January 2025

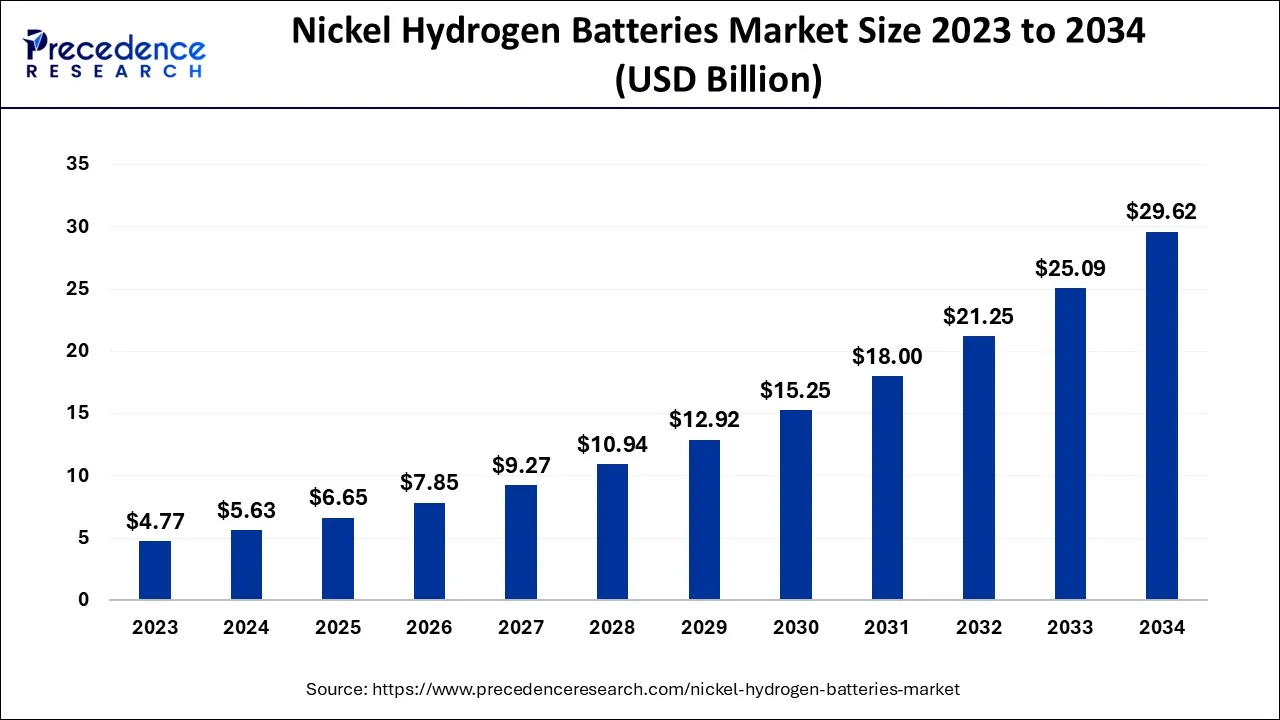

The global nickel hydrogen batteries market size accounted for USD 5.63 billion in 2024, grew to USD 6.65 billion in 2025 and is projected to surpass around USD 29.62 billion by 2034, representing a healthy CAGR of 18.60% between 2024 and 2034.

The global nickel hydrogen batteries market size is estimated at USD 5.63 billion in 2024 and is anticipated to reach around USD 29.62 billion by 2034, expandin at a CAGR of 18.60% from 2024 to 2034.

In hybrid vehicles, nickel metal hydride batteries are increasingly being used. These batteries were ideal for the automotive industry due to their wide temperature range of -30 °C to + 75 °C and rapid charging capacity. NiMH batteries can handle the high-power levels required by electric vehicles. According to a Bloomberg New Energy Finance (BNEF) report, electric vehicle sales will reach 540 million by 2040, accounting for approximately 32% of the world's passenger vehicles. The growing demand for electric cars will benefit the NiMH battery market.

Furthermore, global industrialization and technological advancements have increased the demand for Ni-MH batteries as reliable energy sources. Manufacturers of these batteries focus on improved energy efficiency and battery longevity. Furthermore, these batteries are considered more environmentally friendly than other types because they do not contain the toxic heavy metal cadmium found in nickel-cadmium batteries. Moreover, these batteries are used in various applications, such as medical devices, vehicles, and industrial equipment, propelling the global nickel-metal hydride battery market forward.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.63 Billion |

| Market Size by 2034 | USD 29.62 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 18.6% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Application, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The increase in electricity demand fuels the growth of nickel metal hydride batteries

Global electricity demand is a crucial factor in accelerating market growth, and Nickel-metal hydride batteries provide the necessary high-power capacities for electric vehicles. As a result, the global Ni-MH battery market is primarily driven by rising demand for electric cars and vehicles. The nickel-metal hydride battery is also quick to charge and discharge, making it ideal for portable electronic devices. Furthermore, the increasing use of Ni-MH batteries in medical devices and vehicles is propelling the nickel-metal hydride battery market forward. As a result, the nickel-metal hydride (Ni-MH) battery market is expected to grow during the forecast period.

Furthermore, technological advancements have enabled the development of more efficient and powerful NiMH batteries. Due to its high reliability, stability, and durability, the conventional nickel-hydrogen battery exhibits outstanding rechargeability without capacity decay for over 30,000 cycles. It has been widely used in aerospace, such as satellites and aircraft, with a service life of more than three decades.

Government regulations hamper the market growth

Regulations imposed by various governments for the manufacture of rechargeable batteries hampered market growth. Cadmium, cobalt, copper, cyanide, iron, lead, manganese, mercury, nickel, and zinc are the pollutants released during battery manufacturing. The United States Environmental Protection Agency (EPA) developed the Battery Manufacturing Effluent Guidelines and Standards to regulate such impurities. Furthermore, the availability of alternatives such as lithium-ion batteries and restrictions imposed by various governments for rechargeable batteries may impede global market growth, as the battery manufacturing process generates wastewater and emits pollutants.

Low-cost, high storage provides lucrative opportunities

Significance Rechargeable batteries provide excellent opportunities for low-cost, high-capacity, and highly reliable large-scale energy storage systems. An aqueous nickel-hydrogen battery with an industrial-level areal capacity of 35 mAh cm 2 and a low-cost, bifunctional nickel-molybdenum-cobalt electrocatalyst as hydrogen anode to effectively catalyze hydrogen evolution and oxidation reactions in alkaline electrolyte. The nickel-hydrogen battery has an energy density of 140 Wh kg 1 in aqueous electrolyte and excellent rechargeability over 1,500 cycles with no capacity decay.

The nickel-hydrogen battery is estimated to cost as little as $83 per kilowatt-hour, demonstrating an appealing potential for practical large-scale energy storage. Additionally, for at least 30 years, nickel-hydrogen battery technology has been widely used in satellite applications. Because of their higher specific energy compared to Ni-Cd batteries, Ni-H2 cells have been used on all communication satellites since the 1990s. However, due to the anticipated benefits of lithium-ion batteries for space applications, Ni-H2 technology is expected to be phased out shortly. Most satellite manufacturers have already adapted their satellite power systems to accommodate lithium-ion batteries.

Small-size batteries are expected to grow in the forecast period

Large-sized batteries make up most of the nickel-metal hydride battery market share. They are safer and last longer than other batteries on the market. They are primarily found in Hybrid Electric Vehicles (HEVs). As a result, the increasing use of large-sized batteries in the automobile sector accounts for this segment's dominance. It has good energy density and capacity in rechargeable battery technology for aerospace energy storage.

On the other hand, the small-sized battery segment is expected to grow during the forecast period. Small batteries are commonly found in toys, laptops, vacuum cleaners, remote controls, and other small appliances. Future spacecraft is expected to have more than 6 kW power levels. Another trend is for small, low-cost spacecraft to have a power level of 1 kW. The goal is to reduce battery mass, volume, and cost. NASA Lewis has an in-house and contracted effort to develop a lightweight battery supporting a light storm. For Instance, Toyota's new Acqua compact HEV features a bipolar nickel-hydrogen battery, which the Japanese automaker claims is a world first for a road vehicle (Peter Donaldson). It contains lower energy density than lithium-ion batteries but a much longer service life. According to Toyota, the new nickel-hydrogen battery delivers 1.5 times the output from each cell and packs 1.4 times as many cells into the same volume, effectively doubling the production of the previous car's battery.

The automotive segment is expected to grow in the forecast period

Automotive is expected to contribute significantly to the market growth. One of the primary drivers of segment growth is the increasing use of Ni-MH batteries in commercial vehicles, particularly hybrid electric cars. Ni-MH batteries are increasingly used in various electric vehicles because they have several advantages over lithium-ion batteries. Furthermore, improvements in these batteries to improve performance is expected to help the market grow during the forecast period. On the other hand, Ni-MH batteries are used in various consumer electronic devices such as cameras, toothbrushes, camcorders, and many others. These batteries are also used in toys, remote controls, and other appliances.

Furthermore, A reliable battery is a critical technological component in developing practical electric vehicles. The science and technology of a nickel metal hydride battery are described. Which stores hydrogen in the solid hydride phase and has high energy density, high power, long life, abuse tolerance, a wide operating temperature range, quick-charge capability, and wholly sealed maintenance-free operation. For use as the negative electrode in this battery, a diverse range of multi-element metal hydride materials with structural and compositional disorder on multiple length scales has been engineered. The battery is nontoxic and recyclable, and it operates at room temperature. The manufacturing technology demonstration has been completed.

North America dominated the Nickel hydrogen batteries market

According to regional analysis, North America dominates the global market, and this is due to its growing use in HEVs, telecommunications, and medical devices. Furthermore, the increasing popularity of consumer electronics in this region is expected to fuel market growth. In addition, the Asia-Pacific region is expected to have the highest CAGR in the coming years. This is because most Ni-MH battery manufacturers are from China and India, making it appealing for investors to invest in this market.

Furthermore, the European region is expected to grow by encouraging people to use electric vehicles for public and personal use. Again, due to strict government regulations regarding environmental concerns, the use of Ni-MH batteries as an alternative to nickel-cadmium batteries in major applications is primarily being adopted in this region. Varta (Ellwangen, Germany) and SAFT (Bagnolet, France) are two large European companies that have manufactured consumer-type Ni/MH batteries and filed patent applications in related fields over the last two decades. Varta micro battery was spun off from Varta and focused on the button cell business. SAFT sold its Small Nickel Battery division to Arts Energy (Nersac, France). Alcatel (later merged into Lucent Technology, Paris, France) manufactured Ni/MH batteries for cell phones and was involved in patent filings. Nilar (Täby, Sweden) has recently begun to offer bi-polar prismatic Ni/MH batteries for transportation applications. Hoppecke (Brilon-Hoppecke, Germany) produced prismatic flooded-type Ni/MH batteries for transportation.

Segments Covered in the Report:

By Type

By Application

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

January 2025

January 2025