Oil Refining Market (By Product: Fuel Oil, Light Distillates, Middle Distillates, Others; By Fuel: Gasoline, Kerosine, Liquified Petroleum Gas, Gasoil, Others; By Complexity: Hydro-skimming, Topping, Conversion, Deep Conversion; By Application: Marine Bunker, Transportation, Aviation, Petrochemical, Agriculture, Electricity, Residential & Commercial, Rail & domestic waterways, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

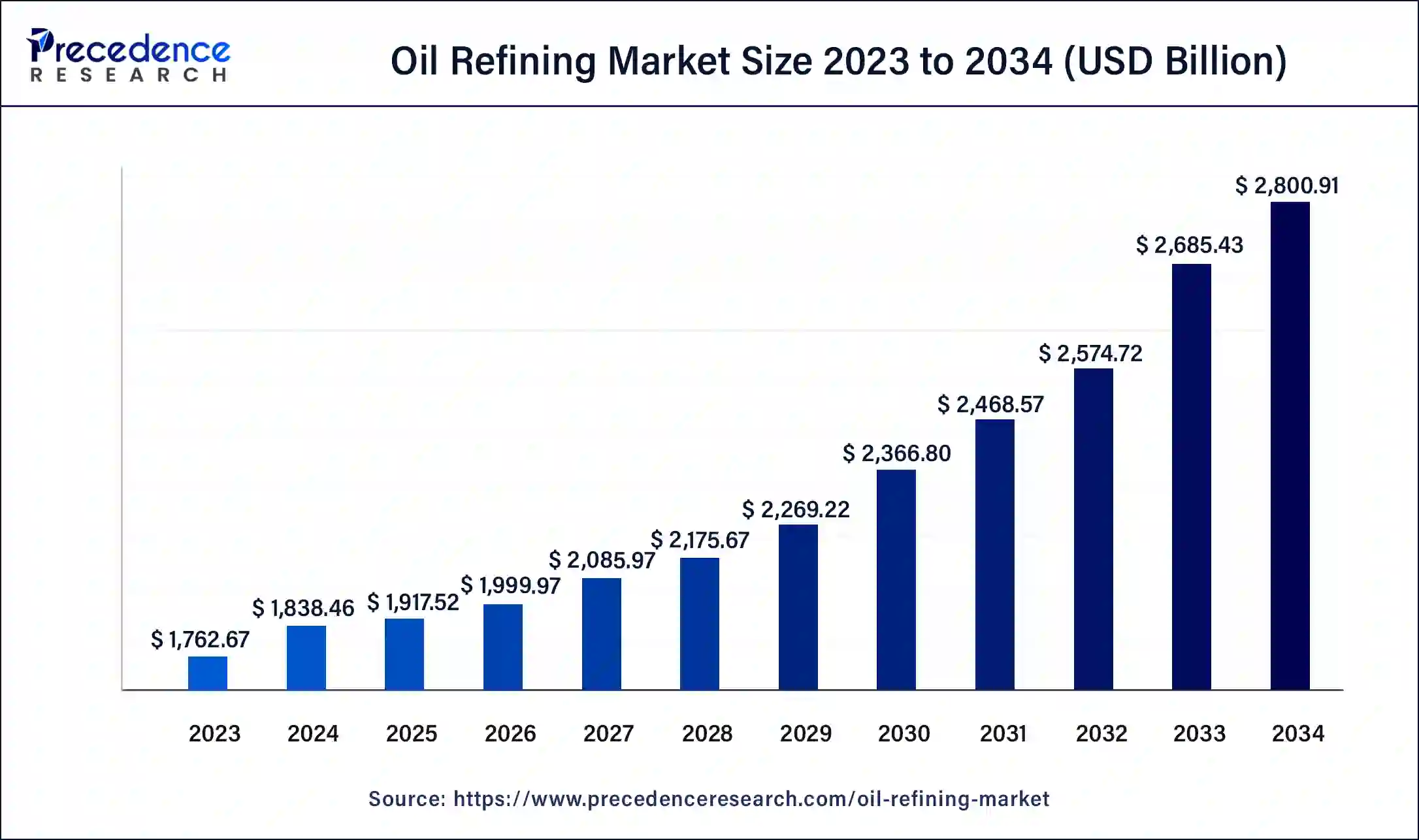

The global oil refining market size was USD 1,762.67 billion in 2023, accounted for USD 1,838.46 billion in 2024 and is expected to reach around USD 2,800.91 billion by 2034, expanding at a CAGR of 4.30% from 2024 to 2034. Oil refining benefits include helping to remove potential contaminants and harmful substances from oils, which makes them healthier for consumption. Their applications include electricity, agriculture, aviation, petrochemical, transportation, marine bunker, etc., which helps the growth of the market.

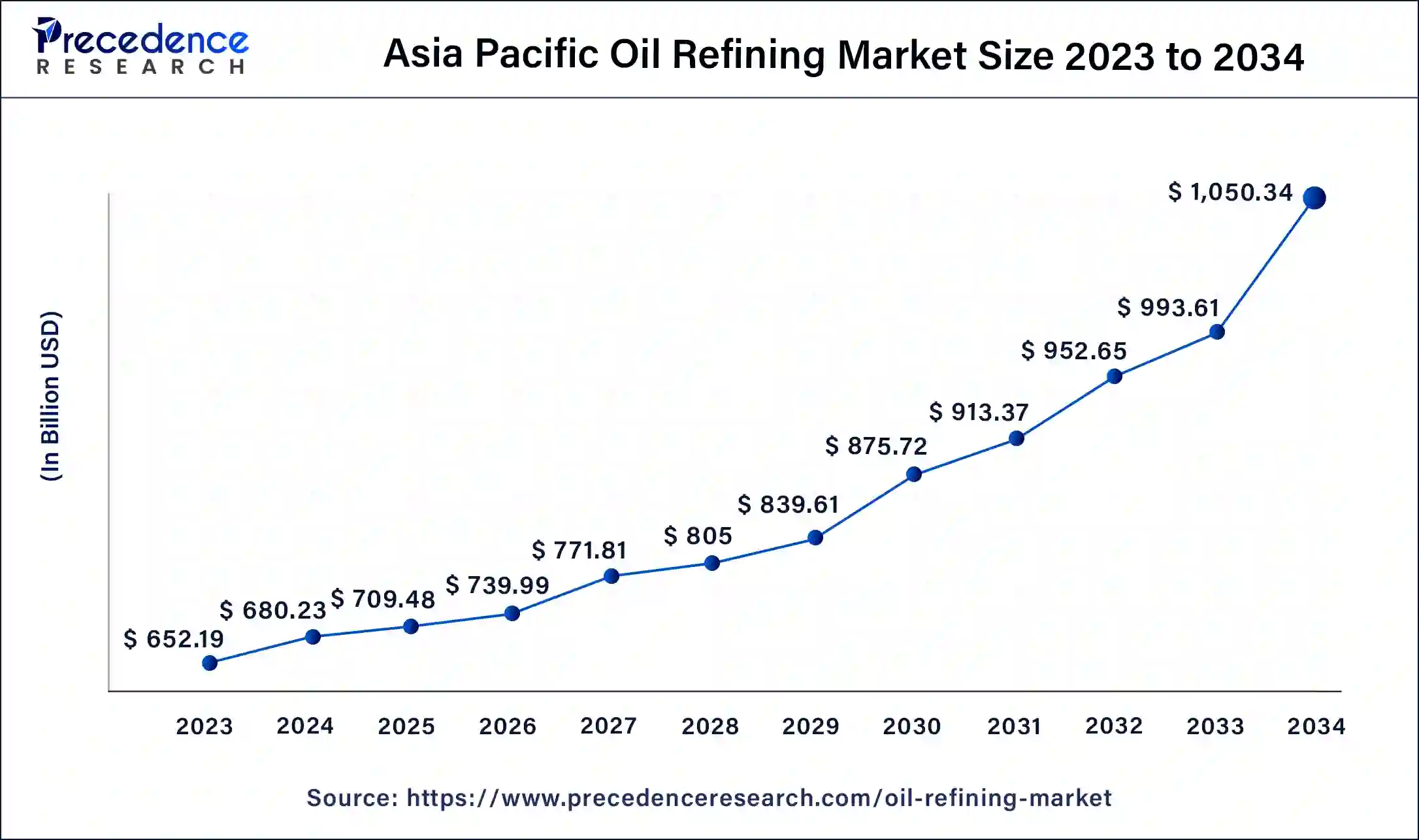

The Asia Pacific oil refining market size was exhibited at USD 652.19 billion in 2023 and is projected to be worth around USD 1,050.34 billion by 2034, poised to grow at a CAGR of 4.42% from 2024 to 2034.

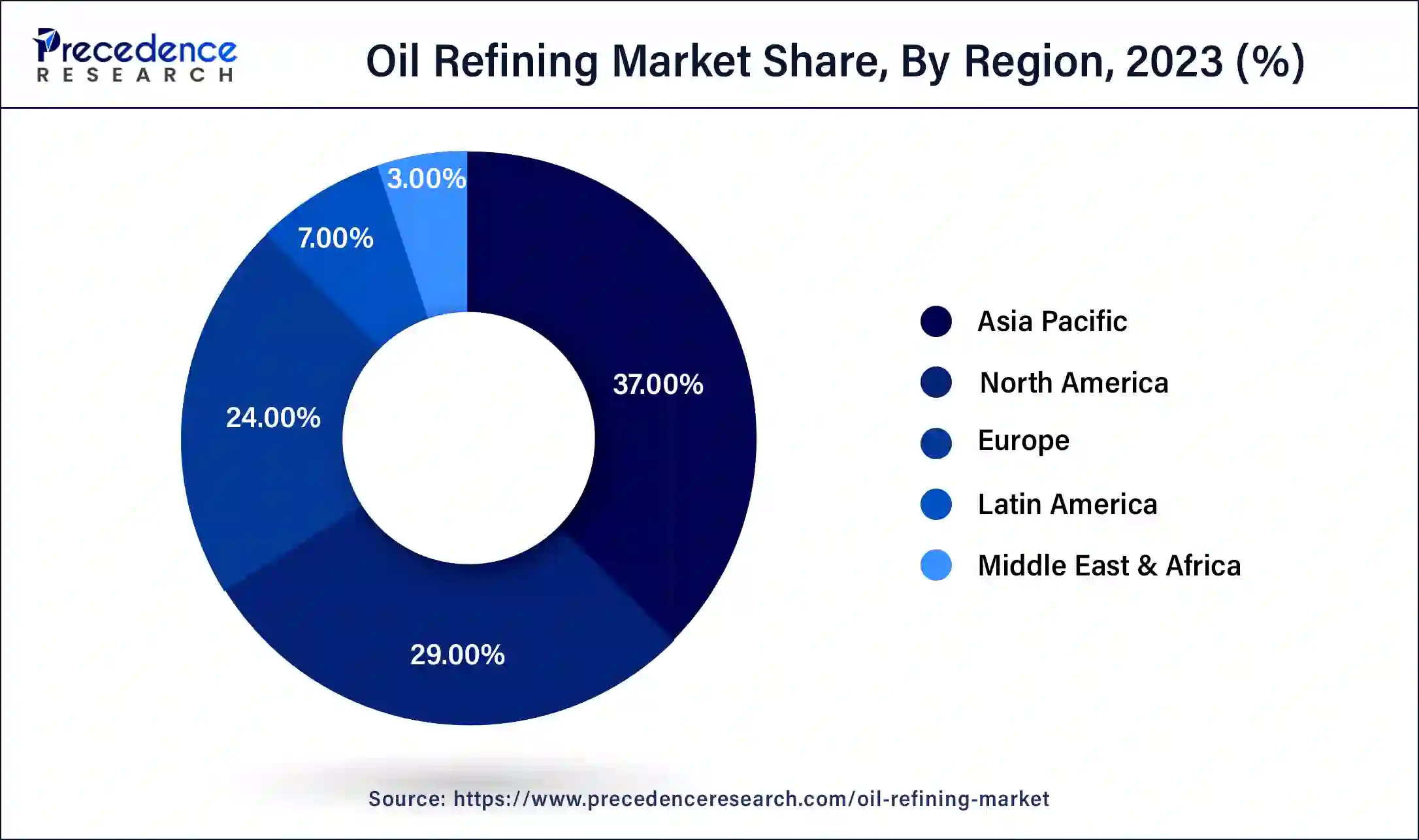

Asia Pacific dominated the oil refining market in 2023. Aviation oils can help to reduce wear and friction in an aviation engine. Rapid urbanization, industrialization, and economic growth play an important role in the growth of the market in the Asia Pacific region. China is the leading country for the growth of the market in the Asia Pacific region.

North America is estimated to be significantly growing during the forecast period of 2024-2034. In North America, there are 149 active oil refineries, which help the oil refining market grow. The United States refines nearly one-fifth of worldwide crude oil, which is considered 18.1 billion barrels per day. Marathon Petroleum Corporation is the leading oil refiner company in the United States.

The oil refining market refers to the oil refining, or petroleum refinery, which is an industrial process plant where crude oil is transformed and refined into products like kerosine, petroleum naphtha, liquefied petroleum gas, heating oil, fuel oils, asphalt base, diesel fuel, and gasoline (petrol). The benefits of oil refining include the improvement of edible value, more profit, improvement of the quality of cooking oil, ability to extend the storage time of cooking oil, production of transportation and other oils, production of bandages, plastics, shaving creams, and shampoos, and creation of raw materials for the chemical industry. These factors help to the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,800.91 Billion |

| Market Size in 2023 | USD 1,762.67 Billion |

| Market Size in 2024 | USD 1,838.46 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.30% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Fuel, Complexity, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising investment in oil refinery facilities

Rising investment in upgrades, reconstruction, and expansion of existing oil refinery facilities helps the growth of the market. Oil refining plays a significant role in the production of transportation and other fuels. The crude oil components, once separated, may be sold to different industries for a wide range of purposes. The benefits of investing in oil refining facilities include dividend yields, diversification, and inflation hedge. Oil stocks serve as a hedge against inflation and growth potential in the oil sector as the global economy expands and energy demand increases, mainly in developing nations. These factors help the growth of the oil refining market.

Downsides of oil refining

Oil refining processes include alkali or acid treatments, de-gumming, deodorizing, dewaxing, and bleaching. These harmful stages reduce the smell, flavor, chlorophyll content, and other nutrients in the oil. After some time, it is affected by increasing rancidity and oxidation in the edible oil. The rise of biofuels and electric vehicles hamper the growth of the market. Carbon taxes and weakening refining margins put oil refining capacity at risk. Risk of industrial exposure to chemicals or accidents like fire or explosions or health and hygiene hazards. The challenges of oil refining include electric vehicles (EVs), decarbonization, rationalization, and profitability. These factors can restrict the growth of the oil refining market.

Advanced technologies

By using advanced technologies in the oil refining helps to the growth of the market. This helps to achieve diversified employment opportunities and economic growth. The benefits of advanced technologies used in oil refining include a decrease in NOx emissions and CO2 emissions with carbon capture and storage (CCS), production of fuels with low carbon footprints, increased production of petrochemicals, and increased competitiveness and flexibility by digitalization and catalyst management. These factors help the growth of the oil refining market.

The middle distillates segment dominated the market in 2023. The advantages of oil refining for middle distillates include lower plot capital investment than the hydrogen additional processes, no residual liquid product to deal with, preferred in low crude oil price environments, highly used in many references, can handle high contaminants (very poor-quality) feeds, etc. can help to the growth of the segment. Middle distillates are primarily used as fuel for lighting, heating, and transportation worldwide. When crude oil refining is done, middle distillates make up between 25% to 40% of the oil products profit. These factors help the growth of the middle distillate segment and contribute to the growth of the oil refining market.

The light distillates segment is anticipated to be the fastest-growing during the forecast period. Light distillates are refined oil products manufactured by fractional distillation. These have lower boiling points, are flammable substances, and consist of short hydrocarbon chains that may be either liquid or gaseous. Light petroleum distillates (LPDs) are most commonly encountered in products like camp stove fuels and pocket lighter fuels. In the medium-range products used as mineral spirits, dry cleaning solvents, paint thinners, charcoal starter fuels, and some automotive fuel treatments. These are also used in liquified petroleum gas (LPG), motor gasoline, naphtha, etc. These factors help the growth of the light distillates segment and contribute to the growth of the oil refining market.

The gasoline segment dominated the oil refining market in 2023. The advantages of gasoline include its support of existing infrastructure like gas, cars, and road stations, quick refueling times, a portable fuel source that can be carried easily into a safe container, readily available, high energy density, etc. Gasoline is used for many purposes, including electricity generators for emergency and portable power supply, powering tools and equipment used in landscaping, forestry, farming, and construction, and fuel for small aircraft, boats, recreational vehicles, motorcycles, light trucks, sports utility vehicles, and cars. These factors help the gasoline segment and contribute to the growth of the market.

The gasoil segment is growing significantly during the forecast period. Gasoil, also called red diesel, is a type of fuel oil refined from petroleum, and it is heavier than paraffin oil. The uses of gasoil include non-commercial purposes like heating and electricity generation, traveling fairs and circuses, boating, sailing, and marine transport, community amateur sports clubs and golf courses, rail transport, etc. Gasoil is also used in rail transport, agriculture, vehicles, generators, powering machinery, etc. These are also used as enriching agents for carbureted water gas manufacturing. The gasoil industry has important economic advantages for communities, including infrastructure development, job creation, and tax revenues. These advantages may have positive social impacts like improved public services, enhanced living standards, and increased economic opportunities. These factors help to the growth of the gasoil segment and contribute to the growth of the oil refining market.

The hydro-skimming segment dominated the market in 2023. Hydro-skimming is the simplest type of oil refining used in the petroleum industry. Hydro-skimming oil refining is more complex than topping oil refining. It is also used to generate higher octane reformations like xylene, benzene, toluene, and hydrogen for hydrotreating units. These factors help to the growth of the hydro-skimming segment and contribute to the growth of the oil refining market.

The transportation segment dominated the oil refining market in 2023. Transportation fuels produced by oil refining include jet fuel, gasoline, and diesel fuel. Gasoline is the dominant transportation fuel in the United States. Transportation of oil refining is important because of the rapid development of worldwide industrialization; refined oil consumption is at a high level, and transportation of refined oil is huge. A high amount of crude oil and refined oil products are transported by ship between points of consumption, production sites, and refineries. These factors help to the growth of the transportation segment and contribute to the growth of the market.

The aviation segment is the fastest-growing during the forecast period. Aviation fuel, also called kerosene or jet fuel from the German Kerosin, is used to power aircraft jet engines. Also called Avtur or aviation turbine fuel, which is a highly refined paraffin. The lubrication system of aircraft deals with clearing, sealing, cooling, and fighting rust and corrosion in the engine. Airplanes need protection from corrosion and rust, which can be provided by using good aviation oils. These factors help to the growth of the aviation segment and contribute to the growth of the oil refining market.

Segments Covered in the Report

By Product

By Fuel

By Complexity

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client