January 2025

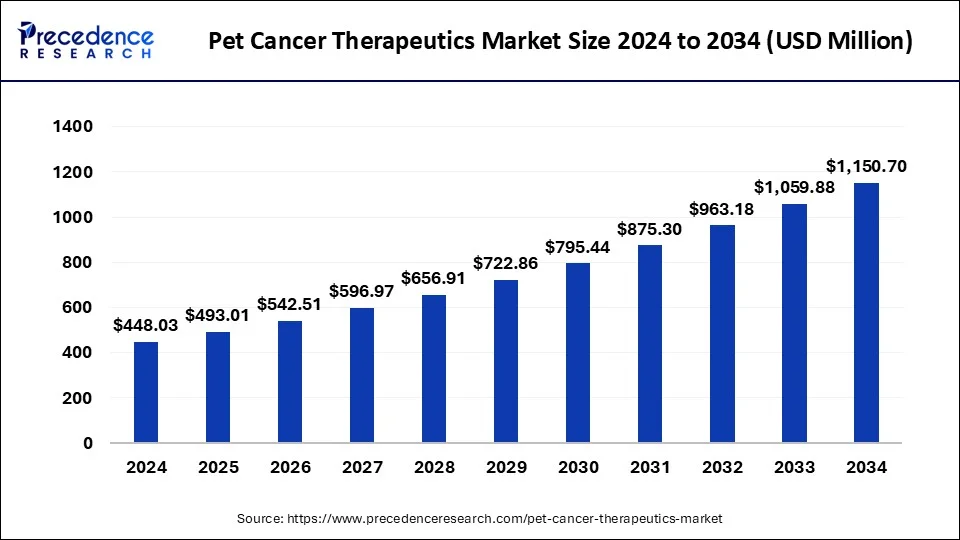

The global pet cancer therapeutics market size is calculated at USD 493.01 million in 2025 and is forecasted to reach around USD 1,150.70 million by 2034, accelerating at a CAGR of 9.89% from 2025 to 2034. The North America pet cancer therapeutics market size surpassed USD 318.10 billion in 2024 and is expanding at a CAGR of AA% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pet cancer therapeutics market size was estimated at USD 448.03 million in 2024 and is predicted to increase from USD 493.01 million in 2025 to approximately USD 1,150.70 million by 2034, expanding at a CAGR of 9.89% from 2025 to 2034.

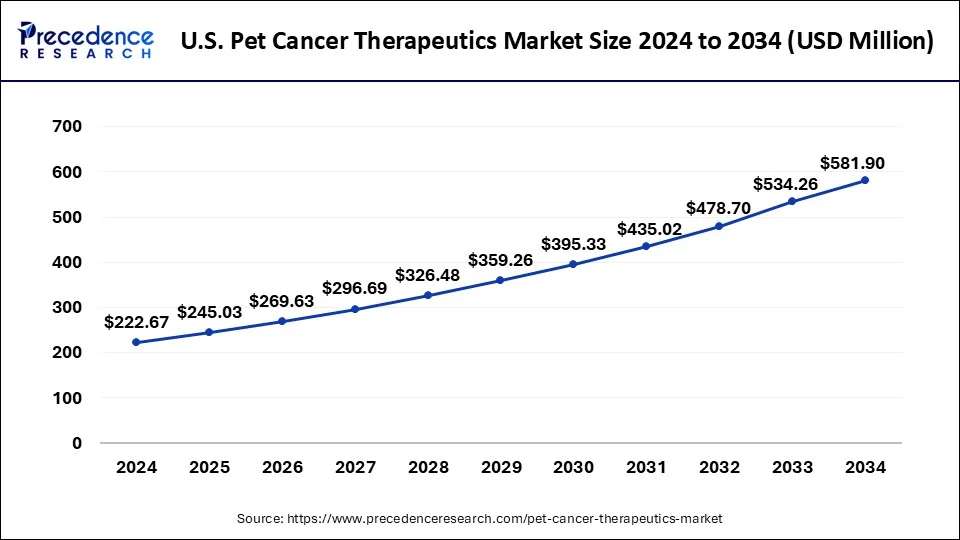

The U.S. pet cancer therapeutics market size was estimated at USD 222.67 million in 2023 and is predicted to be worth around USD 581.9 million by 2034, with a CAGR of 10.08% from 2025 to 2034.

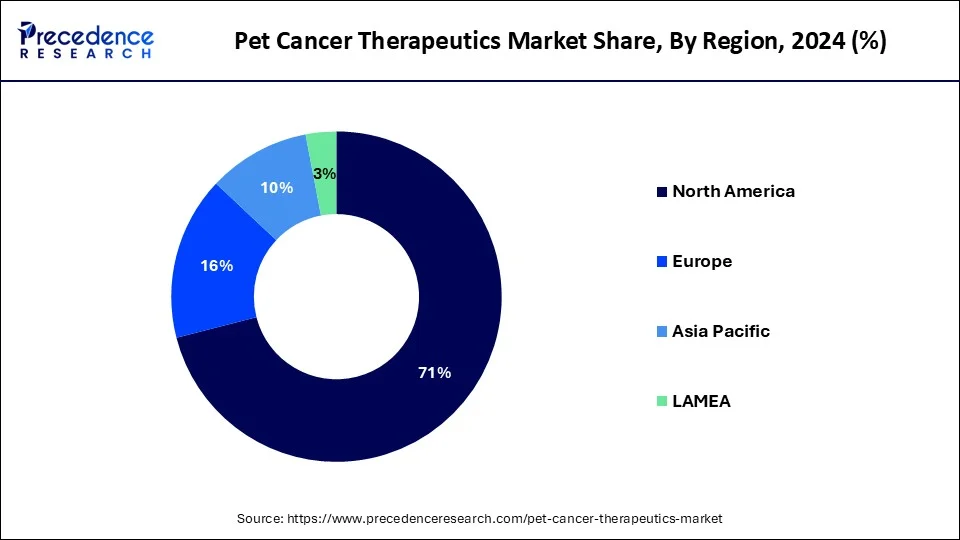

North America dominated the pet cancer therapeutics market in 2024. North America has one of the highest rates of pet ownership globally, with a significant portion of households owning dogs and cats. The area boasts advanced veterinary hospitals and specialty clinics with state-of-the-art diagnostic and treatment facilities, including oncology departments. North America is a hub for pharmaceutical research and development, leading to the development of innovative cancer therapeutics for pets. Regulatory agencies such as the FDA set high standards for veterinary drug approval, ensuring the safety and efficacy of the market. The U.S. accounts for a significant portion of the global market, owing to its large pet population and advanced veterinary healthcare system. Canada’s pet market is growing steadily, driven by increasing pet ownership rates and demand for danced veterinary care.

Asia Pacific is observed to grow at a notable rate in the pet cancer therapeutics market during the forecast period. Some governments in the Asia Pacific region are taking initiatives to improve animal health services, which includes promoting research and development in veterinary medicine and encouraging the establishment of veterinary healthcare facilities. Similar to trends seen in human medicine, the incidence of cancer in pets is rising, partly due to increased lifespans of pets resulting from better overall healthcare. This creates a greater need for effective cancer treatments.

The European region has seen a steady increase in pet ownership rates, particularly in urban areas. Veterinary oncology services are expanding in Europe, with specialized oncology centers and referral hospitals offering advanced cancer diagnostics and treatments. The European Medicines Agency (EMA) regulates veterinary drugs across EU member states, promoting harmonizing regulatory standards for pet cancer therapeutics. European countries emphasize personalized medicine approaches, leading to the development of companion diagnostics and targeted therapies for pets with cancer.

The pet cancer therapeutics market encompasses pharmaceuticals, treatments, and healthcare services specifically designed to diagnose, manage, and treat cancer in pets, including dogs, cats, and other companion animals. The market for pet cancer therapeutics has been steadily growing due to increasing pet ownership rates, advancements in veterinary medicine, and rising awareness about pet health issues. The market size varies depending on factors such as geographic location, prevalence of pet cancer, and access to veterinary care. The market includes pharmaceutical companies, veterinary oncology clinics, research institutions, and diagnostic companies.

Significant players may develop and manufacture cancer drugs, diagnostic tests, and treatment equipment. Market dynamics may vary across regions, influenced by pet ownership rates, socioeconomic factors, and the availability of veterinary services. The market is expected to continue growing as the demand for advanced cancer treatments for pets increases and advancements in veterinary medicine and technology further improve treatment outcomes. Collaboration between stakeholders, including veterinary professionals, pharmaceutical companies, and regulatory bodies, will drive innovation and expand access to effective pet cancer care.

| Report Coverage | Details |

| Market Growth Rate from 2024 to 2033 | CAGR of 9.89% |

| Market Size in 2024 | USD 448.03 Million |

| Market Size in 2025 | USD 493.01 Million |

| Market Size by 2034 | USD 1,150.70 Million |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapy, Applications, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Increasing prevalence of cancers in dogs and cats

Factors such as aging populations, genetic predispositions, environmental exposures, and lifestyle changes contribute to the rising incidence of cancer in pets. Improved diagnostic techniques in the pet cancer therapeutics market allow for earlier and more accurate detection of cancers in dogs and cats, leading to a higher reported prevalence. Greater awareness among pet owners and veterinary professionals about cancer signs and symptoms prompts more frequent screening and diagnosis of pet cancers. This driver contributes to the market's growth by expanding the range of available treatment options, improving treatment outcomes, and enhancing the quality of life for pets with cancer. As investments in research and development continue to increase and awareness about pet cancer grows, the market is expected to further expand in the coming years.

Heavy investments in research and development

Ongoing research and development efforts lead to the discovery and development of novel cancer therapies specifically designed for pets. This includes targeted therapies, immunotherapies, and gene therapies. Continued investment in research facilities and the development of advanced diagnostic tools and techniques, such as molecular diagnostics, imaging modalities, and biomarker assays, enabling more accurate diagnosis and personalized treatment strategies. Investments in clinical trials and studies to evaluate the safety and efficacy of new cancer therapies in pets contribute to expanding treatment options and improving outcomes. Collaboration between pharmaceutical companies, academic institutions, veterinary professionals, and pet healthcare organizations accelerates research efforts and fosters innovation in the pet cancer therapeutics market.

High treatment costs and lack of awareness

Cancer treatments for pets can be expensive, including surgery, chemotherapy, radiation therapy, and supportive care. The high costs involved may limit access to compressive cancer treatment for some pet owners. Similar to human cancer, pets may develop resistance to specific cancer treatments over time, leading to treatment failure or limited efficacy. This can pose challenges for veterinarians in managing advanced or recurrent pet cancers. Pet owners may face difficult decisions regarding the allocation of financial resources for cancer treatment, especially if faced with a poor prognosis or limited treatment options. Ethical considerations about the pet’s welfare and quality of life may influence treatment decisions.

Despite increasing awareness about pet cancer, some pet owners may still lack knowledge about the signs and symptoms of cancer in pets or the available treatment options. This can lead to delays in diagnosis and treatment, impacting treatment outcomes.

Technological advancements and personalized medicine

Continued advancements in medical technology in the pet cancer therapeutics market, such as molecular diagnostics, imaging techniques, and targeted therapies, offer opportunities to improve pet cancer's early detection, diagnosis, and treatment. Innovative technologies can enhance treatment efficacy and minimize adverse effects. The development of personalized cancer therapies tailored to individual pets' unique genetic and molecular characteristics holds great promise for improving treatment outcomes. Companion diagnostics can identify biomarkers that guide treatment decisions, allowing for more targeted and effective therapies.

Collaborative research initiatives and integration of telemedicine

Collaborations between veterinary professionals, pharmaceutical companies, academic institutions, and research organizations foster innovation and accelerate the development of a new pet cancer therapeutics market. Shared knowledge and resources can lead to breakthroughs in treatment options and improve patient outcomes. Integrating telemedicine and teleconsultation services allows for remote consultations between pet owners and veterinary oncologists, improving access to specialized care, particularly in underserved areas. Telemedicine can facilitate timely diagnosis, treatment planning, and follow-up care for pets with cancer.

Expansion of supportive care services and global expansion opportunities

There is an opportunity to expand supportive care services for pets undergoing cancer treatment. This includes pain management, nutritional support, palliative care, and integrative therapies to enhance the pet’s quality of life during treatment and improve treatment tolerance. The market presents opportunities for expansion into emerging markets with growing pet ownership rates. Developing countries with rising disposable incomes and increased awareness of pet health may offer untapped opportunities for market growth.

The chemotherapy segment dominated the pet cancer therapeutics market in 2023. Chemotherapy involves the use of drugs to kill cancer cells or slow their growth. It is a standard treatment modality for various types of pet cancers, including lymphoma, mast cell tumors, and osteosarcoma. Chemotherapy protocols are often tailored to the specific type and stage of cancer, as well as the pet’s overall health status. Chemotherapy for pets has shown a significant effect in the survival period. Chemotherapy also offers a balance for risk of adverse events.

The immunotherapy segment is estimated to be the fastest-growing segment during the forecast period. Immunotherapy harnesses the body’s immune system to recognize and attack cancer cells. Therapeutic vaccines, monoclonal antibodies, and immune checkpoint inhibitors are among the immunotherapeutic approaches being explored for pet cancer treatment.

Immunotherapy aims to enhance the immune response against cancer and may be used alone or in combination with other therapies. Targeted therapy involves drugs targeting cancer cells’ molecular pathways or genetic mutations. These drugs inhibit specific molecules or signaling pathways in cancer growth and progression. Targeted therapies are designed to be more selective and less toxic to normal cells than traditional chemotherapy.

The mast cell cancer segment is expected to grow at the fastest rate during the forecast period. Imaging studies such as ultrasound or radiography are used to evaluate the extent of mast cell tumor involvement and identify potential metastasis to regional lymph nodes or other organs. Fine needle aspiration or incisional biopsy is performed to confirm mast cell tumor diagnosis and determine tumor grade and stage. Surgical excision with wide margins is the primary treatment for localized mast cell tumors. Mohs micrographic surgery may be employed to ensure complete tumor removal while preserving surrounding healthy tissue. Imaging studies such as radiography, ultrasound, or CT scans are used to evaluate the extent of melanoma involvement and identify potential metastasis to regional lymph nodes or distant organs in the pet cancer therapeutics market.

By Therapy

By Applications

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

September 2024

October 2024