May 2024

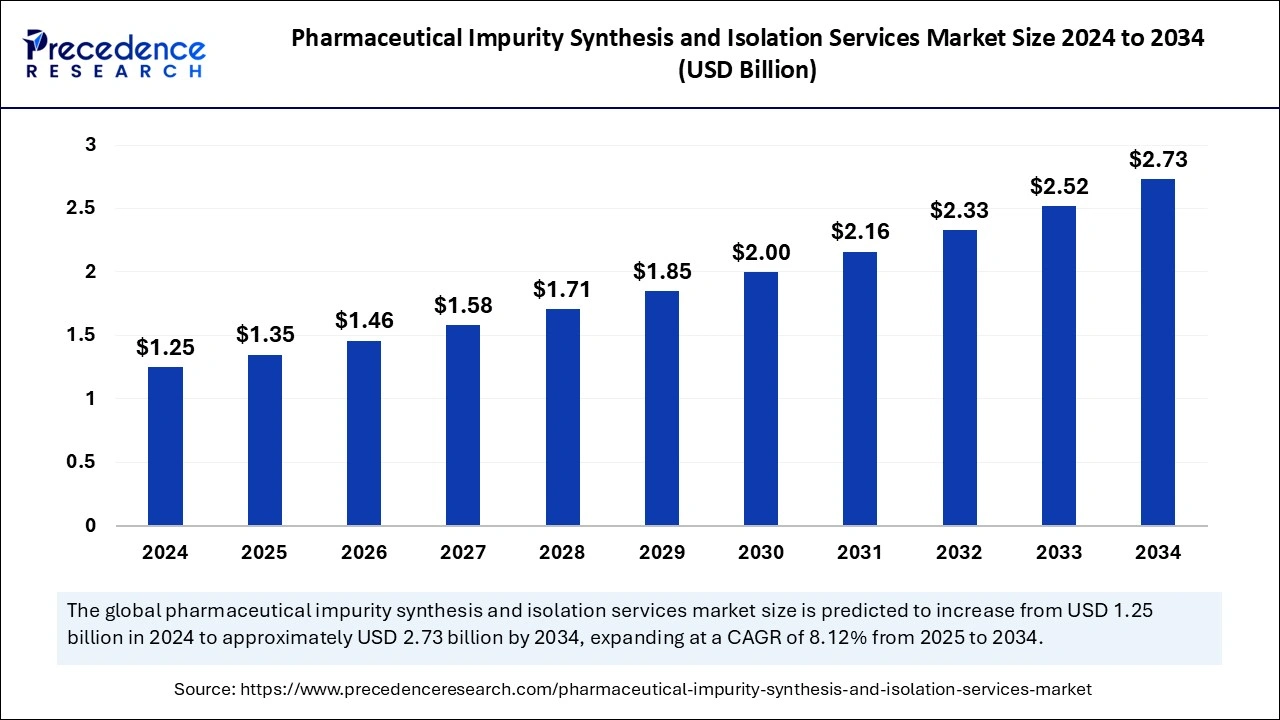

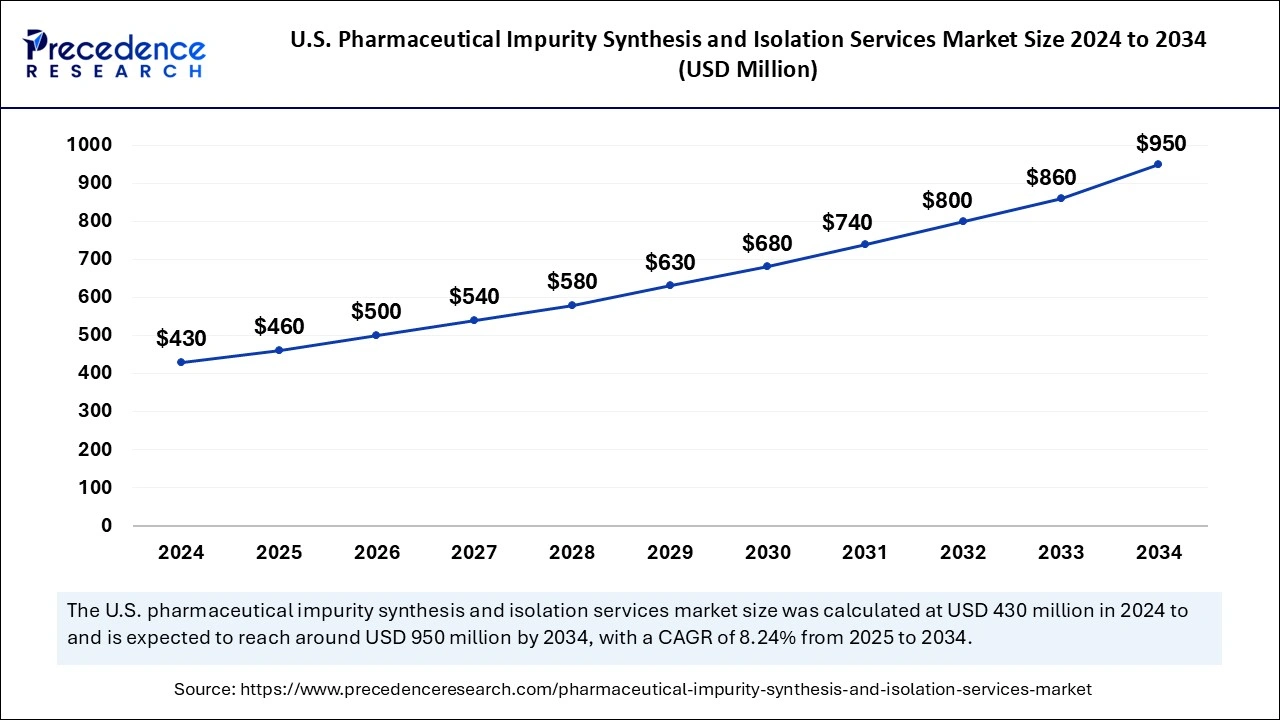

The global pharmaceutical impurity synthesis and isolation services market size is calculated at USD 1.35 billion in 2025 and is forecasted to reach around USD 2.73 billion by 2034, accelerating at a CAGR of 8.12% from 2025 to 2034. The North America market size surpassed USD 430 million in 2024 and is expanding at a CAGR of 8.14% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pharmaceutical impurity synthesis and isolation services market size accounted for USD 1.25 billion in 2024 and is predicted to increase from USD 1.35 billion in 2025 to approximately USD 2.73 billion by 2034, expanding at a CAGR of 8.12% from 2025 to 2034. The market growth is attributed to increasing pharmaceutical R&D investments and advancements in analytical technologies for impurity detection.

The application of artificial intelligence technology in the pharmaceutical impurity synthesis and isolation services market results in enhanced optimization of detection methods, purification procedures, and characterization processes. AI analytical tools that utilize artificial intelligence help detect and trace impurities in advanced pharmaceutical products, resulting in strong compliance with regulatory standards and better detection accuracy. Predictive modeling capabilities of machine learning algorithms help researchers forecast which impurity pathways occur so they can improve their synthesis approaches.

The U.S. pharmaceutical impurity synthesis and isolation services market size was evaluated at USD 480 million in 2024 and is projected to be worth around USD 950 million by 2034, growing at a CAGR of 8.24% from 2025 to 2034.

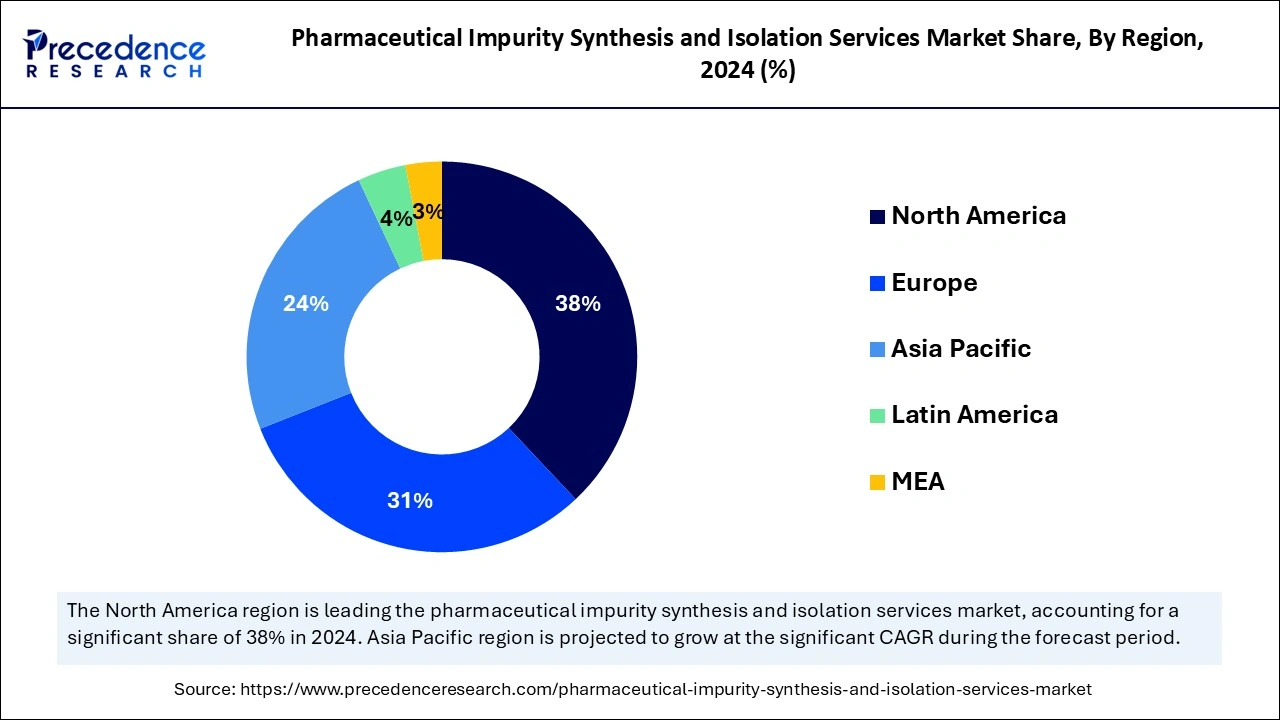

North America dominated the global pharmaceutical impurity synthesis and isolation services market in 2024. The entire pharmaceutical industry benefits from its strict regulations, expansive pharmaceutical manufacturing capabilities, and heavy investments in substance profiling technologies. Intense research and development investments from major pharmaceutical businesses have generated an increased market need for sophisticated impurity evaluation methods. Additionally, the demand for impurity detection solutions increased due to the growing use of biologics alongside biosimilars and gene therapies.

Asia Pacific is projected to host the fastest-growing pharmaceutical impurity synthesis and isolation services market in the coming years, owing to the region experiencing stronger operations through higher pharmaceutical manufacturing capacities along with developing research contracts and regulatory framework changes. Amazon Web Services provides cloud-based system architecture solutions to healthcare customers specifically for impurity detection. Furthermore, the biopharmaceutical and generic drug markets in South Korea and Japan show growth potential.

Demand in the pharmaceutical impurity synthesis and isolation services market has expanded due to rising pharmaceutical impurity regulations enforced by health authorities for maintaining drug safety and efficacy standards. Drug formulation purification through impurity synthesis and isolation requires advanced analytical techniques. This includes chromatography combined with spectroscopy and crystallization for unwanted substance detection and identification and subsequent removal from drug formulations.

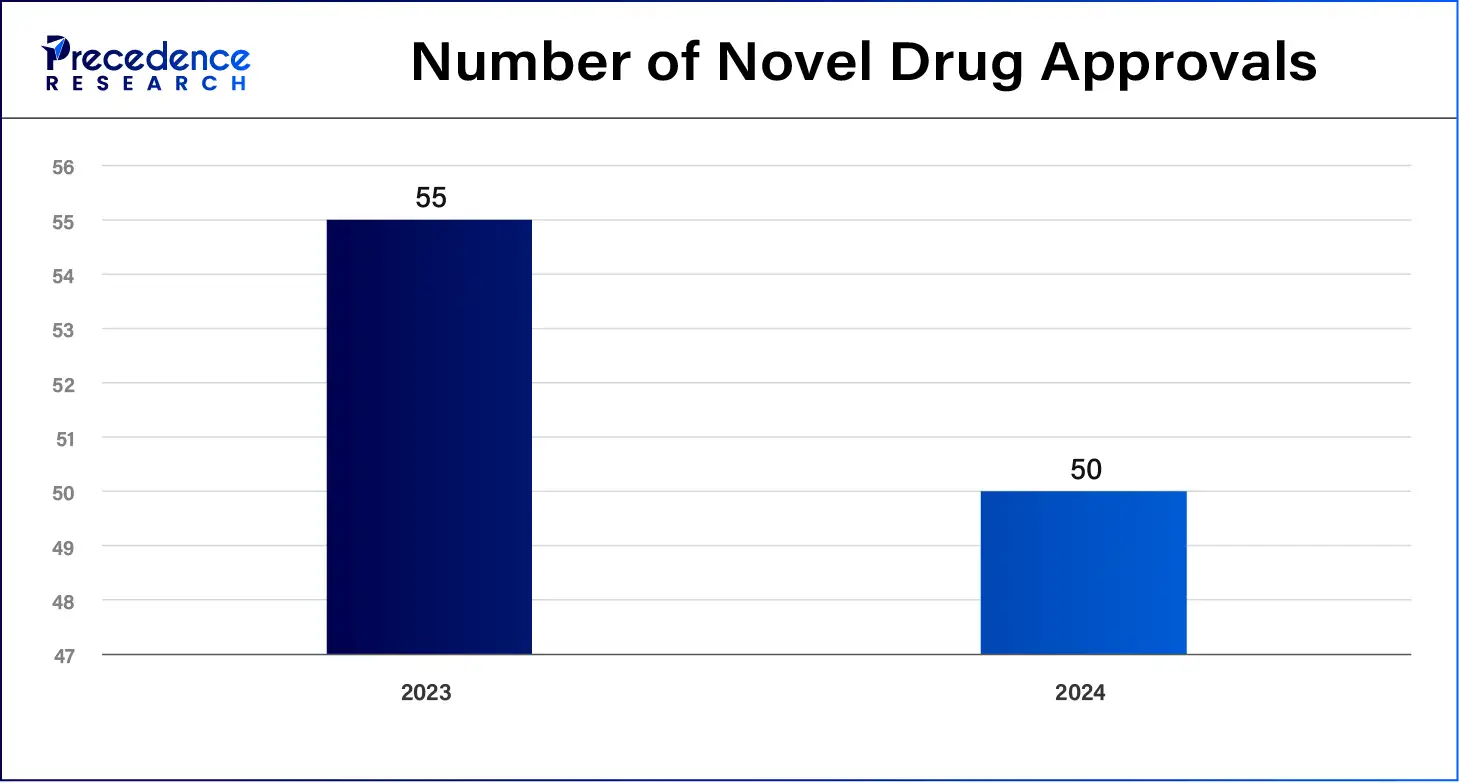

In 2023, the U.S. Food and Drug Administration (FDA) revealed that pharmaceutical product withdrawals, as impurities made up in product recalls, thus showing the need for specialized analytical services. The European Medicines Agency (EMA) has enhanced its testing procedures for impurities by following ICH Q3A and Q3B guidelines, thus leading to faster investments in impurity profiling systems. Furthermore, pharmaceutical companies now use advanced combination analytical methods such as LC-MS and NMR spectroscopy to achieve precise characterization of impurity compounds in their biologics and biosimilar products.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.73 Billion |

| Market Size in 2025 | USD 1.35 Billion |

| Market Size in 2024 | USD 1.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.12% |

| Leading Region/ Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Impurity, Technique, Application, End-use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing regulatory stringency driving service adoption

Increasing regulatory scrutiny is anticipated to drive demand for impurity synthesis and isolation services as pharmaceutical companies comply with stringent guidelines set by organizations such as the FDA, EMA, and ICH. FDA implemented new guidance about human drug nitrosamine impurity control policies in 2024, which shows the necessity for advanced analytical procedures to measure and find trace substances in drug compositions.

Lack of skilled workforce

The lack of a skilled workforce is expected to hinder the pharmaceutical impurity synthesis and isolation services market in the coming years. A deficit of qualified professionals produces operational inefficiencies, longer processing times, and increased costs, which affect service provider expenses. Organizations must spend substantial time and resources training fresh personnel to maintain compliance with new regulatory standards. Market growth restrictions occur due to the limited capability of companies to address complex impurity analysis demands because of a workforce deficiency.

Growing pharmaceutical R&D investments

Growing investments in pharmaceutical research and development are projected to create immense opportunities for the players competing in the pharmaceutical impurity synthesis and isolation services market. The growing pharmaceutical industry investments toward R&D research drive higher demand for impurity synthesis and isolation services, as companies need faster drug discovery methods. The extensive product development costs call for advanced impurity profiling systems to verify both the safety and efficiency of drugs.

A global shift towards precision medicine and biologics has made impurity analysis more complex, so pharmaceutical firms started outsourcing their impurity testing to expert service providers. Furthermore, the rising R&D expenses in pharmaceutical research centers around the world during forthcoming years are expected to fuel the market in the coming years.

The isolation services segment held a dominant presence in the pharmaceutical impurity synthesis and isolation services market in 2024; as the beginning, pharmaceutical companies have maintained isolation services as their core function to verify drug safety through impurity elimination. The increasing complexity of pharmaceutical compounds necessitates precise isolation techniques.

The analytical services segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034. New advancements in analytical technologies, together with high-resolution mass spectrometry and advanced chromatographic techniques, improve both detection and quantification of impurities. Drugs still in development increasingly require total impurity profiling according to quality-by-design approaches, as they need more specialized analytical services than ever

The inorganic impurities segment accounted for a considerable share of the pharmaceutical impurity synthesis and isolation services market in 2024, owing to the rising genotoxic impurities that cause pharmaceutical firms to relocate their specialized analysis work to external providers. Drugs under development within oncology and rare diseases have inorganic impurities, which further fuels the demand for these types of services.

The organic impurities segment is anticipated to grow rapidly during the studied years, as worldwide regulations enforce detailed drug safety assessments of precise impurity quantities. These compounds originate through the use of raw materials and intermediate formation and chemical process degradations, therefore requiring sophisticated identification and purification procedures. Furthermore, the organic impurities remain intact as companies allocate more investment in analytical research and development.

In 2024, the chromatography segment led the global pharmaceutical impurity synthesis and isolation services market due to its exceptional capabilities to detect and measure pharmaceutical impurities accurately. Total impurity profiling needs, as per the FDA and EMA, require pharmaceutical manufacturers to use HPLC instruments to meet ICH Q3A/Q3B guidelines. Reported through the U.S. Pharmacopeia (USP) that HPLC remained the primary analytical method in pharmaceutical testing since it was used for these screens. Moreover, the growing market for biologics along with biosimilars requires advanced detection techniques to identify impurities effectively, which strengthens the adoption of chromatography technology.

The spectroscopy segment is projected to expand rapidly in the coming years, owing to its superior ability to detect unknown pharmaceutical impurities effectively. In 2023, the World Health Organization declared that improved drug impurity detection would decrease unwanted reactions, therefore speeding up mass spectrometry adoption.

The quality control segment held a significant share of the pharmaceutical impurity synthesis and isolation services market in 2024 due to the demanding regulatory standards. GMP and ICH Q3A and Q3B guideline compliance together have elevated the priority of impurity profiling analysis. In 2023, the European Medicines Agency (EMA) confirmed the fundamental requirement of active pharmaceutical ingredients (APIs) and excipient impurity characterization to advance quality control services. Furthermore, the rising production of biosimilars, together with generic drugs, leads to increased market requirements for specific systems to detect and control impurities.

The drug development segment is projected to grow at the fastest rate in the market in the future years, owing to the increasing investments in pharmaceutical research and clinical trials. The market actively adopts improved techniques for impurity characterization as precision medicine, biologics, and complex molecular formulations have gained increasing importance. The 2024 revision by the International Council for Harmonisation (ICH) made thorough impurity risk assessment mandatory during drug development’s initial phase, thus generating an increased need for impurity profiling services.

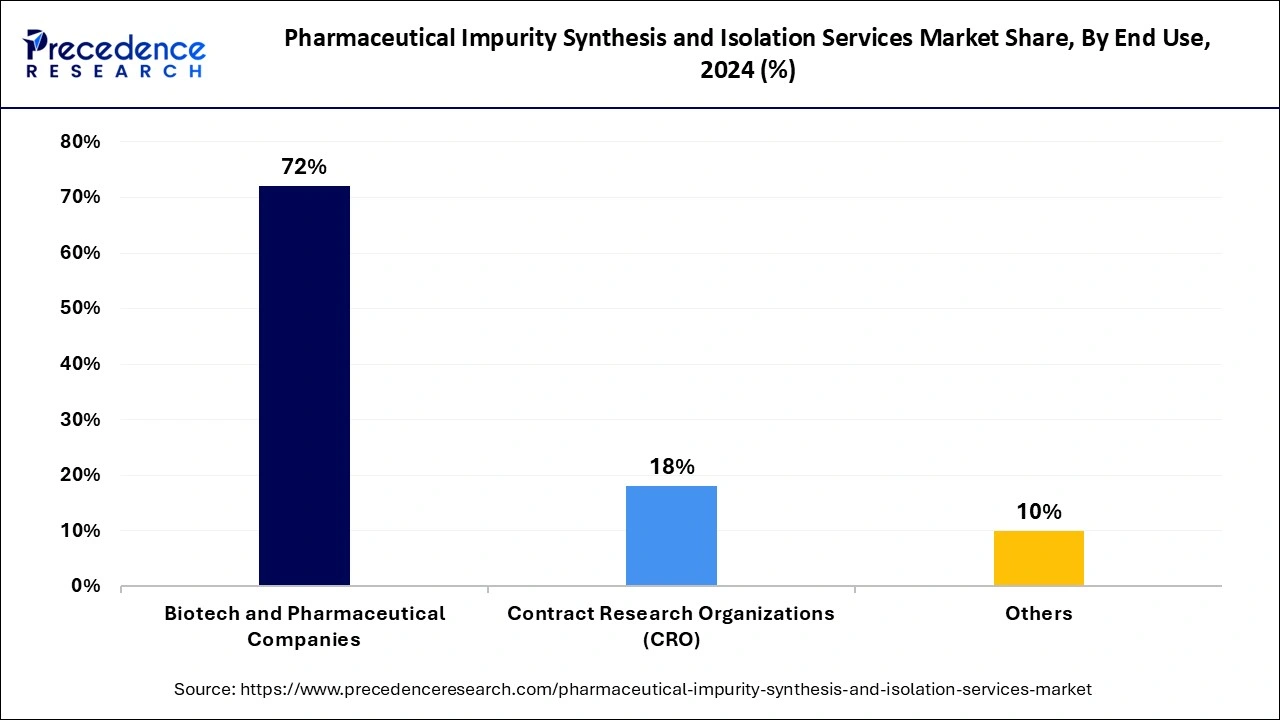

The biotechnology and pharmaceutical companies segment dominated the pharmaceutical impurity synthesis and isolation services market in 2024. Regulatory bodies carry out increased surveillance, while drug manufacturers need a complete analysis of impurities within their formulations. New drug development, along with investments in biosimilars, complex biologics, and clinical drug development, has driven the market demand for advanced impurity characterization methods. The market demand for precise impurity analysis increased as advanced technologies like high-resolution chromatography and mass spectrometry were implemented.

The contract research organizations (CRO) segment is projected to witness rapid growth in the future years, owing to the pharmaceutical companies showing a growing tendency to send their impurity analysis work to dedicated service providers in the market. The combination of lower costs, speedier results, and specialized analytic experience makes outsourcing a primary preference for pharmaceutical manufacturers. Extensive requirements from the International Council for Harmonisation (ICH) to characterize impurities during drug development phases in 2024 strengthened market demand for CRO services. Additionally, the growing regulatory pressure has motivated CROs to buy state-of-the-art analytical solutions, which makes them essential players in providing impurity synthesis isolation services.

By Service

By Impurity Type

By Technique

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

April 2025

February 2025

September 2024