February 2025

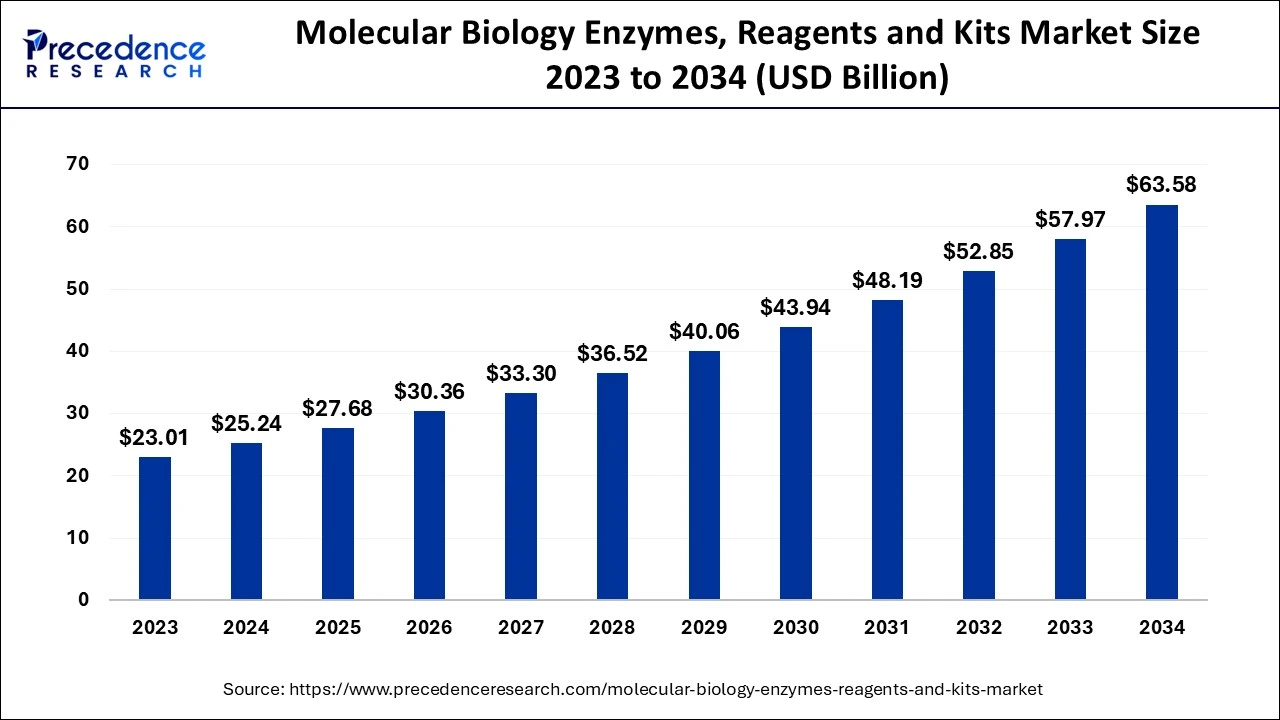

The global molecular biology enzymes, reagents, and kits market size accounted for USD 25.24 billion in 2024, grew to USD 27.68 billion in 2025 and is expected to be worth around USD 63.58 billion by 2034, registering a CAGR of 9.68% between 2024 and 2034. The North America molecular biology enzymes, reagents, and kits market size is evaluated at USD 11.61 billion in 2024 and is expected to grow at a CAGR of 9.69% during the forecast year.

The global molecular biology enzymes, reagents, and kits market size is calculated at USD 25.24 billion in 2024 and is predicted to reach around USD 63.58 billion by 2034, expanding at a CAGR of 9.68% from 2024 to 2034. The molecular biology enzymes, reagents, and kits market is rising along with the increased genomic application, the growing need for molecular diagnostics, expectations for molecular personalized medicine, greater investment in research and development, and innovations in next-generation sequencing and automatization.

Artificial intelligence (AI) enhances the speed of data elaboration in genomics and proteomics sectors to optimize the enzyme as well as reagents. Across the laboratories, AI improves workflow automation, such as PCR setups and high throughput screening, while decreasing variability. Meanwhile, in the synthesis of specialty reagents in targeted populations, artificial intelligence-integrated quality control systems maintain the uniformity of a reagent. However, AI helps to enhance the supply chain, making arrangements to deliver some critically sensitive products in a timely manner. It enhances innovation, reduces cost elements, and fosters diagnoses, therapeutics, and personalized medicine.

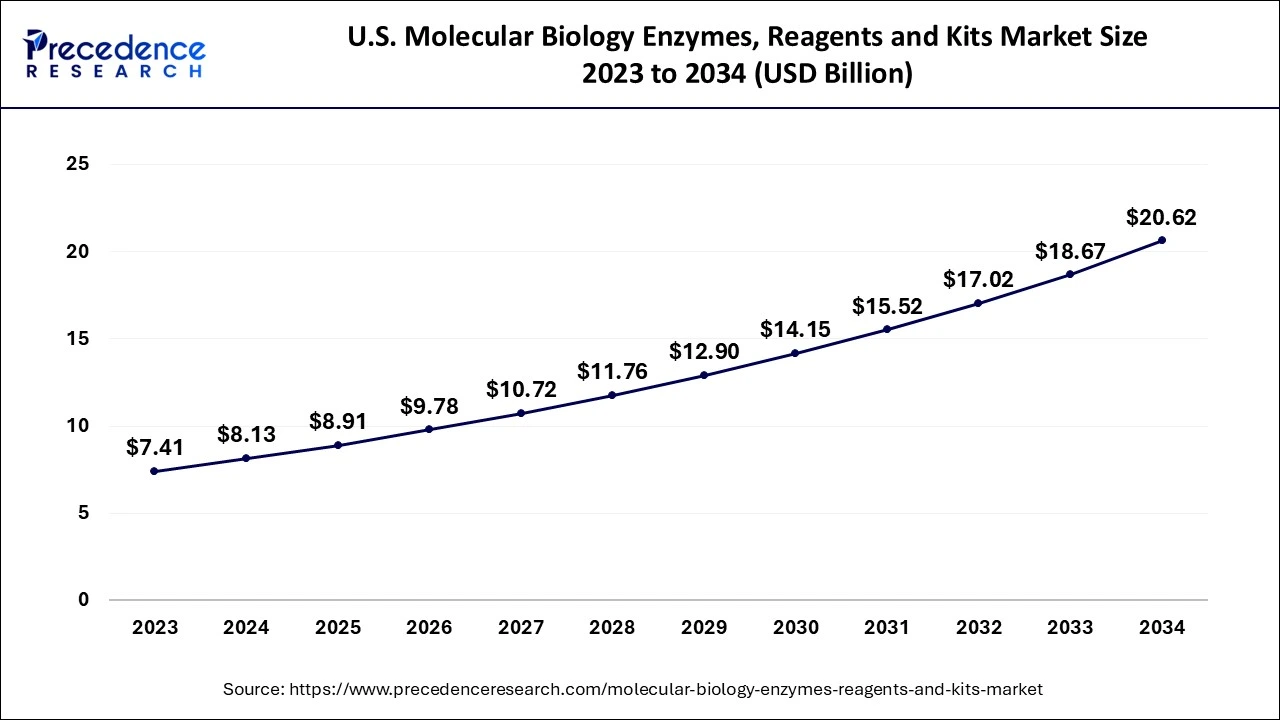

The U.S. molecular biology enzymes, reagents, and kits market size is exhibited at USD 8.13 billion in 2024 and is projected to be worth around USD 20.62 billion by 2034, growing at a CAGR of 9.75% from 2024 to 2034.

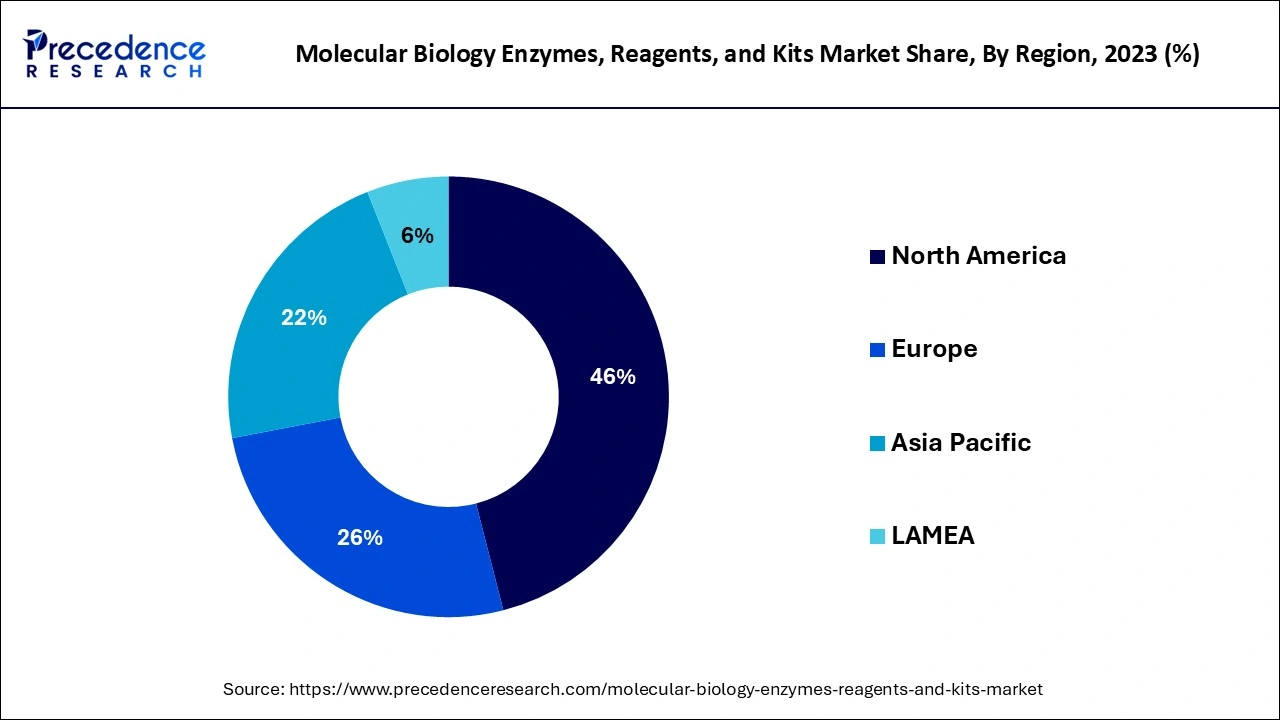

North America accounted for the largest share of the molecular biology enzymes, reagents, and kits market in 2023. The main factors that contributed to the expansion of the market in North America include a strong and steady increase in research activities in genomics, the increasing growth of pharmaceuticals in North America, and awareness campaigns and activities being launched by the government and private sectors. The key drivers include the availability of industry players in the region, research institutes, government and private funding, developed healthcare infrastructure, and high adaptability of new technologies due to the growing incidence of chronic diseases such as cancer, cardiovascular diseases, rare hereditary diseases, genetic disorders, and infectious diseases, and demand for individualized therapies and new technologies in the region.

Asia Pacific is anticipated to witness the fastest growth in the molecular biology enzymes, reagents, and kits market during the forecasted years. China, India, and Japan are major players and have shown positive growth in the market, which is fuelled by the rising investment of governments in the region. The growth and the research for genomics are expected to boost the molecular biology enzymes, kits & reagents market in the forecast period. The government of India has embarked on several initiatives for the startups in the biotechnology sectors that will drive the growth of the molecular biology enzymes, kits & reagents market in the country.

Molecular biology enzymes, kits, and reagents are biochemical reagents that are used to perform both qualitative and quantitative analysis of DNA, RNA, and proteins. They are used in a variety of fields, including Analytical, diagnostic testing, drug discovery, and life science research. Some of these tools are DNA polymerases for DNA amplification, restriction endonucleases for cutting DNA at specific sites, and ligases to join DNA molecules, among others. This field focuses on the characteristics, roles, and controls of biomolecules, including DNA, RNA, Protein, and small molecules in cells and organisms.

Molecular biology enzymes, kits, and reagents are specialized commercial products for varied work in laboratory investigations and associated biotechnological processes in molecular biology. These integrated research activities related to consumables include molecular biology technologies advanced research generating patterns of developing methods that have a wide application. The molecular biology enzymes, reagents, and kits market sales are also on the rise due to the rising application of bioinformatics computational genome analysis and drug discovery.

| Report Coverage | Details |

| Market Size by 2034 | USD 63.58 Billion |

| Market Size in 2024 | USD 25.24 Billion |

| Market Size in 2025 | USD 27.68 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.68% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Increasing prevalence of genetic diseases

There has been an increased incidence of genetic diseases in recent years, resulting in an increase in the use of molecular diagnostics. The processes of molecular diagnostics, including epigenetics and polymerase chain reaction, require the essentials of molecular biology enzymes, kits & reagents. The global rise in the cases of inherited diseases and disorders known as genetic diseases, including Down syndrome, Sickle Cell Anemia, Turner syndrome, and chromosomal abnormalities, is also accountable for the increasing demand for molecular biology enzymes, kits & reagents. A need for innovative diagnostic tools, such as molecular cytogenetics, to guarantee accurate and timely diagnosis.

Limited access to technology

The lack of technology to store genetic information could negatively impact the use of molecular biology enzymes, kits, and reagents. This results in the slowing down of the growth of the molecular biology enzymes, reagents, and kits market because users in some regions or institutions will not be able to have access to the technology required for the usage of the products. Molecular biology tools are limited because of expensive equipment, a shortage of skilled personnel, and limited infrastructure. Due to the absence of facilities and capital to support more technologically developed research, laboratories in developed countries or remote districts can have limited access to the necessary equipment and knowledge to use molecular biology tools proficiently.

Personalized treatment

The use of molecular biology enzymes, kits, and reagents makes tailored treatment a key factor in revenue enhancement. With the advancement of precision medicine in healthcare today, precision tools that facilitate the use of therapeutic interventions according to genetic, molecular, and phenotypic variation are becoming essential. Molecular biology enzymes, kits, and reagents are critical in working with individualized treatments for patients through the combination of genetic and protein profiling. These tools apply in diagnostics, drug discovery, and therapeutic target identification. These are employed in health research and diagnostics to come up with tailored treatment therapies as well as cures for conditions such as cancers, metabolic disorders, and immune disorders.

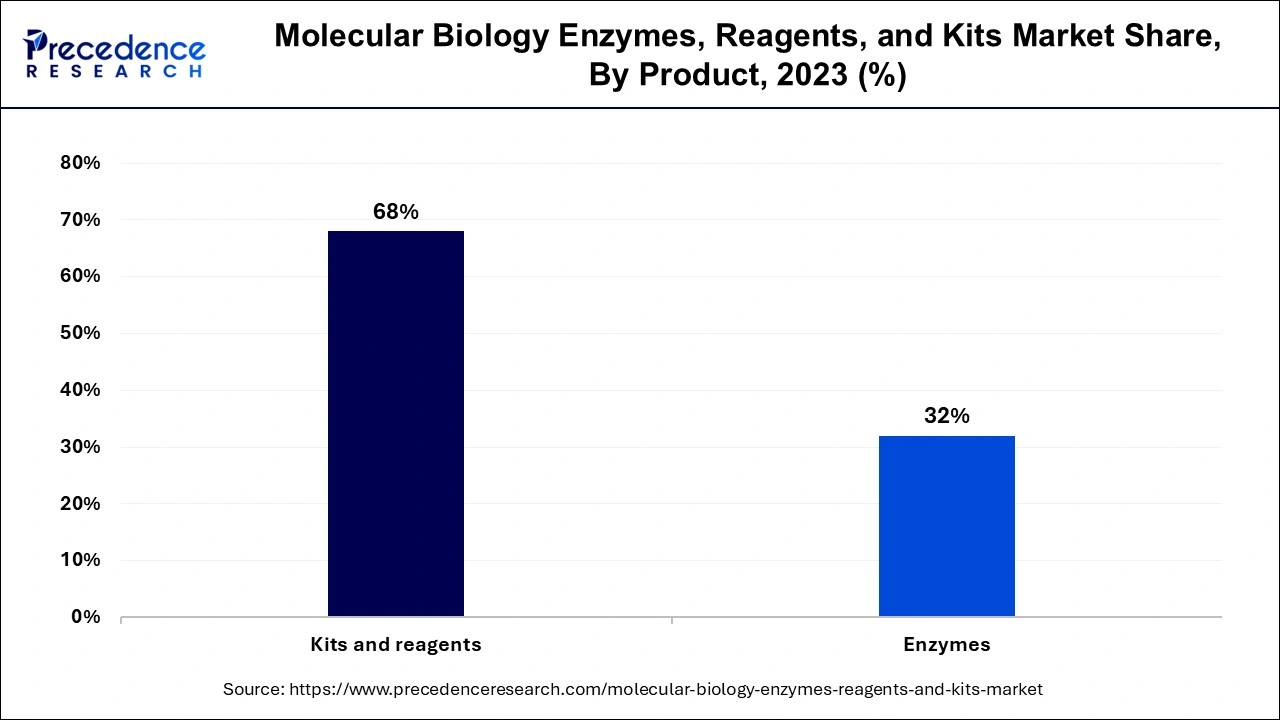

The kits and reagents segment noted the largest share of the molecular biology enzymes, reagents, and kits market in 2023. Molecular Biology Reagents and kits are products applied in laboratories for identifying, analyzing, synthesizing, or quantifying substances. Molecular biology kits and reagents are ready to use multi-component systems for conducting certain operations in molecular biology experiments. They can be applied to many applications, including DNA extraction, DNA purification, RNA isolation, RNA purification, and nucleic acid labeling and determination.

The enzymes segment is projected to witness the fastest growth in the molecular biology enzymes, reagents, and kits market during the forecast period. These enzymes are proteins that express importance to the field of molecular biology. They are used to isolate, characterize, and replicate genes. Due to the availability of various sources of enzymes, including ligases, polymerases, nucleases, methylases, phosphatases, and topoisomerases, cloning applications have improved. Further, to achieve excellence in the field, companies are doing more work to come up with innovative and improved enzymes.

The sequencing segment contributed the largest share of the molecular biology enzymes, reagents, and kits market in 2023. Sequencing is the identification of the exact arrangement of nucleotides (adenine, cytosine, guanine, and thymine) in a DNA or RNA chain. It is one of the most important techniques in molecular biology and genetics, and it is widely used as a source of information about organisms' genomes. This growth can be attributed to the increased use of sequenced-based treatments and the use of sequences in the diagnosis and treatment of cancer. The market for molecular biology enzymes, kits, and reagents is expected to grow since more funding has been allocated to genomics, there are decreasing costs of sequencing, and chronic diseases are on the rise.

The sPCR segment is projected to witness the fastest growth in the molecular biology enzymes, reagents, and kits market during the forecast period. Molecular biology enzymes, kits, and reagents are used in the polymerase chain reaction (PCR), a technique that amplifies specific DNA fragments. The accuracy and reliable results of genetic material detection increased its adoption across the globe. In addition, the advent of new technologies, including ddPCR (droplet digital PCR), offers enhanced detection platforms. These advances and increasing applications of PCR are anticipated to continue driving revenue in this segment.

The pharma and biotech segment generated the highest share of the molecular biology enzymes, reagents, and kits market in 2023. Molecular biology enzymes, kits, and reagents are core products that are used extensively by pharmaceutical and biotechnology companies for drug discovery, development, and manufacture. Several enzymes, such as DNA polymerases and ligases, are widely used in molecular cloning, gene synthesis, and recombinant DNA technology for designing new receptor organisms for producing therapeutic proteins or bioactive molecules. This is because most of these molecular biology products, like PCR, sequencing, genotyping, and DNA/RNA extraction enzymes, are widely accepted to ease the workflow.

The academic and research segment is projected to witness the fastest growth in the market during the forecast period. The increase in new diagnostics and treating infectious diseases escalated the demand for kits and reagents in research facilities. Molecular biology enzyme kits and reagents applied in the discovery of individualized therapy, drug, and diagnostic tests. They are also employed in research work to treat diseases such as cancer, pathogens, and mutation. Moreover, the fact that PCR and Next-Generation Sequencing are propelled forward studies aimed at creating health such as cancer, pathogen, or mutation.

By Product

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

February 2025

January 2025