August 2024

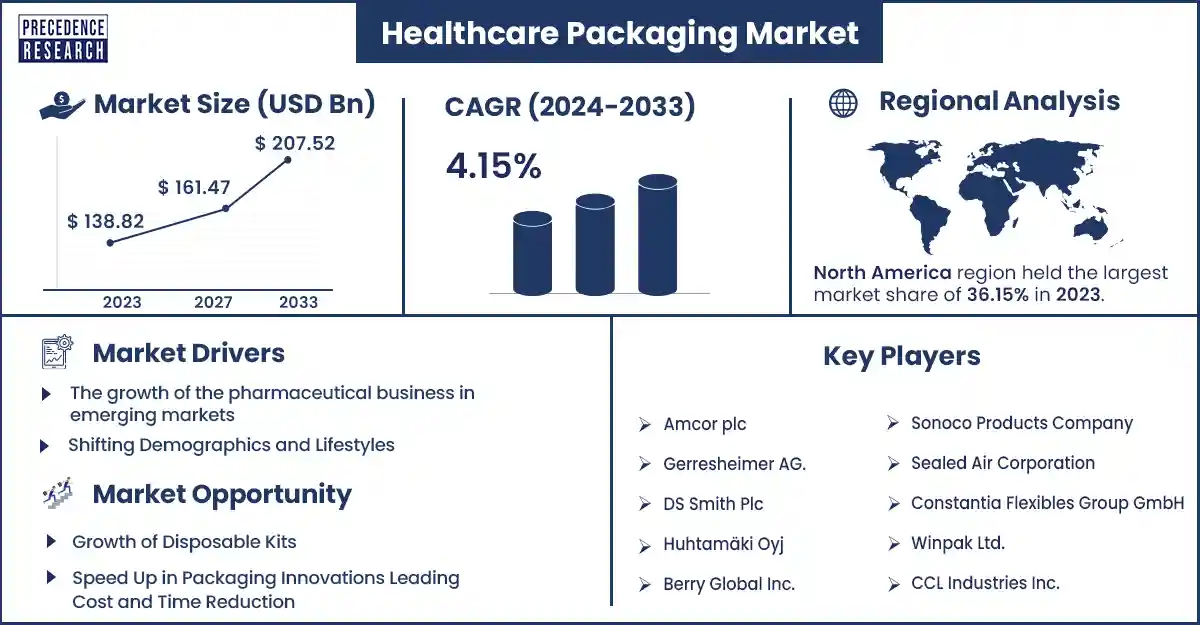

The global healthcare packaging market size surpassed USD 138.82 billion in 2023 and is estimated to cross around USD 207.52 billion by 2033, poised to grow at a CAGR of 4.15% from 2024 to 2033. The increasing demand for plastic packaging in the pharmaceutical and healthcare industry is expected to drive the growth of the market.

The healthcare packaging market refers to the containers and materials used to distribute, store, and protect medical and pharmaceutical products. It plays an important role in ensuring the effectiveness, safety, and integrity of healthcare products. Healthcare packaging is designed to address specific needs, including information for regulatory compliance, providing appropriate labeling, extending shelf life, preventing contamination, and maintaining product sterility.

Increasing healthcare expenditure over the globe is a vital factor in enhancing the market. The increasing geriatric population requiring medications and medical treatments is driving the growth of the market. The technological advancements in packaging, including intelligent labeling, antimicrobial materials, and smart packaging, are also anticipated to drive the growth and demand for the healthcare packaging market.

Improved sterility and patient safety to fuel the growth and demand for the market

In the healthcare sector, the most important focus is patient safety. Healthcare packaging helps sterilize prior to use and is individually sealed. This productive process reduces the risk of microbes and contamination. Using healthcare packaging for things like diagnostics kits, medical devices, and pre-fillable syringes generates a safer atmosphere for the patient. In addition, there are also higher risks of infection in the medical sector. Many of them can be infected with healthcare-associated infections (HAIs). These are caused by fungi, viruses, bacteria, and other pathogens that the patient is exposed to during their medical stay. Protection against fake or counterfeit products is the most vital factor in the patient's safety. Healthcare packaging can help to reduce unwanted risks and create solutions before they create complications in the future. These are major factors anticipated to drive the healthcare packaging market.

However, the negative environmental impact of healthcare packaging may restrain the growth of the market. Most healthcare packaging is made from plastics, which can adversely affect the environment by polluting air and water. Many healthcare industries are utilizing sustainable practices, but there is still the possibility of creating concern about the environment. Many of these healthcare packages are made from non-biodegradable materials, such as plastics, PET, or HDPE, which become waste. The large quantity of waste with maximum use of medical products may create environmental concerns worldwide. Therefore, these are the factors that are responsible for restraining the growth of the healthcare packaging market.

| Report Coverage | Details |

| Market Revenue in 2023 | USD 138.82 Billion |

| Projected Forecast Revenue by 2033 | USD 207.52 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.15% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Development by DuPont Corporation

Recent Development by Amcor plc

Asia Pacific is expected to grow fastest in the forecast period. The expanding developmental activities, rapid economic growth, and increasing geriatric population in this region are anticipated to drive the growth of the healthcare packaging market in the Asia Pacific. India, China, Japan, and South Korea are emerging countries in the Asia Pacific region.

In China, Shanghai Jianzhong Medical Packaging is the biggest manufacturer of healthcare packaging. The main products include factory packaging solutions, non-woven fabrics, wrinkled paper, aluminum foil bags, paper bags, and medical paper plastic bags, which are suitable for high-temperature steam sterilization, plasma, gamma ray, and ethylene oxide. There are various key players in the healthcare packaging market in China, such as Alexander Corporation, Gerresheimer AG, Bilcare Limited, Catalent, Constantia, Aphena Pharma Solutions, Beacon Converters, Sealed Air Corporation, Vetter Pharma International, and United Drug.

Manufacturers of healthcare packaging are investing in unique technologies to offer child-resistant packaging, which is simple to use, long-lasting, and secure. These are some major factors and market key players that are helping the growth of the market.

North America dominated the healthcare packaging market in 2023. The rising medical industry, sizable pharmaceuticals, high healthcare spending intensities, and considerable medical are expected to drive the market growth in North America. The U.S. and Canada are the emerging countries of the market in the North American region. In the U.S., many leading manufacturers provide barcoded unit-dose and serialized product packaging. Their liquid and oral solids allow customers to free up interior resources while avoiding inconvenient in-house healthcare packaging tasks. U.S. healthcare packaging offers safe, verified, and pre-packed packaging for patients. They take care of patient satisfaction and safety by providing good quality healthcare packaging.

Canada also represents the fastest growth in North America due to the innovative investments by manufacturers in the healthcare packaging industry. There are various leading companies in Canada, such as Constantia Flexible Group GmbH, which sells healthcare packaging products to local and international businesses. This company has a strong network in various countries. Sonoco manufacturers provide healthcare packaging services and customer packaging products. This company plays a vital role in the healthcare and pharmaceutical packaging industry. These are major factors, and key manufacturers are expected to drive the growth of the healthcare packaging market in North America.

Addressing trends to enhance the patient experience

Addressing new trends creates an opportunity for creative and innovative healthcare packaging design. Adopting innovative, high-quality materials, optimizing recyclability, and reducing weight by incorporating recycled and more renewable content is significantly helping improve the circularity of healthcare packaging. Healthcare companies can adopt the circularity of expertise that is already presented in other platforms to motivate a new generation of customized advancements in the healthcare industry.

For instance, the food market is using paperboard solutions that can provide a similar performance to plastic for many devices. These materials can be boosted with complex films or coatings to generate high-performance hybrid solutions. These innovative trends help to enhance patient experience and are estimated to drive the growth of the healthcare packaging market in the coming future.

Segments covered in the report

By Material Type

By Product

By Application

By Drug Delivery Mode

By Packaging

By Packaging Format

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2106

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

August 2024

January 2025

January 2025

January 2025