October 2024

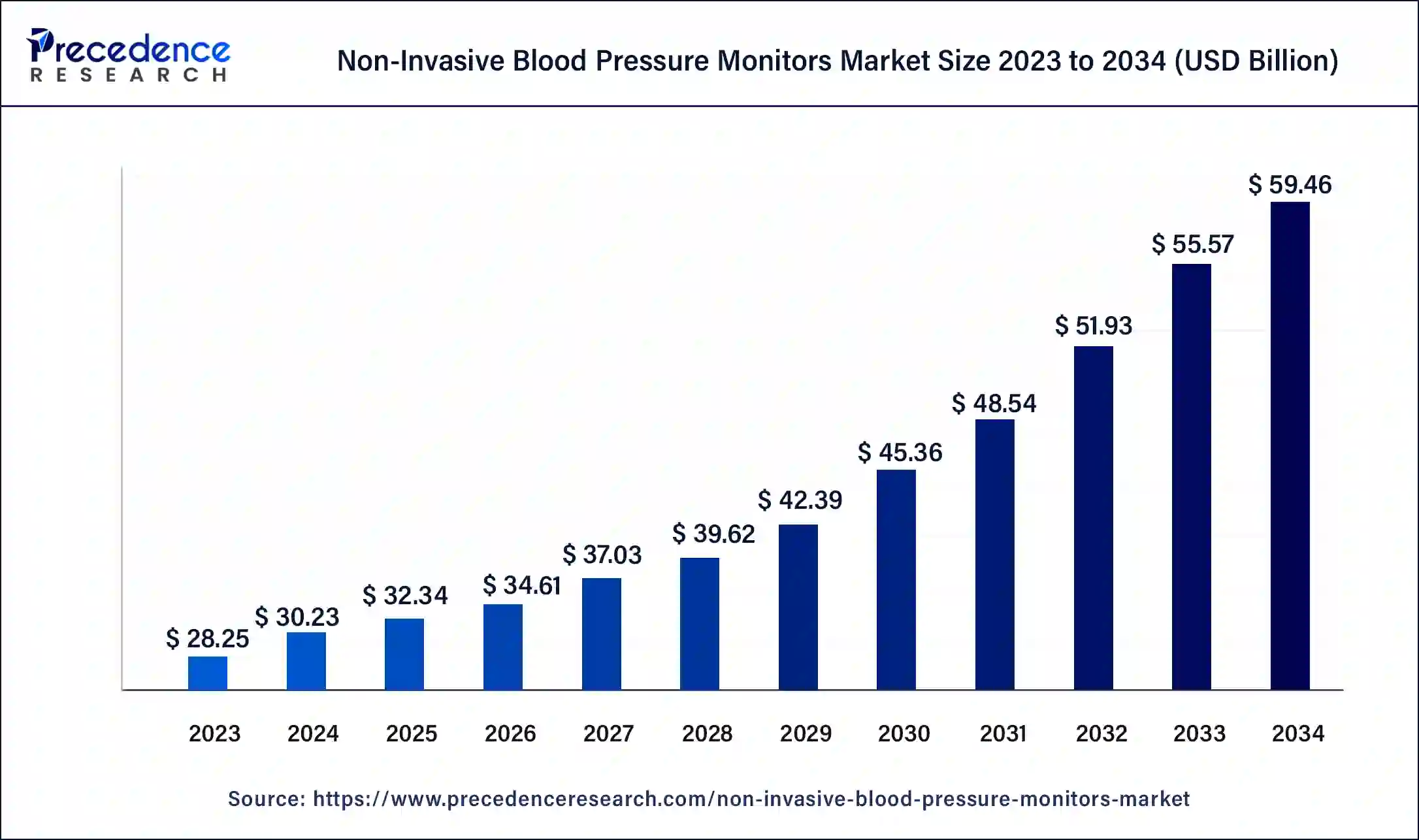

The global non-invasive blood pressure monitors market size was USD 28.25 billion in 2023, calculated at USD 30.23 billion in 2024 and is expected to reach around USD 59.46 billion by 2034, expanding at a CAGR of 7% from 2024 to 2034.

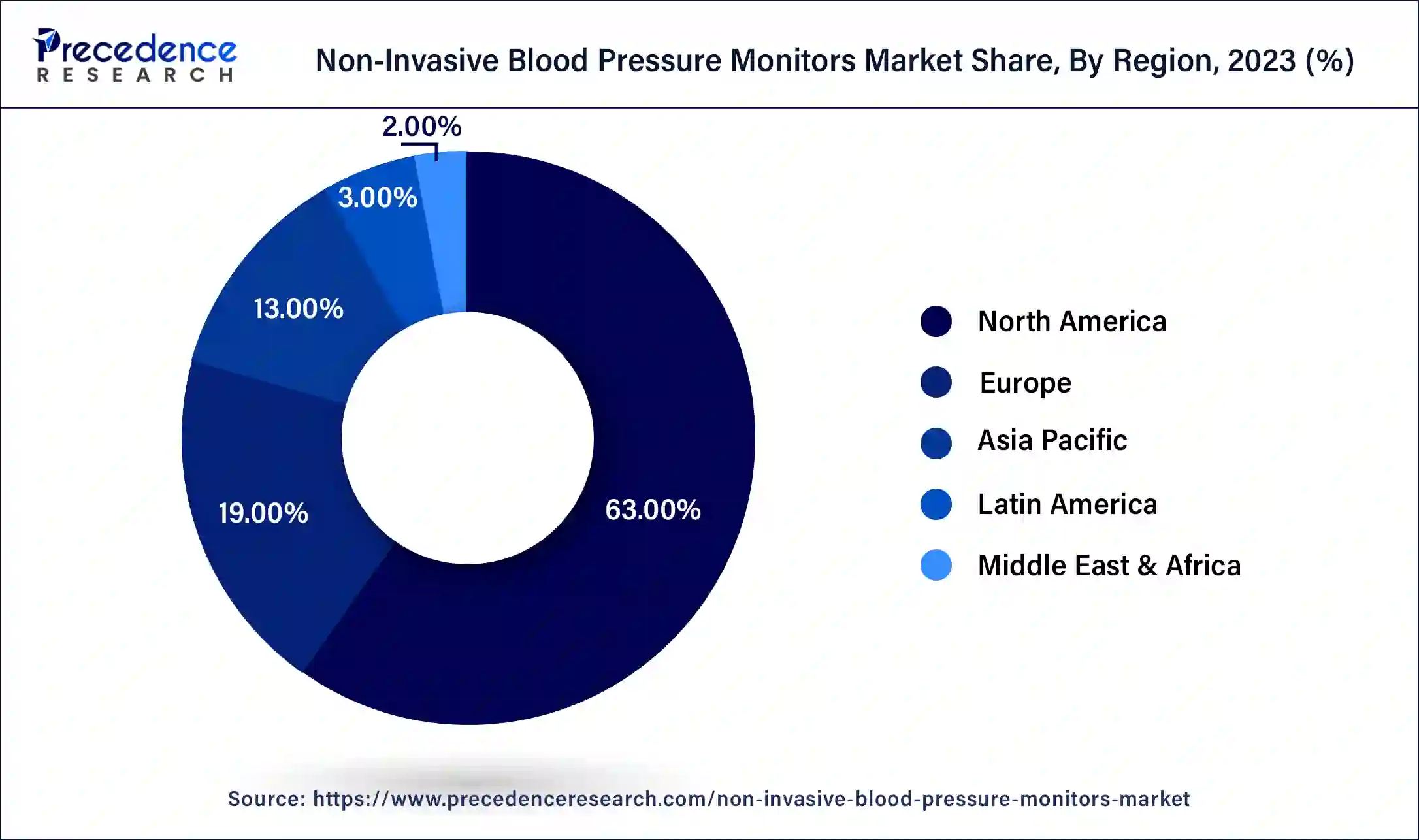

The global non-invasive blood pressure monitors market size accounted for USD 30.23 billion in 2024 and is expected to reach around USD 59.46 billion by 2034, expanding at a CAGR of 7% from 2024 to 2034. The North America non-invasive blood pressure monitors market size reached USD 17.80 billion in 2023.

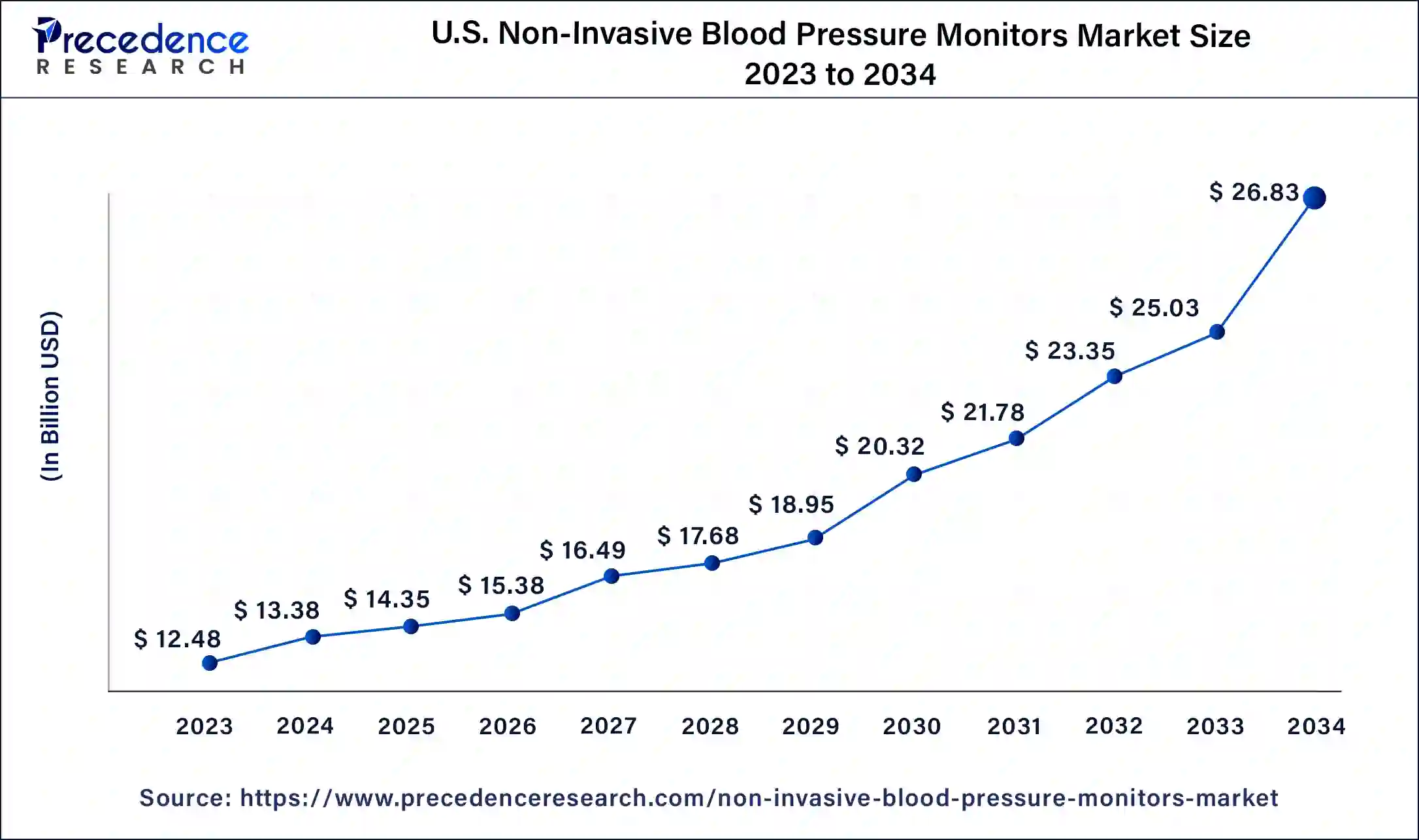

The U.S. non-invasive blood pressure monitors market size was estimated at USD 12.48 billion in 2023 and is predicted to be worth around USD 26.83 billion by 2034, at a CAGR of 7.2% from 2024 to 2034.

North America has held the largest revenue share 63% in 2023. North America dominates the non-invasive blood pressure monitors market primarily due to a combination of factors. The region has a substantial elderly population, which is more prone to hypertension, driving the demand for these devices. Moreover, well-established healthcare infrastructure, high healthcare spending, and a strong emphasis on preventive care and remote monitoring further boost the market. Additionally, technological advancements and a greater awareness of health monitoring contribute to North America's leadership. The COVID-19 pandemic also accelerated the adoption of remote healthcare solutions, amplifying the demand for non-invasive blood pressure monitors in the region.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region commands a significant growth in the non-invasive blood pressure monitors market due to a multitude of compelling factors. Firstly, the regions expansive and aging population, notably in countries like China and India, has stimulated robust demand for blood pressure monitoring devices. Additionally, the rising incidence of hypertension and cardiovascular ailments in Asia-Pacific has propelled the necessity for routine blood pressure assessment.

Furthermore, increased healthcare investments, enhanced medical infrastructure, and a heightened consciousness regarding health surveillance have all contributed to the region's dominant position in the market. Anticipated continued growth is fueled by expanding healthcare accessibility and the deepening awareness of health management within the region.

The non-invasive blood pressure monitors market has witnessed substantial growth in recent years, propelled by a surge in demand for these devices. These instruments are indispensable for tracking blood pressure levels without invasive procedures, rendering them highly coveted in both healthcare and household settings. Key drivers behind this expansion encompass the escalating incidence of hypertension, the aging demographic, and an increased consciousness regarding health surveillance.

Furthermore, technological innovations have ushered in more precise and user-friendly solutions, further augmenting consumer interest. The COVID-19 pandemic has underscored the significance of remote health monitoring, accentuating market dynamics. Consequently, the non-invasive blood pressure monitors market is projected to sustain its upward trajectory.

The non-invasive blood pressure monitors market has witnessed substantial growth in recent years, driven by a convergence of factors. These devices, essential for blood pressure monitoring without invasive procedures, have gained popularity in both healthcare and household settings. A key contributor to this expansion is the increasing prevalence of hypertension, a global health concern. Additionally, an aging demographic has driven the demand for these monitors, as older individuals often require frequent blood pressure monitoring.

Despite its growth prospects, the industry faces certain challenges. Regulatory compliance and accuracy standards are essential concerns, as the market's credibility is based on the reliability of these devices. Additionally, competition among manufacturers has intensified, prompting companies to innovate constantly to gain a competitive edge. However, this rivalry can also lead to price wars, which may affect profit margins.

Nevertheless, the non-invasive blood pressure monitors market presents lucrative business opportunities. As healthcare systems worldwide transition toward more patient-centric and remote care models, there is a growing need for advanced monitoring solutions. Moreover, the integration of wireless technology and smartphone applications into blood pressure monitors is opening new avenues for market growth. These innovations enable users to easily track and share their data with healthcare professionals, fostering a more proactive approach to manage hypertension.

In conclusion, the non-invasive blood pressure monitors market is projected to witness continued growth, driven by the prevalence of hypertension, an aging population, technological advancements, and the lessons learned from the COVID-19 pandemic. However, it must address challenges related to regulation and pricing while capitalizing on emerging opportunities in remote healthcare and smart device integration to sustain its upward trajectory.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7% |

| Market Size in 2023 | USD 28.25 Billion |

| Market Size in 2024 | USD 30.23 Billion |

| Market Size by 2034 | USD 59.46 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Device Type, By Technology, By Accessory, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Prevalence of hypertension

The pervasive presence of hypertension, commonly known as elevated blood pressure, serves as a substantial force propelling the expansion of the non-invasive blood pressure monitors market. Hypertension is a widely prevalent health concern impacting a considerable segment of the global population. It ranks as a primary contributor to cardiovascular ailments, strokes, and other severe health complications. The widespread occurrence of hypertension has sparked a notable increase in the request for blood pressure measurement tools, specifically the non-invasive models.

Non-invasive blood pressure monitors are indispensable for the prompt detection, control, and ongoing monitoring of high blood pressure. They offer a user-friendly and easily attainable means for individuals to conduct regular blood pressure evaluations, whether in medical facilities or the comfort of their residences.

As awareness regarding the inherent dangers associated with hypertension continues to escalate, an increasing number of individuals are motivated to integrate routine blood pressure monitoring into their healthcare routines. Consequently, the demand for non-invasive monitors’ surges, driven by their ease of use, comfort, and precise measurement capabilities. Healthcare practitioners are increasingly endorsing home blood pressure monitoring, firmly establishing these devices as indispensable elements in hypertension management and proactive healthcare strategies.

Accuracy concerns

Accuracy concerns pose a notable hindrance in the non-invasive blood pressure monitor market. These apprehensions center on the pivotal requirement for these monitoring devices to consistently deliver highly accurate readings. Any deviations from precision can result in incorrect diagnoses, misguided treatment decisions, and undermine confidence in the reliability of these instruments. The reliability of blood pressure monitors is paramount, as patients and healthcare practitioners rely on their precision for crucial healthcare determinations.

Manufacturers are confronted with the formidable challenge of ensuring their devices meet rigorous accuracy benchmarks established by regulatory authorities. This process often entails substantial time and financial investments. Furthermore, the potential for fluctuations in readings, particularly in at-home monitoring devices, can introduce uncertainty and distress among users.

Striking an equilibrium between cost-effectiveness and the preservation of the demanding accuracy levels required represents an ongoing challenge. Effectively addressing these accuracy apprehensions is vital for the sustained advancement of the Non-Invasive blood pressure monitors market, as any shortcomings in this regard may dissuade both consumers and healthcare providers from embracing these essential monitoring instruments.

Remote healthcare expansion

The expansion of remote healthcare and telemedicine is creating significant opportunities in the non-invasive blood pressure monitors market. As healthcare delivery shifts towards remote and virtual platforms, non-invasive blood pressure monitors are becoming essential tools for both patients and healthcare providers. These devices empower individuals to monitor their blood pressure at home, reducing the need for frequent clinic visits.

Patients can transmit their blood pressure data remotely to healthcare professionals, enabling timely interventions and adjustments in treatment plans. This aligns with the growing demand for telehealth services, especially in regions with limited access to healthcare facilities or during public health crises like the COVID-19 pandemic.

Furthermore, remote healthcare expansion opens doors for the development of user-friendly smartphone applications and connectivity features that seamlessly integrate with non-invasive blood pressure monitors. These apps can enhance user engagement, provide valuable insights, and facilitate convenient data sharing, further enhancing the market's growth prospects in the era of telemedicine.

According to the device type, the automated BP monitors segment has held a 67% revenue share in 2023. The automated Blood pressure (BP) monitors segment commands a significant share in the market due to its convenience and accuracy. These monitors provide easy-to-use, fully automated readings, making them popular for both healthcare professionals and individuals at home. Their ability to reduce human error and provide quick, consistent results has contributed to their widespread adoption.

Moreover, as healthcare systems increasingly emphasize remote monitoring, automated BP monitors align well with the trend, further solidifying their market dominance. Additionally, innovations such as integration with smartphones and telehealth platforms have expanded their appeal, enhancing their substantial market share.

The BP transducers segment is anticipated to expand at a significantly CAGR of 7.1% during the projected period. The BP Transducers segment holds significant growth in the market due to its critical role in monitoring blood pressure in clinical settings. These transducers provide accurate and real-time blood pressure measurements, essential for medical diagnoses and treatments. The demand for continuous, high-precision monitoring in hospitals, clinics, and ambulatory care settings is a driving factor. Moreover, technological advancements in BP transducers have improved their reliability and ease of use, further increasing their adoption. As healthcare facilities prioritize patient care and monitoring, the BP Transducers segment continues to grow in the market.

By technology, digital is anticipated to hold the largest market share of 45% in 2023. The digital segment holds a substantial share in the non-invasive blood pressure monitors market due to its advantages over traditional analog devices. Digital monitors offer more precise and convenient blood pressure readings, making them preferred by healthcare professionals and users alike. They often feature advanced features such as memory storage, data analysis, and compatibility with mobile apps, enhancing their utility. Additionally, the shift towards digital health and telemedicine has boosted the demand for digital monitors, as they seamlessly integrate with remote healthcare platforms, contributing to their dominant position in the market.

On the other hand, the wearable sector is projected to grow at the fastest rate over the projected period. The dominant growth of the wearable segment within the non-invasive blood pressure monitors market is attributed to its appeal and seamless alignment with contemporary lifestyles. Wearable devices, exemplified by smartwatches and fitness trackers, have garnered substantial market share due to their ability to provide continuous and nonintrusive blood pressure monitoring. These devices cater to the preferences of health-conscious consumers, who prioritize the effortless tracking of vital signs.

The integration of blood pressure monitoring into wearables not only fosters heightened user engagement but also encourages proactive health management. This trend is poised to persist and exert significant growth on market expansion, underlining the prominence of the wearable segment.

The blood pressure cuffs segment held the largest revenue share of 29.9% in 2023. The blood pressure cuffs segment holds a significant share in the non-invasive blood pressure monitors market primarily due to its long-standing history of reliability and widespread use in healthcare settings. Blood pressure cuffs, also known as sphygmomanometers, are trusted devices for measuring blood pressure accurately. Their familiarity and established track record have contributed to their dominance in the market. Moreover, advancements in cuff technology, such as automated and digital models, have ensured their continued relevance and convenience, further solidifying their prominent position in the market among healthcare professionals and consumers alike.

The bulbs sector is anticipated to grow at a significantly faster rate, registering a CAGR of 8.9% over the predicted period. The bulbs segment holds significant growth in the non-invasive blood pressure monitors market due to its crucial role in the devices' functioning. These bulbs, also known as cuffs or sleeves, are an integral component of blood pressure monitors, enabling the non-invasive measurement of blood pressure. Their importance lies in their ability to accurately and comfortably inflate and deflate, facilitating precise readings. As blood pressure monitoring becomes increasingly prevalent in healthcare and home settings, the demand for reliable and user-friendly bulb-equipped monitors remains high, making this segment a dominant growth leader in the market.

The hospitals sector has generated a revenue share of 61 % in 2023. The hospitals segment commands a significant share in the non-invasive blood pressure monitors market primarily due to several key factors. Hospitals require a range of blood pressure monitoring devices for diverse patient needs, from routine check-ups to critical care scenarios. They demand accurate and reliable non-invasive monitors to ensure patient safety and optimal healthcare delivery.

Moreover, hospitals often have larger budgets for medical equipment procurement, allowing them to invest in advanced and specialized blood pressure monitoring technology. As a result, the Hospitals segment remains a major driver of market share due to its continuous demand for these vital medical devices.

The home care setting segment is anticipated to grow at a significantly faster rate, registering a CAGR of 9.8% over the predicted period. The home care setting segment commands significant growth in the non-invasive blood pressure monitors market due to several key factors. First, the growing trend toward home healthcare and remote patient monitoring has led individuals to seek convenient and reliable devices for monitoring their blood pressure from the comfort of their homes.

Additionally, the COVID-19 pandemic accelerated the adoption of telemedicine and home-based care, further boosting demand for these monitors. Moreover, the aging population, with a greater need for regular blood pressure monitoring, has contributed to the dominance growth of the home care setting in this market.

Segments Covered in the Report

By Device Type

By Technology

By Accessory

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

March 2025

October 2024

July 2024