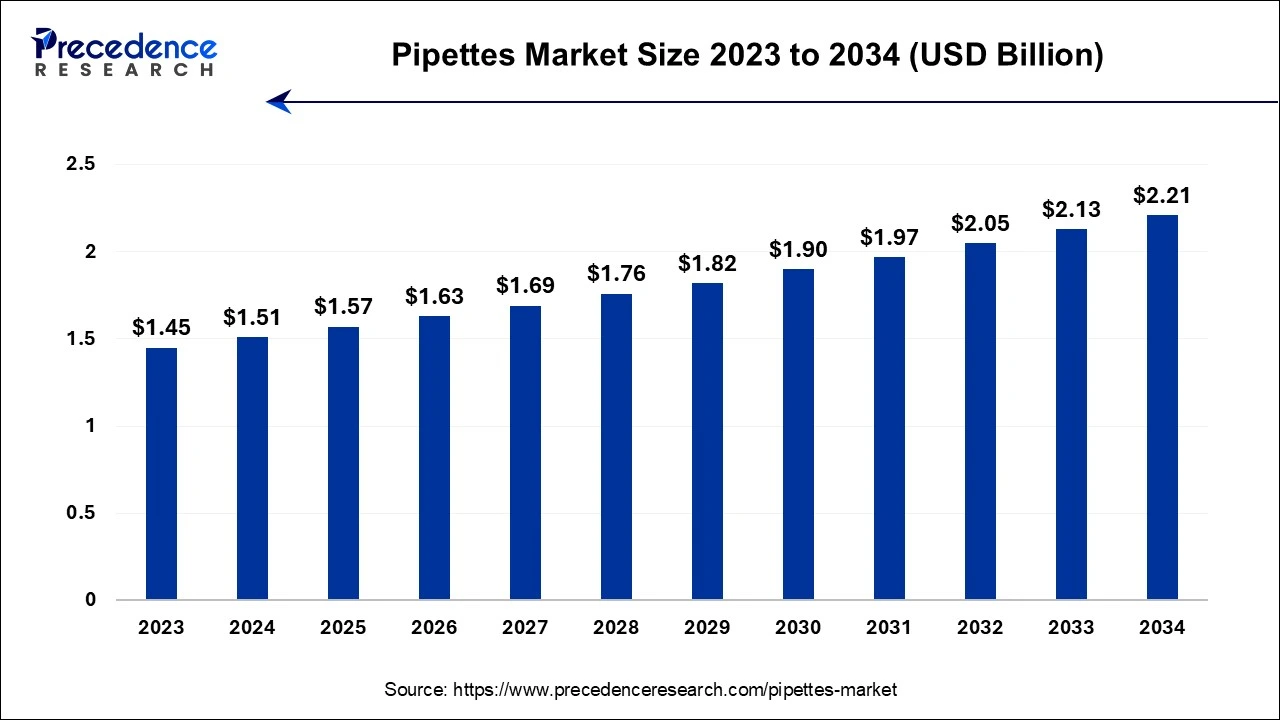

The global pipettes market size accounted for USD 1.51 billion in 2024, grew to USD 1.57 billion in 2025 and is expected to be worth around USD 2.21 billion by 2034, registering a CAGR of 3.90% between 2024 and 2034. The North America pipettes market size is calculated at USD 680 million in 2024 and is estimated to grow at a fastest CAGR of 4.03% during the forecast period.

The global pipettes market size is calculated at USD 1.51 billion in 2024 and is projected to surpass around USD 2.21 billion by 2034, expanding at a CAGR of 3.90% from 2024 to 2034.

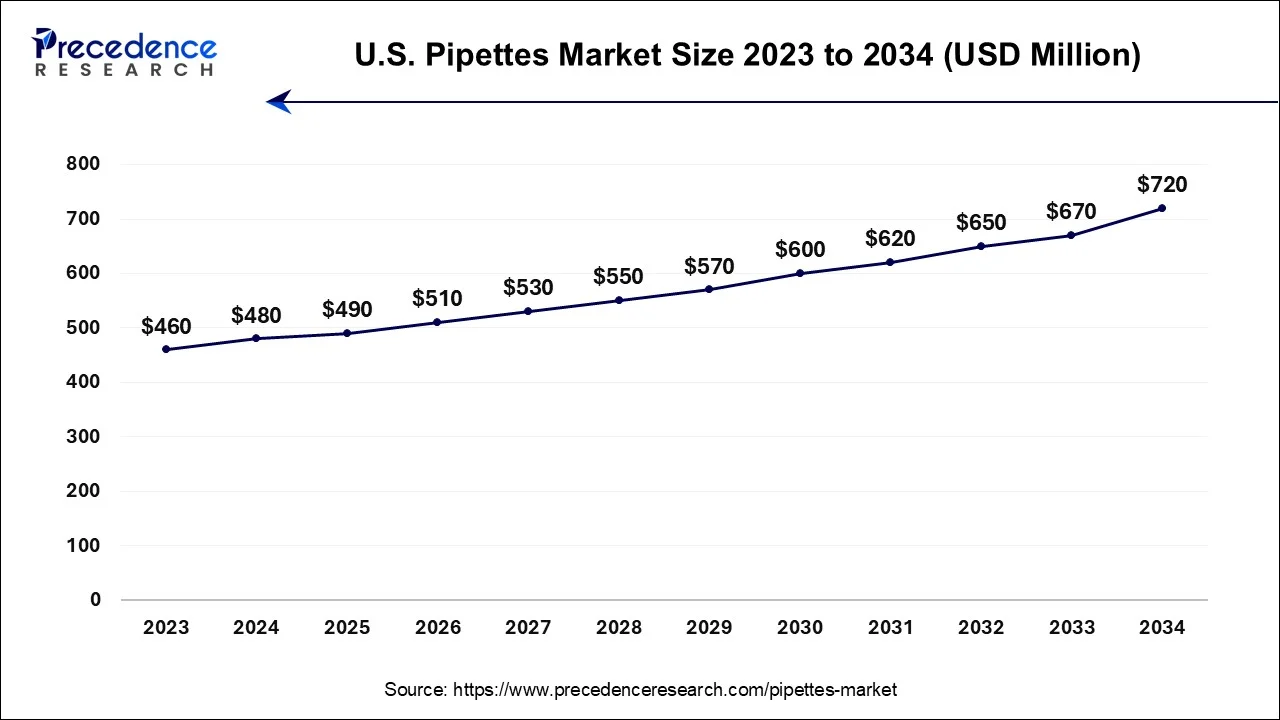

The U.S. pipettes market size was exhibited at USD 480 million in 2024 and is projected to be worth around USD 720 million by 2034, poised to grow at a CAGR of 4.13% from 2024 to 2034.

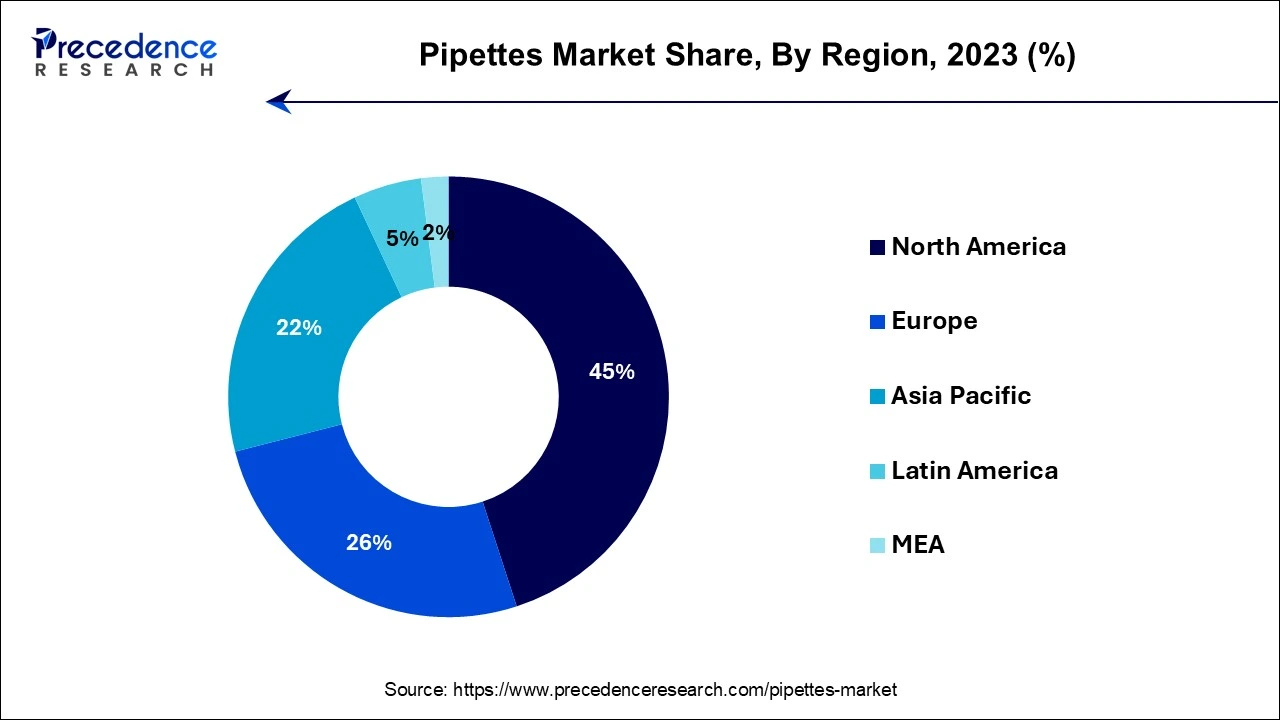

North America has held the largest revenue share 45% in 2023. North America commands a significant share of the pipettes market due to several key factors. The region boasts a robust pharmaceutical and biotechnology market, where pipettes are crucial for drug discovery, development, and quality control. Additionally, advanced healthcare infrastructure and significant research and development activities contribute to a high demand for precise liquid handling instruments. Stringent regulatory standards in North America further necessitate the use of accurate pipettes. Moreover, the presence of major pipette manufacturers and a well-established distribution network ensures easy access to cutting-edge pipette technologies, cementing North America's dominant position in the market.

Asia-Pacific is estimated to observe the fastest expansion with the highest CAGR of 4.3% during the forecast period. Asia-Pacific commands significant growth in the pipettes market due to several factors. The region's burgeoning pharmaceutical and biotechnology sectors, coupled with a growing emphasis on research and development, have fueled the demand for precise liquid handling instruments. Moreover, increased healthcare spending, expanding academic research, and the rise of contract research organizations in countries like China and India have contributed to market growth. Additionally, the adoption of innovative technologies and a large population base requiring healthcare services further cements Asia-Pacific's dominant growth in the pipettes market as the region continues to invest in scientific advancements.

The pipettes market is a segment of the laboratory equipment industry that specializes in the production and distribution of pipetting devices. Pipettes are essential tools in scientific research, healthcare, and diagnostics, used to accurately measure and transfer liquids. The market encompasses a wide range of pipette types, including manual, electronic, and multichannel pipettes, catering to diverse applications in pharmaceuticals, biotechnology, clinical laboratories, and academic research. Factors such as technological advancements, increasing research and development activities, and growing demand for precision in liquid handling have contributed to the steady growth of the pipettes market, making it a significant component of the scientific instrumentation sector.

The pipette market, a vital segment within the laboratory equipment industry, is witnessing substantial growth driven by several key trends and factors. Pipettes play a crucial role in the precise measurement and transfer of liquids in various sectors, including pharmaceuticals, biotechnology, clinical laboratories, and academic research. The market encompasses a diverse range of pipette types, such as manual, electronic, and multichannel pipettes, reflecting the industry's commitment to innovation and meeting the evolving needs of users.

One prominent trend in the pipettes market is the increasing demand for automation and digitization. Electronic pipettes equipped with advanced features like programmability and data recording are gaining popularity, enhancing efficiency and reducing human error. Additionally, the COVID-19 pandemic has amplified the importance of pipettes in diagnostic testing, creating a surge in demand. Moreover, the growing emphasis on precision and reproducibility in laboratory processes is driving the adoption of high-precision pipettes, further stimulating market growth.

Technological advancements continue to be a significant growth factor. The development of ergonomic, user-friendly designs and the integration of innovative materials are enhancing the overall performance of pipettes. Furthermore, the expansion of the biotechnology and pharmaceutical sectors, coupled with increasing research and development activities, is fueling the demand for pipettes, as these industries heavily rely on accurate liquid handling for drug discovery and development.

Despite the growth prospects, the pipettes market faces challenges such as price competition and the need for constant product differentiation. Manufacturers must balance the incorporation of advanced features with affordability to remain competitive. Moreover, ensuring product quality and accuracy while adhering to stringent regulatory standards is a constant challenge for industry players. Supply chain disruptions and raw material shortages can also impact production and distribution.

The pipettes market offers a spectrum of opportunities for both established entities and newcomers. Exploring nascent markets, such as those in Asia-Pacific and Latin America, characterized by burgeoning scientific research and healthcare infrastructures, can be a strategic move. Additionally, the potential for innovation in pipette technology, including the development of intelligent pipettes capable of seamless integration with laboratory information management systems, holds promise. Collaborative ventures with research institutions and laboratories for the co-creation of tailored pipettes designed for specific applications can unlock fresh revenue streams.

In summary, the pipettes market is witnessing robust growth driven by trends like automation and digitization, coupled with factors like technological advancements and increased demand from the pharmaceutical and biotechnology sectors. However, industry players must navigate challenges related to pricing, regulatory compliance, and supply chain disruptions. Exploring new markets and innovating in pipette technology offers promising business opportunities in this dynamic sector.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.21 Billion |

| Market Size in 2024 | USD 1.51 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.90% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Category, Channel Type, Volume Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Biotechnology and pharmaceutical growth

The growth of the biotechnology and pharmaceutical sectors is a primary driver behind the expansion of the pipettes market. Pipettes play a pivotal role in these industries, which are characterized by rigorous research, development, and quality control processes. In biotechnology, pipettes are indispensable tools for tasks such as DNA amplification, protein analysis, and cell culture handling. The demand for precise and reproducible liquid handling is escalating as biotech companies advance their efforts in drug discovery, genomics, and personalized medicine. Likewise, the pharmaceutical sector heavily relies on pipettes for drug formulation, compound screening, and quality assurance.

The development and manufacturing of pharmaceuticals require meticulous attention to detail, and pipettes ensure that precise volumes of ingredients are dispensed accurately, contributing to the efficacy and safety of pharmaceutical products. The continuous expansion of these sectors, driven by advancements in biopharmaceuticals, gene therapies, and the pursuit of novel drug candidates, translates into an ongoing demand for pipettes. As biotechnology and pharmaceutical companies strive for innovation and product development, the pipettes market experiences sustained growth, underlining its crucial role in advancing life sciences and healthcare.

Raw material shortages

Shortages of essential raw materials present a notable constraint on the expansion of the pipettes market. Pipettes, being reliant on a variety of materials such as specialized plastics, precision components, and glass, encounter disruptions in their manufacturing processes when these materials become scarce or their prices fluctuate. Global supply chain disruptions and factors like geopolitical tensions, natural disasters, and economic fluctuations can exacerbate these shortages. Limited access to critical raw materials can result in delays in pipette manufacturing and distribution, ultimately affecting product availability for customers.

Moreover, when manufacturers face higher material costs, they may be compelled to raise prices, which can deter potential buyers and limit market growth. To mitigate the impact of raw material shortages, pipette manufacturers must establish robust supply chain management strategies, explore alternative materials, and work on building resilient and diversified supply chains to ensure a stable and sustainable pipeline of materials for their products.

Customization and innovation

Customization and innovation are generating significant opportunities within the pipettes market. The ability to tailor pipettes to specific applications, industries, or user preferences allows manufacturers to address niche markets and cater to the unique needs of customers. This customization extends beyond basic features and may include factors such as volume range, ergonomic design, and compatibility with specialized materials. Innovation is also a key driver, as manufacturers continually develop advanced pipette technologies. This includes the creation of smart pipettes that can integrate seamlessly with laboratory information management systems (LIMS) or utilize artificial intelligence for precise liquid handling.

Furthermore, innovations in materials and manufacturing processes are enhancing the durability and performance of pipettes. Both customization and innovation not only enable manufacturers to stand out in a competitive market but also empower customers to optimize their laboratory workflows, ultimately driving market growth as researchers and professionals seek solutions that align precisely with their unique requirements and leverage cutting-edge technologies.

The air displacement pipettes segment has held a 57% revenue share in 2023. The dominance of air displacement pipettes in the pipettes market can be attributed to their adaptability and precision. These pipettes find extensive application in diverse fields like genomics, molecular biology, and pharmaceutical research, where precision and consistency are paramount. Their capability to accurately dispense a broad spectrum of volumes, spanning from microliters to milliliters, positions them as indispensable tools in laboratory settings. Furthermore, their user-friendly design and minimal maintenance needs make them the preferred choice among scientists and technicians, solidifying their prominent position in the market.

The positive displacement pipettes segment is anticipated to expand at a significant CAGR of 4.7% during the projected period. Positive displacement pipettes hold a major growth in the pipettes market due to their unique advantages. These pipettes are preferred for applications involving high viscosity or volatile liquids, as they offer accurate and consistent volume measurements regardless of the liquid's properties. They are also suitable for handling hazardous or infectious materials, enhancing safety in laboratories. Additionally, positive displacement pipettes are known for their superior precision and minimal risk of contamination, making them indispensable in critical research, pharmaceuticals, and clinical diagnostics. Their versatility and reliability have cemented their growth as a preferred choice in the market.

The electronic segment had the highest market share of 56% in 2023. The electronic segment holds a major share in the pipettes market due to its advanced features that enhance accuracy and efficiency in liquid handling. Electronic pipettes offer programmable settings, precise volume control, and often have data recording capabilities, reducing human errors. They are particularly favored in industries like pharmaceuticals and biotechnology, where precision is critical for drug discovery and development. Additionally, automation trends in laboratories have driven the adoption of electronic pipettes. Their versatility and ability to streamline workflows make them a preferred choice, contributing to their dominant position within the market.

The manual segment is anticipated to expand at the fastest rate over the projected period. The manual segment holds a major growth in the pipettes market primarily due to its versatility, cost-effectiveness, and reliability. Manual pipettes are widely used across various industries and research settings, offering precise liquid handling for a broad range of applications. They are particularly favored by laboratories with budget constraints, as they are more affordable upfront compared to electronic alternatives. Additionally, manual pipettes are easy to use and require minimal maintenance, making them accessible to a wide user base. Their widespread adoption across diverse fields contributes significantly to their dominant growth in the market.

he multi-channel segment had the highest market share of 52% in 2023. The multi-channel segment holds a significant share in the pipettes market primarily due to its efficiency and time-saving advantages. Multi-channel pipettes allow simultaneous dispensing of multiple samples, enhancing productivity in high-throughput applications common in pharmaceuticals, genomics, and clinical diagnostics. They reduce the need for repetitive pipetting, minimize the risk of errors, and improve workflow consistency, making them indispensable for laboratories striving for precision and efficiency. As a result, the demand for multi-channel pipettes has surged, driving their dominance in the market as a preferred choice for laboratories handling large volumes of samples.

The single channel segment is anticipated to expand at the fastest rate over the projected period. The dominant growth of the single-channel segment in the pipettes market can be attributed to its adaptability and broad utilization across diverse applications. Single-channel pipettes are favored for their precision in liquid handling, making them suitable for routine laboratory tasks as well as complex experiments. Their straightforward operation, user-friendliness, and cost-efficiency render them accessible to a wide spectrum of users, spanning from academic researchers to clinical laboratories. Furthermore, they are the preferred choice for applications demanding exceptional accuracy, including DNA sequencing and PCR. This extensive versatility and dependable performance have firmly established single-channel pipettes as the frontrunners in the market.

The adjustable volume segment had the highest market share of 60% in 2023. The adjustable volume pipettes segment holds a significant share in the market due to its versatility and broad applicability. These pipettes allow users to accurately dispense varying volumes of liquids, making them suitable for a wide range of laboratory tasks. Researchers and technicians can adjust the volume as needed, reducing the need for multiple pipettes and increasing cost-efficiency. Additionally, adjustable volume pipettes are commonly used in molecular biology, genomics, and pharmaceutical research, where precision and flexibility are paramount. Their widespread adoption across diverse scientific disciplines contributes to their substantial market presence.

The fixed volume segment is anticipated to expand at the fastest rate over the projected period. The fixed volume segment holds a major growth in the pipettes market primarily due to its simplicity and reliability. Fixed volume pipettes are pre-set at a specific volume, eliminating the need for calibration and reducing the risk of user error. This makes them ideal for routine laboratory tasks and applications with consistent volume requirements, such as clinical diagnostics and quality control. They are also cost-effective compared to adjustable volume pipettes. Their ease of use, consistent performance, and lower price point make fixed volume pipettes a preferred choice for a wide range of laboratories, contributing to their significant market growth.

The pharmaceutical laboratories segment had the highest market share of 38% in 2023. Pharmaceutical laboratories hold a substantial share in the pipettes market due to their critical reliance on precise liquid handling. Pipettes are indispensable tools for pharmaceutical research, drug formulation, quality control, and analysis. The industry's continuous innovation and development of new medications demand accurate and reproducible measurements, creating a consistent demand for high-quality pipettes. Additionally, stringent regulatory requirements in the pharmaceutical sector necessitate adherence to precise measurement standards, further driving the need for reliable pipetting instruments. As a result, pharmaceutical laboratories maintain a major market share, emphasizing the integral role of pipettes in advancing pharmaceutical science and drug development.

The forensics laboratories segment is anticipated to expand at the fastest rate over the projected period. Forensics Laboratories hold a significant growth in the pipettes market due to the stringent demands for accurate and precise liquid handling in forensic applications. Pipettes are indispensable tools for DNA analysis, blood testing, and sample preparation in criminal investigations and forensic research. The need for traceability and reliability in handling sensitive samples has driven the adoption of high-quality pipettes. Additionally, advancements in forensic science techniques and the increasing caseloads have further fueled the demand. As forensic research continues to evolve and expand, the reliance on pipettes for error-free and reproducible results ensures their dominant growth in this sector.

Segments Covered in the Report

By Type

By Category

By Channel Type

By Volume Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client