February 2025

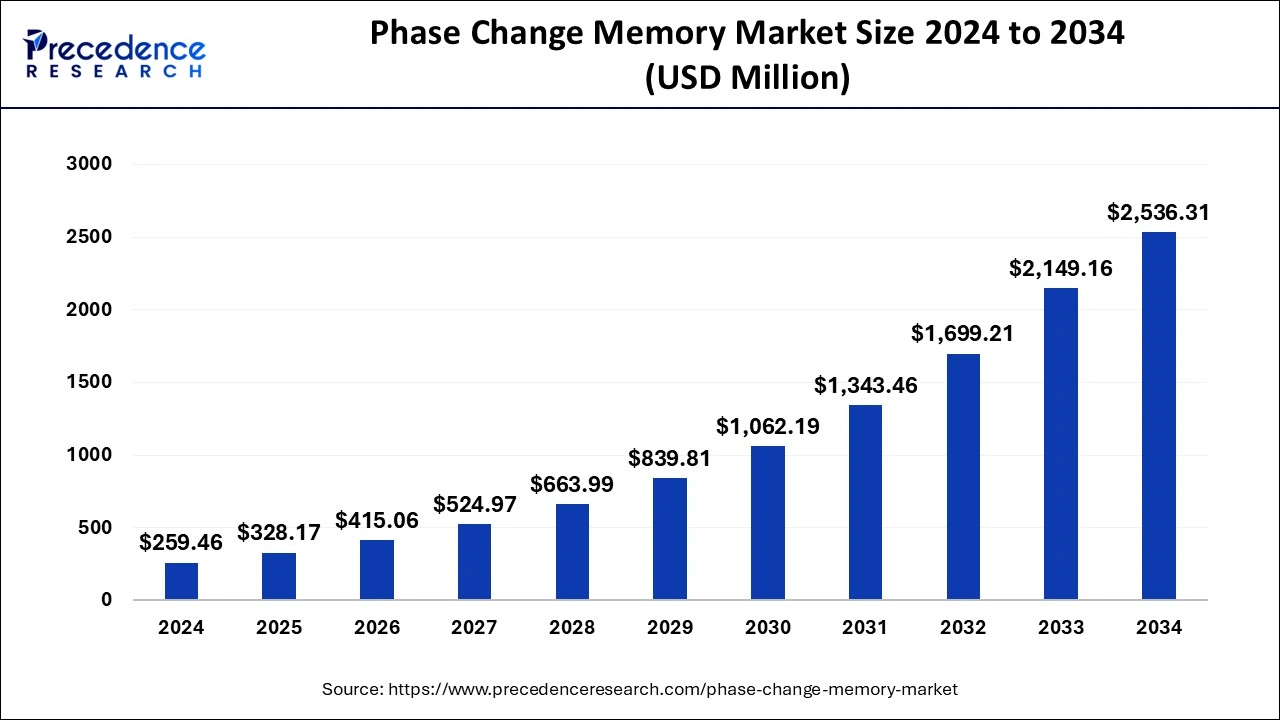

The global phase change memory market size is calculated at USD 328.17 million in 2025 and is forecasted to reach around USD 2,536.31 million by 2034, accelerating at a CAGR of 25.61% from 2025 to 2034. The North America phase change memory market size surpassed USD 93.41 million in 2024 and is expanding at a CAGR of 25.78% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global phase change memory market size was estimated at USD 259.46 million in 2024 and is predicted to increase from USD 328.17 million in 2025 to approximately USD 2,536.31 million by 2034, expanding at a CAGR of 25.61% from 2025 to 2034.

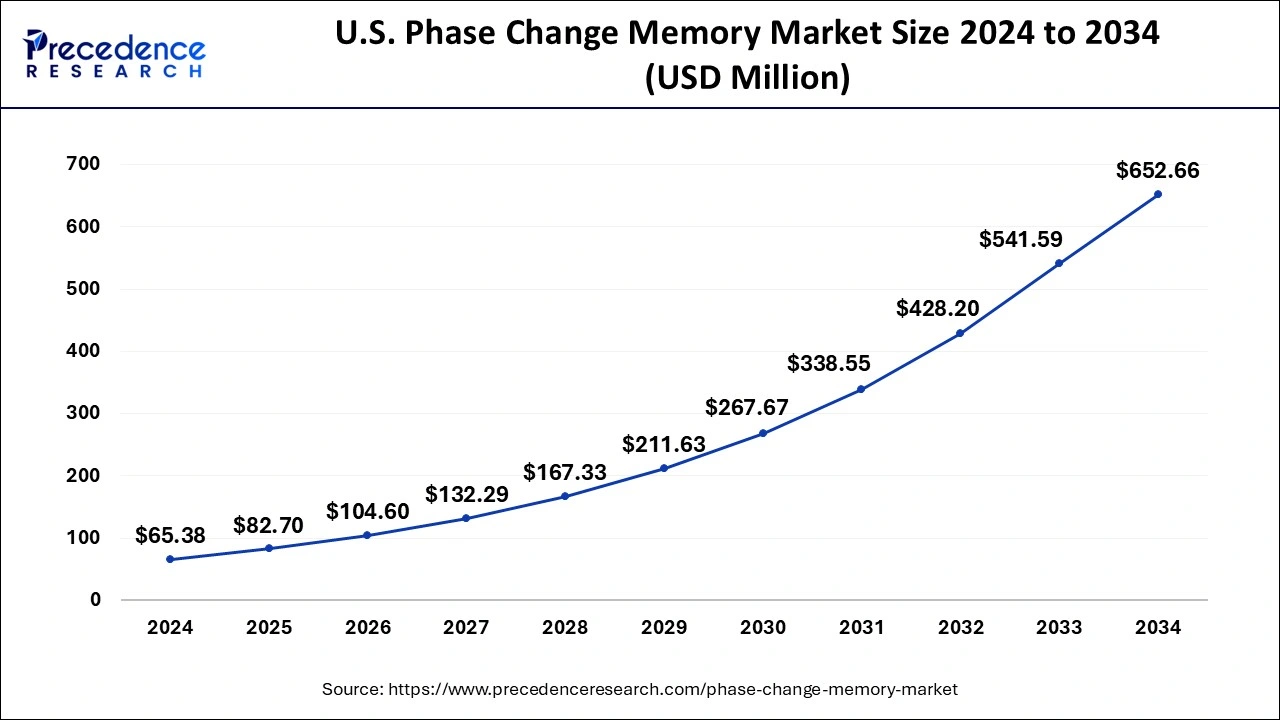

The U.S. phase change memory market size reached USD 65.38 million in 2024 and is projected to be worth around USD 652.66 million by 2034, poised to grow at a CAGR of 25.87% from 2025 to 2034.

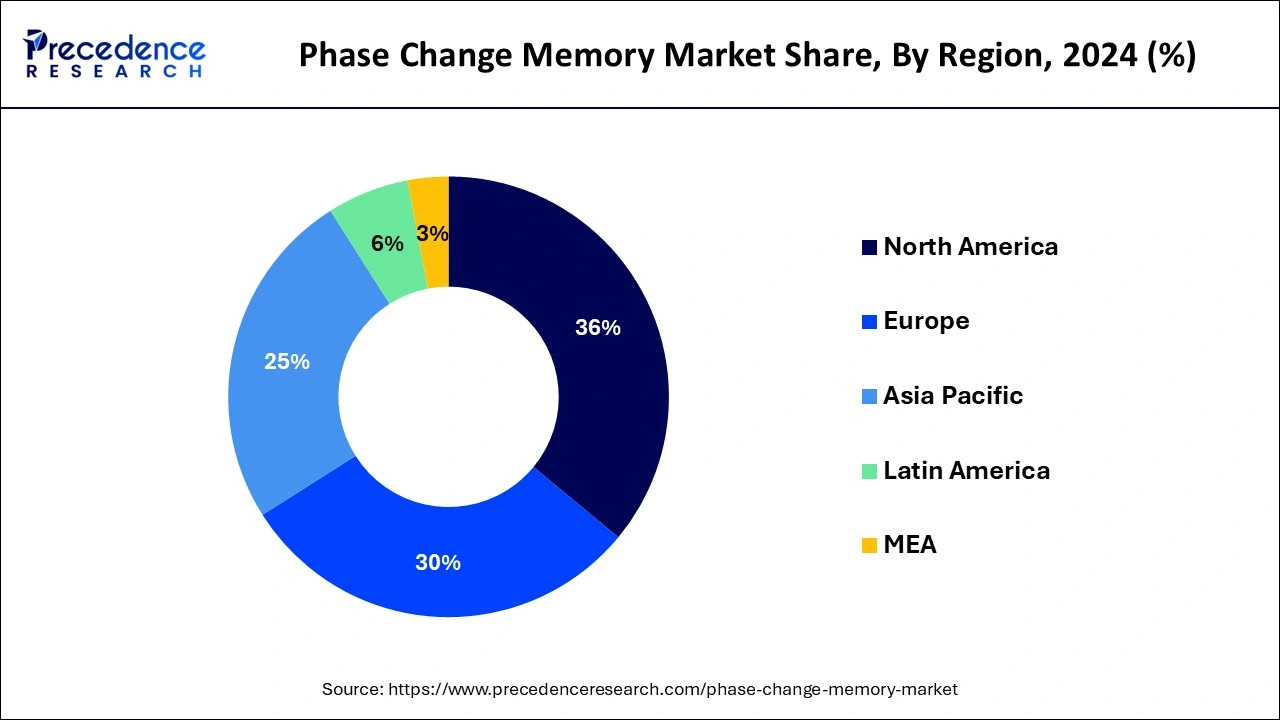

North America contributed more than 36% of phase change memory market share in 2024. North America stands poised to dominate the PCM market over the forecast period, primarily due to the presence of top semiconductor companies and the region's substantial investments in research and development (R&D). With leading data center firms also headquartered in the area, North America benefits from a robust ecosystem supporting PCM technology. The increasing demand for high-performance computer systems further bolsters the market's growth prospects in the region.

Asia Pacific is expected to experience the fastest CAGR of 29.43% during the projected period in the phase change memory market. This growth is attributed to the region's rising need for high-speed data transport and the expanding use of artificial intelligence (AI) and machine learning (ML) technologies, particularly in emerging economies like China and India. Significant investments in the semiconductor sector in Asia Pacific are driving innovation and fostering the adoption of PCM technology.

In Europe, the PCM market is forecasted to grow at a moderate rate due to the rising acceptance of emerging technologies and the increasing demand for high-performance computing systems. Noteworthy investments in R&D activities and the development of cutting-edge semiconductor technologies across Europe contribute to the expansion of the PCM market in the region. These investments signify a commitment to technological advancement and innovation, positioning Europe as a key player in the global PCM market landscape.

The phase change memory market offers services and solutions associated with the groundbreaking advancement in computer non-volatile random-access memory technology. It harnesses the unique properties of chalcogenide glass, which can transition between two stable physical phases, amorphous and crystalline upon the application of heat. One of the key advantages of phase-change memory is its ability to deliver fast read and write speeds, making it highly suitable for a wide range of applications. PCM's swift performance renders it ideal for tasks such as caching, buffering, and data transmission, where rapid access to stored information is critical.

The high-speed capabilities of phase-change memory address the increasing demand for efficient memory devices in modern computing systems. With the proliferation of data-intensive applications, including artificial intelligence, machine learning, and real-time data analytics, there is a growing need for memory solutions that can keep pace with the demands of these advanced technologies.

Moreover, phase-change memory's non-volatile nature ensures that stored data remains intact even when power is removed, enhancing reliability and data integrity in computing environments. This reliability, coupled with its high-speed performance, positions phase-change memory as a promising solution for meeting the evolving memory requirements of today's computing systems.

Phase Change Memory Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 25.61% |

| Market Size in 2025 | USD 328.17 Million |

| Market Size by 2034 | USD 2,536.31 Million |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Heightened adoption owing to the surging demand for non-volatile memory solutions

Phase change memory is experiencing heightened adoption owing to the surging demand for non-volatile memory solutions across various industries. Unlike conventional memory technologies like DRAM and flash memory, PCM offers superior durability and dependability, making it an attractive option for applications requiring robust data storage. One of the key drivers of PCM adoption is its ability to provide high-density storage and high-speed data transmission capabilities. With the exponential growth of data generated by modern applications such as artificial intelligence, big data analytics, and cloud computing, there is an increasing need for memory solutions that can accommodate larger volumes of data and facilitate rapid data access and retrieval.

PCM's high-density storage capabilities enable it to meet these requirements effectively, making it well-suited for data-intensive applications. Furthermore, PCM's low-power consumption characteristics are driving its popularity in the phase change memory market. As energy efficiency becomes a paramount consideration in both consumer electronics and enterprise-level computing systems, there is a growing demand for memory solutions that can deliver optimal performance while minimizing power consumption. PCM's ability to operate efficiently with lower power requirements positions it as a preferred choice for applications where power efficiency is critical, such as mobile devices, IoT devices, and battery-powered systems.

Moreover, PCM's reliability and endurance make it highly suitable for mission-critical applications where data integrity and system stability are paramount. Its ability to withstand frequent read and write cycles without degradation ensures consistent performance over extended periods, contributing to its reputation as a dependable memory solution. Hence, the increasing demand for non-volatile memory, coupled with PCM's superior durability, high-density storage, high-speed data transmission, and low-power consumption capabilities, are driving significant market revenue growth. As industries continue to prioritize efficiency, reliability, and performance in their computing systems, PCM is expected to play a pivotal role in meeting these evolving requirements and shaping the future of memory technology.

High cost of phase change memory

The high cost of phase change memory (PCM) poses a significant constraint on its widespread adoption and market growth. As a relatively new technology with specialized manufacturing processes and materials, PCM production costs remain relatively high compared to traditional memory solutions like DRAM and flash memory. This high cost of production translates into higher prices for PCM products, making them less accessible to a broader range of consumers and industries. Furthermore, the lack of industry standardization in PCM technology presents challenges for market expansion.

The absence of standardized specifications and protocols complicates the selection process for end users, who may struggle to identify the most suitable PCM solutions for their specific requirements. Without clear guidelines and compatibility standards, potential adopters may hesitate to invest in PCM technology, fearing compatibility issues and interoperability challenges with existing systems and infrastructure.

Moreover, the relatively small production capacity of PCM contributes to its limited availability and adoption in various end-use sectors. The scarcity of PCM products further restricts its market penetration and inhibits its potential to address the growing demand for high-performance, non-volatile memory solutions across industries. Addressing these constraints will require concerted efforts from industry stakeholders to drive down production costs, establish industry-wide standards and protocols, and expand production capacities to meet the increasing demand for PCM technology. Only through these measures can the phase change memory market overcome its current limitations and realize its full growth potential in the future.

Innovation in analytical chemistry

The increasing investments in phase change memory (PCM) research and development represent a significant opportunity for the phase change memory market’s future growth and innovation. Major market players are allocating substantial resources to enhance PCM technology and develop cutting-edge solutions that address the rising demand for high-speed and non-volatile memory solutions across various industries. Investments in research and development operations enable companies to explore new materials, device architectures, and manufacturing processes to improve the performance, reliability, and cost-effectiveness of PCM solutions.

By leveraging advancements in materials science, semiconductor technology, and nanotechnology, researchers can overcome existing limitations and unlock new capabilities in PCM technology. These investments also facilitate the development of next-generation PCM products with enhanced features such as higher storage densities, faster read and write speeds, lower power consumption, and improved durability. Such advancements are crucial for meeting the evolving needs of data-intensive applications, including artificial intelligence, machine learning, big data analytics, and cloud computing.

Moreover, research and development efforts drive innovation in PCM applications across diverse industries, including consumer electronics, automotive, healthcare, aerospace, and telecommunications. By continuously pushing the boundaries of PCM technology, companies can position themselves at the forefront of the market, gain a competitive edge, and capitalize on emerging opportunities in the rapidly evolving memory solutions landscape. Hence, increasing investments in PCM research and development underscore the market's potential for future growth, technological advancement, and the phase change memory market leadership, driving innovation and delivering value to customers across industries.

The PCM-RAM segment held the highest share of 49% in 2024. PCM-RAM is poised to lead in terms of market share in the phase change memory market due to the increasing demand for high-performance computing and data-intensive applications. As a non-volatile memory solution, PCM-RAM ensures data integrity even after power is turned off, making it ideal for critical operations. Its ability to combine the advantages of DRAM and NAND Flash memory technologies has propelled its adoption across diverse industries, including automotive, aerospace, and telecommunications. PCM-RAM's versatility and reliability make it a preferred choice for applications where fast and responsive memory is essential, driving its growth across various end-use sectors.

The PCM-ROM segment is anticipated to witness rapid growth in the phase change memory market at a significant CAGR of 27.63% during the projected period. The growth is primarily attributed to its utilization in read-only memory applications.

The increasing demand for high-density memory solutions with low power consumption and rapid access times is driving the adoption of PCM-ROM across various industries, including consumer electronics and automotive. Its ability to provide reliable read-only memory functionalities make it a preferred choice for applications where data integrity and quick access are essential. As industries continue to seek efficient and dependable memory solutions, PCM-ROM remains a viable option, contributing to its stable development in the foreseeable future.

The enterprise storage segment has held a 27% market share in 2024. The enterprise storage segment is poised to dominate the phase change memory market in the coming years, driven by the increasing demand for high-density and low-power memory solutions in data centers and cloud computing applications. As enterprises seek high-performance and high-capacity memory systems capable of efficiently storing and accessing massive amounts of data, PCM technology emerges as a favored choice. Its ability to deliver high-density, low-power, and fast memory solutions aligns well with the requirements of enterprise storage solutions. PCM technology's popularity in this segment underscores its relevance and suitability for addressing the evolving storage needs of modern enterprises.

The automotive segment is anticipated to witness significant growth of 28.73% over the projected period in the phase change memory market. This growth is driven by the increasing demand for high-performance and reliable memory solutions in advanced driver-assistance systems (ADAS) and autonomous driving applications. PCM technology stands out for providing quick and dependable memory solutions that can operate effectively in challenging automotive conditions. Its ability to withstand varying temperatures, vibrations, and other harsh environmental factors makes PCM technology well-suited for integration into automotive electronics. As vehicle manufacturers continue to prioritize safety and reliability in their systems, the adoption of PCM technology is expected to surge, driving considerable growth in the automotive segment.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2024