October 2023

Osteoporosis Treatment Market (By Drug Class: Bisphosphonate, Hormone Replacement Therapy, Selective Estrogen Receptor Modulator (SERMs), RANK ligand (RANKL) Inhibitor, Others; By Route of Administration: Oral, Parentera; By Distribution Channel: Hospitals Pharmacies, Retail Pharmacies & Stores, Online Pharmacies) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

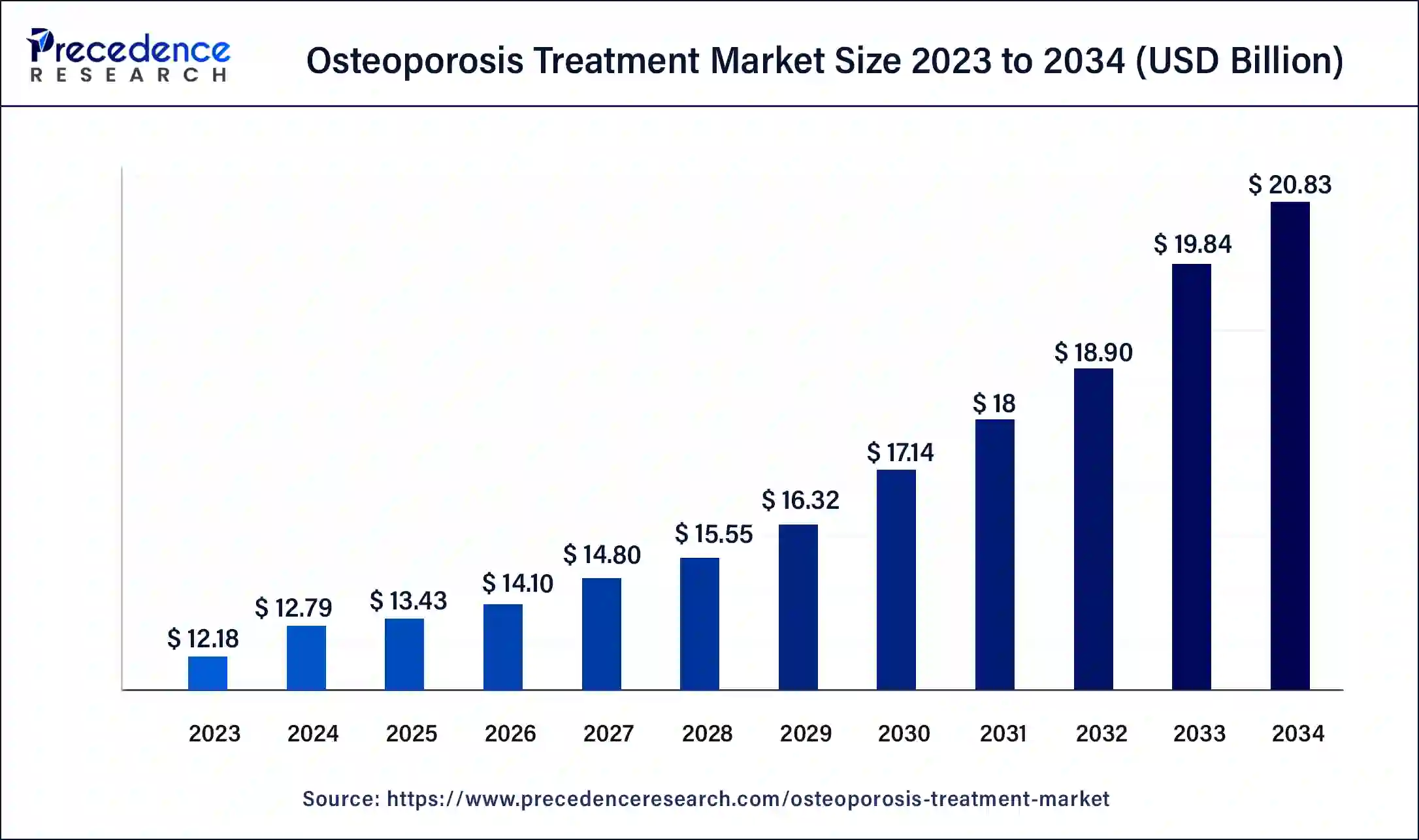

The global osteoporosis treatment market size accounted for USD 12.79 billion in 2024, and is expected to reach around USD 20.83 billion by 2034, expanding at a CAGR of 5% from 2024 to 2034. The North America osteoporosis treatment market size reached USD 4.99 billion in 2023.

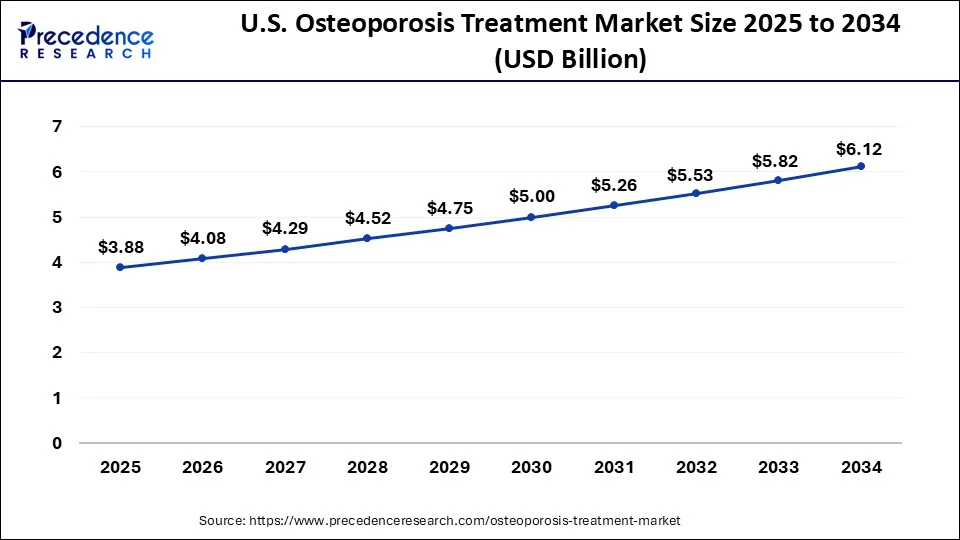

The U.S. osteoporosis treatment market size was estimated at USD 3.50 billion in 2023 and is predicted to be worth around USD 6.12 billion by 2034, at a CAGR of 5.2% from 2024 to 2034.

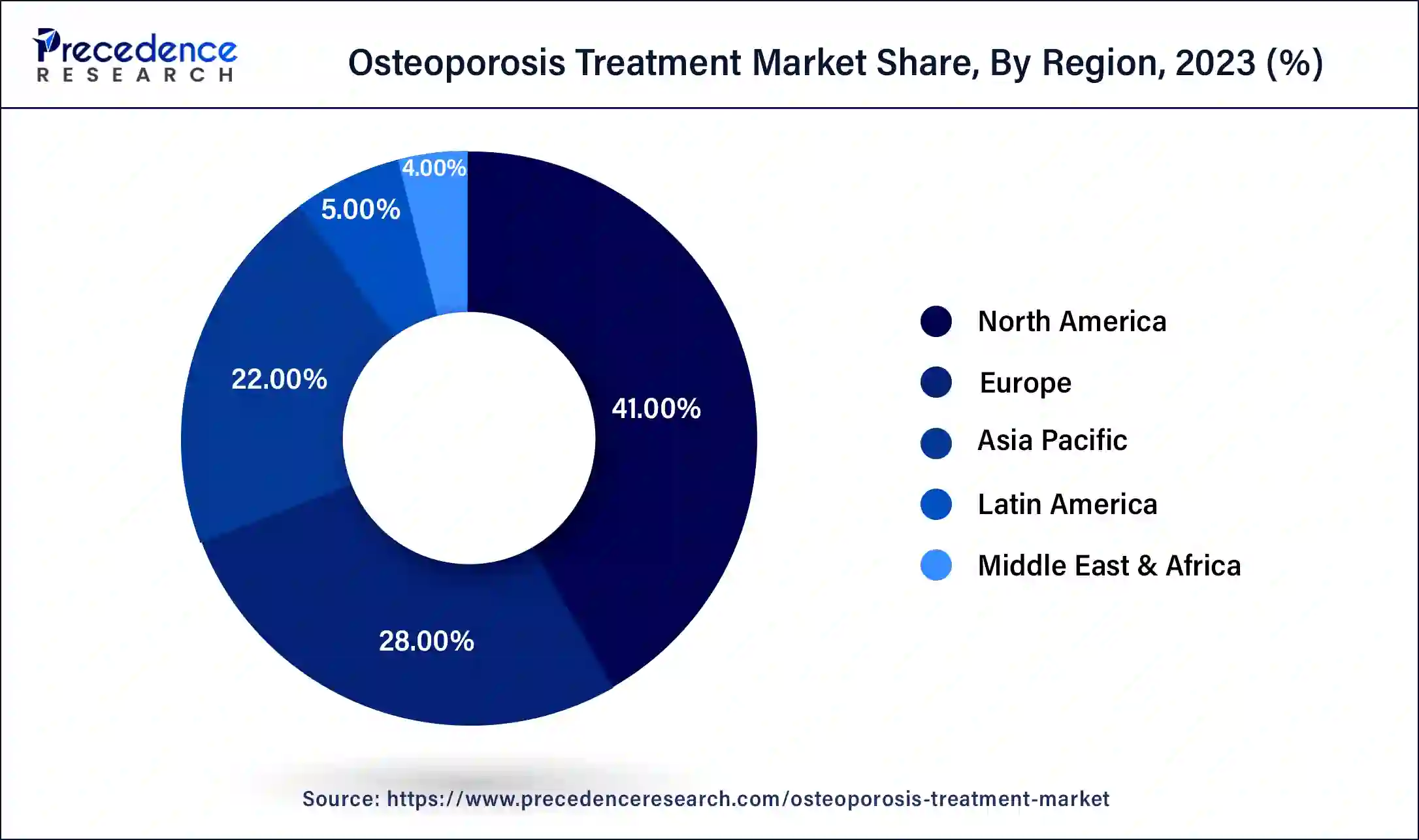

North America has held the largest revenue share 41% in 2023. North America maintains a significant share of the osteoporosis treatment market due to several key factors. Firstly, the region has a substantial aging population, with a higher awareness of osteoporosis, which drives the demand for treatments. Secondly, advanced healthcare infrastructure and widespread access to medical services enable timely diagnosis and treatment. Additionally, the presence of major pharmaceutical companies and ongoing research and development initiatives fosters the introduction of innovative therapies. Lastly, favorable reimbursement policies and insurance coverage support patients in seeking osteoporosis treatments, consolidating North America's position as a major player in the market.

Asia-Pacific is estimated to observe the fastest expansion with the highest CAGR of 6.3% during the forecast period. Asia-Pacific's dominant growth in the osteoporosis treatment market can be attributed to a confluence of distinctive factors. The region is marked by a swiftly aging demographic, particularly prominent in nations like Japan and China, leading to an elevated prevalence of osteoporosis. Increasing health consciousness, urbanization, and shifts in lifestyle patterns contribute to heightened diagnosis rates. The burgeoning middle-class population, coupled with expanded healthcare accessibility, propels the demand for osteoporosis treatments. Moreover, enhancements in healthcare infrastructure and the burgeoning pharmaceutical sector render Asia-Pacific a central hub for the substantial growth and evolution of the osteoporosis treatment market.

The osteoporosis treatment market encompasses a diverse array of pharmaceuticals and therapeutic modalities meticulously designed to combat osteoporosis, a condition marked by bones rendered fragile and susceptible to fractures. The therapeutic arsenal often features bisphosphonates, hormone therapy, denosumab, and a gamut of dietary supplements, complemented by lifestyle adaptations such as heightened physical activity and a nutrition regimen enriched with calcium. Market expansion is driven by the burgeoning elderly demographic, notably in developed regions, and the escalating acknowledgment of osteoporosis as a pressing health conundrum. Additionally, ceaseless research and development endeavors aim to introduce pioneering, more efficacious interventions for managing this incapacitating ailment.

Within the realm of the osteoporosis treatment market lies a dynamic arena dedicated to confronting the formidable medical challenges presented by osteoporosis, a condition marked by the weakening of bones, rendering them more susceptible to fractures. This expansive market comprises an extensive array of pharmaceuticals, therapeutic modalities, and lifestyle adaptations customized for the purpose of managing and thwarting the advancement of this incapacitating ailment.

Prominent industry trends within the osteoporosis treatment market encompass the burgeoning aging populace, with a notable concentration in developed nations, thereby amplifying the demand for effective osteoporosis management. Furthermore, the market is driven by the expanding recognition of osteoporosis as a substantial public health issue. Continuous innovation through research and development initiatives facilitates the introduction of more advanced and effective treatments, such as groundbreaking drug therapies and precision medicine strategies. Additionally, technological advancements in diagnostic and monitoring tools hold considerable potential for enhancing patient care and treatment outcomes.

The osteoporosis treatment market draws strength from an array of growth factors, including the surge in healthcare expenditures, a heightened emphasis on preventative healthcare, and the integration of digital health solutions for patient management. Moreover, the market presents promising avenues for businesses, from pharmaceutical companies to biotechnology enterprises and medical device manufacturers, to pioneer innovative treatments and diagnostics. Collaborative ventures among healthcare providers, insurers, and pharmaceutical entities hold the potential to create models based on value-driven care, thereby paving the way for improved patient outcomes and cost-efficiency.

Despite its promising trajectory, the osteoporosis treatment market encounters a range of challenges. These encompass rigorous regulatory prerequisites for drug approvals, demanding long-term clinical trials to establish the safety and effectiveness of novel treatments. The market is further beset by the high cost associated with osteoporosis management, a factor that engenders concerns surrounding affordability for both patients and healthcare systems. Furthermore, addressing the unique needs of diverse patient populations, particularly those with accompanying health conditions, necessitates a multifaceted approach and a nuanced comprehension of the ailment. In summary, the osteoporosis treatment market is poised for sustained expansion, buoyed by demographic shifts, augmented awareness, and advancements in therapeutic choices. However, stakeholders in the industry must adeptly navigate the challenges of regulatory compliance and financial accessibility while seizing opportunities through inventive solutions and cooperative endeavors, all in the service of delivering comprehensive care for those grappling with osteoporosis.

| Report Coverage | Details |

| Market Size in 2023 | USD 12.18 Billion |

| Market Size in 2024 | USD 12.79 Billion |

| Market Size by 2034 | USD 20.83 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.8% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Drug Class, By Route of Administration, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Lifestyle modifications

Lifestyle modifications stand as a compelling catalyst in propelling the expansion of the osteoporosis treatment market. Osteoporosis, characterized by brittle bones, is effectively managed and prevented through lifestyle adaptations, and this transformative trend plays a central role in the market's ascent. Physical activity assumes a pivotal role in this paradigm shift. Regular weight-bearing exercises, including walking, running, and resistance training, instigate bone health and density. The heightened focus on exercise encourages individuals to seek osteoporosis treatments, aiming to maintain an active lifestyle resilient to fractures. Dietary adjustments also take center stage.

A diet rich in calcium and bolstered by vitamin D is paramount for bone well-being. This burgeoning awareness prompts individuals to integrate bone-strengthening foods and supplements into their daily nutritional routines, thus intensifying the demand for osteoporosis treatments. Furthermore, the broader emphasis on holistic health and well-being fuels the uptake of regular health check-ups, encompassing bone density screenings. As individuals proactively monitor their bone health, early diagnosis and intervention become increasingly prevalent, further invigorating the market's expansion. In essence, the osteoporosis treatment market derives considerable impetus from the expanding emphasis on lifestyle modifications, instrumental in elevating bone health awareness and fostering demand for both preventive and therapeutic solutions.

Comorbidities and complexity

The intricate interplay of comorbidities and the ensuing intricacy in managing osteoporosis constitutes a significant constricting force on the expansion of the osteoporosis treatment market. Osteoporosis often converges with an array of other medical conditions, such as cardiovascular ailments, diabetes, and arthritic disorders, thereby injecting an added layer of intricacy into the treatment landscape. Patients frequently necessitate a multifaceted approach, incorporating a medley of medications and interventions, thereby elevating the risk of drug interactions and undesirable medical events.

The demand for tailored osteoporosis management, shaped by the presence of these comorbidities, heaves a considerable burden onto healthcare providers, mandating the development of unique treatment blueprints and unwavering patient monitoring. This multifaceted framework can yield results that fall short of optimal, while simultaneously escalating healthcare expenditures. Moreover, the insufficiency of well-established clinical directives pertaining to osteoporosis management within the framework of diverse comorbidities serves as a barrier for healthcare professionals. The scarcity of exhaustive research and tailored treatment strategies tailored to these intricate healthcare scenarios can obstruct the creation and uptake of efficacious solutions for osteoporosis treatment. Confronting these intricacies is pivotal to fine-tune patient care and stimulate progress within the osteoporosis treatment market.

Digital health solutions

Digital health solutions are serving as a pivotal catalyst in forging substantial opportunities within the osteoporosis treatment market. These technological innovations, encompassing telemedicine, wearable devices, and remote monitoring, augment patient engagement, facilitate real-time monitoring, and bolster adherence to treatment regimens. They offer a platform for more holistic and patient-centric care, enabling healthcare providers to remotely oversee bone health and medication compliance. Moreover, these digital solutions enable the collection and analysis of data in real time, refining the personalization and efficacy of treatments.

Patients benefit from timely reminders, access to educational resources, and streamlined communication with healthcare professionals, leading to enhanced adherence to treatment plans. Furthermore, telemedicine aids in extending access to specialized care, particularly in underserved areas, broadening the horizons of osteoporosis treatment. Harnessing these digital tools not only enhances patient outcomes but also ushers in innovative opportunities for the creation of data-driven, individualized treatment strategies and the development of integrated care models in the osteoporosis treatment market.

Impact of COVID-19

The COVID-19 pandemic had a notable impact on the Osteoporosis Treatment market. Disruptions in healthcare services, delayed elective procedures, and a heightened focus on the pandemic shifted attention away from non-urgent conditions like osteoporosis. Patients' reluctance to seek in-person care also affected diagnosis and treatment initiation. Additionally, pharmaceutical supply chain disruptions briefly affected medication availability. However, the pandemic accelerated the adoption of telehealth and digital solutions in managing osteoporosis, offering remote patient monitoring and telemedicine appointments. As the healthcare system adapts, it is expected that these technologies will continue to play a more prominent role in osteoporosis care.

According to the drug class, the prostacyclin and prostacyclin analogs segment has held 45% revenue share in 2023. The Bisphosphonates segment exerts significant influence in the osteoporosis treatment market owing to its prominent share. Bisphosphonates, encompassing compounds like alendronate and zoledronic acid, hold a well-established reputation for efficacy and enjoy widespread adoption. These agents effectively inhibit bone resorption, thereby enhancing bone density and reducing fracture risks. With extensive clinical histories, regulatory approvals, and availability in oral and intravenous formulations, they stand as favored choices for healthcare professionals. Furthermore, their cost-effectiveness and comprehensive insurance coverage contribute to their prevalence in the market, solidifying their position as the preferred option for many patients and medical practitioners.

The hormone replacement therapy drugs segment is anticipated to expand at a significant CAGR of 5.1% during the projected period. The commanding growth of the hormone replacement therapy (HRT) drug sector in the osteoporosis treatment market can be ascribed to its effectiveness in mitigating osteoporosis, predominantly among postmenopausal women. HRT directly addresses hormonal imbalances linked to menopause, thereby fostering the preservation of bone density and the reduction of fracture risks. This segment's dominance is underpinned by its longstanding reputation and widespread prescription, firmly establishing it as a proven and enduring treatment choice with tangible benefits in counteracting bone loss. The historical eminence of HRT within osteoporosis management accentuates its role as a primary option for a substantial segment of the patient populace, particularly in instances where alternative treatments may be less suitable.

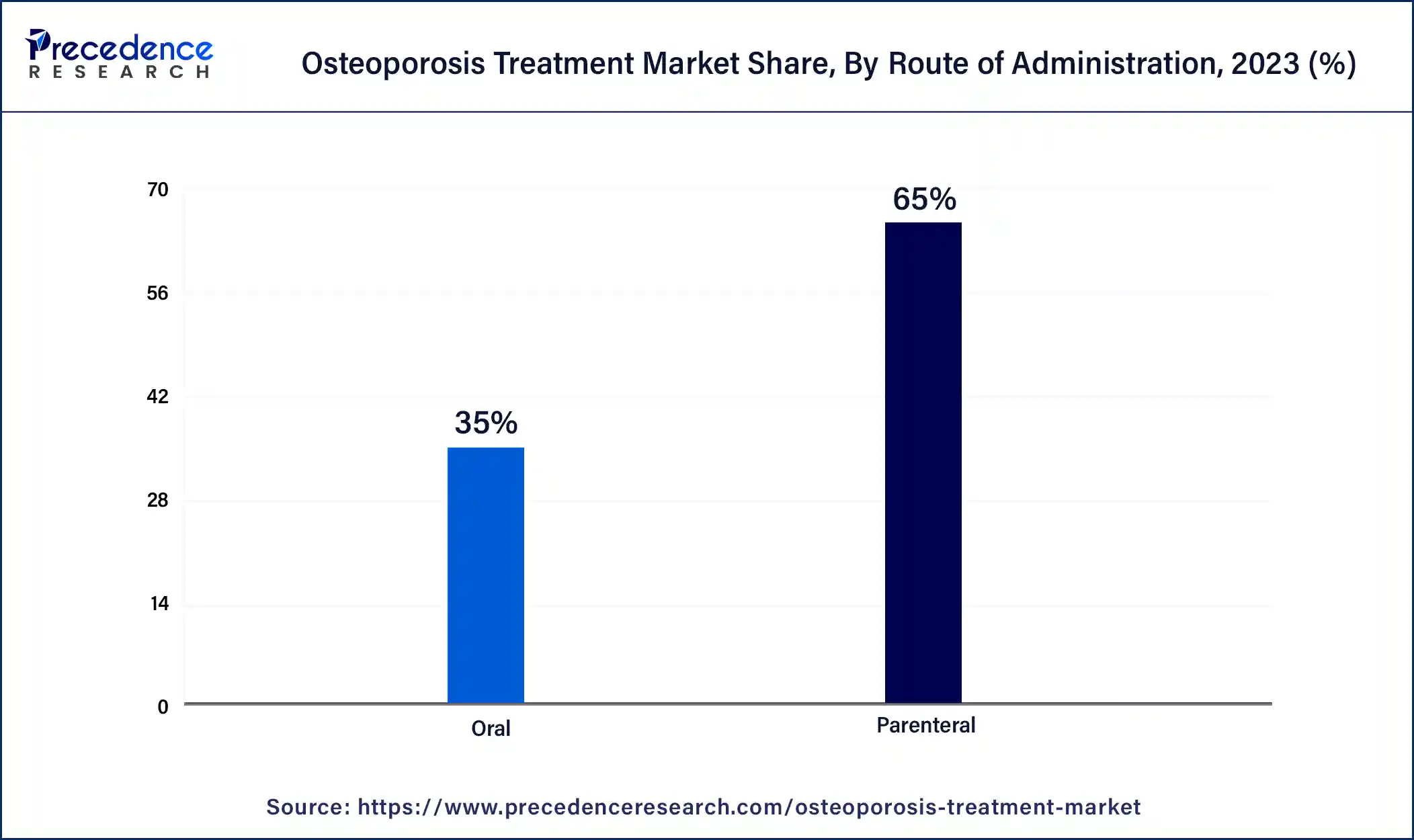

In 2023, the parenteral segment had the highest market share of 65% on the basis of the route of administration. The dominant presence of the parenteral segment in the osteoporosis treatment market can be attributed to its efficacy and reliability as a drug delivery method. By administering treatment through injections, parenteral methods ensure direct drug entry into the bloodstream, resulting in swift and predictable absorption, a crucial advantage in managing osteoporosis. Furthermore, certain osteoporosis medications are exclusively available in parenteral forms, further solidifying its market share. With an improving trend in patient compliance for self-administered injections and the continual emergence of innovative drug delivery solutions, the parenteral segment is poised to retain its substantial market foothold.

The oral segment is anticipated to expand at the fastest rate over the projected period. The oral segment commands significant growth in the osteoporosis treatment market primarily due to its convenience and widespread patient acceptance. Oral medications are easy to administer, enhancing patient adherence, and are generally cost-effective. This segment offers a broad array of options, including bisphosphonates and selective estrogen receptor modulators, providing a range of choices for both patients and healthcare providers. Additionally, familiarity of oral medications makes them the preferred choice, especially when compared to injectable or intravenous alternatives, contributing to their dominant market growth in osteoporosis treatment.

In 2023, the hospital pharmacies segment had the highest market share of 44% on the basis of the distribution channel. Hospital pharmacies hold a significant share of the osteoporosis treatment market primarily due to their role in acute care and patient management. They play a crucial part in dispensing medications for patients receiving inpatient treatment, which is often necessary for severe cases of osteoporosis or after fractures. Hospital pharmacies also provide a centralized location for comprehensive pharmaceutical services, including drug administration, patient education, and monitoring. Given the complexity of osteoporosis treatment and the need for close supervision, hospital pharmacies are well-equipped to cater to these demands, contributing to their major share in the market.

The other segment is anticipated to expand at the fastest rate over the projected period. The "Others" segment in the distribution channels of the Osteoporosis Treatment market holds a significant share due to the diverse and evolving ways in which osteoporosis treatments are dispensed. This category encompasses various distribution methods, such as specialty clinics, rehabilitation centers, and home healthcare, offering flexibility and accessibility for patients. Osteoporosis management often requires a multidisciplinary approach, and these "Other" channels facilitate a range of therapeutic options, including physical therapy, counseling, and medication administration. This diversity allows patients to access tailored treatments, contributing to the substantial share of the "Others" segment in the Osteoporosis Treatment market.

Segments Covered in the Report

By Drug Class

By Route of Administration

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2023

January 2025

May 2024

February 2025