July 2024

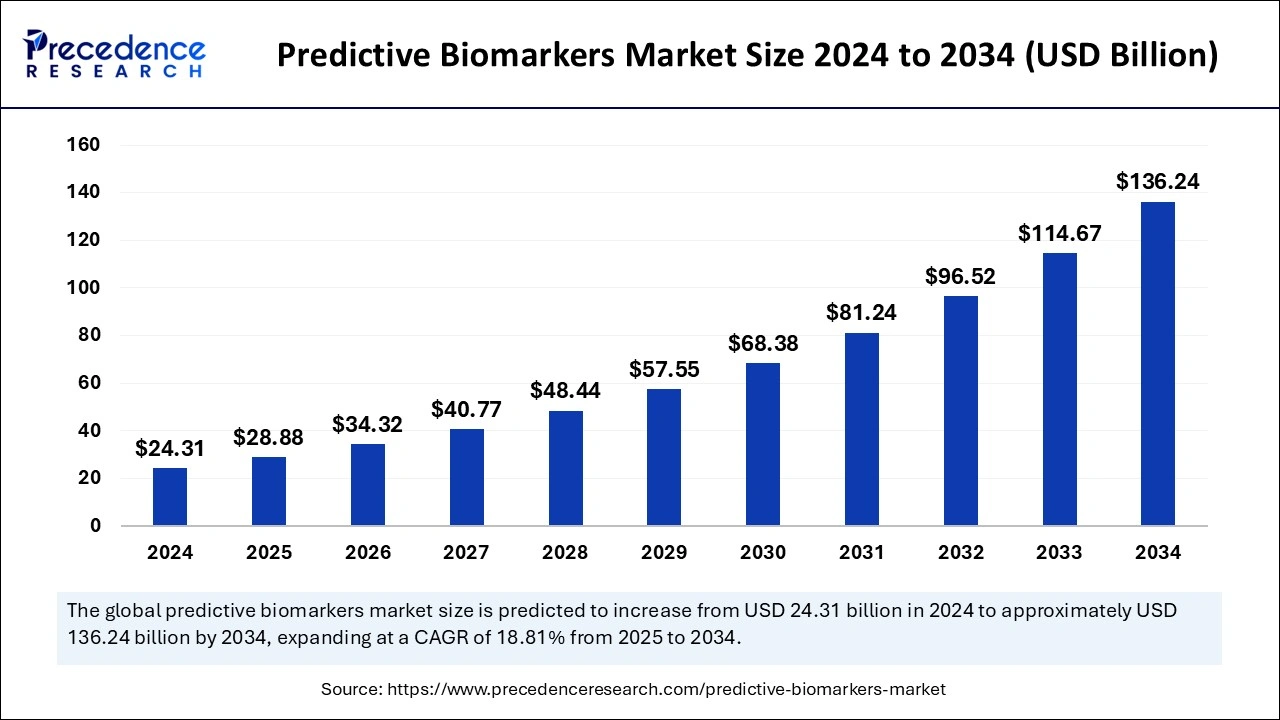

The global predictive biomarkers market size is accounted at USD 28.88 billion in 2025 and is forecasted to hit around USD 136.24 billion by 2034, representing a CAGR of 18.81% from 2025 to 2034. The North America market size was estimated at USD 8.27 billion in 2024 and is expanding at a CAGR of 18.97% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global predictive biomarkers market size was estimated at USD 24.31 billion in 2024 and is predicted to increase from USD 28.88 billion in 2025 to approximately USD 136.24 billion by 2034, expanding at a CAGR of 18.81% from 2025 to 2034. The demand for early diagnosis and therapies has increased due to the rising prevalence of chronic disease, making the expansion of the predictive biomarkers market. The market further has witnessed significant growth due to increased demand for personalized medicines. The growing need for non-invasive technologies is projected to drive the market expansions.

Artificial intelligence plays a crucial role in the development of new predictive biomarkers, as it can analyze large amounts of data from various sources with accuracy and effectiveness. Recent AI performance in the predictive biomarkers market includes biomarker quantification, personalized medicine, and predicting treatment response optimization. AI algorithms can identify patterns in complex, integrated data from high-dimensional data. With the help of AI in data analytics, the identification of potential biomarkers from large databases has become easier.

The integration of AI in various omics technologies in oncology, neurology, and cardiology allows for the identification of the predictive efficiency of therapies, making it easier for the predictive biomarkers market to determine the therapy required in individual patients. The ability of AI methodologies such as ML and deep learning to provide predictive results of therapy outcomes plays a favorable role in personalized medicines. With the integration of AI, predictive biomarkers are gaining more importance and advantages for personalized medicines.

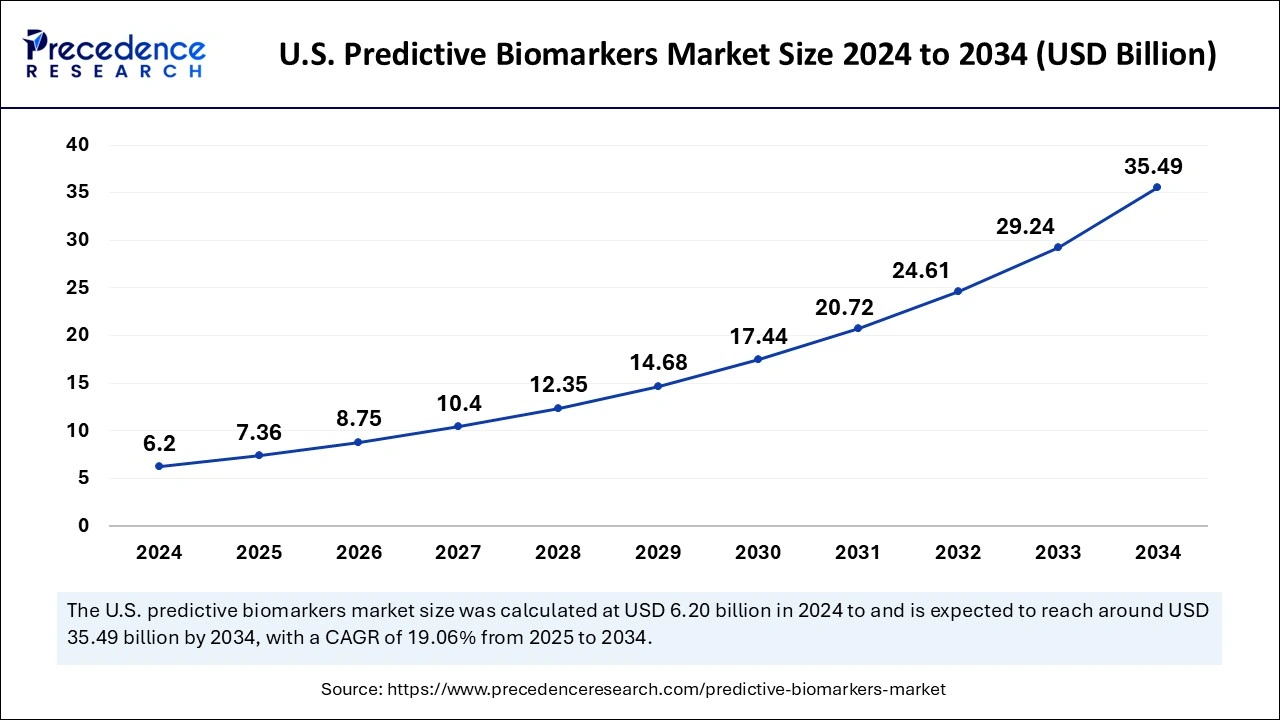

The U.S. predictive biomarkers market size was exhibited at USD 6.2 billion in 2024 and is projected to be worth around USD 35.49 billion by 2034, growing at a CAGR of 19.06% from 2025 to 2034.

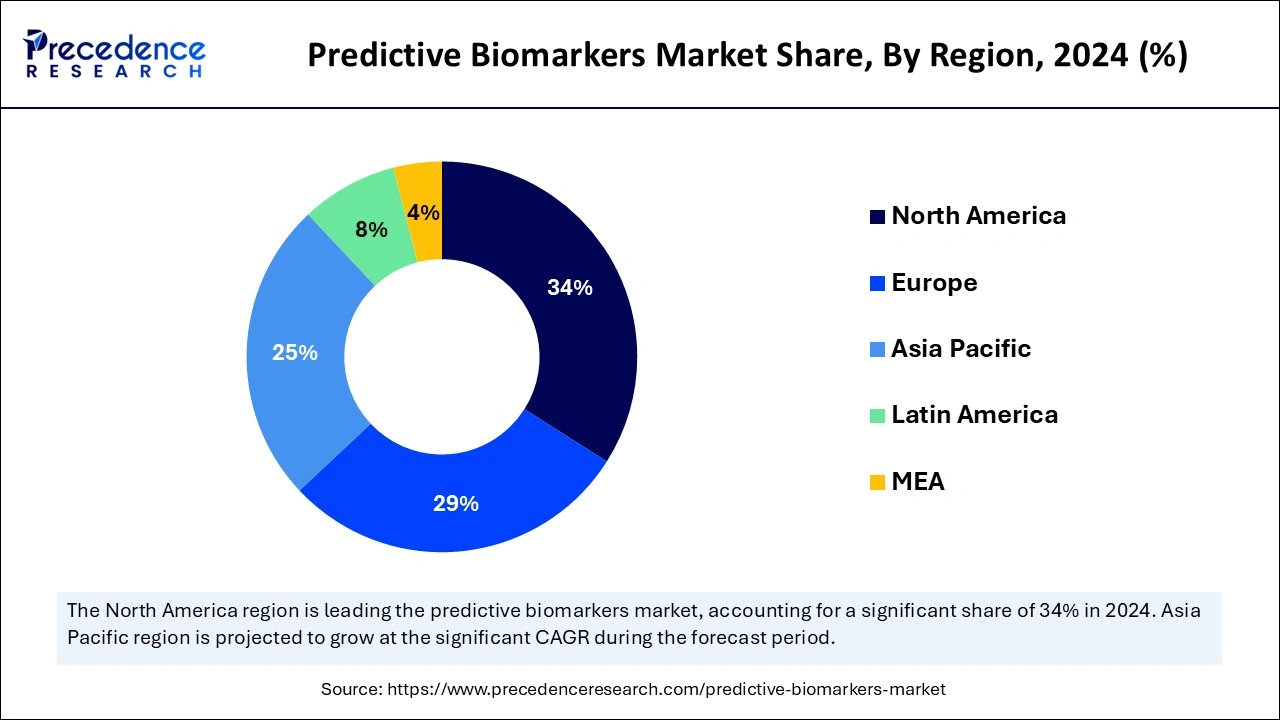

North America led the global predictive biomarkers market with the highest share in 2024 due to its well-established pharmaceutical and biotechnology infrastructures, research, and academic institutes. Government and company investments in the R&D sector also play a favorable role in the regional market. The growing burden of chronic diseases like cancer, cardiovascular, and renal disease is driving advancements in predictive biomarker technology in North America.

The United States is leading the regional market due to its large patient population base and advanced healthcare infrastructure. The availability of key pharmaceutical and biotechnology companies is fueling countries' markets. Furthermore, support of regulatory frameworks in discovering and developing new innovative predictive biomarkers is anticipated to witness further market growth in the forecast period. Biomarkers, EndpointS, and other Tools (BEST) Resource Glossary developed by the FDA and NIH play a crucial role in promoting the use of biomarkers and advancements in biomarker science.

Asia Pacific is estimated to expand the fastest CAGR in the predictive biomarkers market between 2025 and 2034 due to the increasing prevalence of chronic and non-communicable diseases in the region. Technological advancements in genomics and developments of precision medicines are further fueling the predictive biomarkers sector in Asia. Government funding allows developing countries to adopt digitalization in the healthcare sector. Also, investments in research and development are shaping the regional market. Countries like China, Japan, India, South Korea, and Australia are playing a crucial role in the regional market expansion.

China leads the Asian predictive biomarkers market due to expanding advanced healthcare infrastructure and pharmaceutical and biotechnology companies. The rising government investments in pharmaceutical companies, R&D, and technology advancements are allowing the country to discover and develop predictive biomarkers. The increased research activity for precision medicines is the key factor leveraging countries' markets.

Japan is the second largest country leading the regional market due to the country's advanced research ecosystem. Factors like an aging population and a growing prevalence of cancers have driven demands for personalized medicines in the country, leading to enhanced predictive biomarker developments. Furthermore, the availability of government funding in R&D is boosting Japan's innovations in biomarkers.

Predictive biomarkers are being used for potential patient identification, early disease detection, diagnosis, treatment plans, and monitoring. The rising incidence of chronic disease and demand for personalized medicines are the major factors driving the need for the predictive biomarkers market. Furthermore, the adoption of predictive biomarkers is rising for drug discovery and development, disease risk assessments, and forensic applications. Predictive biomarkers not only target the therapy but also provide an understanding of the potential effects of a therapeutic intervention. The utilization of predictive biomarkers for treatment outcome predictions is emerging in the market.

Ongoing strategic collaborations between research institutes, pharmaceutical and biotechnology companies, government organizations, and academic institutes are significantly transforming the innovations and development of predictive biomarkers. Along with advanced data analytical techniques, the integration of AI, ML, and well-designed clinical trials are expanding clinical facilities and are showing potential in the predictive biomarkers market. Furthermore, several market obstacles, including government funding in large-scale predictive biomarker solutions, developments, and sustainability concerns in predictive biomarkers, are projected to unveil modern and innovative changes in the forecast period.

| Report Coverage | Details |

| Market Size by 2034 | USD 136.24 Billion |

| Market Size by 2025 | USD 28.88 Billion |

| Market Size in 2024 | USD 24.31 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.81% |

| Leading Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Indication, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Personalized medicines

The rising prevalence of chronic disease has led to a demand for personalized medicines. Personalized medicines are able to provide tailored treatment solutions for individual patients according to their genetic expressions and profiles. The need for effective, accurate, and invasive or minimally invasive treatment solutions drives healthcare professionals and patients toward personalized medicines. The requirement of predictive biomarkers market services for monitoring, predictive analytics, treatment reactions, and enhanced accuracy of predictive medicines is driving the market.

The rising adoption of next-generation sequencing to develop predictive medicines is driving innovation and the development of novel predictive biomarkers. The rising focus on precision treatment and target therapies is driving demands for predictive biomarkers in the identification of potential candidates for clinical trials and is further leveraging market growth. Ongoing collaboration between research institutes to advance predictive biomarkers and develop predictive medicines for chronic diseases is shaping the market.

High development cost

The high capital investment in research and developments, clinical trials, and regulatory compliance to the discovery, development, and validation of predictive biomarkers are primary restraints of the predictive biomarkers market. The cost related to regulatory requirements of data quality and patient privacy further hampers the adoption of predictive biomarkers. Such expenses not only hamper their adoption but also innovations and developments. Costs related to the development of novel technologies hinder companies' investments, leading to an influence on market competition. However, with growing government investments and collaboration between research institutions and enterprises, costs will be reduced for cutting-edge technology innovation and developments, including predictive biomarkers.

Early detection

The growing prevalence of chronic diseases like cancer, cardiovascular disorders, and neurological disorders is driving the need for the early detection of disease. The rising prevalence and risk of such diseases are surging for their early detection and diagnosis. The predictive biomarkers market can provide disease origin and potential for disease progress. Additionally, technological advancements, including next-generation sequencing, can develop novel and innovative predictive biomarkers to expand their performance in disease diagnosis and treatments. The increased utilization of predictive biomarkers in oncology, precision medicines, and personalized medicines helps healthcare professionals plan tailored treatment strategies for individual patients and enhance patient outcomes.

The cancer segment held the largest predictive biomarkers market share in 2024 due to the rising prevalence of cancer. The increased prevalence of cancers is driving demand for predictive biomarkers for early detection, diagnosis, tailored treatment recommendations, and treatment monitoring. Increased adoption of personalized medicines in cancer treatments is heightening the importance of predictive biomarkers for cancer indication. Ongoing research and development of predictive biomarkers in various types of cancers, including ER-positive breast cancer, cell tumors, and neuroendocrine tumors, are emerging in the market. Furthermore, advancements in cancer genomics, including next-generation DNA sequencing, are enabling innovations and developments of new predictive biomarkers for oncology.

The neurological disease segment is anticipated to grow at a remarkable CAGR between 2025 and 2034. The segment growth is attributed to an increased need for early detection. The prevalence of neurological diseases such as Alzheimer's and Parkinson's have increased, which are rapid, progressive, and debilitating nature conditions, so the demand for early detective tools for neurological diseases is driving the adoption of predictive biomarkers. Additionally, the limited availability of treatment options is encouraging researchers to adopt predictive biomarkers to identify potential candidates for research and clinical trials.

The prediction segment captured the biggest predictive biomarkers market share in 2024 because of the ability of predictive biomarkers to predict patient behavior for specific treatment options. The need for prediction for applied treatment solutions, effects, and patient outcomes is the major reason behind the increased adoption of predictive biomarkers. Additionally, the rising need to know disease progression in a patient's body to provide early preservations is highlighting the use of predictive biomarkers. The leverage of advanced technology, including AI and ML, is further contributing to the delivery of spectacular predictive models. With the growing importance of personalized medicines, the segment is projected to continuously dominate the market.

On the other hand, the diagnosis segment is expected to expand at a notable CAGR over the projected period due to the increased importance of predictive biomarkers in early disease detection, diagnosis, prognosis, and therapy monitoring. Advancements in diagnostic technology, including next-generation sequencing and imaging technologies, are fueling the segment's growth. Additionally, the adoption of companion diagnostics technology and liquid biopsy are driving demands for predictive biomarkers.

The research institutes segment captured the largest predictive biomarkers market share in 2024. The segment growth is accounted for by increased developments and innovations in new predictive biomarkers. Additionally, the rising adoption of predictive biomarkers in clinical trials and the development of personalized medicines are leveraging the segment's growth. Predictive biomarkers can identify early development of disease and help to detect potential patients for treatment research. The segment is further witnessing growth due to rising government and company investments and funding for research institutes, allowing them accessibility to cutting-edge technologies, including predictive biomarkers. With growing collaborations of research institutes with key companies, governments, and academic institutes, they are projected to boost segment growth in the upcoming period.

However, the hospital's segment is projected to witness notable growth over the forecast period due to the rising prevalence of chronic disease and increased hospitalizations. The increased demand for personalized medicines by healthcare professionals and patients is driving the adoption of predictive biomarkers in hospitals. Hospitals play a crucial role in the utilization of predictive biomarkers for early disease detection, diagnosis, treatment plan selection, and monitoring.

By Indication

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

September 2024

January 2025

December 2024