November 2024

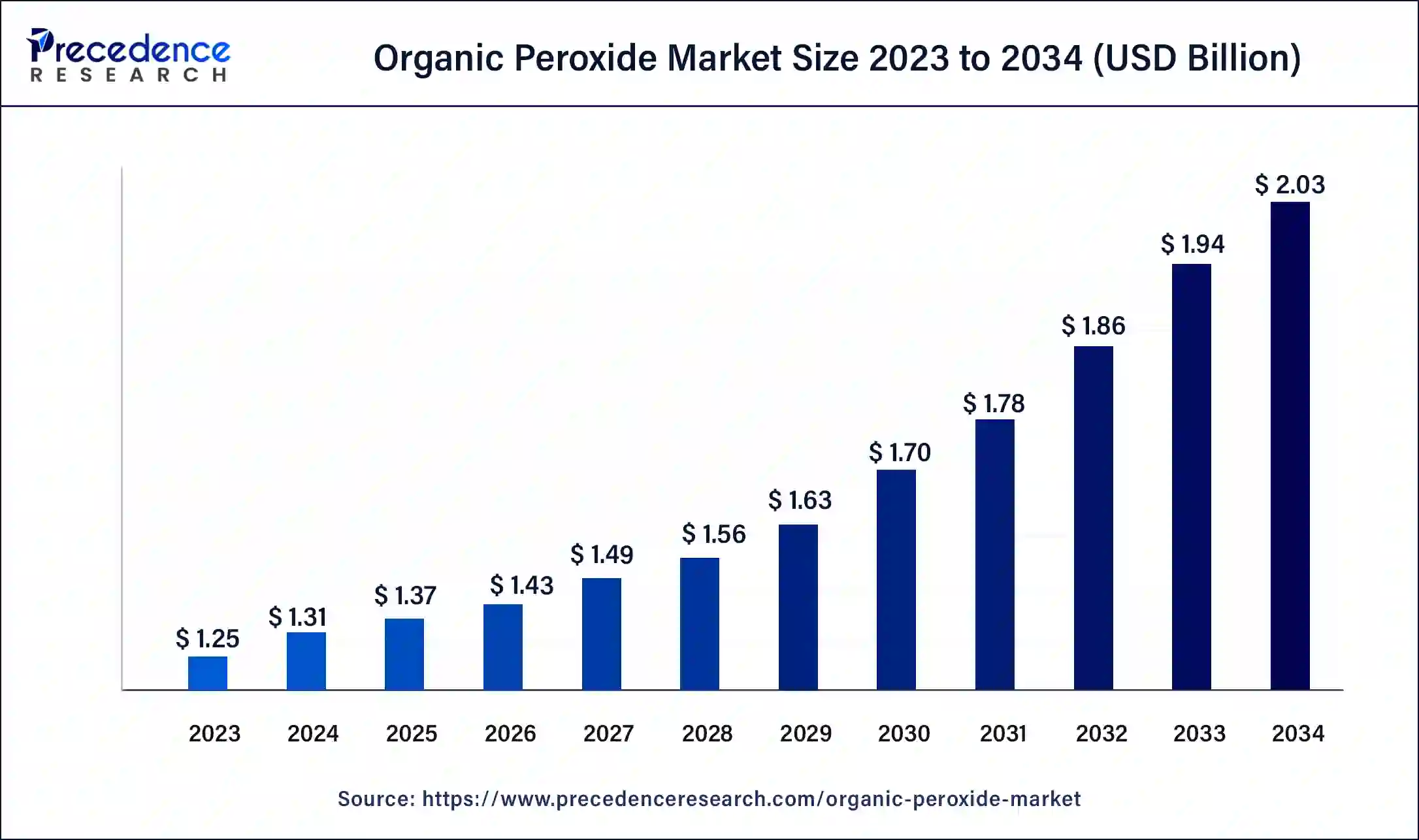

The global organic peroxide market size was USD 1.25 billion in 2023, calculated at USD 1.31 billion in 2024 and is expected to reach around USD 2.03 billion by 2034, expanding at a CAGR of 4.5% from 2024 to 2034.

The global organic peroxide market size accounted for USD 1.31 billion in 2024 and is expected to reach around USD 2.03 billion by 2034, expanding at a CAGR of 4.5% from 2024 to 2034. The North America organic peroxide market size reached USD 500 million in 2023.

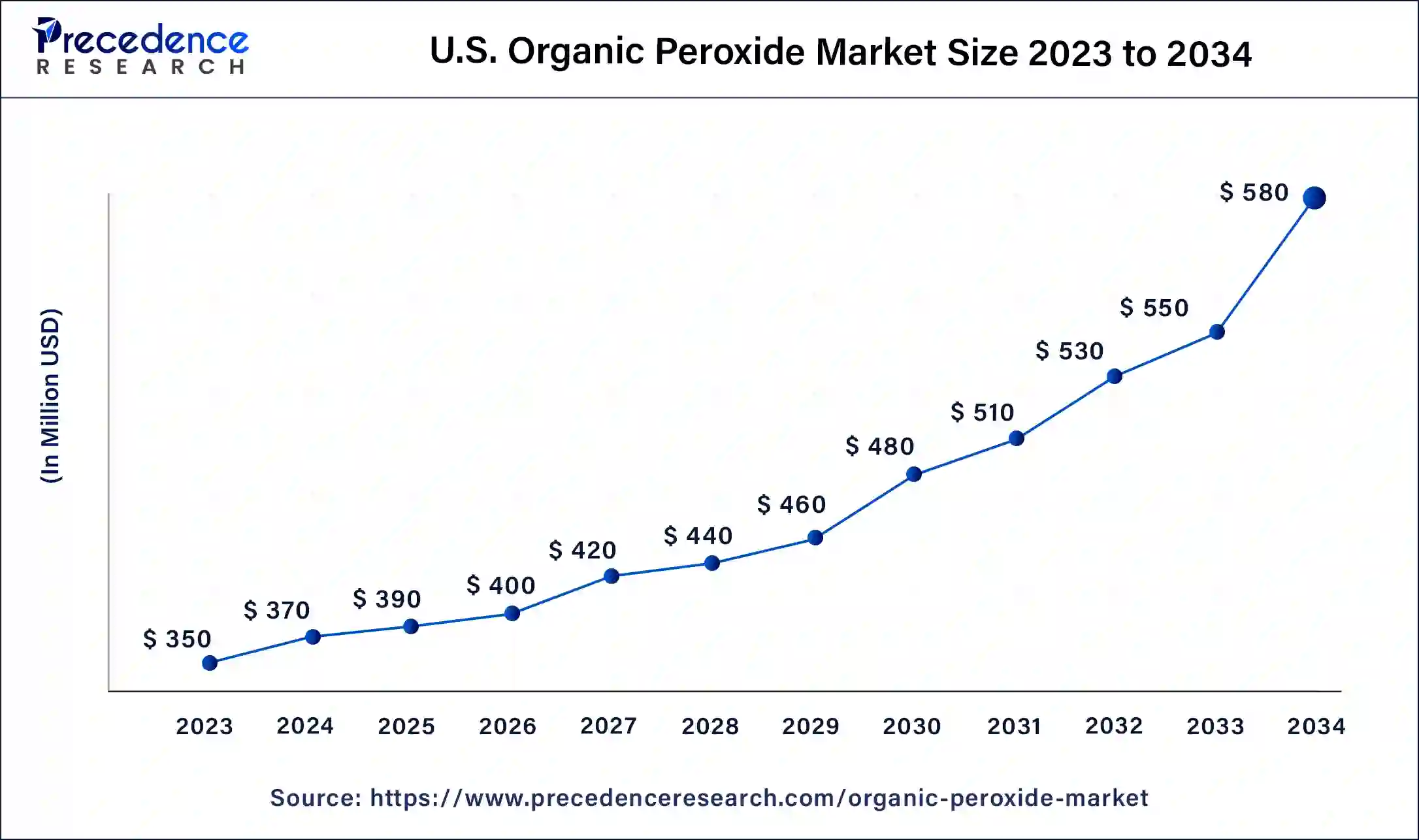

The U.S. organic peroxide market size was estimated at USD 350 million in 2023 and is predicted to be worth around USD 580 million by 2034, at a CAGR of 4.6% from 2024 to 2034.

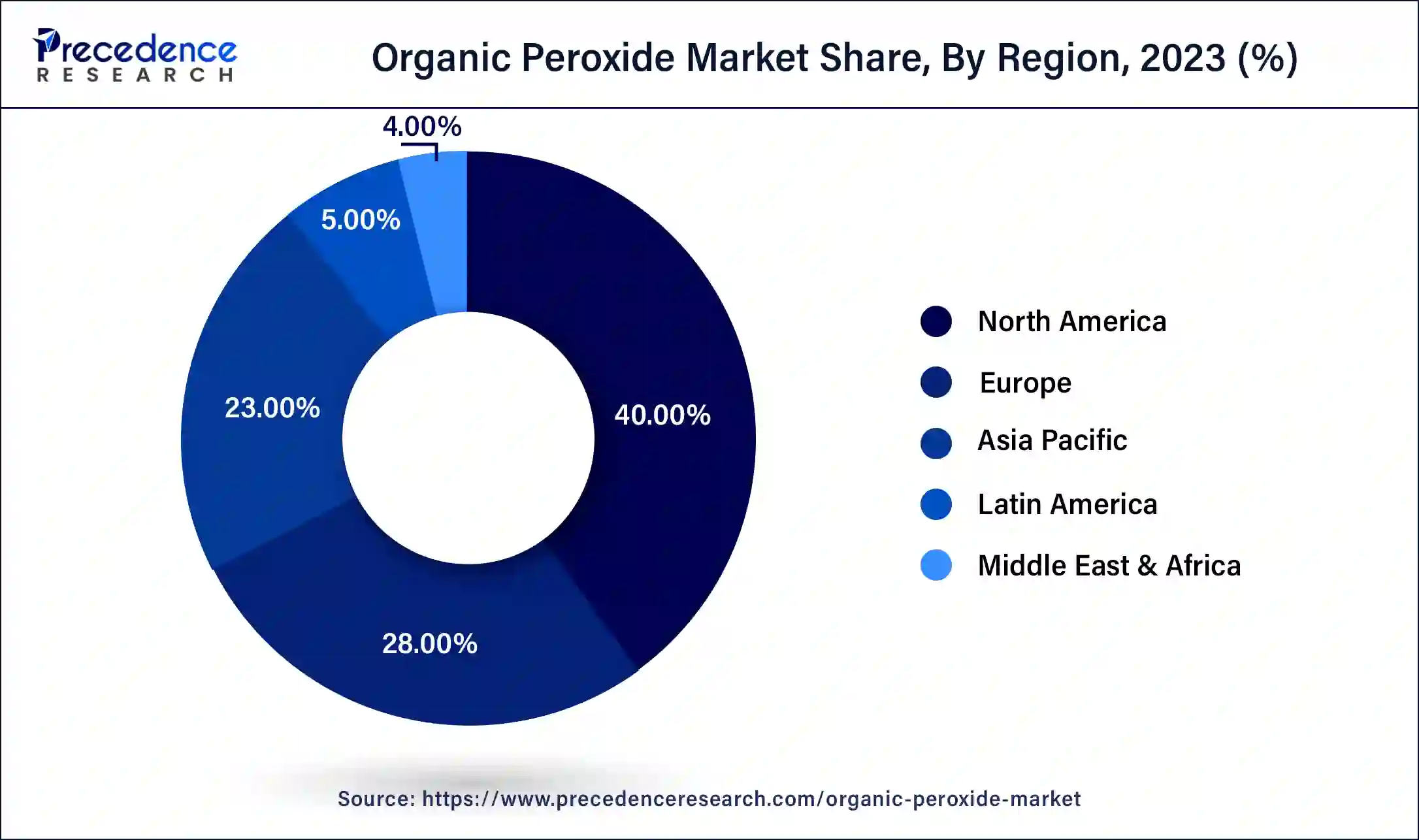

North America, in 2023 dominated the organic peroxide market while holding 40% of the market share, mainly driven by manufacturers' increasing focus on competitive regions with abundant raw materials and cost-effective labor. The rising investments in establishing new product lines, influenced by factors such as plastic type, manufacturing process, and application, are expected to fuel demand in this region as a catalyst. Notably, the Canadian organic peroxide market has secured the largest market share, with the US organic peroxide market emerging as the fastest-growing segment within the North American region.

Formosa Plastics Corporation is currently executing a Polyvinyl chloride (PVC) expansion project at its 513,000 metric tons per year unit in Baton Rouge, Louisiana. This expansion aims to augment the output by an additional 130,077 metric tons per year and is scheduled to be operational by the end of 2021. In July 2021, the company disclosed its substantial investment of USD 332 million to enhance polyvinyl chloride (PVC) production at the Baton Rouge site. However, due to the disruptions caused by the COVID-19 outbreak, the PVC expansion project has been deferred, and the new anticipated timeline for completion is in the fourth quarter of 2022. The increased utilization of polymers is expected to drive a substantial rise in the demand for organic peroxides, particularly in polymerization applications. This surge in consumption is anticipated to significantly contribute to the overall growth of the market.

The Asia-Pacific organic peroxide market is projected to witness the fastest CAGR of 7.8% during the forecast period. This growth is attributed to the rising production of synthetic rubber in the region. According to the National Bureau of Statistics in China, the country manufactured 807.47 million tires in 2020, slightly declining from the 844.45 million units produced in 2019. Notably, the Chinese organic peroxide market has secured the largest market share in the Asia-Pacific region, while the Indian organic peroxide market stands out as the fastest-growing market. These trends highlight the significant role of synthetic rubber production in propelling the organic peroxide market in the Asia-Pacific region.

Along with that, The Asia-Pacific region has emerged as one of the largest consumers of plastic products, representing over 42% of the global demand. This demand is projected to continue over the next eight years. The rise of China and India as key destinations for product manufacturing, combined with increased exports and domestic demand, is anticipated to further stimulate the usage of plastic products in the region during the projected period.

Tthe Europe organic peroxide market holds the second-largest market share, primarily attributed to the surge in construction activities in the region, which has bolstered the demand for paints and coatings. Notably, the German organic peroxide market has secured the largest market share within Europe, while the UK organic peroxide market stands out as the fastest-growing market in the region. These trends underscore the significance of the construction sector and the expanding demand for organic peroxides in the European market.

Organic peroxides are chemicals characterized by the presence of the peroxide functional group (-O-O-), and they find applications in a wide range of industries, primarily serving as initiators for polymerization reactions in the production of plastics, rubbers, resins, and other polymer-based materials. Organic peroxide market offers materials that are utilized in the manufacturing of adhesives and sealants. As construction and automotive industries grow, there is an increased demand for adhesives and sealants, further driving the demand for organic peroxides.

The continual growth of the plastics and rubber industries, driven by consumer goods, packaging, and automotive sectors, contributes significantly to the demand for organic peroxides for cross-linking and curing purposes. They are used in the bleaching process in the pulp and paper industry. Growth in this industry, driven by factors such as increased demand for packaging materials, can contribute to the demand for organic peroxides. Ongoing research and development efforts in the field of chemistry may lead to the discovery of new applications for organic peroxides, expanding their market potential.

Organic Peroxide Market Data and Statistics

| Report Coverage | Details |

| Global Market Size in 2023 | USD 1.25 Billion |

| Global Market Size in 2024 | USD 1.31 Billion |

| Global Market Size by 2034 | USD 2.03 Billion |

| Global Market Growth Rate from 2024 to 2034 | CAGR of 4.5% |

| U.S. Market Size in 2023 | USD 350 Million |

| U.S. Market Size by 2034 | USD 550 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing manufacturing of synthetic rubber and elastomers

The increasing manufacturing of synthetic rubber and elastomers serves as a significant catalyst for the expansion of the organic peroxide market.

The demand for organic peroxides is closely tied to the growth of the plastics and rubber industries. These chemicals are crucial for cross-linking and curing processes in the production of plastic and rubber products. This surge in rubber and thermoplastics manufacturing, where organic peroxides are utilized, is anticipated to propel the revenue growth of the organic peroxide market.

Safety concerns

The safety concerns associated with organic peroxides, stemming from their highly reactive nature, constitute a significant restraint for the global organic peroxide market. These safety challenges manifest during manufacturing, transportation, and usage, presenting risks of fire, explosions, and the release of hazardous byproducts. Factors contributing to safety concerns include the chemical reactivity, thermal instability, handling complexities, and transportation risks associated with organic peroxides. Mitigation strategies involve rigorous process design, employee training, compliance with regulations, and the development of emergency response plans to ensure safe production, storage, and transportation of these chemicals. Despite their critical role in industrial processes, the need for comprehensive safety measures underscores the potential risks associated with organic peroxides.

Innovative greenfield development

Establishing an innovative Greenfield project for the production of environment-friendly organic peroxides is a key driver of opportunities in the organic peroxide market.

This entails incorporating green chemistry principles, utilizing renewable feedstocks, implementing energy-efficient production methods, minimizing waste, prioritizing advanced safety measures, collaborating with environmental agencies, innovating in packaging, and positioning the project as a sustainable supplier. The focus is on creating a state-of-the-art facility that not only meets current market demands for organic peroxides but also aligns with sustainability goals and positions the project as a leader in environmentally responsible chemical production.

The diacetyl peroxide segment held the dominating share of 41%. The escalating need for hardened polymers in the construction and manufacturing sectors, coupled with a growing demand for resins to enhance flooring solutions, is anticipated to be a pivotal factor influencing the market for diacetyl peroxide in the projected period. platforms, reflecting a commitment to driving the overall improvement of sequencing technologies in genomics research and diagnostics.

The ketone peroxide segment is anticipated to be the fastest-growing segment at a CAGR of 6.7% during the forecast period. This upsurge is attributed to the increasing demand for plastic-reinforced glass, commonly known as fiberglass. This heightened demand is particularly driven by the production of watercraft in marine parts, substituting traditional wood and steel structures, and the rising demand for automobiles in emerging economies. The aviation sector's robust growth, fueled by an increasing demand for cost-effective air travel, is expected to boost the need for high-end fiberglass, thereby amplifying the consumption of ketone peroxide in various crosslinking applications.

The paper and textiles segment emerged as the leader in terms of market share while holding a market share of 36% in 2023. The rising demand for ready-made clothing, driven by the preferences of the emerging middle-class population for trends like western fashion, designer apparel, and brand choices, is expected to significantly boost the need for organic peroxides in the coming eight years. Additionally, the ongoing remodeling of interior architecture for enhanced and creative decoration purposes is anticipated to contribute to the increased demand in the carpet and curtain industry, thereby further amplifying the overall requirement for the mentioned products in the future.

The polymer segment is expected to witness the fastest rate of 7.3% in the organic peroxide market during the forecast period. The escalating demand for robust plastics, including polyvinyl chloride, thermosetting plastics, and plastic-reinforced glasses, driven by the increasing needs in residential construction and profile applications, is projected to result in heightened production rates. This surge in production is expected to drive the demand for the market significantly over the next eight years. Additionally, the paper and pulp segment is anticipated to be the third-largest application segment, propelled by the adoption of smart packaging materials, which is expected to experience growth.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2025

September 2024

October 2024