July 2024

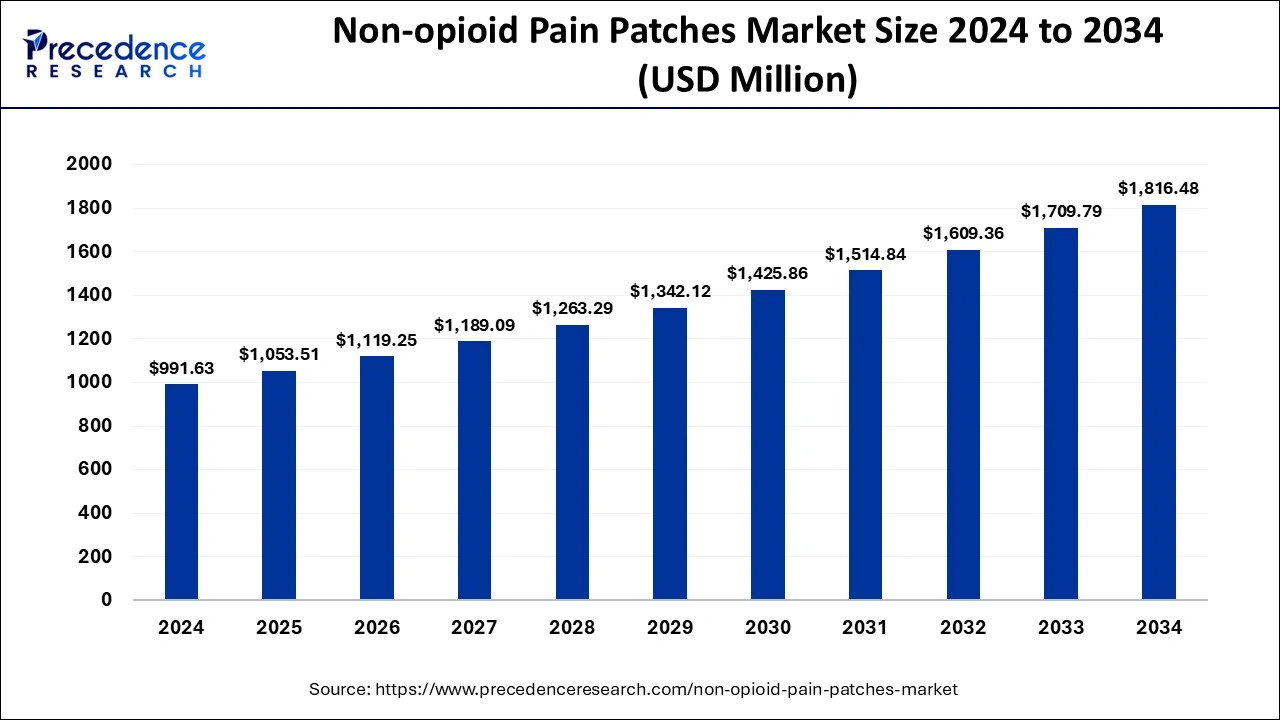

The global non-opioid pain patches market size was accounted for USD 991.63 million in 2024, grew to USD 1,053.51million in 2025 and is projected to surpass around USD 1,816.48 million by 2034, representing a CAGR of 6.24% between 2025 and 2034. The North America non-opioid pain patches market size is calculated at USD 406.57 million in 2024 and is expected to grow at a CAGR of 6.37% during the forecast year.

The global non-opioid pain patches market size was accounted for USD 991.63 million in 2024 and is expected to exceed around USD 1,816.48 million by 2034, growing at a CAGR of 6.24% from 2025 to 2034. The non-opioid pain patches market growth is attributed to the increasing demand for safer, non-opioid alternatives for pain management amid growing concerns over opioid-related risks.

Healthcare has an enormous outlook for artificial intelligence advancements that implement quality performance standards for the diagnosis and treatment of patients. AI technologies are currently driving the management of pain and influencing product form and the non-opioid pain patches market. Big data tools work with massive patient databases to find out what is good for the patient and the best course of action that a manufacturer can take to try to help them without invasive tools or procedures.

Artificial intelligence in the non-opioid pain patches market support helps to manage the supply chain and improve its efficiency in satisfying increasing production and demand requirements. Furthermore, these innovations help non-opioid pain patches enhance precision medicine by accurately addressing patients' and healthcare organizations’ inclination and usage rates, respectively, based on their pain types.

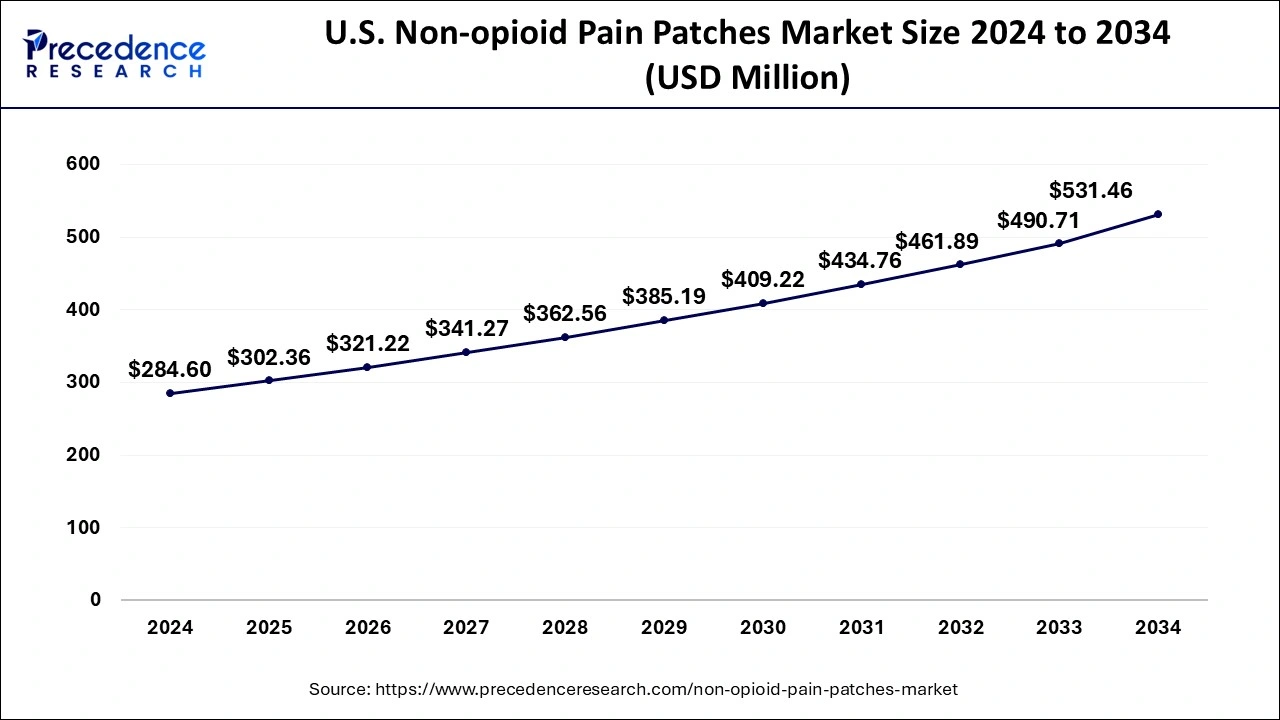

The U.S. non-opioid pain patches market size was exhibited at USD 284.60 million in 2024 and is projected to be worth around USD 531.46 million by 2034, growing at a CAGR of 6.44% from 2025 to 2034.

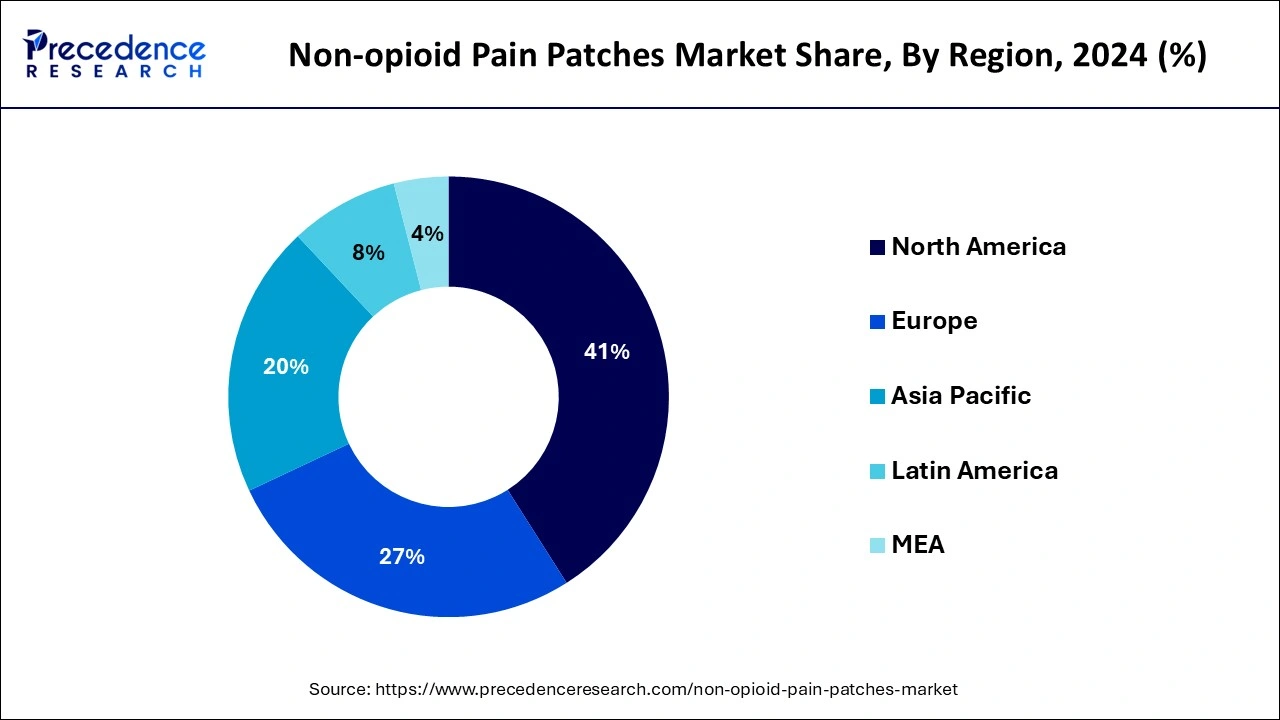

North America dominated the global non-opioid pain patches market in 2024 due to the increasing consciousness of the opioid problem and the consequent effort by physicians and patients to look for safer pain management options. The escalating incidence of chronic diseases, such as arthritis and neuropathies, is likely to increase the demand for precise non-opioid treatments. Moreover, the permissive clinical recommendations and legislation in North America have also propelled the acceptability of these patches.

Asia Pacific is projected to host the fastest-growing non-opioid pain patches market in the coming years, owing to factors such as rising urbanization and changes in lifestyle, eventually leading to chronic pain cases to create a boost in the pain management market demand. According to the NHI report, the three major non-communicable diseases (NCDs) in the region are cardiovascular diseases (CVDs), cancer, and diabetes, driven by the rising loss of disability-adjusted life years (DALYs).

Higher healthcare costs and improved accessibility to medical care have let the patient look and manage for non-opioid options. The advancement in e-commerce has helped most patients in the region to easily order these non-opioid types of products. Efforts by the government to contain the abuse of opioids are leading to a shift to better long-term management of pain and increased uptake of non-opioid pain patches.

The continuing increase in opioid use has put pressure on physicians to recommend other means of pain relief, making transdermal drug delivery systems progress considerably. These refinements have improved the efficiency and usage of non-opioid pain patches over regular opioid patches and are, as such, preferable in the management of chronic pain illnesses. This growth is an effect of escalating the incidence of chronic pain conditions and growing awareness of the dangers posed by opioids to patients.

The technology applied to transdermal delivery has grown rapidly, which has helped to unveil better results in terms of absorption rate and better dosing than conventional oral delivery. The inclusion of these technologies into non-opioid patches enhances the effectiveness of these patches, making it a viable strategy against traditional pain treatments.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,816.48 Million |

| Market Size in 2025 | USD 1,053.51 Million |

| Market Size in 2024 | USD 991.63 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.24% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Patch Type, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing prevalence of chronic pain disorders

Increasing cases of chronic pain disorders, including arthritis, neuropathy, and lower back pain, are anticipated to drive demand for the non-opioid pain patches market. There is an even higher demand for non-opioid drugs for pain management. Non-opioid pain patches deliver effectively timed and long-lasting relief, which reflects the general and specific desire of patients and HCPs for safer and non-invasive therapies. Moreover, the pain patches do not have any invasive characteristics, and their usage by patients is simpler than that of opioid-containing medications.

A 2023 DOP survey conducted in 2021 found that about 20.9% of U.S. adults had at least one chronic pain issue, while 6.9% had a high-impact chronic pain issue, which clearly depicts the prevalence of these issues. Chronic pain is common in the elderly population; in 2023, 36% of U.S. adults aged 65 and over had chronic pain, indicating the importance of efficient and non-opioid treatment in elderly people.

Competition from alternative pain management solutions

The availability of alternative pain management therapies, including physical therapy, acupuncture, and over-the-counter analgesics, is projected to restrain the non-opioid pain patches market growth. They undergo these procedures for reasons such as convenience, cost, and culture. The non-opioid promoters of new oral and injectable pharmaceuticals offer intense rivalry. These alternatives tend to usurp non-opioid pain patches where present, particularly in those areas of the world where they are heavily marketed. It is important to create awareness of the various promotional points of pain patches as a way of dealing with the mentioned challenge.

Spurring technological advancements in transdermal delivery

Spurring advancements in transdermal drug delivery technologies are projected to support the development of innovation in the non-opioid pain patches market. Technological advancements in pain management include microneedle-based patches for drug delivery, enhanced permeability enhancer-delivering technologies, and innovative smart patches with real-time monitoring. Such developments boost the rate of drug delivery and accuracy in dosing and increase the convenience for patients in achieving better results. Thus, the use of these technologies to enhance non-opioid-containing patches improves their value as a potent therapeutic modality that is a strong contender to traditional pain management approaches.

The lidocaine patches segment held a dominant presence in the non-opioid pain patches market in 2024 due to their use in the management of localized pain, especially in neuropathic pain. The use of such drugs is associated with the results of multiple dozens of patients with diseases, such as postherpetic neuralgia, in which long-term pain control is required. These patches are expected to maintain their popularity, as they work locally and do not cause systemic side effects as conventional oral analgesics do. Neuropathic disorders are on an upward trend, and so are the geriatric population, who experience chronic pain.

The capsaicin patches segment is expected to grow at the fastest CAGR in the non-opioid pain patches market from 2025 to 2034, owing to its method of easing pain by numbing the nerve receptors. These patches have been effective in the treatment of chronic pain, such as diabetic neuropathy and osteoarthritis, and this has made it easier for patients to look for long-term control. Capsaicin patches conform to the market's trend of adopting nonopioid drugs, and this is further appreciated through approvals by the relevant authorities for their usefulness due to safety when recommended clinically. It is expected that the subsequent improvements in the transdermal delivery systems will improve their effectiveness and, therefore, the patient's outcome.

The hospital pharmacies segment accounted for a considerable share of the non-opioid pain patches market in 2024, as they are responsible for managing intricate patient care. These are the pharmacies that avail all various forms of pain relief, not limited to non-opioid patches, and guarantee clients personalized treatment plans. The introduction of non-opioid pain patches into the hospital environment supports international healthcare goals of minimization of opioid use and safe management of acute pain. They add to the protection of the patient while also promoting the goal of fighting the opioid usage issue on the whole.

The online pharmacies segment is anticipated to grow with the highest CAGR in the non-opioid pain patches market during the studied years. Since e-commerce platforms have emerged, patients now obtain non-opioid pain patches without having to attend physical shops. Their convenience is especially valued by persons living far from the centers or suffering from mobility impairments. Furthermore, it is easier to get a wider variety of products and cheaper online, which means more people can afford non-opioid pain patches. Online pharmacy business is a global phenomenon that follows modern society’s trend of adopting digital solutions in healthcare.

By Patch Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

August 2024

October 2024

October 2024