February 2025

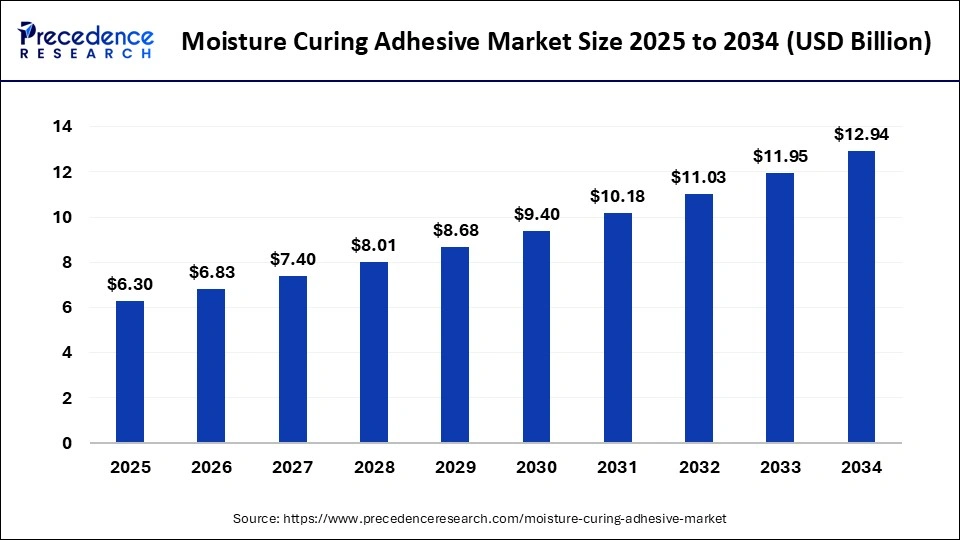

The global moisture curing adhesive market size was USD 5.37 billion in 2023, calculated at USD 5.82 billion in 2024 and is expected to be worth around USD 12.94 billion by 2034. The market is slated to expand at 8.32% CAGR from 2024 to 2034.

The global moisture curing adhesive market size is projected to be worth around USD 12.94 billion by 2034 from USD 5.82 billion in 2024, at a CAGR of 8.32% from 2024 to 2034. The rising investments in the construction and automotive sectors and advancements in medical devices drive the moisture curing adhesive market.

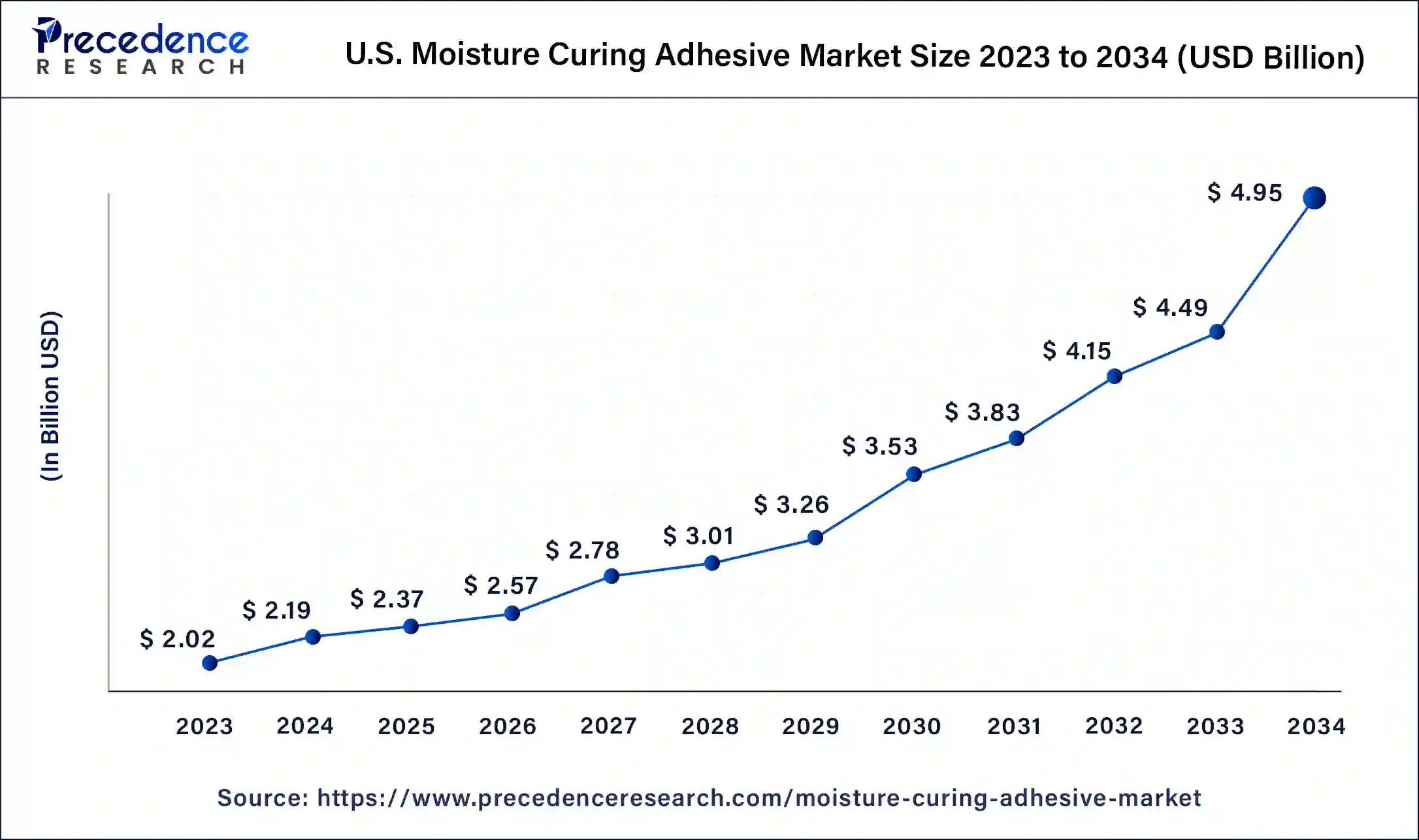

The U.S. moisture curing adhesive market size was exhibited at USD 2.02 billion in 2023 and is projected to be worth around USD 4.95 billion by 2034, poised to grow at a CAGR of 8.48% from 2024 to 2034.

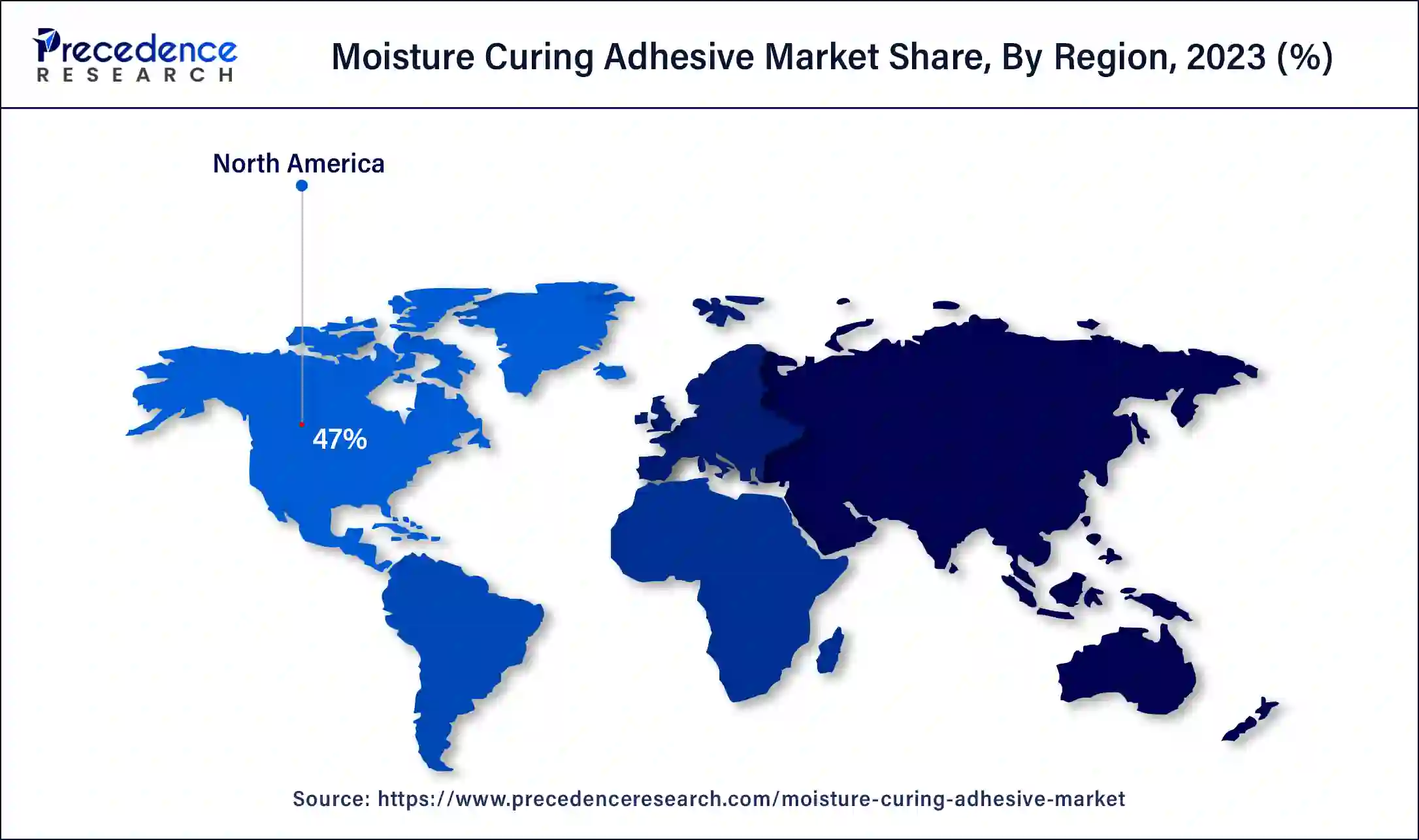

North America dominated the moisture curing adhesive market in 2023. The rising investments in the construction and automobile sector, advanced healthcare facilities, state-of-the-art research and development, the presence of key players, and environmental concerns drive the market growth. The rapid developments of housing and infrastructure in the U.S. accounted for USD 1,034.8 billion in investment in the region. Countries like the U.S. and Canada are also at the forefront of the automotive sector.

Asia Pacific is estimated to grow at the fastest rate in the moisture curing adhesive market during the forecast period. The rising investments in infrastructure, automobiles, and healthcare sectors drive the moisture curing adhesive market. In 2023, the Chinese government invested around 6.7% of GDP in the infrastructure. While India launched the National Infrastructure Pipeline (NIP) in 2020, with an investment of INR 111 Lakh Cr from 2020 to 2025, accounting for 22 Lakh Cr investment annually. Additionally, the raw materials required for producing moisture-curing adhesives are supplied from China globally. Nearly 40% of the world’s chemical raw materials are supplied from China.

Moisture Curing Adhesive Market: Bound by Moisture

The moisture-curing adhesive is a type of one-component adhesive that reacts with the atmospheric moisture to cure. It forms a polymer layer over the material’s surface with high strength and adhesive properties. This type of adhesive is used to bond surfaces that are difficult to bond, such as metals, wood-based materials, or plastics, except polyethylene and polypropylene. They are also used for materials exposed to higher temperatures, i.e., 100-1400C, like insulation panels or exterior roofing. Additionally, it is used for thin and sensitive materials like sheet metal fascia for stores and some plastic panels. The resins used in moisture-curing adhesives include cyanoacrylates, silicones, and polyurethanes. The moisture-curing adhesive is widely used in household appliances, as well as in construction, space aviation, defense, electronics, medicine, and automotive industries.

How Can AI Help the Moisture Curing Adhesive Market?

Utilizing AI in the moisture curing adhesive market enhances precision, accuracy, efficiency, customization, and innovation. AI can simplify manufacturing processes and produce the desired output. AI can foster research and innovation in the field of adhesives and sealants at a faster pace, reducing waste and saving money. AI enables the design of intelligent software to generate an efficient system. Manufacturing processes can be improved through real-time data, which enables predictive maintenance, reduces downtime, and enhances precision.

AI can automate the manufacturing process, adjust production parameters, and predict the defects in equipment. Additionally, AI can offer insights into product development and formulation, providing customization and personalization to consumers for diverse applications. Hence, AI is crucial for the advancement of the adhesives and sealants industry and highlights the collaboration between AI and human expertise in the moisture curing adhesive market.

| Report Coverage | Details |

| Market Size by 2034 | USD 12.94 Billion |

| Market Size in 2023 | USD 5.37 Billion |

| Market Size in 2024 | USD 5.82 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.32% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Substrate, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise in the automotive sector

The rising demand and investments in the automotive sector for developing safer, more efficient, and environmentally friendly vehicles increase the demand for the moisture curing adhesive market. The moisture-curing adhesives have immense potential in the automotive sector to enhance vehicle performance, develop lightweight vehicles, and manufacture vehicles using aluminum, glass fiber-reinforced composites, carbon fiber composites, and others.

They are used to attach various components of the vehicle, like panels, doors, and roofs. This enhances the strength, durability, and resistance to corrosion, forming a robust and cost-effective vehicle. Additionally, they are used for bonding electronic components in electric vehicles, thereby increasing electrical connectivity.

Supply chain disruptions

The availability of raw materials is a major issue due to logistics challenges. The high rising demand for adhesives makes it difficult to supply the products. Because of the logistics issues, lead times are significantly longer, delivery timelines are unpredictable, and transportation and materials costs are relatively higher. The supply chains are also affected due to the COVID-19 pandemic and environmental issues. Hence, all these aspects hinder the moisture curing adhesive market.

Mobile network technologies

Rapid information processing is becoming necessary as mobile network technology like 5G continues to bring unprecedented levels of smart connectivity in the moisture curing adhesive market. Moisture-curing adhesives like silicones have proven their capacity to support the 5G ecosystem efficiently. Electronic manufacturers need high-performing materials that match the stringent criteria of 5G technology to ensure seamless functioning. These adhesives possess efficient features like adhesion, coating, encapsulation, and EMI shielding.

The moisture curing adhesive market offers resistance to moisture, chemicals, and contamination and maintains a soft and flexible nature. Additionally, resins like silicones are heat-resistant, offering protection even at higher and lower temperatures. Silicones are widely used in smartphones, smartphone accessories, and smartwatches. They possess anti-cracking, stress relief, and shock absorption properties. They are also widely used in smartphone displays, providing waterproof sealing.

The polyurethane segment dominated the moisture curing adhesive market in 2023. Polyurethane adhesives are preferred due to their unique characteristics, as they can be formulated to provide a range of physical properties. They adhere to almost any surface regardless of their porosity and are known for their elasticity. They can bond to any surface, such as metals, concrete, wood, rubber, epoxy, leather, paper, glass, etc. Apart from these, they are highly moisture-resistant and temperature-resistant. They can withstand temperatures from -400C to 1000C. Polyurethanes are eco-friendly, offering timber lamination, and also have very low to zero VOCs. Polyurethane adhesives are used in automotive, woodworking, footwear and fabrics, and construction industries.

The silicone segment is expected to grow rapidly in the moisture curing adhesive market during the forecast period. Silicone is widely applicable as a moisture-curing adhesive due to its diverse properties. It is a water-resistant, inert, and non-toxic adhesive whose primary component is silica. Silicone adhesive is biocompatible. Hence, it has immense potential in the medical field, such as bandages and medical devices. It can bond to materials like ceramic, glass, rubber, metal, and wood.

Its temperature-resistance, flexibility, durability, and water-resistance properties make it a preferred choice. Additionally, it is very user-friendly and environmentally friendly. Silicone adhesive is widely used in space exploration, skin prosthetics, dentistry, automotive, medical products, and food grade.

The metal segment dominated the moisture curing adhesive market in 2023. Moisture-curing adhesives are widely used for bonding metals in place of mechanical fasteners, soldering, and welds, as they can bond dissimilar substrates. The cure time of moisture-curing adhesives saves time, space, labor, and regulatory compliance costs, reducing the steps in assembly lines and speeding up the process. These adhesives are lighter, chemically inert, temperature-resistant, and cheaper than mechanical fasteners. Metal components are used in automotive, agriculture, space exploration, construction, and medical fields.

The plastic segment is anticipated to grow significantly in the moisture curing adhesive market during the forecast period. Plastics have diverse applications in various sectors like packaging, electronics, construction, automobiles, electrics, aerospace, etc. The rising demand in these sectors increases the use of plastics. Moisture-curing adhesives like polyurethanes and silicones are versatile and form thermoset polymers after curing.

The construction segment led the global moisture curing adhesive market in 2023. Moisture-curing adhesives are widely used in the construction sector due to their activities in flooring, tilling, insulation, roofing, and wall covering. They are also used in road maintenance projects like pothole repair due to their deformation and fatigue resistance. In addition, these adhesives have been used in window and door installation, paneling and cladding, and structural bonding like metal framework or supporting structural components. The construction sector is booming due to globalization and rapid advancements in infrastructure. The global construction industry was valued at $8.9 trillion in 2023.

The automotive segment is estimated to grow rapidly in the moisture curing adhesive market during the fastest period. The rising demand for electric vehicles and lightweight materials drives the market growth. Moisture-curing adhesives like polyurethanes, silicones, and cyanoacrylates offer widespread use in the automotive sector. The moisture-curing adhesive-coated lightweight materials in automobiles are used to fabricate structures by deploying materials such as glass fiber-reinforced composites and carbon fiber composites.

Moisture Curing Adhesive Market Segments

By Type

By Substrate

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

February 2025

December 2024