August 2024

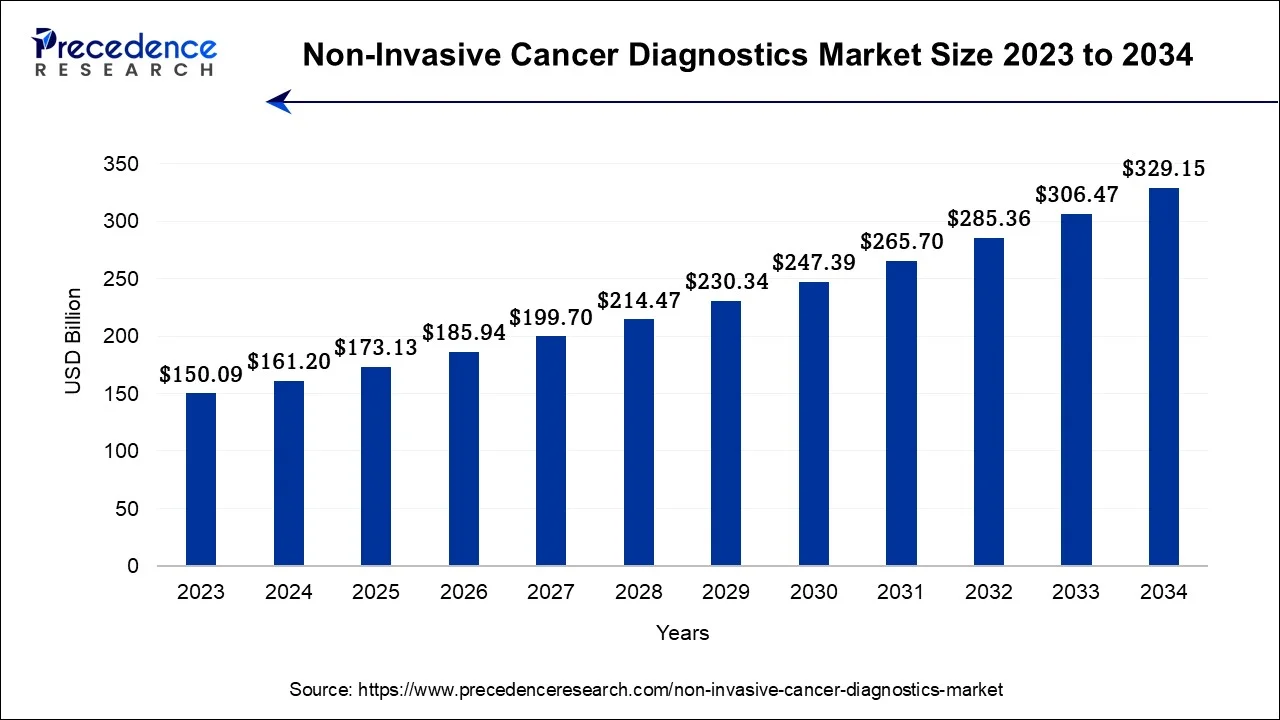

The global non-invasive cancer diagnostics market size is calculated at USD 161.2 billion in 2024, grew to USD 173.13 billion in 2025 and is predicted to hit around USD 329.15 billion by 2034, expanding at a CAGR of 7.40% between 2024 and 2034.

The global non-invasive cancer diagnostics market size accounted for USD 161.2 billion in 2024 and is anticipated to reach around USD 329.15 billion by 2034, growing at a CAGR of 7.40% between 2024 and 2034.

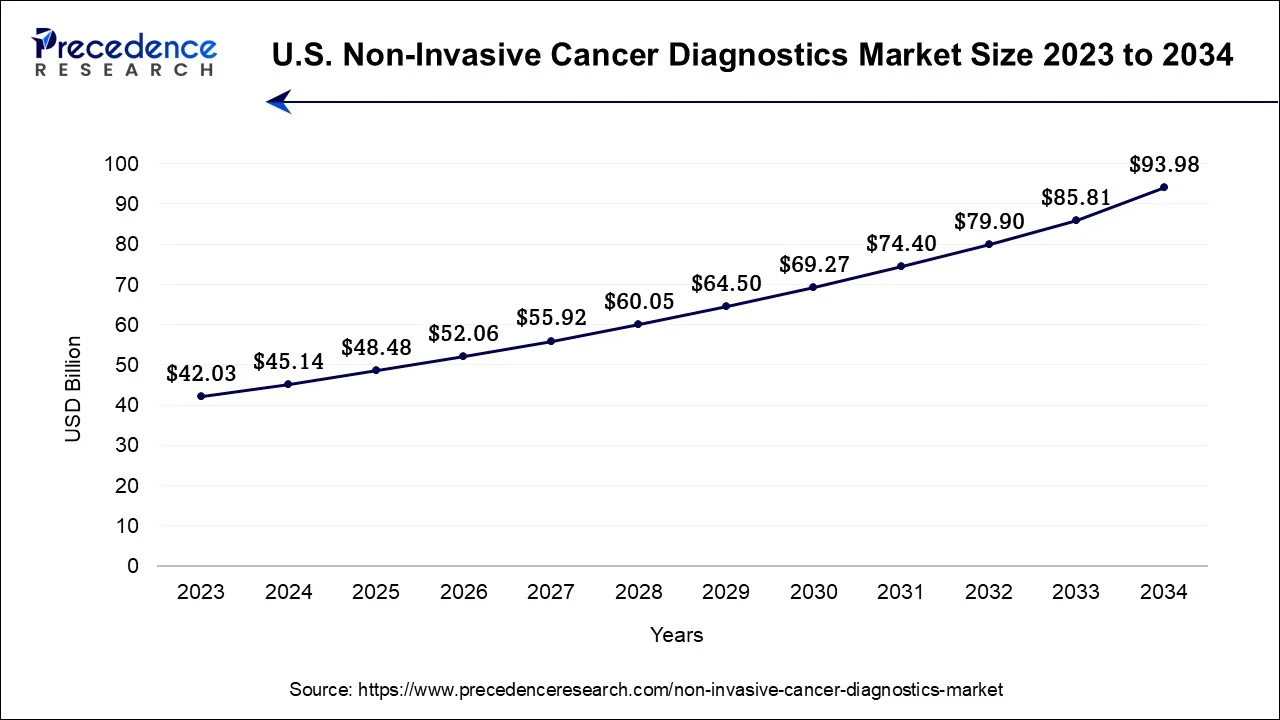

The U.S. non-invasive cancer diagnostics market size accounted for USD 45.14 billion in 2024 and is expected to be worth around USD 93.98 billion by 2034, at a CAGR of 7.60% from 2024 to 2034.

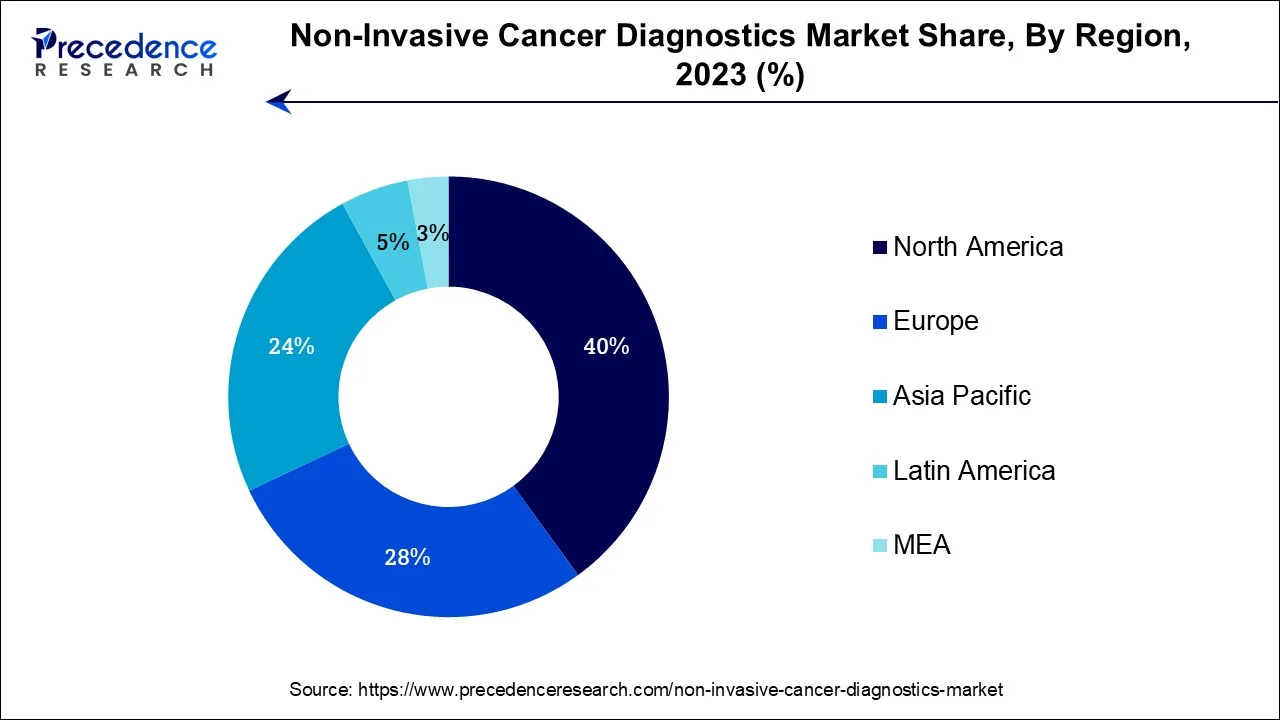

North America has held largest revenue share 40% in 2023. North America commands a significant share in the non-invasive cancer diagnostics market due to several factors. The region boasts advanced healthcare infrastructure, a strong focus on early cancer detection, and a high prevalence of cancer cases. Robust research and development activities, coupled with significant investments in cutting-edge diagnostic technologies, contribute to the region's dominance.

Moreover, favorable reimbursement policies, a well-established healthcare regulatory framework, and a proactive approach to healthcare innovation further drive market growth. Additionally, the region's willingness to adopt new technologies and the presence of key market players solidify North America's prominent position in this dynamic industry.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region commands a significant share in the non-invasive cancer diagnostics market due to several key factors. Firstly, the region's large and aging population contributes to a higher incidence of cancer cases, boosting demand for diagnostic tools. Secondly, increasing healthcare expenditure and improving healthcare infrastructure have enhanced accessibility to non-invasive cancer diagnostics. Thirdly, a growing awareness of the importance of early cancer detection has driven adoption. Lastly, the presence of prominent market players and ongoing technological advancements in countries like China, Japan, and India has propelled the region's prominence in this market.

The realm of non-invasive cancer diagnostics unfolds as a burgeoning segment in the healthcare landscape, dedicated to the art of discerning malignancies without the need for intrusive procedures such as surgical biopsies. It encompasses an array of avant-garde technologies, encompassing liquid biopsy methodologies, advanced imaging modalities, and the meticulous scrutiny of blood-borne cancer biomarkers.

This domain's expansion is propelled by the surging demand for early-stage cancer detection, offering patients heightened comfort and rendering treatment strategies increasingly precise. Unfolding strides in genomics and molecular biology have paved the way for increasingly precise and individualized non-invasive diagnostic modalities, positioning this sector as a pivotal pillar in the global campaign against cancer.

The non-invasive cancer diagnostics market is experiencing a remarkable surge owing to its groundbreaking approach to detecting and monitoring cancer without invasive procedures like conventional biopsies. This dynamic domain encompasses an array of state-of-the-art technologies, encompassing liquid biopsies, advanced imaging methodologies, and the scrutiny of cancer-specific biomarkers in blood samples. The global non-invasive cancer diagnostics market has evolved rapidly, emerging as a pivotal component in the global crusade against cancer.

Numerous pivotal industry trends and growth catalysts are propelling the non-invasive cancer diagnostics market forward. Firstly, there is a burgeoning focus on early cancer detection and intervention, fueling demand for these non-invasive modalities. Secondly, advancements in genomics and molecular biology have ushered in more precise and personalized diagnostic approaches, elevating the market's allure. Thirdly, the diminishment of patient discomfort linked to non-invasive diagnostics is further expediting market expansion. Lastly, the escalating global incidence of cancer cases and the imperative for accessible and cost-effective diagnostic tools are steering the adoption of these innovative methods.

The market's growth is underpinned by a medley of growth drivers and offers a plethora of business prospects. The surging prevalence of cancer, particularly in aging demographics, provides a substantial customer base. Moreover, the emergence of innovative technologies and diagnostic platforms is fostering opportunities for innovation and market penetration. Collaborative ventures between healthcare institutions, research centers, and diagnostic firms can stimulate research and development endeavors, ultimately broadening the market's outreach and product portfolio. The global proliferation of telemedicine and the heightened demand for remote diagnostic solutions also present lucrative avenues for growth.

Despite its promising trajectory, the non-invasive cancer diagnostics market confronts significant challenges. Foremost among these are stringent regulatory examinations and approval processes for novel diagnostic technologies, which can be arduous and time-consuming. Additionally, the need for robust clinical validation and the standardization of non-invasive diagnostic techniques pose formidable hurdles. Market competition is fierce, with numerous contenders vying for market dominance, necessitating companies to distinguish themselves through ingenuity and quality. Lastly, reimbursement complexities and variations in healthcare infrastructure across different regions could impede the market's expansion.

In summation, the non-invasive cancer diagnostics market is poised for substantial expansion, propelled by trends accentuating early cancer detection, breakthroughs in genomics, and the quest for more patient-centric diagnostic solutions. While offering promising business opportunities, surmounting regulatory obstacles, ensuring rigorous clinical validation, and navigating competitive landscapes remain pivotal challenges for industry stakeholders aspiring to make a significant mark in this transformative domain.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.4% |

| Market Size in 2024 | USD 161.2 Billion |

| Market Size by 2034 | USD 329.15 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Product Type, By Test Type, By Application, and By End Users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Non-invasive cancer diagnostics

The relentless surge in global cancer cases is a potent catalyst propelling the expansion of the non-invasive cancer diagnostics market. This continuous upswing in cancer occurrences can be ascribed to a myriad of factors, encompassing shifting demographics, evolving lifestyle patterns, environmental influences, and inherent genetic predispositions. As the shadow of cancer looms larger, there is an escalating demand for diagnostic techniques that are both efficacious and minimally intrusive.

Non-invasive cancer diagnostics emerge as a pivotal solution, providing the means to detect malignancies without subjecting individuals to the discomfort and potential hazards associated with invasive procedures such as surgical biopsies. Furthermore, the substantial economic burden borne by healthcare systems and societies due to the cancer challenge underscores the urgency for early and precise diagnostic tools.

Non-invasive modalities facilitate early detection, potentially leading to expedited interventions, improved treatment outcomes, and a potential reduction in the overall financial outlay linked to cancer care. Hence, the mounting incidence of cancer stands as a formidable driving force, energizing the non-invasive cancer diagnostics market as it endeavors to confront and mitigate the mounting healthcare challenge posed by cancer.

Clinical validation

Clinical validation stands as a substantial impediment to the advancement of the non-invasive cancer diagnostics market. Ensuring the precision, dependability, and clinical credibility of non-invasive diagnostic techniques is a pivotal challenge. Prior to widespread adoption, these approaches must undergo extensive testing and validation procedures to establish their effectiveness in detecting cancer. This necessitates comprehensive clinical trials, meticulous data accumulation, and validation studies, all of which demand considerable resources and time.

The protracted validation process has the potential to delay the market entry of novel diagnostic technologies, constraining innovation and decelerating market growth. Furthermore, there exists a risk that certain non-invasive diagnostic methods may not meet the requisite standards of clinical accuracy, leading to skepticism among healthcare providers and potential patients. Consequently, the imperative for robust clinical validation, though vital to ensure patient safety and diagnostic reliability, can obstruct the swift expansion of the non-invasive cancer diagnostics market, creating impediments for emerging technologies striving to establish credibility and acceptance within the medical community.

Early detection emphasis

The increasing focus on early cancer detection stands as a pivotal driver of opportunities within the non-invasive cancer diagnostics market. As healthcare systems and individuals increasingly appreciate the profound advantages of identifying cancer in its earliest and most treatable stages, the demand for non-invasive diagnostic technologies is poised for remarkable expansion. This accentuation of early detection is fostering an environment of heightened research and inventive solutions in the field, nurturing the creation of state-of-the-art diagnostic tools capable of pinpointing cancer-related biomarkers, genetic anomalies, and other indicators with exceptional precision.

Such innovations empower healthcare providers to deliver timely interventions, thereby elevating patient outcomes and potentially reducing the overall financial burden of cancer care. Furthermore, this heightened awareness of early detection's benefits is stimulating patient engagement and fueling the demand for regular cancer screenings, thereby broadening the market's horizons. Consequently, the non-invasive cancer diagnostics market is expected to witness groundbreaking advancements and investment within the healthcare domain, all rooted in the burgeoning emphasis on the early detection of cancer.

Impact of COVID-19

The COVID-19 pandemic had a multifaceted impact on the non-invasive cancer diagnostics market. Initially, the market experienced disruptions due to strained healthcare resources and the postponement of elective procedures. However, as the pandemic highlighted the importance of remote and non-invasive diagnostic solutions, there was a subsequent surge in demand for telemedicine and non-invasive cancer diagnostic tools. The pandemic accelerated the adoption of these technologies, promoting innovation and market growth. Additionally, the emphasis on early detection of cancer gained prominence, further driving the market as healthcare systems sought more accessible and safer diagnostic options in the wake of the pandemic.

The breast cancer sector has held a 16.3% revenue share in 2023. The dominance of the breast cancer segment within the non-invasive cancer diagnostics market can be attributed to several pivotal factors. Breast cancer ranks among the most prevalent malignancies worldwide, and its early detection is of paramount importance for enhanced treatment outcomes. Non-invasive diagnostic modalities, including breast MRI, mammography, and blood-based biomarker assessments, offer efficacious and minimally intrusive avenues for breast cancer detection.

The heightened awareness, dedicated screening initiatives, and relentless research efforts focused on breast cancer diagnostics have bolstered the demand for non-invasive solutions. Consequently, the breast cancer segment secures a significant share, reflecting the substantial demand and market potential inherent in breast cancer detection and surveillance.

The Curved Display sector is anticipated to expand at a significantly CAGR of 8.1% during the projected period. Lung cancer, renowned as one of the most prevalent and deadliest malignancies globally, has fostered an escalated demand for highly effective diagnostic solutions. Non-invasive methodologies, encompassing state-of-the-art imaging technologies, liquid biopsy methods, and cutting-edge diagnostic techniques, have demonstrated their exceptional value in the early identification of lung cancer, given the associated risks tied to more invasive alternatives. Furthermore, the relentless drive towards innovation and research has birthed sophisticated non-invasive tests that elevate diagnostic precision, further cementing the lung cancer segment's preeminence and dominant market growth.

Based on the product type, clinical microbiology is anticipated to hold the largest market share of 22% in 2023. The clinical microbiology segment commands a substantial share in the non-invasive cancer diagnostics market due to its pivotal role in diagnosing cancer through non-invasive means. This segment encompasses a wide range of diagnostic methods, including liquid biopsies and molecular assays, which analyze genetic and molecular markers present in bodily fluids, offering highly sensitive and specific cancer detection. The precision, convenience, and minimal discomfort associated with clinical microbiology-based non-invasive diagnostics have propelled its adoption, making it a cornerstone in early cancer detection and monitoring, thereby securing a significant market share.

On the other hand, the hematology segment is projected to grow at the fastest rate over the projected period. The Hematology division exerts substantial sway within the non-invasive cancer diagnostics arena owing to its central role in unearthing hematological malignancies like leukemia, lymphoma, and myeloma. Non-intrusive methodologies, encompassing approaches such as liquid biopsies and the scrutiny of blood-based biomarkers, have inaugurated a transformative era in the diagnosis of hematological cancers. They furnish the capacity for early detection and the continual tracking of maladies without necessitating intrusive procedures.

The efficacy of these methods, coupled with the mitigation of patient discomfort and their expanded range of applications, has cemented the Hematology segment's eminence as a pivotal contributor to market hegemony. As healthcare systems increasingly give precedence to the early identification and oversight of hematological cancers, this segment retains a substantial growth within the market.

The imaging tests segment held the largest revenue share of 22% in 2023. The imaging tests segment holds a substantial share in the non-invasive cancer diagnostics market primarily due to its established effectiveness in detecting and visualizing cancerous lesions and abnormalities. Modalities such as MRI, CT scans, and ultrasound provide detailed anatomical and functional information, aiding in accurate cancer diagnosis and staging.

Additionally, they offer non-invasive options for monitoring disease progression and treatment efficacy. Their widespread availability, proven track record, and patient-friendly nature contribute to their dominance in the market, making imaging tests a preferred choice for both clinicians and patients in the realm of non-invasive cancer diagnostics.

The spectroscopy segment is anticipated to grow at a significantly faster rate, registering a CAGR of 10.9% over the predicted period. The spectroscopy segment commands a significant growth in the non-invasive cancer diagnostics market due to its ability to offer precise and non-invasive insights into cancer at the molecular level. Spectroscopy techniques, such as Raman and infrared spectroscopy, enable the identification of biomarkers and abnormal tissue characteristics without invasive procedures.

This technology's accuracy and versatility in detecting various cancer types have propelled its adoption. Additionally, advancements in spectroscopic imaging and data analytics have enhanced diagnostic capabilities, further solidifying its position as a preferred choice for non-invasive cancer diagnostics, leading to major market growth.

The blood segment has generated revenue share of 45% in 2023. The prominence of the blood segment within the non-invasive cancer diagnostics market is attributed to its efficacy in detecting cancer-related biomarkers and genetic material. Blood-based assessments, such as liquid biopsies, present a minimally intrusive means of cancer screening and monitoring, rendering them more attractive to both patients and healthcare providers.

Furthermore, advancements in the realms of molecular biology and genomics have elevated the precision of these tests, bolstering their adoption. Offering the potential to identify various cancer types, blood-based diagnostics have emerged as a versatile and dependable asset in the battle against cancer, contributing significantly to their substantial market presence.

The Saliva segment is anticipated to grow at a significantly faster rate, registering a CAGR of 11.8% over the predicted period. The dominance growth of the Saliva sector within the non-invasive cancer diagnostics market can be attributed to its notable advantages, characterized by its ease of use, patient-friendly approach, and wide accessibility. Saliva-based diagnostics have gained prominence due to their non-intrusive collection method, simplifying the sampling process while eliminating the necessity for invasive procedures like tissue biopsies.

Furthermore, advancements in molecular biology have expanded the horizon for detecting cancer biomarkers in saliva, enhancing its diagnostic potential. With this combination of factors and a growing focus on research and development, the Saliva segment has established a significant foothold in the market, emerging as a prominent growth leader to the quest for effective and patient-centered cancer diagnostic techniques.

The diagnostic centers segment has generated revenue share of 35 % in 2023. The diagnostic centers segment holds a significant share in the non-invasive cancer diagnostics market due to its specialized expertise, advanced equipment, and comprehensive diagnostic services. Diagnostic centers are well-equipped to perform a wide range of non-invasive cancer diagnostic tests efficiently. They often collaborate with healthcare providers, offering convenient access to these services for patients.

Moreover, diagnostic centers typically stay updated with the latest technologies, ensuring accurate and reliable results. This reliability and convenience make them a preferred choice for both healthcare professionals and patients, contributing to their dominant position in the market.

The ambulatory care segment is anticipated to grow at a significantly faster rate, registering a CAGR of 8.6% over the projected period. The ambulatory care segment holds substantial growth in the non-invasive cancer diagnostics market due to its patient-centric advantages. It offers the convenience of non-invasive diagnostic procedures performed outside traditional hospital settings, reducing patient discomfort and healthcare costs.

Additionally, the rising emphasis on early cancer detection has led to increased outpatient screenings and diagnostics. Ambulatory care facilities are well-suited for these purposes, making them a preferred choice. Moreover, the COVID-19 pandemic accelerated the adoption of telemedicine, further bolstering the ambulatory care segment, as it aligns with remote and non-invasive diagnostic trends.

Segments Covered in the Report

By Type

By Product Type

By Test Type

By Application

By End Users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

March 2025

October 2024

July 2024