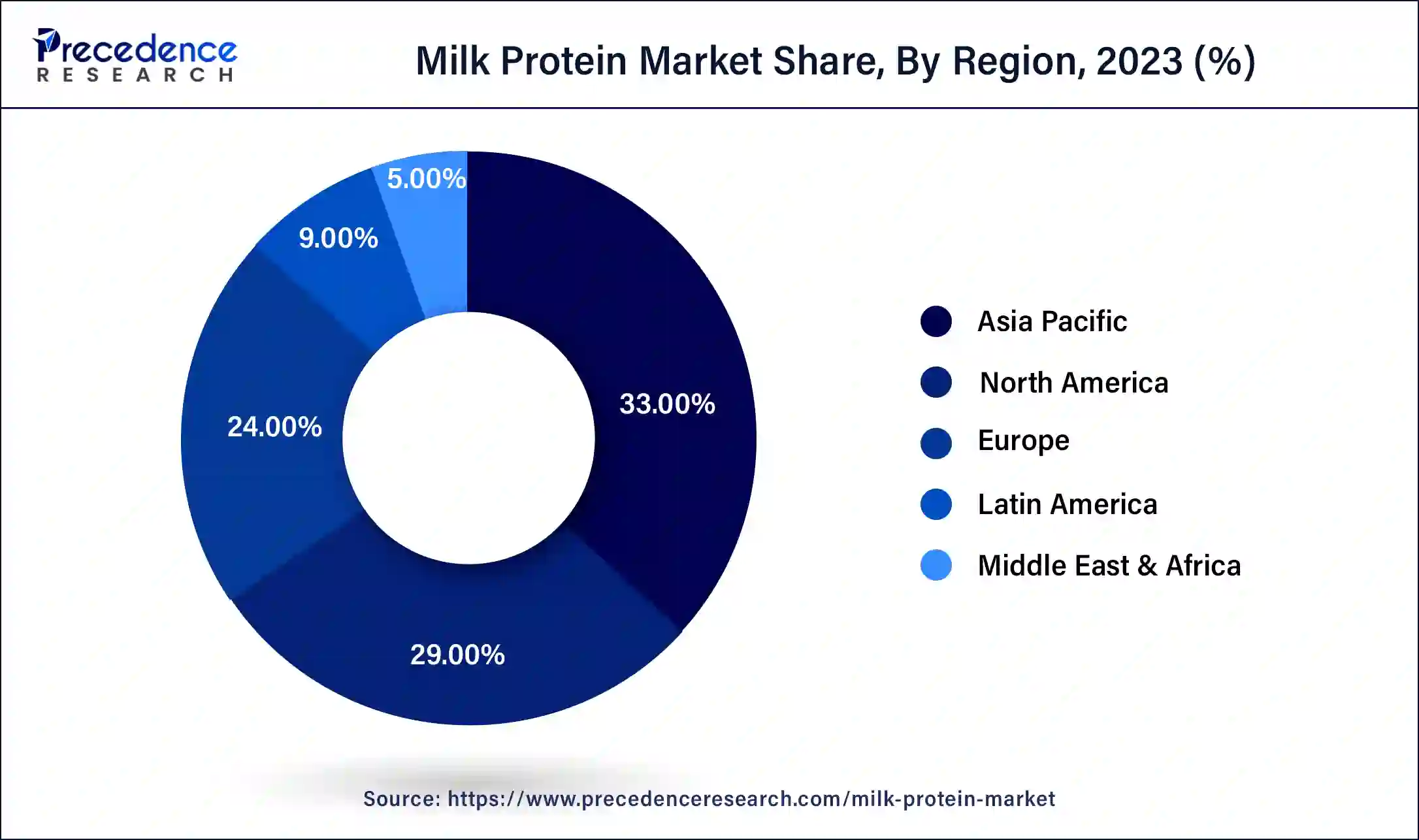

Asia-Pacific held a share of 33% in the milk protein market in 2023 due to several factors such as large population, increasing disposable incomes, and changing dietary preferences towards protein-rich foods contribute to its significant market presence. Additionally, rising health consciousness and awareness of the nutritional benefits of milk protein drive demand in countries like China, India, and Japan. Moreover, the presence of key dairy-producing nations and growing investments in food and beverage industries further propel the market's growth and dominance in the Asia-Pacific region.

The North America region is experiencing rapid growth in the milk protein market due to several factors. Increasing consumer awareness about the health benefits of protein, coupled with a growing demand for functional foods and beverages, is driving market expansion. Additionally, the popularity of high-protein diets and sports nutrition products has surged, further boosting the demand for milk protein-based supplements. Innovations in processing technologies and product formulations are also contributing to market growth, meeting the evolving preferences of health-conscious consumers in the region.

Meanwhile, Europe is experiencing notable growth in the milk protein market due to several factors. Increasing consumer awareness about the health benefits of milk protein, such as muscle building and weight management, is driving demand. Additionally, advancements in processing technologies have led to the development of innovative milk protein products with improved functionality, appealing to a broader consumer base. Furthermore, the rise of sports nutrition and functional food sectors in Europe has created opportunities for milk protein manufacturers to diversify their product offerings and expand their market presence, contributing to overall market growth.

Milk protein is a type of nutrient found in milk and dairy products. It is made up of two main types: casein and whey protein. Casein forms the majority of milk protein and is known for its slow digestion rate, providing a steady release of amino acids into the bloodstream. Whey protein, on the other hand, is quickly absorbed by the body and is often used in sports supplements due to its ability to promote muscle growth and recovery.

In addition to supporting muscle health, milk protein also plays a role in various bodily functions, including immune system regulation and hormone production. It is a valuable source of essential amino acids, which are the building blocks of proteins that our bodies cannot produce on their own. Milk protein is commonly used in a wide range of food products, including yogurt, cheese, protein shakes, and nutrition bars, contributing to their nutritional content and providing consumers with important health benefits.

Milk Protein Market Data and Statistics

| Report Coverage | Details |

| Global Market Size by 2034 | USD 25.20 Billion |

| Global Market Size in 2023 | USD 12.94 Billion |

| Global Market Size in 2024 | USD 13.76 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.24% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Form, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of lactose intolerance

The rising prevalence of lactose intolerance is boosting the growth of the milk protein market as an alternative source of protein for individuals who cannot tolerate lactose, a sugar found in milk. Lactose intolerance is a condition where the body lacks the enzyme lactase needed to digest lactose properly, leading to digestive discomfort such as bloating, gas, and diarrhea after consuming dairy products. As a result, people with lactose intolerance often seek lactose-free or low-lactose alternatives to meet their nutritional needs.

Milk protein, particularly whey and casein protein isolates, offers a solution for individuals with lactose intolerance by providing high-quality protein without the lactose content found in whole milk. These milk protein supplements and fortified products cater to consumers looking for dairy-free protein options, contributing to the growth of the milk protein market. As awareness of lactose intolerance increases and more people seek dairy alternatives, the demand for milk protein products is expected to continue rising, driving market expansion in the coming years.

Increasing competition from plant-based protein alternatives

Increasing competition from plant-based protein alternatives poses a restraint on the market demand for milk protein. As more consumers opt for plant-based diets due to health, environmental, or ethical reasons, the demand for dairy-free protein sources rises. Plant-based protein options like soy, pea, and almond protein offer alternatives to traditional milk protein products, appealing to vegans, vegetarians, and those with lactose intolerance or dairy allergies. This competition from plant-based alternatives reduces the market share of milk protein products, limiting their overall demand.

Moreover, advancements in plant-based protein technology have led to the development of products that closely mimic the taste, texture, and nutritional profile of dairy proteins. These plant-based alternatives offer comparable protein content and functionality, further challenging the dominance of milk protein in the market. As a result, milk protein manufacturers face pressure to innovate and differentiate their products to maintain consumer interest and compete effectively in an increasingly crowded protein market.

Targeting health-conscious consumers with specialized protein formulations

Targeting health-conscious consumers with specialized protein formulations presents significant opportunities in the milk protein market. As more individuals prioritize their health and fitness goals, there is a growing demand for protein-rich products that cater to specific dietary needs and preferences. Milk protein, known for its high-quality amino acid profile and digestibility, is well-positioned to meet these requirements. By developing specialized formulations such as low-fat, high-protein dairy products or protein-fortified snacks, manufacturers can capitalize on the increasing consumer interest in healthier food options.

Furthermore, the rising popularity of functional foods and beverages presents an avenue for innovation in milk protein formulations. Products fortified with milk proteins can offer additional health benefits beyond basic nutrition, such as muscle recovery, satiety, and immune support. By targeting health-conscious consumers with these value-added propositions, companies can differentiate their offerings in the market and tap into a lucrative segment of the population seeking convenient yet nutritious options for their active lifestyles.

The hydrolyzed segment held the largest market share of 45% based on the product type. The hydrolyzed segment in the milk protein market refers to proteins that have been broken down into smaller peptides through hydrolysis, making them easier to digest and absorb. This segment is witnessing increasing demand due to its enhanced solubility, rapid absorption, and reduced allergenic potential compared to intact proteins. Hydrolyzed milk proteins are widely used in infant formula, sports nutrition, and medical nutrition products. As consumers seek faster recovery and better nutrient absorption, the hydrolyzed segment continues to grow.

The isolates segment is anticipated to witness rapid growth at a significant CAGR of 6.6% during the projected period. In the milk protein market, isolates refer to concentrated forms of milk proteins where the protein content is significantly higher compared to other components like fat and carbohydrates. Isolates are produced through filtration processes that remove most of the non-protein components, resulting in a purer protein product. A trend in this segment is the increasing demand for whey protein isolates, driven by their high protein content, fast absorption rate, and versatility in various applications such as sports nutrition, dietary supplements, and functional foods.

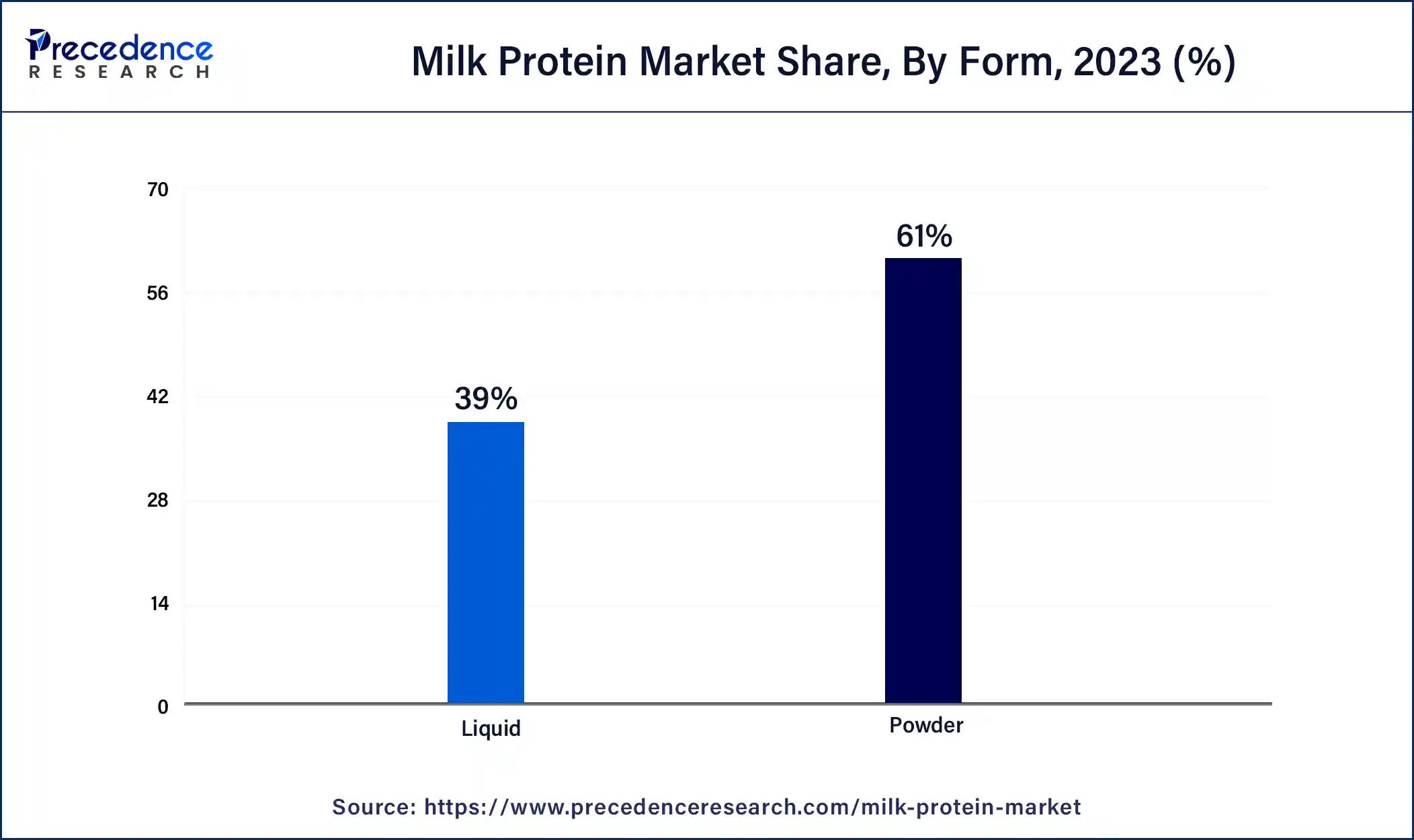

The powder segment held a 61% market share in 2023. In the milk protein market, the powder segment refers to milk protein products that have been processed into a powdered form. This includes whey protein powder, casein protein powder, and blends of both. Powdered milk protein products are versatile and convenient, allowing for easy incorporation into various food and beverage applications, such as protein shakes, smoothies, and baking recipes. Recent trends in this segment include the development of flavored and functional powder formulations to cater to diverse consumer preferences and nutritional needs.

The liquid segment is anticipated to witness rapid growth over the projected period. In the milk protein market, the liquid segment refers to products that are in liquid form, such as milk, yogurt drinks, and protein shakes. This segment encompasses ready-to-drink beverages and dairy-based liquids fortified with milk proteins like whey and casein. Trends in the liquid segment include the introduction of flavored milk protein drinks, convenient on-the-go protein shakes, and innovative formulations targeting specific consumer needs, such as high-protein yogurts and smoothies.

The food & beverages segment has held 22% market share in 2023. In the milk protein market, the food and beverages segment refer to the incorporation of milk proteins into various food and drink products. This includes dairy products like yogurt, cheese, and milk-based beverages, as well as non-dairy items such as protein bars, shakes, and baked goods. A prominent trend in this segment is the development of functional foods and beverages fortified with milk proteins to enhance nutritional value, cater to health-conscious consumers, and meet the growing demand for protein-rich options in the market.

The nutraceuticals & dietary supplements segment is anticipated to witness rapid growth over the projected period. In the milk protein market, the nutraceuticals and dietary supplements segment refers to products specifically formulated to enhance health and well-being. This includes protein powders, capsules, and bars designed to support muscle growth, weight management, and overall nutrition. Recent trends indicate a growing demand for milk protein-based supplements due to their perceived effectiveness in promoting muscle recovery, satiety, and overall fitness. Manufacturers are innovating with flavored variants, convenient packaging, and personalized nutrition solutions to cater to diverse consumer preferences within this segment.

Segments Covered in the Report

By Product Type

By Form

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

April 2025

August 2024