July 2024

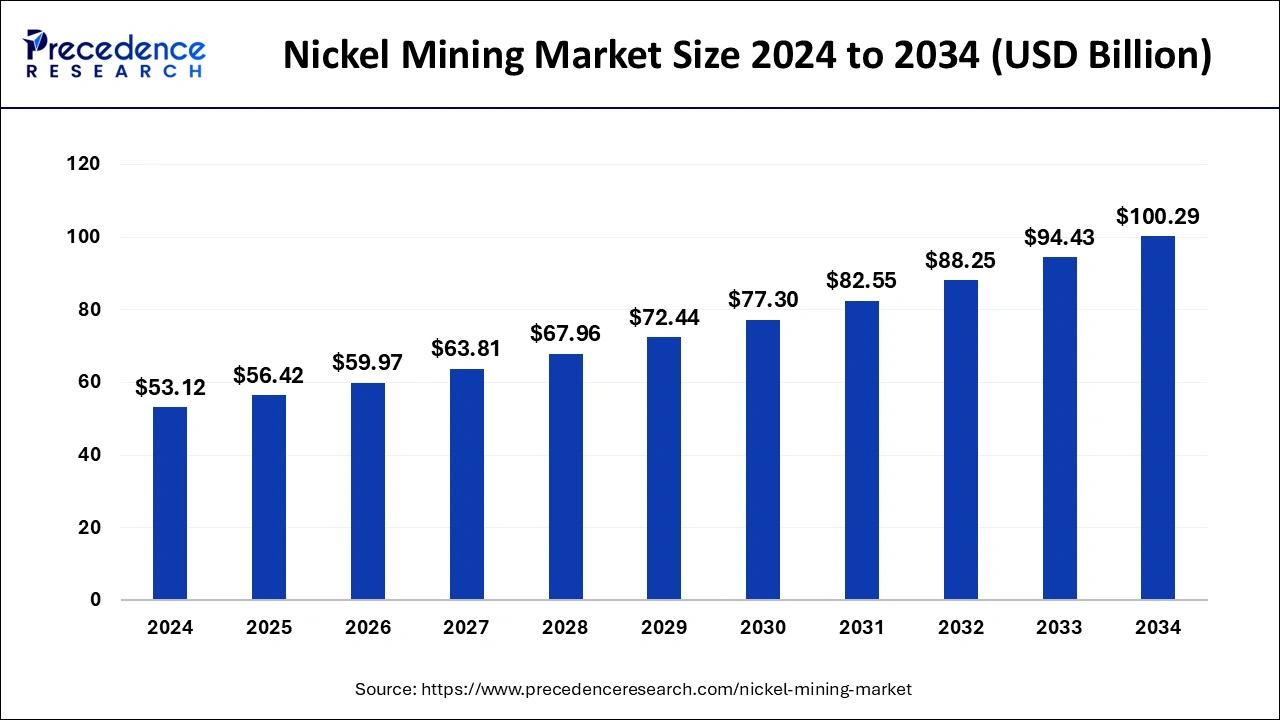

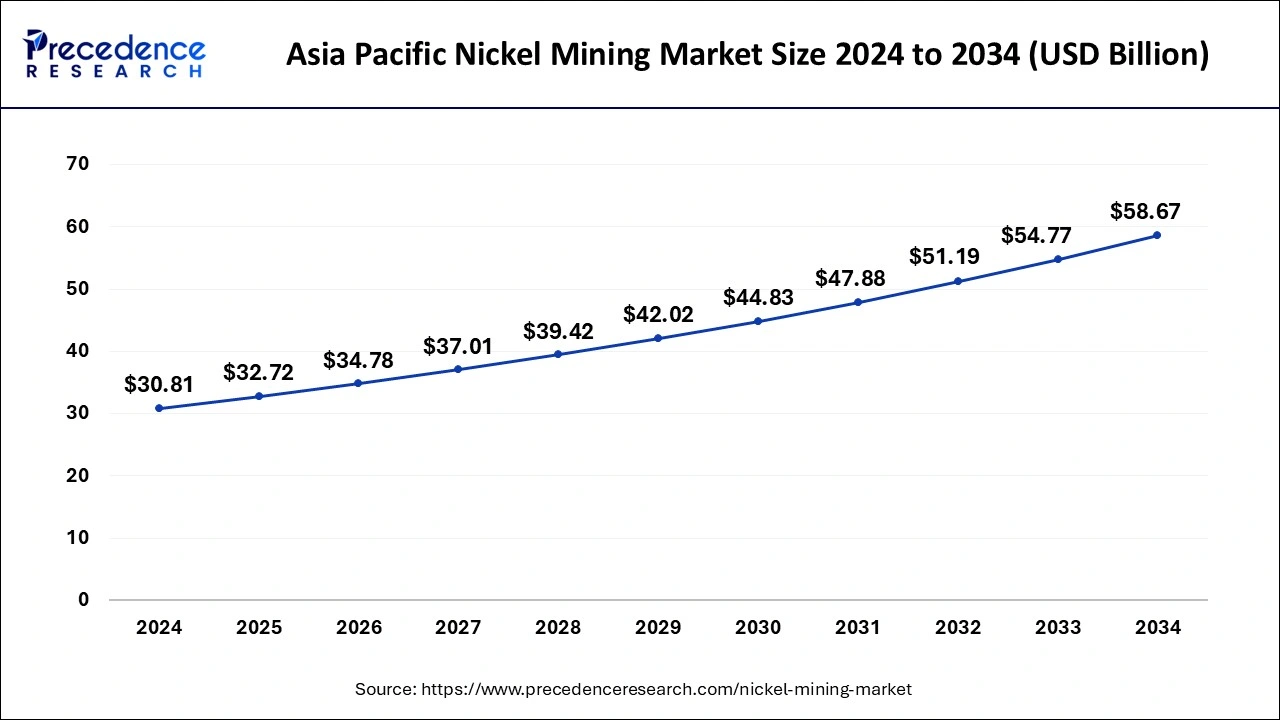

The global nickel mining market size is calculated at USD 56.42 billion in 2025 and is forecasted to reach around USD 100.29 billion by 2034, accelerating at a CAGR of 6.56% from 2025 to 2034. The Asia Pacific market size surpassed USD 30.81 billion in 2024 and is expanding at a CAGR of 6.65% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global nickel mining market size accounted for USD 53.12 billion in 2024 and is predicted to increase from USD 56.42 billion in 2025 to approximately USD 100.29 billion by 2034, expanding at a CAGR of 6.56% from 2025 to 2034.

The Asia Pacific nickel mining market size was exhibited at USD 30.81 billion in 2024 and is projected to be worth around USD 100.29 billion by 2034, growing at a CAGR of 6.65% from 2025 to 2034.

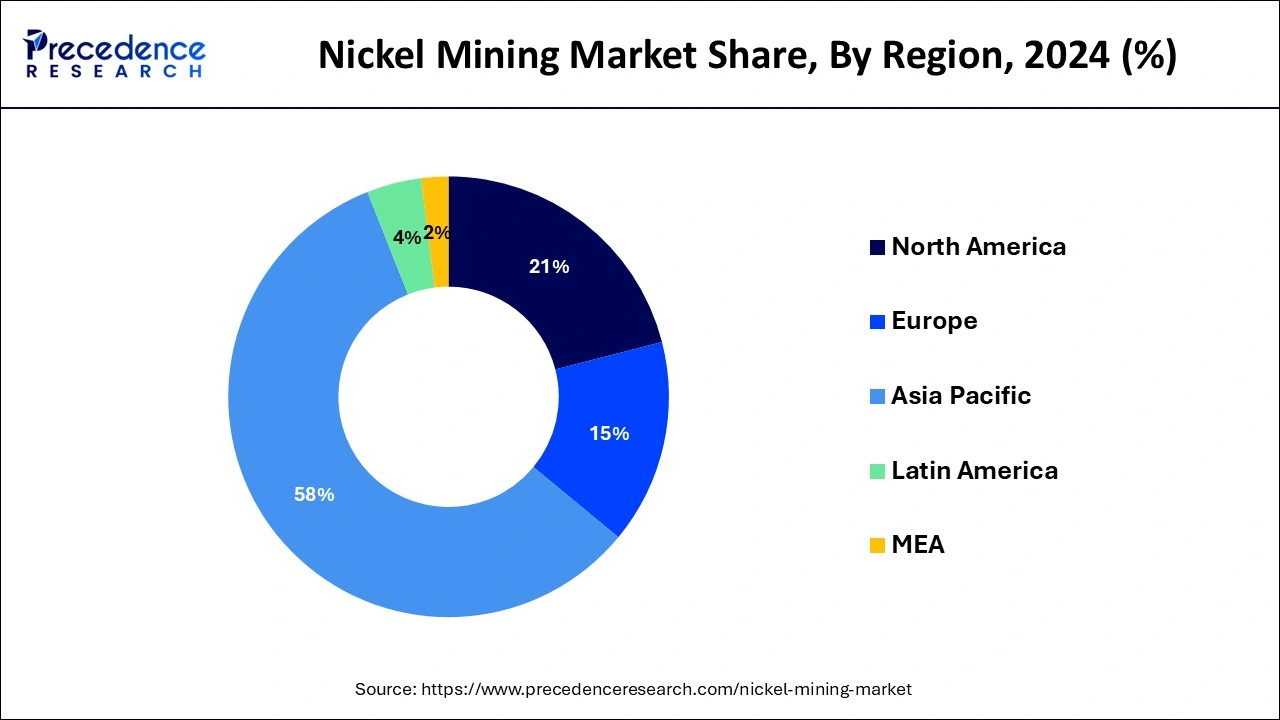

Asia-Pacific held a dominating share of 58% in the nickel mining market due to a combination of factors. Asia-Pacific commands a significant share in the nickel mining market due to robust industrialization, infrastructure development, and the region's pivotal role in the global stainless steel sector.

The surge in electric vehicle (EV) production and renewable energy projects further propels the demand for nickel, a crucial component in batteries and clean energy technologies. With expanding economies, strategic investments in mining infrastructure, and a burgeoning urbanization trend, Asia-Pacific remains a key player, driving substantial growth and influencing the dynamics of the global nickel mining market.

North America is set for swift expansion in the nickel mining market owing to a heightened need for nickel in electric vehicle (EV) manufacturing and renewable energy applications. The region's commitment to clean energy initiatives and carbon reduction fuels the demand for nickel, essential in EV battery production. Supported by favorable government policies, investments in sustainable mining methods, and advancements in mining technologies, North America stands as a pivotal player in the growing nickel mining sector on the global stage.

Europe is witnessing substantial growth in the nickel mining market, propelled by a heightened demand for nickel, particularly in electric vehicle (EV) manufacturing and renewable energy projects. The region's strong commitment to reducing carbon emissions and embracing sustainable energy sources has fueled investments in nickel, essential for EV batteries and green technologies. Supported by progressive government policies, technological advancements, and a dedication to environmentally conscious practices, Europe emerges as a key player in the expanding nickel mining market.

Nickel mining involves the extraction of nickel-containing ores from the Earth's crust. The primary sources of nickel include laterite and sulfide deposits. Laterite deposits are commonly found in tropical regions and are extracted through open-pit mining. The process typically involves the removal of overlying soils and bedrock to access the nickel-rich layer beneath. Sulfide deposits, on the other hand, are often situated in deeper underground formations and require more complex mining methods, including underground mining and flotation processes. Post-extraction, nickel ores undergo processes like crushing, grinding, and concentration to isolate the valuable nickel.

Subsequently, smelting or hydrometallurgical methods are used to obtain pure nickel. This end product is crucial for stainless steel manufacturing, as well as for batteries, alloys, and various industrial applications. The environmental impact of nickel mining, including habitat disruption and potential contamination, has led to a push for sustainable mining practices.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.56% |

| Market Size in 2025 | USD 56.42 Billion |

| Market Size by 2034 | USD 100.29 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End-use and Mining Technique |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Stainless steel production surge

The surge in stainless steel production significantly propels the demand for nickel in the mining market. Stainless steel, a corrosion-resistant alloy, is a major consumer of nickel, utilizing it to enhance durability and resistance to corrosion and rust. As infrastructure development, urbanization, and construction projects intensify globally, the demand for stainless steel rises commensurately.

This growth is driven by robust construction activities and the increasing preference for stainless steel in diverse industries. Moreover, stainless steel's ubiquity in various applications, from architecture to automotive components, amplifies the need for nickel. The construction boom in emerging economies and ongoing infrastructure projects further fuels this demand. As a result, the nickel mining market experiences heightened activity, driven by the integral role of nickel in the production of stainless steel for diverse industrial applications.

Social and community opposition

Social and community opposition poses a significant restraint to the market demand for nickel mining. Local communities near mining sites often express concerns about the potential negative impacts of mining operations on their livelihoods, health, and overall well-being. Community resistance can lead to delays in project approvals, heightened regulatory scrutiny, and increased operational costs as companies navigate efforts to address and mitigate community concerns. In some cases, opposition may result in legal challenges, causing protracted delays and uncertainties in project development.

The adverse social and community sentiments surrounding nickel mining can also affect a company's social license to operate, influencing its reputation and relationships with stakeholders. Public resistance and negative perceptions can lead to heightened scrutiny from environmental and human rights organizations, impacting investor confidence and raising challenges in attracting funding for mining projects. As a result, effective community engagement and proactive measures to address social concerns are imperative for the sustainable development of the nickel mining industry.

Recycling and circular economy initiatives

Recycling and circular economy initiatives are creating notable opportunities for the nickel mining market by emphasizing sustainable practices and resource efficiency. As industries worldwide prioritize environmental responsibility, the demand for recycled materials, including nickel, has surged. Nickel, a key component in various alloys and products, can be recovered and reintegrated into the supply chain through advanced recycling technologies. This not only reduces the reliance on virgin ore but also aligns with the principles of a circular economy.

The growing emphasis on recycling nickel aligns with global goals to minimize environmental impact and foster a more sustainable supply chain. Moreover, as regulations and consumer preferences increasingly favor eco-friendly practices, nickel mining companies engaging in responsible recycling initiatives can enhance their market positioning, meet evolving sustainability standards, and contribute to a circular economy that promotes resource conservation and waste reduction.

The non-ferrous alloys segment had the highest market share of 46% in 2024. This substantial investment is set to boost the demand for non-ferrous alloys. These alloys, containing metals like nickel, are crucial in aerospace applications due to their resilience against corrosion and high strength. Collins Aerospace's strategic move aligns with the broader industry trend of heightened reliance on non-ferrous alloys, especially in cutting-edge technologies. The investment underscores the significance of these alloys in the realm of engineering and manufacturing, signalling a notable development in the sector.

The batteries segment is anticipated to expand at a significant CAGR of 7.8% during the projected period. The batteries segment in the nickel mining market pertains to the utilization of nickel in battery technologies, particularly in electric vehicles (EV) and energy storage applications. Nickel, a crucial component in lithium-ion batteries, enhances their energy density and performance. The increasing demand for electric vehicles and grid-level energy storage systems is driving substantial growth in this segment. As the global transition toward cleaner energy accelerates, the batteries segment in nickel mining is witnessing a surge, with ongoing trends emphasizing advancements in battery technologies and sustainable resource extraction practices.

The open cast mining segment held a 56% market share in 2024. Open-cast mining, also known as open-pit mining, is a mining technique employed in the nickel mining sector, involving the extraction of ore deposits from the surface. In this method, large quantities of overlying soil and rock are removed to access the nickel-rich ore beneath. Open-cast mining is preferred for its cost-efficiency and suitability for shallow nickel deposits. Recent trends in the nickel mining market indicate a continued reliance on open-cast mining techniques due to their economic viability, ease of access to ore bodies, and adaptability to varying geological conditions.

The underground mining segment is anticipated to expand fastest over the projected period. Underground mining in the nickel mining market involves extracting ore deposits beneath the Earth's surface. This technique minimizes environmental impact and allows access to deeper, higher-grade nickel deposits. A trend in the nickel mining industry involves continuous improvements in underground mining technologies, enhancing safety, efficiency, and extraction rates. Innovations such as advanced drilling techniques and automated systems contribute to the sustainable development of underground nickel mining, meeting the rising demand for nickel in applications like electric vehicles and renewable energy.

By End-use

By Mining Technique

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

August 2024

September 2024

August 2024