December 2024

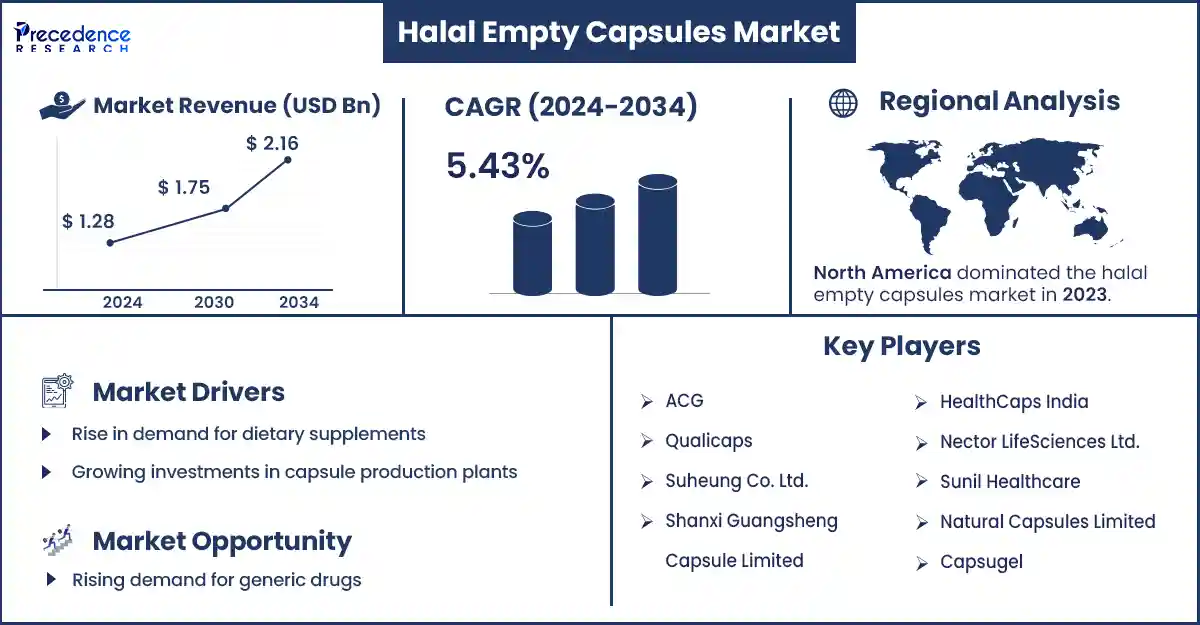

The global halal empty capsules market revenue was valued at USD 1.28 billion in 2024 and is expected to attain around USD 2.05 billion by 2033, growing at a CAGR of 5.43% during the forecast period. The demand for halal empty capsules market is increasing due to the increasing need for halal-certified products in the pharmaceutical sector.

The halal empty capsules are products manufactured by Islamic dietary laws and do not contain any non-halal substance or pork in them. These capsules are primarily used in the nutraceutical and pharmaceutical industries. In addition, vegetarian capsules are becoming more popular because of shifting consumer preferences and dietary restrictions. There is also a regulatory requirement for halal certification standards.

New product launches

The launch of innovative encapsulation solutions in the pharma industry is propelling the halal empty capsules market growth. Major market players are creating improved empty capsule variants like HPMC capsules, which can be an alternative to hard gelatin capsules and fulfill particular dietary demands. In addition, there is a rise in the number of regulatory approvals for halal-certified capsules from various nations.

Increasing adoption of dietary supplements

The growing popularity of dietary supplements, along with the increasing awareness of healthy lifestyles, is the key trend in the halal empty capsules market. Also, consumers with high disposable income are likely to buy dietary supplements. Moreover, the availability of supplements through online platforms has raised the consumption of dietary supplements. Empty capsules are increasingly becoming popular as they are easy to swallow and hide unpleasant tastes.

The growing potential of the pharmaceutical sector

The increasing investment by big government organizations in the development of the pharma sector is driving market growth. The implementation of innovative technologies in the production process of non-gelatin capsules to enhance quality products fuels the growth prospects for the halal empty capsules market in the future.

North America dominated the halal empty capsules market in 2023. The dominance of the region can be linked to the strong presence of major market players along with the region's well-established distribution system. Moreover, the region also has a growing nutraceutical industry, which can greatly influence market growth. In the region, the U.S. held a remarkable market share due to the increasing incidence of chronic diseases.

Asia Pacific is anticipated to grow at the fastest rate in the halal empty capsules market over the projected period. The growth of the region can be credited to the presence of elderly populations in countries like China and Japan, who are prone to chronic diseases. Furthermore, the region is the home for major exporters of halal empty capsules globally, such as Europe, Africa, and the Middle East. Furthermore, in Asia Pacific, China held the dominant position because of a surge in the country's investment in healthcare infrastructure.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 1.28 Billion |

| Market Revenue by 2033 | USD 2.05 Billion |

| CAGR | 5.43% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation

By Type

By Application

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/5246

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

December 2024

January 2025

April 2024

January 2025