August 2024

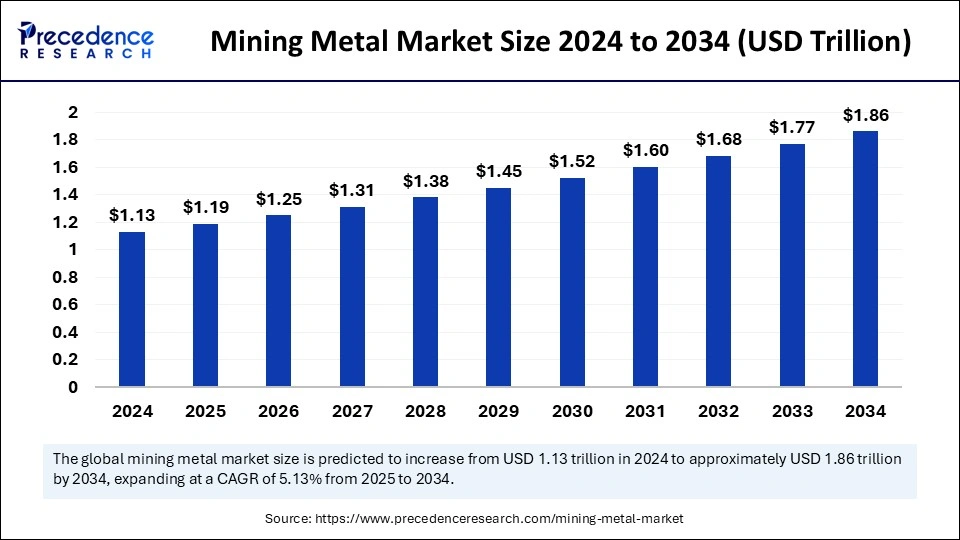

The global mining metal market size is accounted at USD 1.19 Trillion in 2025 and is forecasted to hit around USD 1.86 Trillion by 2034, representing a CAGR of 5.13% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global mining metal market size was calculated at USD 1.13 Trillion in 2024 and is predicted to increase from USD 1.19 Trillion in 2025 to approximately USD 1.86 Trillion by 2034, expanding at a CAGR of 5.13% from 2025 to 2034.The growth of the mining metal market is driven by increasing industrialization, rapid adoption of EVs, and rising infrastructural developments.

The use of Artifical Intelligence technology improves both efficiency and productivity across mining operations. The use of AI allows mining companies to automate operations. This further optimizes operational performance and production levels. Predictive maintenance systems reduce mining company expenses by minimizing equipment repair costs as well as maintaining equipment integrity. The implementation of advanced AI algorithms enables real-time operational changes that enhance efficiency. Thus, mining businesses are spending money on AI solutions to increase productivity levels as well as enhance safety standards and efficiency.

The mining metal market focuses on extracting base metals from the earth. These metals include copper, nickel, zinc, lead, and aluminum. Various mining approaches, including open-pit mining, placer mining, and underground mining, enable the extraction process. These base metals function as essential construction elements in various industries, such as automotive, electronics, and building & construction.

The mining metals industry places more importance on environmentally friendly practices and sustainable mining techniques. The mining metal industry is experiencing digital transformation due to the advent of artificial intelligence, machine learning, automation systems, the Internet of Things (IoT), and advanced artificial intelligence solutions. The mining metal industry operates under strict environmental regulations and needs to fulfill all permitting requirements. The market is expected to witness significant growth in the coming years due to the increasing demand for metals from the electrical & electronics and automotive industries. The production of electrical and electronic equipment heavily relies on metals.

| Report Coverage | Details |

| Market Size by 2034 | USD 1.86 Trillion |

| Market Size in 2025 | USD 1.19 Trillion |

| Market Size in 2024 | USD 1.13 Trillion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.13% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End use Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing Utilization of Metals in the Automotive and Electronics Sectors

Metals, including copper, aluminum, and nickel, are essential components within automotive and electronic industries because these sectors require large amounts of metals for structural parts, wiring, and battery elements. The mining metal industry has determined substantial expansion because metals have gained increasing adoption from automotive manufacturers and electronics producers. Automotive manufacturers heavily use aluminum and copper to produce lightweight components for vehicles since they improve their performance and fuel efficiency. Moreover, manufacturers of electronic devices use copper, lithium, and aluminum to create various electronic products, spanning smartphones, laptops, batteries, and circuit boards.

Rising Demand for Renewable Energy Technologies

The metal mining industry is influenced significantly by rising interest in renewable energy technologies, including wind and solar power. Renewable energy technologies need lithium, cobalt, nickel, copper, rare earth elements, and metals for batteries, solar panels, and wind turbine operations. The rising global demand for renewable energy encourages mining companies to enhance their operations and develop sustainable mining practices. Sustainable innovation and capital investment result from the transformation of renewable energy, creating a path toward future sustainability in energy production and resource management.

Environmental Issues and Strict Regulations

The mining metal market encounters hurdles because of rising environmental issues caused by mining operations. Stringent regulations that govern mining operations limit market growth. Environmental regulations encourage mining businesses to spend on advanced technologies that support sustainable practices by handling waste, conserving water, and rehabilitating land. Since advanced technologies are costlier, small-scale businesses find it difficult to obtain them. Moreover, mining operations result in habitat destruction, water contamination, and air pollution, which raise environmental concerns and hamper market growth.

Innovations in Mining Technologies

The mining metal industry experiences technological transformations that enhance both mining exploration techniques and minimize environmental harm. The mining operation operates more efficiently because of recent technological achievements, including 3D mapping, automation, and superior mineral processing equipment. The mining industry embraces environmentally sustainable practices through improved waste management systems as well as lower emissions. Technological advancements provide mining operations with increased efficiency and functionality, and help mining companies fulfill environmental standards and public expectations.

The copper segment accounted for the largest market share in 2024. This is mainly due to the increase in the adoption of copper for various applications across industries such as electronics and construction. Copper is the most used material in the construction industry for wiring and plumbing. It is heavily used in electronic devices as it is a good conductor of electricity. The need for copper will continue to increase worldwide throughout the upcoming years. The rapid increase in infrastructure development contributes to segmental growth since copper is a vital component of building construction, wire systems, and telecommunications infrastructure.

The aluminum segment is expected to grow at a notable growth rate in the coming years due to the increasing demand from the automotive industry. The automotive industry heavily uses aluminum in automotive components due to its lightweight. The rising automobile production worldwide is likely to support segmental growth. With the growing focus on improving vehicle performance, there is a high demand for lightweight materials. Aluminum is also used in construction materials such as windows and doors. As construction activities increase worldwide, the demand for aluminum in the construction industry also increases.

The construction segment dominated the mining metal market with the largest share in 2024. This is due to the rapid increase in construction activities, especially in emerging countries. The use of metals spans across building & construction, interior design, and architectural sectors. Governments worldwide have invested heavily in supporting smart city projects. This significantly propelled the demand for mining metals like copper and aluminum for construction materials.

The construction sector uses steel, aluminum, and copper to build structures, bridges, and other public construction projects. The growing population worldwide and expanding urbanization in emerging countries propel the need for residential and commercial infrastructures. The rising infrastructure development and the growing demand for lightweight construction materials contribute to segmental growth.

The automotive segment is expected to witness significant growth over the studied period. Mining metals like aluminum, copper, nickel, and lead are used to produce various automotive components such as door panels, batteries, and bumpers. The rising demand for lightweight vehicles and the growing focus on improving vehicle performance further boost the demand for mining metals.

The automotive industry worldwide is expected to expand in the next few years due to the rising adoption and production of vehicles. This highlights the need for steel and aluminum. Increasing production of EVs further influences the segment.

Asia Pacific dominated the mining metal market in 2024. This is mainly due to the rapid expansion of electrical and electronics, automotive, and construction industries. The region is rich in mineral resources. China, India, and Australia remain the top metal producers and consumers worldwide. Due to the rapid urbanization, construction activities have increased in the region, bolstering the market growth.

China leads the Asia Pacific mining metal market. China is the world's largest producer of mining metals such as gold, zinc, and manganese. It is also the largest producer of vehicles, boosting the demand for aluminum. Due to the rising aluminum production, India is expected to play a major role in the regional market. According to the Ministry of Mines report, India stands as the world’s second-largest aluminum producer, the third-largest lime producer, and the fourth-largest iron ore producer. The growing metal consumption within the country is mainly due to the rising industrialization. Moreover, increasing initiatives to support the mining and automotive sectors contribute to regional market growth.

North America is projected to witness the fastest growth in the mining metal market throughout the forecast years. The robust industrial base and advancements in mining technologies are expected to drive the growth of the North American metal mining market. The mining sector in the U.S. and Canada is focusing on producing crucial metals such as copper, aluminum, and nickel to meet the demands of construction, automotive, and aerospace industries.

The rising production of electric vehicles (EVs) is further driving the market’s growth as they require large quantities of copper for their wiring systems, aluminum for lightweight parts, and nickel for producing batteries. The mining sector in the U.S. is investing in advanced mining technologies, leading to more efficient extraction of minerals.

By Type

By End-use Industry

By Regions

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

February 2025

February 2025

April 2025