October 2024

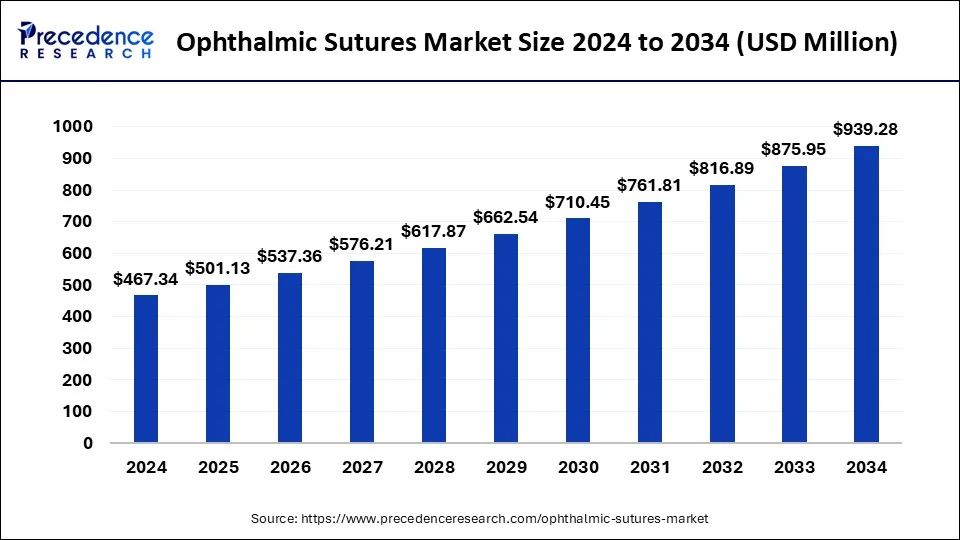

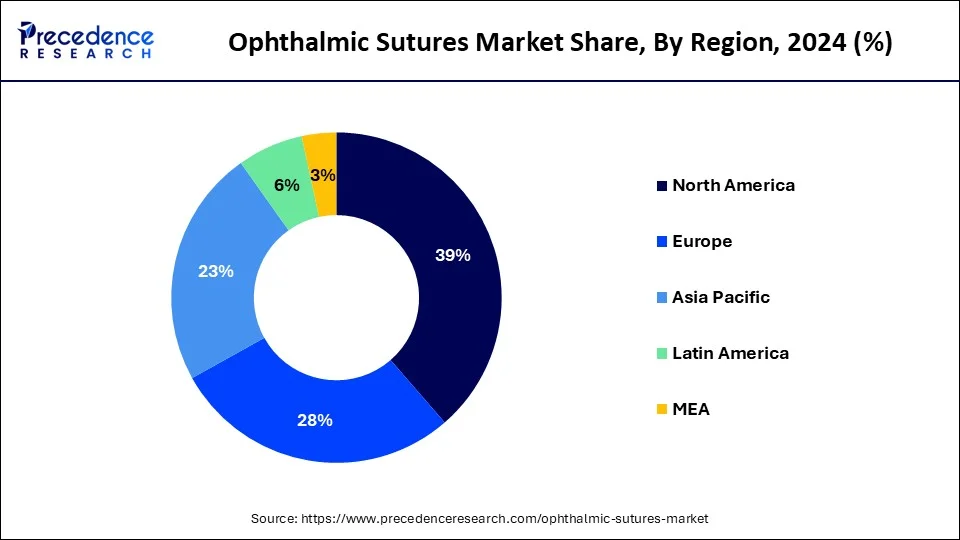

The global ophthalmic sutures market size is calculated at USD 501.13 million in 2025 and is forecasted to reach around USD 939.28 million by 2034, accelerating at a CAGR of 7.23% from 2025 to 2034. The North America ophthalmic sutures market size surpassed USD 182.26 million in 2024 and is expanding at a CAGR of 7.37% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global ophthalmic sutures market size was estimated at USD 467.34 million in 2024 and is predicted to increase from USD 501.13 million in 2025 to approximately USD 939.28 million by 2034, expanding at a CAGR of 7.23% from 2025 to 2034. The ophthalmic sutures market is driven by the increasing prevalence of diabetes resulting in eye issues

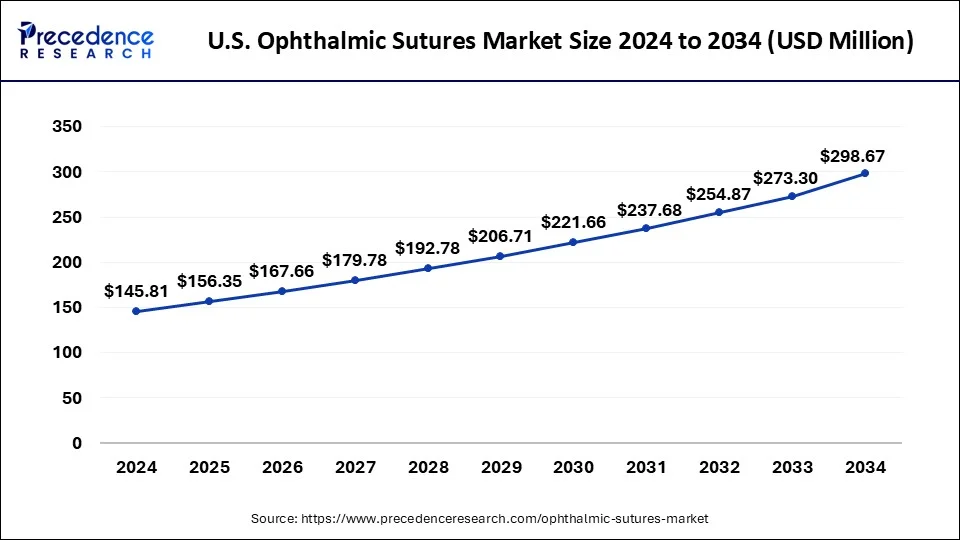

The U.S. ophthalmic sutures market size was valued at USD 145.81 million in 2024 and is expected to be worth around USD 298.67 million by 2034, growing at a CAGR of 7.43% from 2025 to 2034.

North America has its largest market share in 2024 in the ophthalmic sutures market. This area consistently makes investments in the creation of cutting-edge ocular surgical methods and supplies, including sutures. To improve surgical outcomes, lower complications, and increase patient comfort, advanced sutures with better materials, coatings, and designs have been introduced. The probability of having ocular problems rises with age, hence requiring surgical interventions such as corneal transplantation, cataract surgery, and retinal surgery. Ophthalmic sutures are in high demand in the area since they are crucial to various surgical procedures for wound closure, tissue approximation, and encouraging healing.

Asia-Pacific is the fastest-growing in the ophthalmic sutures market during the forecast period. People are becoming more conscious of the need for routine eye exams and the state of their eyes. The demand for sutures has increased because people are seeking treatment for eye-related diseases sooner than later. This increased awareness and improved access to information through digital media have also contributed to an increase in ocular procedures. The Asia-Pacific area has seen significant investments made in surgical and ophthalmology facilities and other healthcare infrastructure. The demand for ophthalmic sutures has increased due to this advancement, which has made it easier to receive eye treatments and procedures.

During surgical treatments, ophthalmic sutures are specific threads or materials used to close incisions or sores in the eye. These sutures are made with specific qualities appropriate for the delicate tissues of the eye, and they are meant to be non-reactive and biocompatible. One of the most popular eye surgeries performed worldwide is cataract surgery, and ophthalmic sutures are used to repair incisions caused during the procedure. During vitrectomy treatments, sutures can be used to secure retinal detachments or to repair incisions.

In surgeries to repair strabismus (misalignment of the eyes), sutures are used to realign the ocular muscles. When it comes to keeping donor, corneas secure during corneal transplant procedures (keratoplasty), ophthalmic sutures are essential.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.23% |

| Market Size in 2025 | USD 501.13 Million |

| Market Size by 2034 | USD 939.28 Million |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Absorption Capacity, Application, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing incidence of various eye diseases and vision loss

People are increasingly vulnerable to diseases such as diabetic retinopathy, cataracts, glaucoma, and macular degeneration as they get older. Such rising incidence of diseases creates a significant driver for the ophthalmic sutures market. Surgical procedures are frequently necessary for these disorders, and ocular sutures are essential for wound closure and tissue approximation. Recent years have seen tremendous developments in ophthalmic sutures. Sutures with greater biocompatibility, smaller sizes for sensitive ocular tissues, and better-handling qualities for surgeons are being developed by manufacturers.

The number of eye surgeries has increased dramatically due to advances in medical technology and surgical methods. The prevalence of procedures like vitrectomy, corneal transplants, cataract surgery, and retinal detachment repair is rising. Ophthalmic sutures are required for each of these surgeries to provide exact wound closure and the best possible healing results.

High risk of infection

The body may respond negatively to these materials in certain instances, which could result in inflammation, a slower rate of wound healing, and a higher risk of infection. In some people or in situations where the sutures are exposed for an extended period, this reaction may be more noticeable. Such risk can hinder the product adoption by creating a restraint for the market.

Infections can be avoided by using sterile ophthalmic sutures. When used in surgeries, improper handling, storage, or packaging can weaken their sterility and increase the risk of contamination and infections. Sterility maintenance across the supply chain is difficult and necessitates following tight guidelines and quality control procedures.

Increasing awareness about eye health and the availability of advanced eye care facilities

Macular degeneration, glaucoma, and cataracts are among the age-related eye conditions that naturally rise with the world's population. Due to this change in demographics, there is an increased need for ophthalmic surgeries, especially ones that include tissue repair and wound closure with sutures. Spending on healthcare has increased as many regions have seen improvements in their economic standing. For a wider range of people, this means that more sophisticated eye care procedures and treatments will be more reasonably priced. The need for ophthalmic sutures increases as more people chooses these services. In addition to age-related problems, environmental variables, genetic predispositions, and lifestyle changes are contributing to an increase in eye diseases and disorders.

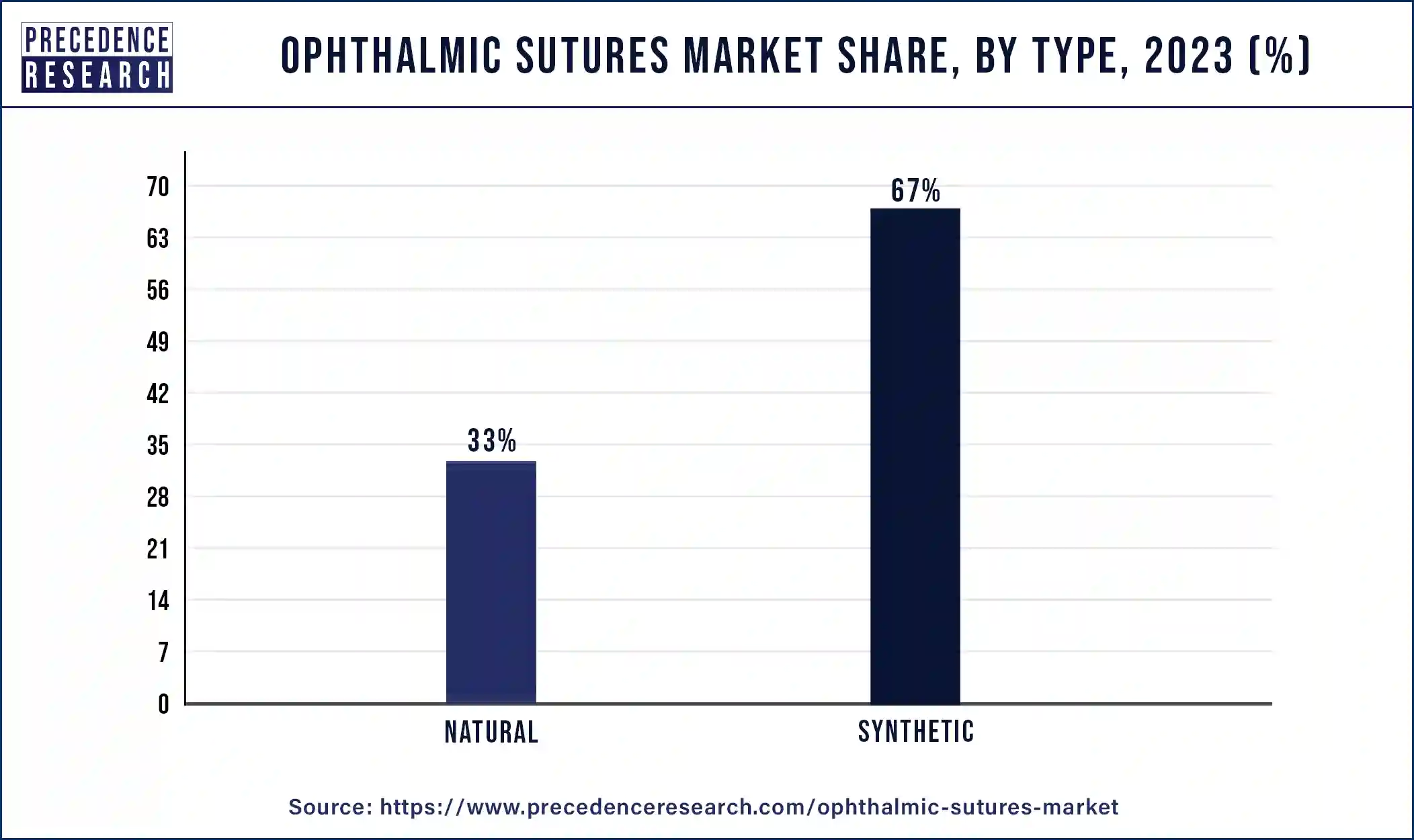

The synthetic segment dominated the ophthalmic sutures market share of 67% in 2024. As a result of their high biocompatibility, synthetic materials like polypropylene, polyamide (nylon), and polyglactin are less likely to react negatively when utilized in human tissue. In contrast, patients may occasionally experience allergic reactions to natural materials like silk. Because synthetic sutures have a lower chance of generating difficulties, both surgeons and patients prefer them. The synthetic portion contains absorbable materials like polyglactin and polyglycolic acid in addition to non-absorbable sutures.

In many circumstances, the necessity for suture removal is eliminated when using these absorbable sutures because they progressively degrade in the body over time. This function is especially helpful for eye procedures when it's important to minimize post-operative interventions and patient discomfort.

The natural segment shows significant growth in the ophthalmic sutures market during the forecast period. Patients and healthcare professionals are beginning to favor natural materials in medical procedures and technologies. Concerns with long-term biocompatibility, allergic reactions, and reactivity to foreign bodies are what is driving this movement. When opposed to synthetic sutures, natural sutures, which are typically constructed of materials like silk, catgut, and collagen, are thought to be safer and more biocompatible.

The non-absorbable segment dominated the ophthalmic sutures market in 2024. The materials used to make non-absorbable sutures are usually silk, nylon, or polyester, which are renowned for their tensile strength and longevity. Non-absorbable sutures provide the necessary longevity without disintegrating too soon after ocular procedures, when sutures may need to stay in place for a long time to promote healing. It frequently involves sensitive tissues like the sclera or cornea, where accurate wound closure is essential for promoting the best possible recovery and minimizing problems following surgery. Non-absorbable sutures offer superior control throughout the suturing process, enabling surgeons to accomplish accurate tissue apposition and reduce the likelihood of wound dehiscence or leakage.

The absorbable segment is the fastest growing in the ophthalmic sutures market during the forecast period. The goal of absorbable sutures is to gradually dissolve and be absorbed by the body. Because of this feature, there is no longer a need for suture removal procedures, which lessens patient discomfort and the possibility of consequences from non-absorbable sutures. These sutures are extremely desirable for ophthalmic procedures because they can disintegrate naturally, which is important. After all, limiting post-operative treatments is critical for patient recovery. Its breakdown profile and composition facilitate improved tissue repair.

Materials that are biocompatible and progressively degrade without irritating tissue, such as polyglactin, polyglycolic acid, or polylactic acid, are frequently used to make these sutures. In ophthalmic procedures, the suture material gradually absorbs into the incision in a manner that aligns with the natural healing process, resulting in better wound closure and less scarring.

The cataract surgery segment dominated in the ophthalmic sutures market in 2024. Among all eye surgeries, cataract surgery is one of the most popular ones done around the globe. The prevalence of cataracts rises with population age, increasing the need for cataract surgery. To encourage appropriate healing and lower the chance of problems such as wound leakage, infection, and astigmatism, accurate wound closure is necessary. Ophthalmic sutures are essential for regulating intraocular pressure both during and after surgery and guaranteeing the integrity of incisions. The need for premium sutures with outstanding tensile strength, biocompatibility, and low tissue response is thus rising.

The corneal transplantation surgery segment is the fastest growing in the ophthalmic sutures market during the forecast period. Globally, the prevalence of eye problems such as keratoconus, corneal ulcers, and corneal dystrophies is rising. Surgery to replace diseased or damaged corneal tissue with healthy donor tissue is frequently required for these disorders. The need for corneal transplantation procedures and associated sutures rises in tandem with the development of these illnesses. Manufacturers of ophthalmic sutures are always coming up with new ideas to create sutures that have better qualities including lower tissue response, increased tensile strength, and biocompatibility. Due to these developments, sutures are now more appropriate for delicate corneal procedures, which improves results and reduces post-operative problems.

The ambulatory surgical centers segment dominated the ophthalmic sutures market in 2024. Delivering outpatient operations, such as ophthalmic surgeries including cataract surgery, corneal transplants, and glaucoma procedures, is an area of expertise for ambulatory surgical centers (ASCs). Ophthalmic sutures are frequently needed for wound closure following these procedures. Because ASCs offer outpatient care at a lower cost than inpatient hospital settings and have shorter wait times, patients prefer them. For eye procedures, ASCs are more affordable than typical hospital settings. ASCs often have lower overhead costs, resulting in lower surgery costs for payers and patients.

The hospitals segment shows significant growth in the ophthalmic sutures market during the forecast period. Complex eye surgeries like vitreoretinal surgery, corneal transplantation, and cataract surgery are primarily performed in hospitals. There is an increasing need for these surgical operations as the world's population ages and the prevalence of eye problems increases. Hospitals' need for ocular sutures is directly impacted by this rise in surgical activity.

In November 2022, the announcement was made by Alcon, the world leader in eye care committed to enabling people to see clearly, that it has successfully acquired Aerie Pharmaceuticals, Inc. With an increasing number of commercial pharmaceuticals and development pipeline, Alcon's position in the ophthalmic pharmaceutical market is strengthened by this deal.

By Type

By Absorption Capacity

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

October 2024

September 2024